I’m a Delta flyer; here's why I gave United Airlines a second chance

I grew up an Eastern Air Lines boy.

Living in northern New Jersey, we had Newark as our home airport. My dad had elite status in the early days of frequent flyer programs.

Then Eastern got folded into Continental and that became our go-to airline.

For the latest travel news, deals and points and miles tips please subscribe to The Points Guy daily email newsletter.

By the time United and Continental merged, I was no longer living in New Jersey. But loyalty starts at an early age.

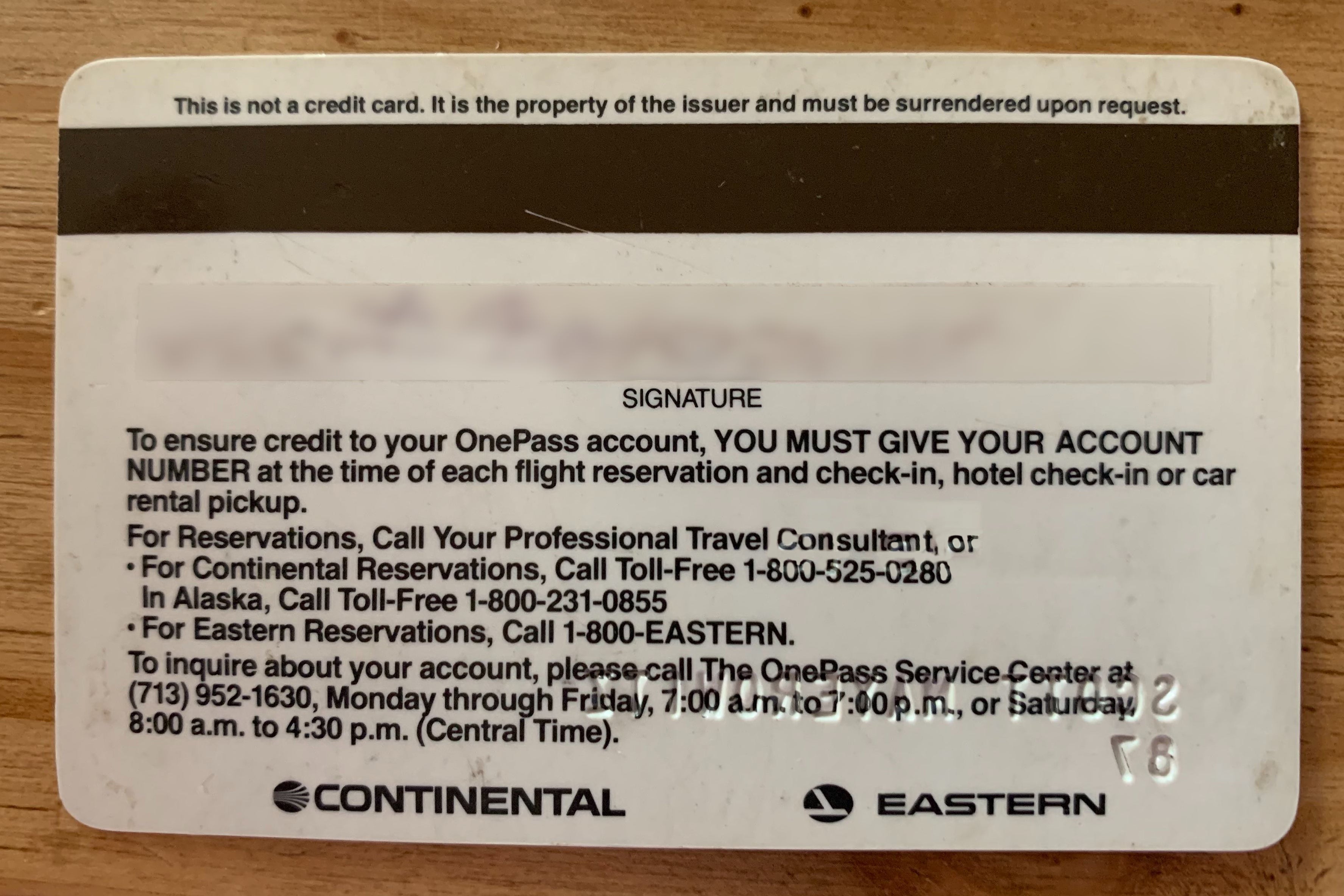

My OnePass card with Eastern and Continental logos on the back — yes, I still have it in a desk drawer — dates back to the mid-1980s.

When I started flying enough to earn elite status, it was on United. I had entry-level Silver status and it was earned the hard way: lots of domestic flights, plus a round-trip to Asia in coach.

