TPG expert tip: 5 ways to maximize Southwest sales

Everyone loves a good flight sale, and most travelers love Southwest. But these days, the LUV carrier promotes sales literally every week, and it can be hard to see past the $39 one-way inter-island Hawaii flights to find the good deals.

Sign up for TPG's daily newsletter for more travel-related news and tips

Deal fatigue can be real, especially where Southwest is involved. But you can still take advantage of lower fares, even if you don't have a trip in mind.

Here are some of my favorite ways to maximize Southwest sale fares, regardless of where you fly from.

Best ways to maximize Southwest sale fares

Create your own flight deal

Southwest's sale fares can be daunting to dig through, especially since the desktop version of the sale page doesn't allow shoppers to filter by departure city any longer. (You can still search by city on the mobile app, but I usually prefer buying my flights on my computer.) You can still search by individual city pairs, such as between Los Angeles and San Francisco, but you can't see every deal that is being advertised from your airport of origin.

Here's where it helps to know some of Southwest's background. Southwest operates its flights from point-to-point rather than following the traditional hub-and-spoke model that larger carriers observe — but some central airports, such as Dallas Love Field (DAL), still boast a larger presence than others. So if you live by one of these airports, or frequently fly through them on your way to other destinations, try searching for good fares between your home airport and the layover cities you've visited in the past: You can always piece together your own flight deal.

complete a travel challenge for cheap

Every now and then, Southwest offers challenges for select travelers, such as fly six one-way flights within 90 days to earn A-List elite status through the end of the year. Or for lucky California residents most years, it's frequently been an offer to book and fly now to earn a Companion Pass for the rest of the year. (This year, everyone got to participate in a one-flight challenge to earn a two-month Companion Pass for early 2021.)

Unlike most airlines, Southwest usually calculates progress toward elite status based on the number of flights you take, not the dollar amount you spend with the airline. This means that a $49 fare counts as one flight, just the same as a $490 flight.

