6 flyer-friendly improvements United should consider implementing next

United is on a roll.

On Sunday, Aug. 30, the Chicago-based carrier announced it's permanently removing most change fees. UA started a trend; within 48 hours, Alaska, American and Delta all made similar announcements.

But United's narrative was different than the others. As part of the news, the airline included a video of CEO Scott Kirby explaining the move. In it, he promises "some exciting new announcements in the weeks to come."

Though time will tell what exactly Kirby's referring to, I'm hopeful that the following six changes are implemented soon.

Stay up-to-date on airline and aviation news by signing up for our brand-new aviation newsletter.

Improve the basic economy experience

Of the legacy carriers, United's basic economy offering is the most restrictive. That's because the carrier doesn't let flyers bring a full-sized carry-on bag on most routes. In addition, you can't complete online check-in, even if you're just bringing a personal item.

UA just began allowing basic economy flyers to purchase Economy Plus seats — a move in the right direction.

Though I'd love to see basic economy eliminated outright, that's likely not happening. Instead, it'd be great if United loosened some of the aforementioned restrictions. Plus, with American Airlines revamping its basic economy experience beginning Oct. 1, there's even more pressure to follow suit.

Related: All the changes American Airlines is making to basic economy

Issue credit when switching to a cheaper flight

Though UA deserves praise for being the first of the Big 3 to eliminate change fees, there's one notable downside. If you move to a cheaper flight, you won't receive future travel credit for the fare difference.

For example, say you booked a flight from Newark to Hawaii for $2,000. If you decide to stay closer to home and fly to Florida on a $200 fare, you'll lose the $1,800 difference.

When American Airlines announced its version of the no-change-fee policy, it specifically highlighted that flyers will receive the fare difference when switching to cheaper flights. It's now United's turn to match AA's move.

Related: How airline no-change-fee policies stack up against Southwest

Elite status thresholds significantly lowered for 2021

In April, United announced elite-status extensions for its Premier members. All existing elites, including Global Services, now hold status through Jan. 31, 2022.

But the Premier qualifying clock resets in just under four months, and most elites likely won't be able to hit the pre-pandemic thresholds in 2021.

Fortunately, the airline already promised to make adjustments. In April it wrote that "we recognize that getting back to travel will occur at a different pace for different members. Keep an eye out for changes we will make to help you earn status in 2021 for 2022."

Hopefully, United is hard at work at creating attainable thresholds.

Give higher-tier elites longer window for same-day changes

As a Premier 1K, one of my favorite day-of-travel benefits is the ability to make confirmed same-day changes. In markets with multiple daily frequencies, this perk has helped me get home earlier or spend some extra time by the beach.

Beginning on Jan. 1, 2021, United will grant access to complimentary same-day changes to all elites, including previously-excluded Silver members.

Going forward, there will be more competition for the few remaining seats on the day of departure. Therefore, UA should consider implementing a staggered window for confirming same-day changes. Premier Platinums and 1Ks should be able to make confirmed changes 48 hours in advance — when there is greater availability and more Economy Plus seats left, too.

