Your life rewarded

Global stories of award travel, points + miles

News

Africa's first Edition hotel is opening in Cape Town next year

Published Dec. 18, 2025

/

1 min read

Guides

Keep calm and carry on: The best carry-on luggage for every kind of trip

Published Dec. 18, 2025

/

8 min read

Guides

6 ways to maximize the Chase Sapphire Preferred as a beginner

Published Dec. 18, 2025

/

9 min read

News

Alaska Airlines adds 7 new routes, fortifies its turf in the Pacific Northwest and Alaska

Published Dec. 18, 2025

/

2 min read

Guides

Brookfield Place is a holiday oasis for shopping, dining and more in downtown Manhattan

Published Dec. 18, 2025

/

4 min read

News

American Airlines adds new US airport, plans 16-route expansion covering 20 cities in 2026

Published Dec. 18, 2025

/

5 min read

Guides

Chase Points Boost to offer less than 2 cents per point at some properties in The Edit — beginning after Dec. 22

Published Dec. 18, 2025

/

5 min read

Guides

How I leveraged my Amex Business Platinum benefits for Delta Medallion status

Published Dec. 18, 2025

/

6 min read

News

Basic economy on American will no longer earn miles or Loyalty Points, a blow to AAdvantage members

Published Dec. 17, 2025

/

3 min read

Great offers from partners that reward every day

HOW WE'D USE THESE POINTS

Madison Blancaflor

Managing editor

WHY YOU'LL LIKE IT

Valuable rewards, a low annual fee and wide-ranging travel protections

LIMITED-TIME OFFER

BEST PREMIUM CARD FOR EARNING FLAT-RATE MILES

Terms Apply

LIMITED-TIME OFFER: Earn 100,000 bonus miles

See rates & feesHOW WE'D USE THESE POINTS

Nick Ewen

Senior editorial director

WHY YOU'LL LIKE IT

Solid earning rates, extensive travel protections and terrific airport lounge access

LIMITED-TIME OFFER

Best for businesses with high spending

Terms Apply

LIMITED-TIME OFFER: Earn up to 400K bonus miles

See rates & feesHOW WE'D USE THESE POINTS

Brian Kelly

Founder + "The Points Guy"

WHY YOU'LL LIKE IT

Unlimited access to Capital One’s awesome airport lounges

$2500+ IN ANNUAL VALUE

HOW WE'D USE THESE POINTS

Stephanie Stevens

Associate credit cards writer

WHY YOU'LL LIKE IT

Unlock more than $2,500 in travel and business credits each year.

Explore our favorite cards

We know what points are worth

Invest in the right programs with our unique points valuations — designed to help you travel your way.

2.05¢

Chase Ultimate Rewards

2.20¢

Bilt Rewards

2.00¢

American Express Membership Rewards

1.85¢

Capital One Miles

1.90¢

Citi Thank You Rewards

1.55¢

American AAdvantage

1.45¢

Alaska Airlines Milage Plan

1.40¢

Avios

1.35¢

Southwest Rapid Rewards

1.30¢

United MileagePlus

1.45¢

JetBlue TrueBlue Rewards Program

1.25¢

Delta SkyMiles

1.70¢

Word of Hyatt Loyalty Program

0.70¢

Marriott Bonvoy

0.50¢

Hilton Honors

Navigate with more news, reviews + guides

We've traveled the world to bring you the do's and don'ts of points and miles.

News

Southwest adds Turkish Airlines as sixth international partner

Published Dec. 17, 2025

/

3 min read

News

IHG is targeting select members with a compelling offer to buy elite qualifying points

Published Dec. 17, 2025

/

4 min read

News

Current Chase Sapphire Preferred offer: Earn 75,000 points, worth over $1,500 in travel

Published Dec. 17, 2025

/

3 min read

News

American to give older DCA Admirals Club a much-needed upgrade in 2026

Published Dec. 17, 2025

/

4 min read

Reviews

First look: Park Hyatt Tokyo is back — here’s what it’s like inside the newly renovated hotel