I eventually jumped ship from United, falling in love with American for a few years. As American pulled back from New York and Delta Air Lines increased its presence here, I made one more switch — to Delta.

As I noted in a recent post on why I'm loyal to Delta, the airline is an on-time machine. The staff is almost always friendly. And although I have my issues with redeeming SkyMiles for premium awards, the program does everything possible to treat its elite members — especially the top-tier ones — like royalty.

For years, United struggled to make the Continental merger work. Flight delays were all too frequent and employees were so beaten down that it showed. Service declined and I found myself booking away from United.

United's CEO, Oscar Munoz, is now four years into his tenure, and although operations aren't yet at Delta's levels, the airline is much better.

United has revamped the premium experience, introducing its Polaris business-class seats and lounges. United is helping 10,000 passengers each month make connections thanks to its new ConnectionSaver service that takes advantage of flights that are already going to arrive early at their destination and holding them before takeoff for connecting passengers.

New heads of domestic and international route planning are taking some ambitious steps to increase United's reach, including a route that I'm very excited about: nonstop service from Newark to Cape Town, South Africa.

All 26,000 flight attendants have gone through new training, focusing on customer service. And United is making some smart technology moves, updating its app and adding 3-D seat maps. It's also experimenting with some cool ways to ease the travel experience, like delivering bags directly to business-class flyers' hotels.

"No one could recall a time when we felt more confident in the progress we've made," Josh Earnest, the airline's chief communications officer, told reporters at a recent media day. (You might recognize that name from the Obama White House, where Earnest was the President's chief spokesman.)

So when I had to fly out to Chicago last week for United's media day, I decided to give the airline another shot. As a reminder, TPG pays for its own travel. In this case, I decided to book a first-class ticket to Chicago and Economy Plus for the ride home.

United knew that I was traveling for its media day and arranged lounge access in New York for any reporter flying the carrier. Because I wasn't flying as an average customer, this isn't a full review but rather my general impression of how much United has improved. Trust me: There are certain things an airline can fake when it knows you are on a flight. But there have been many other flaws in the travel experience that American, Delta and United have failed to fix over the years, even though they knew I was on board.

When I got to the new gate area of LaGuardia's Central Terminal, where United is one of the first occupants, I had to pinch myself to remember that I was in one of America's worst airports.

The high ceilings, natural light and improved — but expensive — food make it feel like a modern airport. It was a pleasure to walk around, hear boarding announcements clearly and find plenty of seating and places to plug in. American and Delta are upgrading their gate areas too, but United has a leg up for now.

On the second floor of the terminal sit the new United Club and Air Canada's Maple Leaf Lounge.

Both are open to the terminal and seem to fit perfectly into the space.

The United Club had plenty of seating and was very quiet. I actually found it was faster to connect to the terminal's Boingo Wi-Fi than United's.

The food was about what you would expect in a domestic lounge: no hot items but plenty of choices. I didn't care too much since I would have breakfast on my flight.

I found the presentation of the hard-boiled eggs — already cut in half — a bit of overkill. But it was much better than the old days at the Delta Sky Club when you needed to peel the eggs yourself. (Luckily, that has stopped.)

Until recently, United Club members only had access to a space before security. The move inside security, alone, is a major improvement — although it has much more to do with the airport than the airline.

The big windows gave me great views of the planes, the runway and the sunrise. Nothing like an early-morning flight. Soon it was time to board.

Boarding was extremely organized. It started promptly at 7:25 a.m. for my 8 a.m. flight.

By 7:40 a.m., the door was closed and our 19-year-old Airbus A320 was on its way.

I'm going to pause here and note how extraordinary that is. The U.S. Department of Transportation (DOT) considers a flight to be on time even if it leaves the gate 14 minutes late. Here we were, pushing back 20 minutes before departure. Even more miraculous, at 7:58 a.m. we were rolling down the runway. That's two minutes before the scheduled departure. At LaGuardia.

The flight was uneventful. There were no TVs, which meant I couldn't watch a movie while eating breakfast. There were plenty of free streaming videos that I could watch on my laptop or phone but I prefer having a TV so I can multitask.

The very attentive United flight attendants in first class offered a pre-departure beverage and I got some orange juice with my meal. But Delta offers water bottles in first class and it's nice to have some control over my own hydration.

The meal was about as good as you will get in domestic first class. I was in the last row of the cabin but was still able to get my choice: an egg-white sandwich, which was loaded with cheese and awkward to eat. But it was tasty and isn't that really what matters?

United's Wi-Fi has a bad reputation. Folks often can't connect or they have to deal with excruciatingly slow speeds. I was ready for the worst but had no issues at all. It wasn't a high-speed, fiber-optic connection, but my tests showed normal speeds for flying seven miles above the earth.

