Why I prefer flying wide-body planes when traveling cross-country

Though now's not the time to travel, it hopefully won't be too long until we (safely) get back in the air again.

And once travel restarts, odds are that we'll be taking many more domestic trips than usual , before venturing abroad. That's one of the reasons we are running more flight reviews focused on domestic products.

Right before the coronavirus halted travel, I made a trip to the West Coast to attend the grand opening of the Amex Centurion Lounge at LAX. I reviewed United's Polaris product on the Boeing 787-10 on the way there, and American's Flagship First on the Airbus A321T on the return (both publishing next week).

Though I'll have a full comparison of these two products (along with JetBlue Mint) publishing shortly, there's one thing that I preferred about flying United, and it was the plane type.

Specifically, I much prefer flying on wide-body aircraft than single-aisle jets. And here's why.

For more travel tips and news, sign up for our daily newsletter

[table-of-contents /]

Cutting-edge hard product

In general, airlines reserve their best products for wide-body planes. That's because the jets are capable of flying a carrier's top-traffic, long-haul routes. Plus, there's much more space available to install industry-leading products.

Delta and United are the two carriers that regularly fly the Boeing 767, 777 and 787 on the premium routes between New York and Los Angeles and San Francisco.

Related: Ultimate guide to United Polaris

In business class, each seat features direct aisle access, as well as a more private and spacious version of biz compared to flying on a narrow-body like the Boeing 757.

American and JetBlue fly only one plane type across the coasts — the Airbus A321. I definitely prefer this narrow-body plane to its chief competitor, the Boeing 737, but the comforts available on a wide-body far outweigh those of the A321.

(Note that AA is the only carrier to fly a true first-class product cross-country, so if you're looking for the best way to fly commercially in America, you'll be flying Flagship First on the A321T.)

Better coach experience

Though it'd be great if we could all enjoy the lie-flat seats up front, most passengers will find themselves in coach. And the economy experience on a Boeing 787 is generally much better than that on an A321.

For one, there are many more aisle seats compared to a single-aisle jet. On an A321, there's an equal distribution of aisles, middles and windows. On a 787, there are many more aisles, then middles and finally windows.