Published Dec. 17, 2025

/

10 min read

Guides

3 reasons United flyers should consider the Aeroplan credit card

Published Dec. 17, 2025

/

4 min read

News

Bilt Rewards adds Spirit Airlines' Free Spirit as a 1:1 transfer partner

Published Dec. 17, 2025

/

2 min read

Reviews

Chase Sapphire Preferred Card review: A top travel and dining card

Published Dec. 16, 2025

/

8 min read

Guides

Why the end of the year is the perfect time to open a premium credit card

Published Dec. 15, 2025

/

6 min read

News

Activate Chase Freedom Q1 categories now: Dining, Norwegian Cruise Line and American Heart Association

Published Dec. 15, 2025

/

14 min read

Reviews

Chase Freedom Unlimited review: A great card for beginners and pros alike

Published Dec. 13, 2025

/

8 min read

News

Highest Chase Freedom Unlimited offer in 9 months — should you apply?

Published Dec. 12, 2025

/

4 min read

Guides

Final reminder: Your Amex Platinum’s $50 Saks credit expires Dec. 31 — here are 6 items to buy

Published Dec. 12, 2025

/

4 min read

Guides

How to transfer Chase Ultimate Rewards points to Air France-KLM Flying Blue

Published Dec. 15, 2025

/

5 min read

News

Save 15% on award nights at new IHG hotels and resorts when you stay by Feb. 28

Published Dec. 08, 2025

/

3 min read

News

When do travel rewards expire? A guide to expiration policies for popular loyalty programs

Published Dec. 08, 2025

/

15 min read

Guides

How to transfer Chase Ultimate Rewards points to United MileagePlus

Published Dec. 08, 2025

/

6 min read

Guides

10 points and miles tasks to complete by the end of the year

Published Dec. 03, 2025

/

8 min read

Guides

How to retroactively credit flights to your frequent flyer account

Published Dec. 03, 2025

/

11 min read

Guides

What are points and miles worth? TPG’s December 2025 monthly valuations

Published Dec. 02, 2025

/

13 min read

Deals

Deal of the day: Fly to South America from 12,000 points or miles

Published Dec. 16, 2025

/

4 min read

Guides

Which airports will welcome you into the terminal without a plane ticket?

Published Dec. 08, 2025

/

7 min read

Guides

Updated: All the best Travel Tuesday and Cyber Week flight deals

Published Dec. 02, 2025

/

15 min read

Deals

United Cyber Week sale: Flights starting at 12,000 miles one-way

Published Dec. 01, 2025

/

2 min read

Guides

We’re giving away 6 tickets to Hong Kong on Cathay Pacific: Here’s how to enter and how to maximize your Asia Miles for travel

Published Nov. 03, 2025

/

11 min read

Guides

12 best things to do in Icy Strait Point and Hoonah, Alaska, on a cruise

Published Nov. 21, 2025

/

9 min read

Guides

Hubbard Glacier vs. Glacier Bay: Which is the better scenic cruising spot in Alaska?

Published Nov. 20, 2025

/

10 min read

Guides

A beginners guide to visiting Alaska’s Glacier Bay National Park & Preserve

Published Nov. 16, 2025

/

14 min read

Guides

These 3 amazing Princess tours of Alaska will get you deep into the wilderness

Published Nov. 09, 2025

/

7 min read

Guides

6 amazing excursions you’ll only find on an Alaska cruisetour

Published Nov. 06, 2025

/

6 min read

Guides

Which Princess Alaska cruisetour is right for you? A complete guide to all your options

Published Nov. 05, 2025

/

16 min read

Reviews

Something for everyone: 6 things to know before you visit a Gaylord resort

Published Dec. 11, 2025

/

8 min read

News

4 reasons to check into a hotel for the holidays instead of hosting at home

Published Dec. 07, 2025

/

7 min read

Guides

The best Cyber Monday and Travel Tuesday hotel deals in 2025

Published Dec. 01, 2025

/

10 min read

CardMatch™

On the search for your next card?

Get pre-qualified and limited-time offers in less than 60 seconds with CardMatch™

Find my match

Go-to stories from our writers

Get to know the points guides that have grown TPG over the years.