My flight arrived in Chicago at 9:05 a.m., 25 minutes ahead of schedule. One leg down and United was winning me over.

After a day of hearing all about United, I arrived back at O'Hare for my return trip in Economy Plus. Everything seemed to be off to a good start.

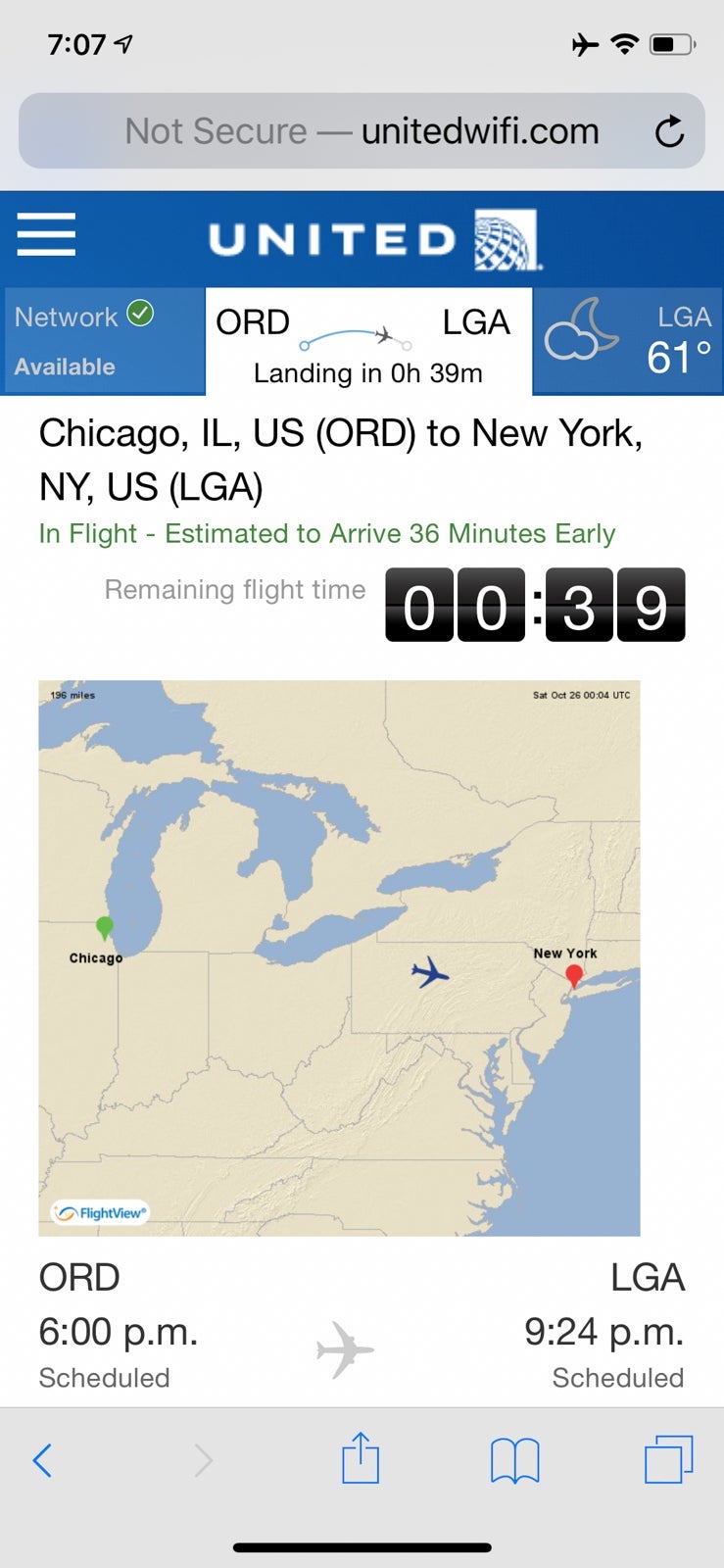

Some reporters on a 5 p.m. flight were facing delays with their inbound aircraft but my Airbus A319 was on time.

At 5:29 p.m., boarding started for the 6 p.m. flight. It was organized enough. The zones were clearly announced and everybody knew what lane to stand in.

We pushed back from the gate at 5:55 p.m. and, after the normal Friday night traffic at O'Hare, we were wheels up at 6:13 p.m.

The seat had extra legroom and I didn't feel the least bit cramped.