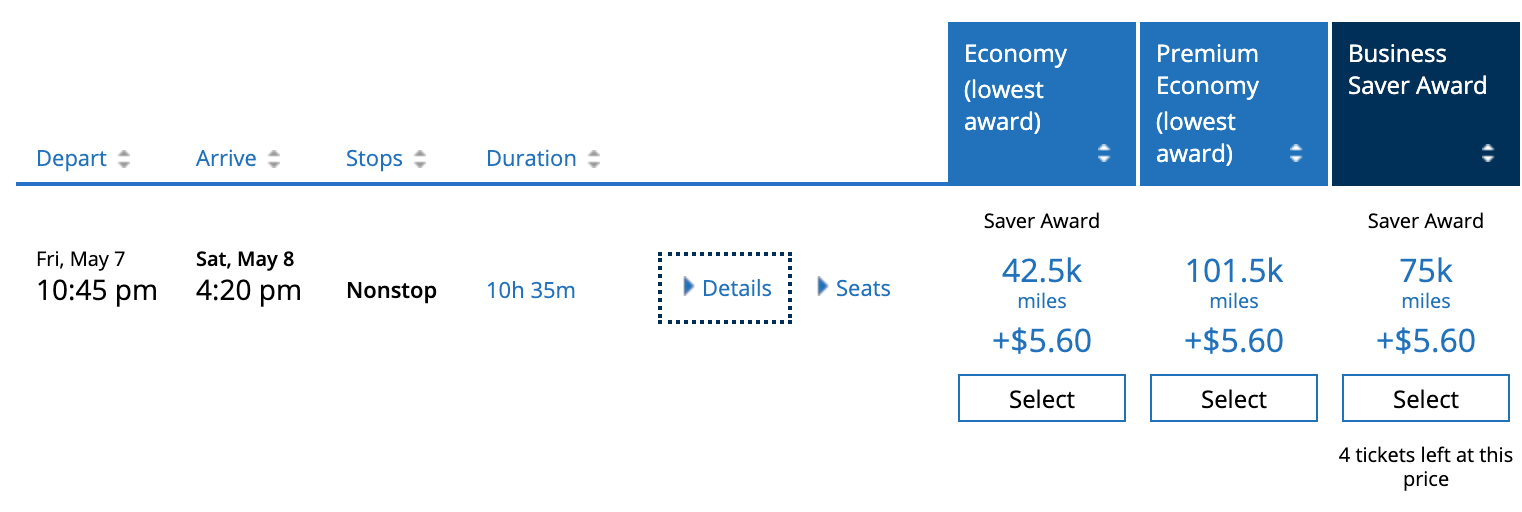

Restore award charts

Perhaps the most unwelcome recent change in the loyalty world is the removal of award charts. Without charts, airlines are free to price award tickets as they see fit. Customers don't know exactly how much awards will cost, so saving for a specific flight is impractical.

With demand for travel expected to take years to recover, airlines will likely look to their loyalty programs to drive revenue. And United's program is particularly lucrative; it was just mortgaged for $5 billion.

If United wants to buy goodwill with frequent flyers — and get them excited about redeeming again — the carrier should consider restoring award charts.

Make Premium Plus a more compelling offer

As business-class seats get nicer, airlines have found a market for a product in between coach and biz — premium economy.

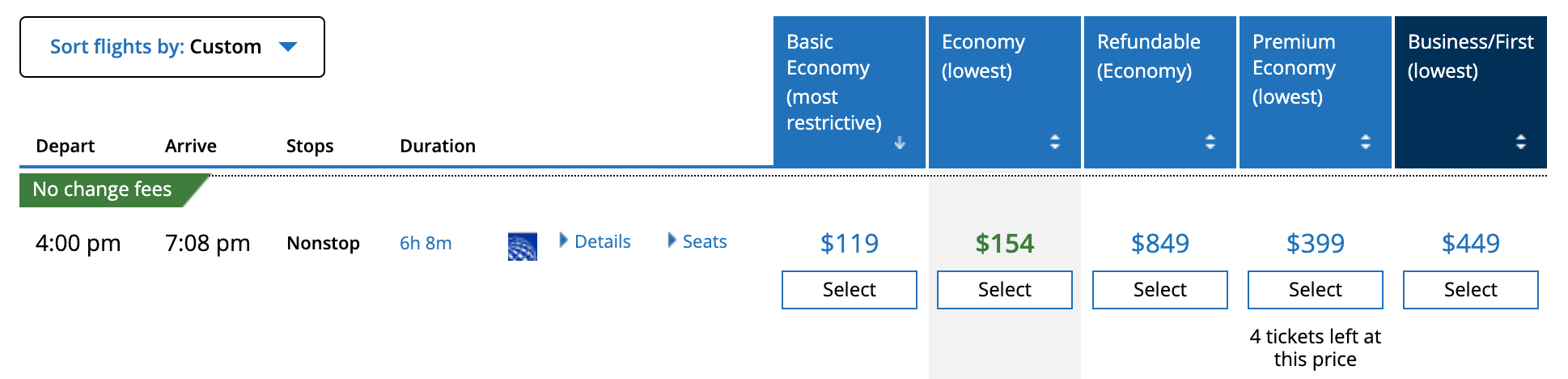

Though the hard product fits somewhere between coach and biz, the pricing structure doesn't. In many instances, United charges nearly the same, if not more, for its version of premium economy, dubbed Premium Plus.

Consider a flight in May 2021 from Newark to San Francisco. United was charging nearly $300 more than coach for Premium Plus, yet just $50 less than lie-flat biz.

How about long-haul international travel from Newark to Tel Aviv? In this case, the cost of Premium Plus is even more than saver biz.

These two examples are just part of a larger trend. Premium Plus should be a modest upsell from coach; not a substitute to business class.

Related: When is premium economy worth it?

Bonus: Restore Saks duvet and On The Rocks Old Fashioned

In the middle of July, United restarted serving liquor in premium cabins and made other improvements to the onboard beverage service as well.

At the same time, UA announced that it's trimming the Saks Fifth Avenue bedding on certain flights. Specifically, the plush Saks duvet has been removed from domestic business class and first class on lie-flat flights between the mainland U.S. and Alaska and Hawaii. The duvet has been replaced with a noticeably less comfortable day blanket.

In addition, UA has temporarily suspended serving my favorite drink — the On The Rocks Old Fashioned — in Polaris on the premium transcon routes.

When travel picks up again, I hope these special amenities are reintroduced.

Bottom line

In addition to permanently eliminating change fees, United has promised more exciting news to come.

Though it's anyone's guess what the airline has up its sleeve, hopefully, it'll be one (or more) of the seven suggestions mentioned above. From restoring award charts to improving the basic economy experience, United has lots of opportunities to get customers excited to fly again.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app