New CDC testing policy could have ‘chilling’ effect on international travel, expert warns

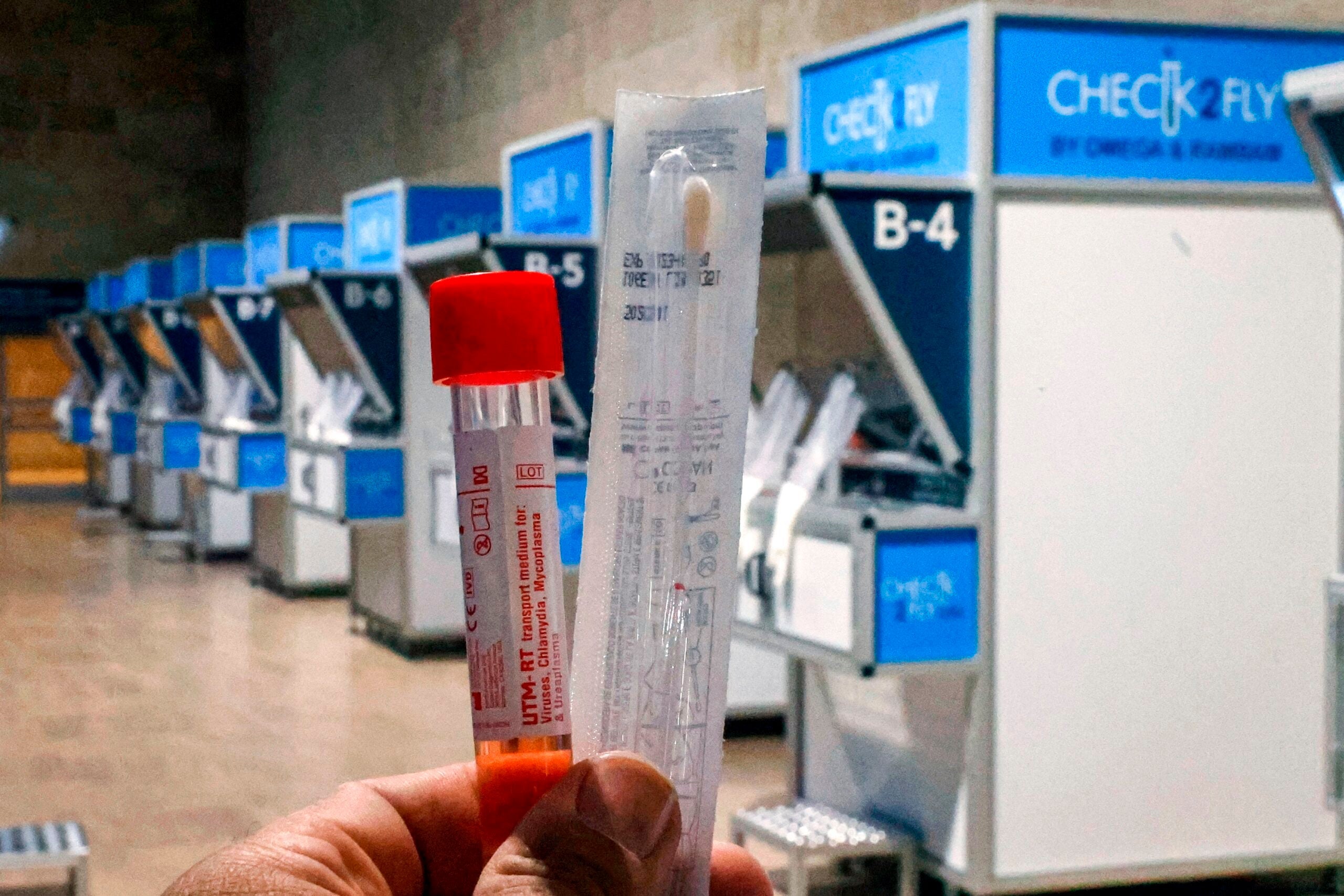

The U.S. Centers for Disease Prevention and Control (CDC) announced Tuesday that all travelers entering the United States must present a negative COVID-19 test, or prove that they have recovered from COVID-19, before crossing U.S. borders.

The new mandate goes into effect on Jan. 26, and the onus falls on individual airlines to screen travelers for compliance. Private and charter flight travelers must also comply with the same requirements as commercial passengers.

Passengers who cannot get test results in time, or who test positive for the coronavirus, will be denied boarding on international flights to the U.S. However, the CDC will consider temporary waivers for travelers entering from countries with few or no testing facilities, according to Reuters.

Related: Where can I travel right now? A country-by-country guide to reopening

Travelers who have already received COVID-19 vaccinations must still comply with the testing requirement before returning to the U.S., according to the CDC. Travelers who have recovered from COVID-19 within the past three months can produce proof of the initial positive test result, as well as a doctor's note saying the person is not contagious, in order to enter the U.S.

A similar policy has already been in place since Dec. 28, 2020, for travelers entering the U.S. from the United Kingdom.

As everyone awaits further details on the policy implementation, TPG asked travel and medical professionals for input. Here's what they had to say.

How airlines are supporting affected passengers

"This testing requirement will provide yet another layer of protection in the travel journey," American Airlines said in a statement. "We support the implementation of a global program to require COVID-19 testing for travelers to the United States."

