Why I’m going to earn more Wyndham points this year

Wyndham Rewards has long been a program I've watched closely but never earned or redeemed points with — and I suspect that's going to change this year.

Wyndham has made a handful of consumer-friendly changes over the years and made it easier to earn Wyndham Rewards points with credit cards and various promotions. This makes the program more intriguing — especially to someone who generally uses hotel points for stays at mid-tier properties.

Here's a quick look at why I plan on earning more Wyndham Rewards points in 2021.

The Wyndham shopping portal often has top-earning rates

I've used the Wyndham Rewards shopping portal more this year — largely due to its excellent earning rates.

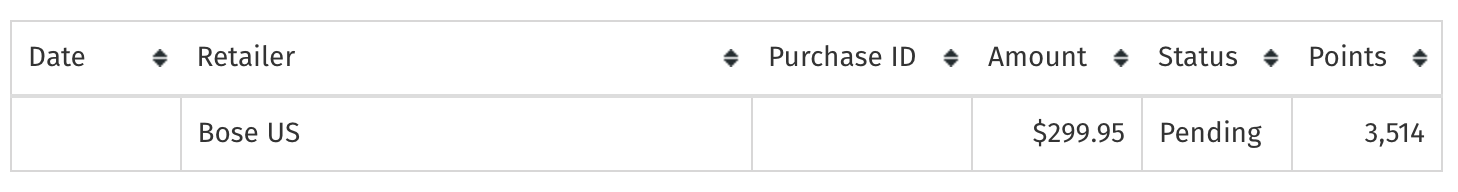

Wyndham launched a promotion last month that offered 5x increased earning rates on purchases made with select merchants. This helped me earn a huge 12x points per dollar on a new speaker from Bose. The $299.95 purchase earned 3,514 points, which is a pretty incredible return.

While that promotion has since ended, the Wyndham Rewards shopping portal has continued to offer higher rewards than other loyalty programs. For example, you can earn 3x points per dollar when shopping with Bed Bath & Beyond. Many airline portals are only offering 1x miles per dollar and Rakuten is offering 1% cash back (or 1x Membership Rewards points).

Of course, more points don't always equal more value. We value Wyndham Rewards points at 1.1 cents per point, so 3x points at Bed Bath & Beyond would be worth roughly 3.3% cash back. The Alaska Airlines shopping portal offers 1x points per dollar, which is worth 1.8 cents per point. So while I'd pick Alaska if it offered 2 miles per dollar spent, the bonus points earning makes earning Wyndham points advantageous.

That said, always use a shopping portal aggregator like CashbackMonitor to ensure you're earning the most points on your online purchases.

Related: The beginner's guide to airline shopping portals

Wyndham has solid ongoing promotions

Like most hotel groups these days, the chain has ongoing promotions to incentivize hotel stays. Wyndham's current promotion is pretty solid too. You'll earn 7,500 points for every three nights — worth one free night at a lower-end hotel. Here's the breakdown:

- Stay one night = 1,000 points

- Stay two consecutive nights = 3,000 points

- Stay three or more consecutive nights = 7,500 points

You can register for this promotion through May 28 and book stays through May 31. Plus, you can earn this bonus as many times as you'd like across multiple stays — making it really valuable for frequent Wyndham travelers. If you have two three-night stays over the next month, you can score a nice haul of extra points. Just note that you can only earn one bonus per stay.

I'd assume we'll see more of these promotions over the coming months as we move through the pandemic and travel starts to pick back up. While this particular promotion isn't as powerful as some offered by Hyatt and Marriott, it's easier to maximize with low-cost Wyndham stays on road trips.

Related: There's a Wyndham property for every traveler

Redemption rates are reasonable

Another major draw to building a stash of Wyndham Rewards points is its redemption rates. There are only three hotel categories: 7,500 points, 15,000 points and 30,000 points per night. At the higher end, you can stay at properties like the Aspen Meadows Resort in Aspen, Colorado, and The Mills House Wyndham Grand Hotel in Charleston, South Carolina. Both of these resorts frequently cost close to $400 per night, giving you more than our valuation of 1.1 cents per point in value.

At the 15,000-point level, you have great city break options like the Wyndham Midtown 45 in New York City and the Ramada Plaza Menam Riverside in Bangkok. These hotels range in price, but you'll generally get more than 1 cent per point in value. There are also good ski options at this price point, like the Wyndham Park City in Utah.

I've found that the lowest tier — 7,500 points per night — is best for roadside hotels on road trips or other off-the-beaten-path destinations. You'll generally want to book these with cash, but having the option to pay with points can make sense for last-minute stays and holidays.

You can also use your Wyndham Rewards points at all-inclusive resorts like the Viva Wyndham Dominicus Beach in the Dominican Republic. You'll pay 30,000 points per night at these properties, but always compare the cash and points values before you book your ticket.

Related: The ultimate guide to earning and redeeming Wyndham Rewards

The Vacasa partnership is super powerful

Another great use of points is booking Vacasa vacation rentals with your Wyndham Rewards points. This partnership lets you use Wyndham points at all 15,000-plus properties that span North America, Belize and Costa Rica. These range from studio apartments to full-on luxury homes — perfect for a mid-pandemic getaway in nature.

Vacasa vacation rentals start at 15,000 Wyndham Rewards points per night per room. So, one-bedroom and studio condos available for rent with Vacasa will cost 15,000 points per night, while larger homes cost more points.