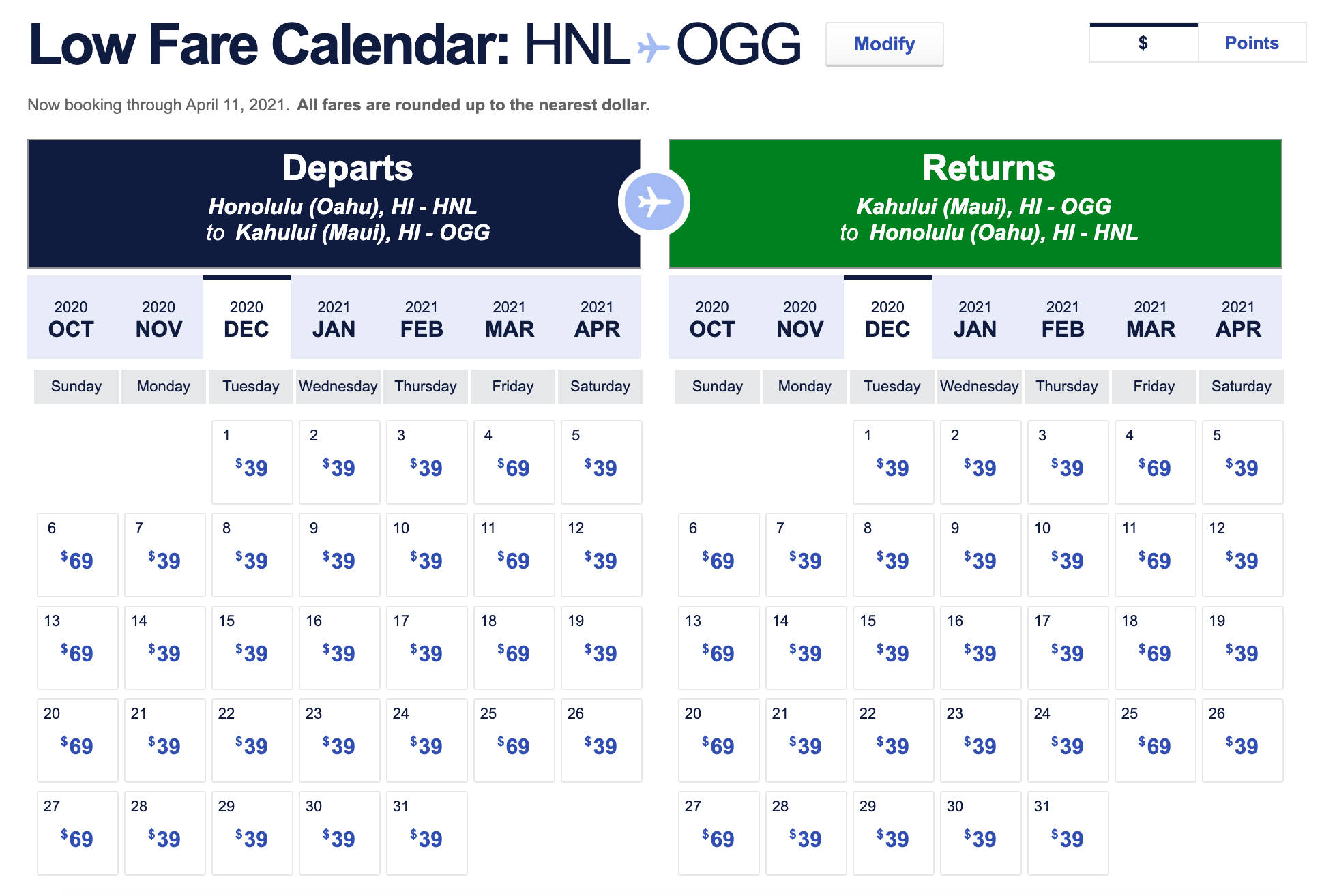

If you're trying to reach a challenge goal, Southwest fare sales provide the perfect opportunity to do so without breaking the bank. You'll often find a handful of city pairs with flights starting from $39 to $49 each way during Southwest sales. One such example is between Hawaii's Big Island and Maui, where inter-island flights start from $39 on most days in November:

The same low sale fares are often available between Los Angeles and San Francisco:

I often utilize my knowledge of these city-pair discounts when planning out my flights for a status challenge.

Last year, for example, I had the opportunity to earn A-List elite status with Southwest after completing six one-way flights within 90 days. Most flights originating out of Austin cost more than $100 one way, but I can usually find cheap one-way flights between city pairs.

So I booked myself a multi-stop trip in the name of maintaining my elite status, with the following series of one-way flights: From Austin out to the southern California coastline (LAX), one flight up to the Bay Area (SFO) to visit my best friends, then a few discounted hops through Denver (DEN), St. Louis (STL and Kansas City (MCI) before returning to Austin, my hometown.

Related: What is Southwest elite status worth?

My little weekend jaunt allowed me to grab lunch or dinner with a number of long-missed friends while maintaining an airline benefit that's very valuable to me, all for the grand total of $372 — approximately the same price I would've paid for a standard round-trip flight from Austin on most airlines, including Southwest.

Related:

Check out all of TPG’s mileage run series:

- TPG challenged 3 people to fly as far as they could for $725 — here’s what happened

- How and why to book a mileage run

- What to pack on a mileage run

- Why a mileage run is a bad idea

If you're hoping to accomplish something similar, I highly suggest mapping out a fun route like mine. Sure, you could ping-pong back and forth between airports such as Dallas and Houston a few times — from a time-saving perspective, you can't beat short, cheap commuter routes. But life is about the journey, not just the destination, and planning out a U.S. tour through airports you rarely frequent is its own unique adventure.

Visit a loved one, "just because"

If you happen to live far from beloved family members, Southwest sale fares are the perfect time to stock up on surprise flights, holiday trips or other "just because" moments. Thanks to the airline's famous policy against change fees, you can always cancel or reschedule your trip at a later date if needed. So whenever the Tuesday sale rolls around, check fares between your home and theirs.

Sneak in a bonus trip

I don't know about you, but I'm [almost] always up for an impromptu trip to Las Vegas, New Orleans or some warm, sandy beach. I prefer to plan my jetsetting adventures on a grander scale, such as the trip to Antarctica I'm still dreaming about. But little weekend jaunts to fun domestic destinations usually happen because I saw a cheap flight and decided to book the fare, then plan the rest of my trip around the dates and times I chose.

If you share my spontaneous trip philosophy or would like to try it on for size, write up a list of 5-6 spots you always love visiting, whether it's Denver (DEN) for fall foliage and outdoors hiking, New Orleans (MSY) for $68 round trip, the greater Miami area (FLL) for sunshine in the dead of winter or Las Vegas (LAS) for the weekend. Then the next time a sale rolls around, quickly spend 30 seconds searching for good deals from your airport. Your future memories will thank you.

Book a positioning flight

I recently shared how I manage to snag amazing sale fares, even though I live in an area that doesn't have any major airports. Southwest sale fares are a huge part of my strategy, since there's no point in saving $1,000 on a great international deal only to spend $600 of it traveling across the U.S.

If you've already booked a big bucket-list trip for the future, hold off on booking a positioning flight until sale time. (Or with Southwest, you can always book ahead of time, then claim credit for the fare difference when the route goes on sale.) Then the next time you see a fare sale, check for routes that will get you from home to your departure airport in time.

Just keep in mind that, even though Southwest offers free checked bags, you'll still have to pick up your bags in your connecting airport, then drop them off again with your next airline before proceeding through security. So when you book your positioning flights, remember to build in enough buffer time to account for any hiccups.

Bottom line

Southwest offers some of the most versatile flight options in the industry, and its sale fares are just icing on the cake. Use these tips to help you plan your next big adventure — while sticking to your budget.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.