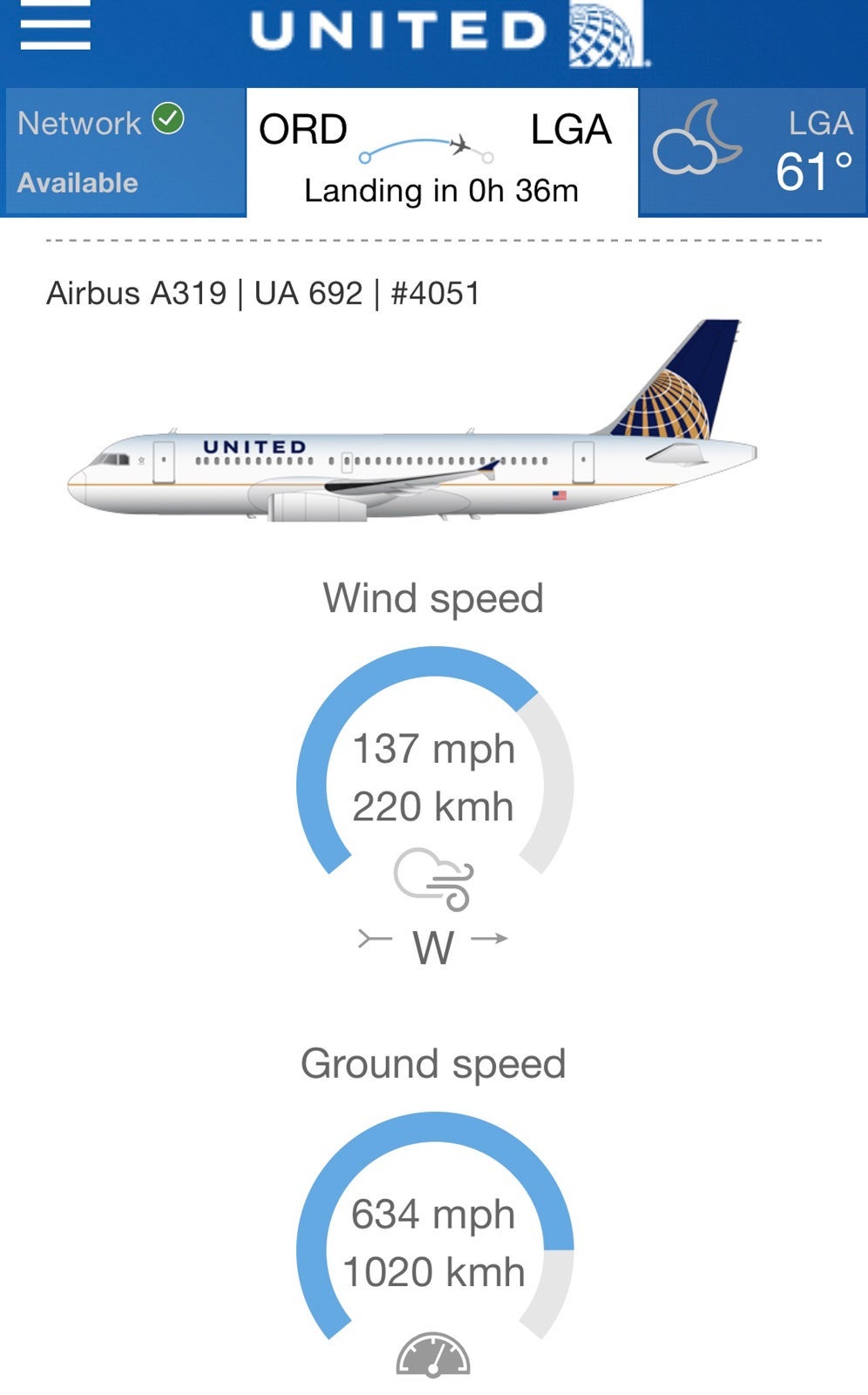

The flight took less than two hours thanks to an amazing tailwind.

The streaming movies worked well but were draining my battery. Besides, there was no way to prop up my phone, so I gave up.

I bought a snack box and was pleased with all the offerings -- the Stroopwafel is a fun treat and unique to United. Delta used to be unique with Biscoff cookies but now that American has them too ... something is just lost there.

For me, the trip highlight was all the flight information in the app. I guess when you don't have TVs with that info, it's the next best thing. The detail and presentation on the app was fantastic and the AvGeek part of me was enthralled.

American and Delta: Learn something from United. Add all the cool data and graphics to your apps.

Your frequent flyers will enjoy it and it helps pass the time.

We were at the gate at 8:50 p.m., nearly 30 minutes ahead of schedule.

The flight attendants had been extremely friendly and service was prompt and pleasant.

The pilot thanked passengers on their way out, a little gesture that left me feeling even better about my flight.

So, am I ready to make the switch to United? Probably not yet. I still am hooked on Delta. But I'm not booking away from United anymore. I was won over by the operation and service on my two flights and am ready to add it back into my flying rotation.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app