American will waive fare differences for passengers scheduled to travel between Jan. 12 and Feb. 9, as long as travel begins on or before Jan. 25, the statement said.

Related:

- The best airlines of 2020: Who did it best in the COVID-19 era

- These airlines offer free COVID-19 travel insurance

American, along with United and Delta, eliminated most of its change fees on domestic and international routes last summer, in response to the pandemic.

Southwest told TPG that the airline is finalizing procedures to comply with the new CDC orders.

TPG has reached out to other airlines and will update this article with their responses as they come in.

Advice from travel providers

"Precautions to prevent the spread of the disease are only as good as the ability for travelers to get access to fast, reliable, convenient testing options," said Dan Richards, CEO of travel risk management firm Global Rescue. "Uniform digital health passports need to be in place to avoid unnecessary burdens on border agents, airline staff and travelers."

"These new rules will have a chilling effect on international travel, and further hurt an industry already brought to its knees," Richards told TPG.

Related: 2020 was the worst year ever for airlines

"I'm encouraging my clients just to hang tight and not do any last-minute international travel unless it's necessary," travel agent Katie Warner told TPG, at least over the next few days until country-by-country guidelines regarding test availability become clearer, and the CDC releases clearer guidelines.

Warner, co-founder of boutique travel agency Luxury Travel Hackers, has encouraged clients traveling internationally to purchase travel evacuation policies from companies such as Medjet, which transports hospitalized patients overseas to a U.S. medical facility of their choice. Warner herself holds a policy with Medjet, she said.

Although the CDC will only permit travelers with negative COVID-19 tests to enter the U.S., the new order does not apply to medical transports such as evacuation services.

"[The CDC's] ruling does not affect us," Medjet chief operating officer John Gobbels told TPG, since the evacuation company offers "hospital to hospital" transport for sick travelers, with trained containment professionals.

Related: Traveling soon? Here's where to get a PCR test in the U.S.

A traveler who tests positive for COVID-19 who doesn't require hospitalization would not qualify for Medjet services, Gobbels said, and those people should look into their travel insurance coverage under the basic trip interruption clause.

"[Transporting non-hospitalized travelers] is not something that we addressed prior, nor is it in our purview now," Gobbels said.

Megan "Lundy" Lundquist, co-owner of group travel company Legit Trips, said, "I think it's about time we do our part as a country to minimize the spread of [COVID-19]. I don't think it's a lot to ask people not to bring the coronavirus back to the U.S."

However, Lundy hopes the CDC will offer an alternative for travelers who cannot get a test result in time, such as mandatory quarantine in an approved facility. "That's pretty standard across the board [in other countries]," she said.

Related: 4 times you may find a travel agent helpful

"Unfortunately, the new policy may deter people from traveling because most aren't willing to figure out how to comply with [the new requirements]" Lundy said, adding that travelers may find travel agents helpful at this time since professionals will have the latest updated information regarding testing requirements.

For travelers who prefer to take a DIY-approach, Lundy advises them to do their research before leaving the country or booking travel to ensure they'll have access to a testing site near their airport of departure.

What medical professionals have to say

The CDC entrance requirement policy does not require a mandatory quarantine for travelers upon their return to the U.S.

However, the CDC encourages travelers to take a follow-up test within three to five days after landing and to stay home or otherwise self-quarantine for seven to 10 days, in keeping with updated guidelines.

"Always follow state and local recommendations or requirements related to travel," the CDC stated on its FAQ page for the new testing order.

Related: Following NYC's COVID-19 rules? Expect to hear from the sheriff

"Testing does not eliminate all risk," CDC Director Robert R. Redfield stated Tuesday. "But when combined with a period of staying at home and everyday precautions like wearing masks and social distancing, it can make travel safer, healthier and more responsible."

Some medical professionals aren't convinced the new CDC measure will be sufficient to quash the spread of the highly infectious virus.

Related: An aggressive new strain of the coronavirus forces travel back into hibernation

"These tests are going to be unverifiable," said Melissa, a concerned nurse in Texas who asked TPG to withhold her last name. "I don't know how this policy will really help."

Travelers can easily forge or doctor test results, she said, while testing protocols and results can vary wildly between destinations or even amongst clinics in the same region.

Related: Planning a trip to Mexico? The CDC says you should cancel

"As much as people complain about the health care system in the U.S. ... I would much prefer to get COVID-19 here than abroad," said healthcare worker and member of the TPG Facebook group Nan Bedrosian Pollard. "Many countries' health systems are overwhelmed caring for their own citizens."

Will travel insurance help?

The new policy "raises an interesting dilemma," said Donna Pairo, also a member of the TPG Facebook group. "Now, we can't get home unless we test negative. I wonder how travel insurance companies will work that out."

Related: Will my travel insurance plan cover COVID-19?

"Travelers need to have a plan in case you get infected if you travel anywhere," said another TPG Facebook group member, Mike Bono. "Are you OK getting sick and having to deal with the medical care offered in whatever destination you are at? ... Will hotels and resorts even let you stay on property if you test positive and can't go home? That's a big threat to their other guests."

Bottom line

At the end of the day, the CDC's ruling isn't a death knell for international travel in 2021. But the order significantly complicates planning, so travelers looking to explore should carefully calculate all of the variables before booking and departure.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app