Points 101

Prepare for takeoff with points + miles

Begin your points and miles journey here. We'll walk through terms you need to know, earning points 101, how to find new cards and loyalty programs, and how to make that first redemption.

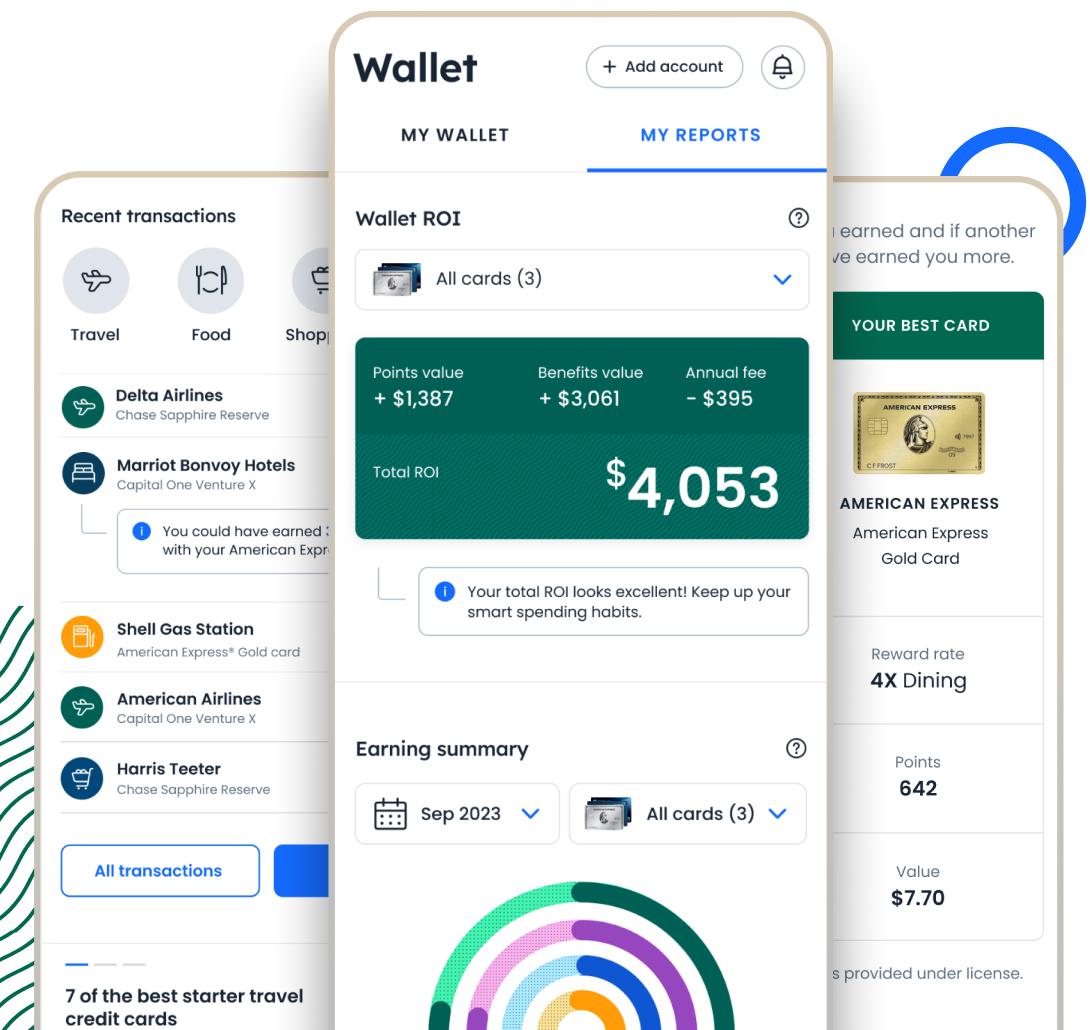

Go to guideKeep The Points Guy in your pocket

Keep TPG in your pocket

Download the TPG App

- Get the latest news and deals, curated just for you

- Maximize points on every purchase

- Track all your points, miles and rewards in one place

- Find limited-time offers for new credit cards

- Identify earning gaps and round out your wallet