Related: The best and worst transcon economy seats

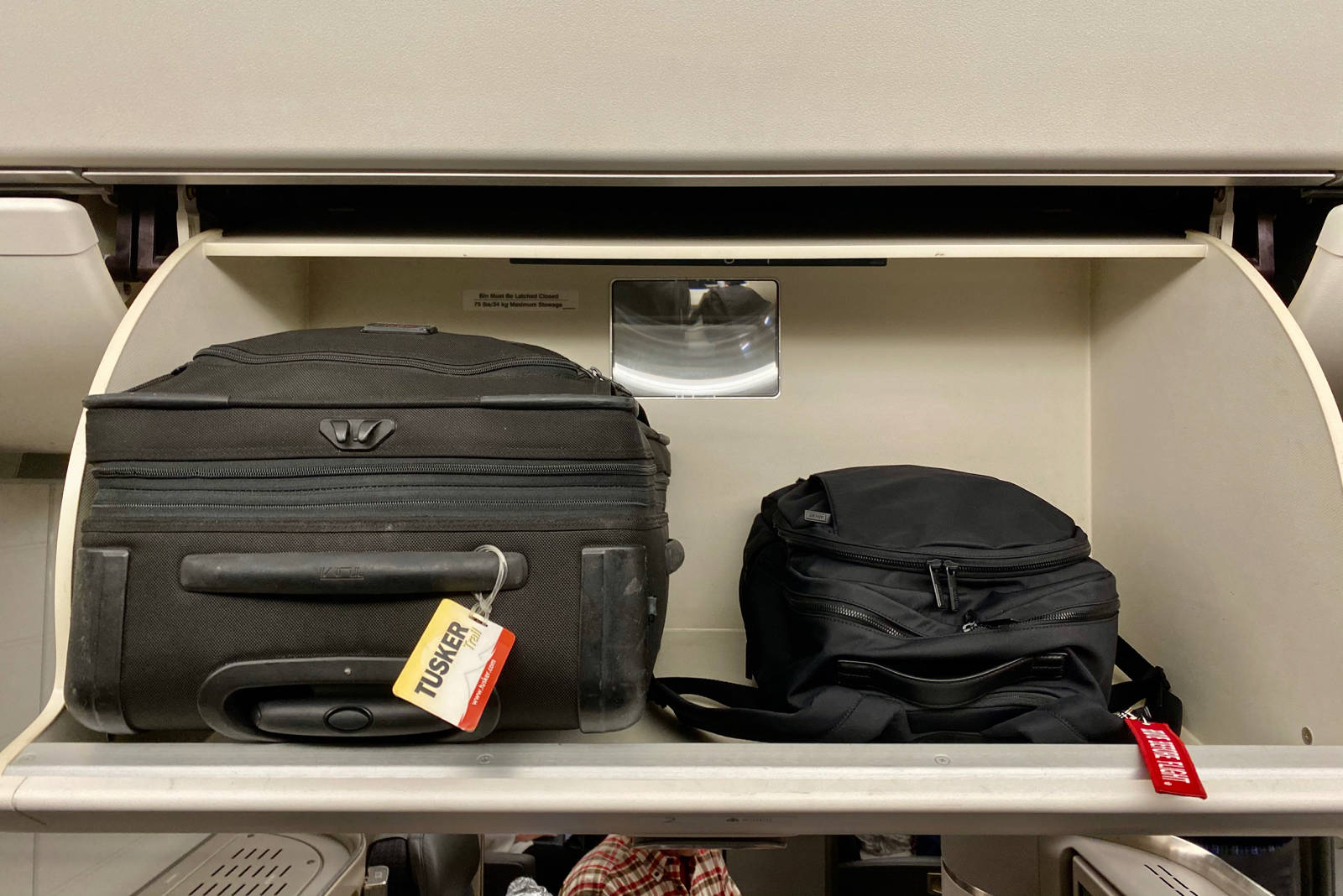

More overhead space and volume

As the names imply, a wide-body is much larger than a narrow-body jet.

That's great for those who frequently need to gate check their bags since wide-bodies have much more overhead storage space.

Additionally, I personally feel much less claustrophobic on a twin-aisle plane. The added volume in the cabin makes me feel more comfortable and enhances my perception of personal space.

Two aisles compared to one

When you're flying for five-plus hours across the country, you're definitely going to want to stretch your legs and move about the cabin.

On a narrow-body, you've got just one aisle and a small galley at the back of the plane in which to stretch. There's always so much foot traffic in these single-aisle planes that moving around can feel like you're playing a game of human Tetris.

Wide-bodies have two aisles. Yes, they have more passengers as well, but at least there's another aisle in which to walk around. Plus, the galleys and lavatories on these twin-aisle jets are typically a bit larger than their single-aisle counterparts, making them much more comfortable overall.

Novelty

As an aviation enthusiast (follow my Instagram for all my pics!), I find that there's something special about getting on a twin-aisle plane.

Most run-of-the-mill domestic flights are operated by narrow-bodies, and I like to change it up from time-to-time. Getting a chance to fly a wide-body domestically is a privilege to me.

Related: American to retire 100 more planes early amid pandemic

Also, as the industry recovers from the coronavirus, odds are that we're going to see many fewer domestic flights operated by wide-bodies. During the pandemic, we've seen American Airlines retire a lot of its international fleet. The carrier previously used these wide-bodies for many domestic flights, but now that they've been retired, AA will probably be flying many more Oasis 737s with dense seating layouts on routes that used to feature the Boeing 767.

Bottom line

If faced with the choice, I'm on team wide-body.

You'll typically enjoy a better hard product in biz, an improved coach experience and more overhead space. Plus, when it's time to head to the lavatory, the two aisles on a wide-body help ease the congestion.

And finally, if you're an AvGeek like me, you'll enjoy the novelty of flying some of the biggest planes on domestic routes.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app