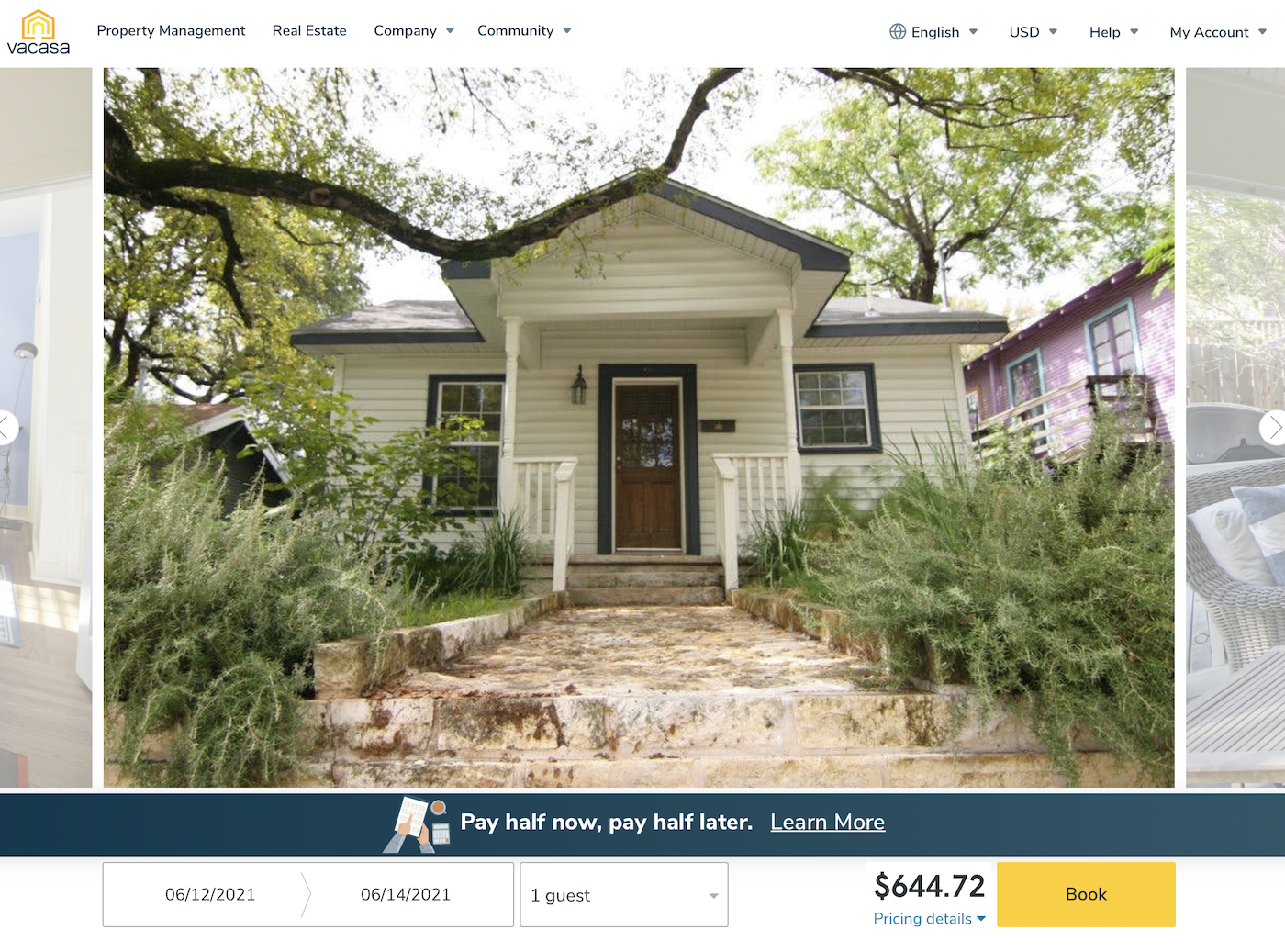

These redemptions have the potential to be an excellent deal. For example, a two-night stay at this one-bedroom cottage in Austin costs $644.72, or 30,000 points total. This means you'd get a huge 2.14 cents per point in value from this redemption — almost twice our current valuation.

These redemptions are a huge draw to Wyndham's points, especially as I travel domestically more due to the pandemic. I plan on making Vacasa redemptions in upstate New York and Austin over the coming months.

Related: 5 ways to use points to book vacation home rentals

A possible easy status match to Diamond

Wyndham isn't currently offering a status match, but I'll match my Marriott Titanium status to Wyndham Diamond the next time it's offered. In the past, this was offered as a straight match with no stay requirement. This status tier makes you eligible for space-available suite upgrades, a welcome amenity and other various benefits.

Platinum and Diamond can also status match to Caesars Rewards. Diamond members match Caesars Diamond, which includes benefits like waived resort fees, a $100 dining credit and more.

It's also worth noting you can qualify for Wyndham elite status with Wyndham's new credit card portfolio. I may end up applying for one of these beforehand, which would give me instant elite status and a nice points haul. Talk about a win-win.

That said, I won't go out of my way to earn Wyndham elite status organically. Its benefits are too limited when compared to other programs. I also don't think I'll stay at enough Wyndham properties to justify earning outside of promotions.

Related: Does elite status from a credit card get you less recognition?

I'm diversifying my points portfolio

Lastly, I'm working to diversify my points portfolio to avoid future devaluations and use my points for different types of redemptions. This article isn't to say that I'm only going to earn Wyndham Rewards points — in fact, I'm still focusing more on Marriott Bonvoy. But now that I'm back on the road, I'll split my stays and points earning with Wyndham, Hilton and other programs when it makes sense to do so.

Related: 16 ways to earn Wyndham Rewards points for your next redemption

Bottom line

With the addition of Vacasa redemptions, new promotions and my newfound appreciation for domestic travel, Wyndham Rewards points are more interesting to me than ever before. In this article, I walked you through why I plan on earning more of these points in 2021 and beyond. Keep it in mind as you plan your hotel points earning for the rest of the year.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app