Deal alert: Singapore business class awards on the world's longest flight — including using Aeroplan miles

Want to see the latest flight deals as soon as they're published? Follow The Points Guy on Facebook and Twitter, and subscribe to text message alerts from our deals feed, @tpg_alerts.

Editor's note: As the travel industry reopens following COVID-19 shutdowns, TPG suggests that you talk to your doctor, follow health officials' guidance and research local travel restrictions before booking that next trip. We will be here to help you prepare, whether it is next month or next year.

This past weekend, we learned that Singapore Airlines is blocking award availability to partners. However, that doesn't mean you can't book any Singapore awards anymore.

In fact, we're currently seeing widespread, business-class award availability on a number of routes, including on its famous Newark (EWR) to Singapore (SIN) ultra-long-haul route. Even better, despite the partner restriction, as long as you're not traveling before the end of November, you may even be able to book through Air Canada Aeroplan.

However, there are some important caveats about booking this deal, so be sure to read through the end of the post.

For more TPG news and deals delivered each morning to your inbox, sign up for our daily newsletter.

Singapore business class award availability

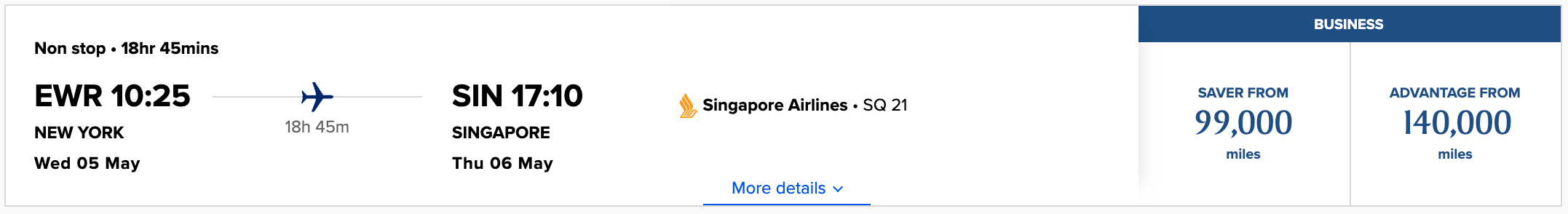

Singapore Airlines has released a ton of business-class award seats at the Saver level on the EWR to SIN route (a.k.a. the world's longest flight). The flight covers a distance of roughly 9,500 miles with just under 19 hours of flying time and is operated by Singapore's two-cabin Airbus A350-900ULRs, with just business class and premium economy.

Seats are available from March 2021 through the end of the flight schedule, with some dates offering four or more open award seats. You'll find the most availability through Singapore's KrisFlyer program.

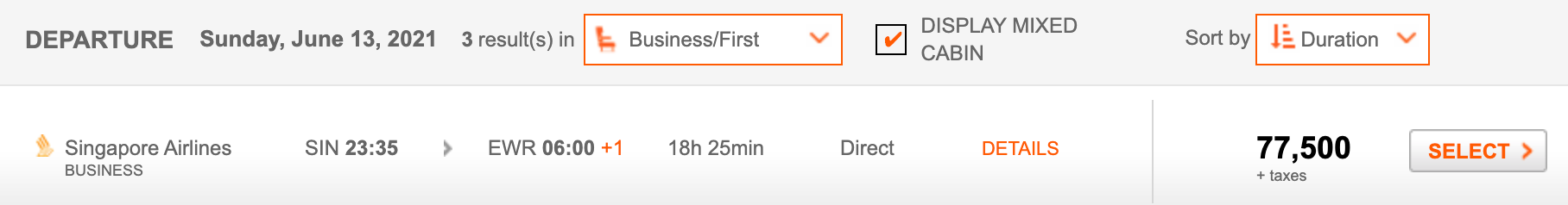

We're also seeing some availability through Air Canada Aeroplan, which charges fewer miles on this route. This is extremely rare, as Singapore usually restricts long-haul business- and first-class award space to members of its own loyalty program.

We even did a test booking to ensure this wasn't phantom award space — and it was ticketed and confirmed without any problems.

Just note that Aeroplan's doesn't always match KrisFlyer's availability. For instance, KrisFlyer is showing three business class award seats for EWR-SIN on March 3, 20201, while Aeroplan is only showing two seats. On the other hand, KrisFlyer is showing four seats available on March 10, 2021, whereas Aeroplan is showing no availability on this date.

No other partners are showing access to this availability.

How to book

As mentioned above, the only way to book this deal is through Singapore's KrisFlyer program or Air Canada Aeroplan. Of the two, the cheapest option would be through Aeroplan, which charges just 77,500 miles to book a one-way ticket on the route. KrisFlyer, on the other hand, will charge you at least 99,000 miles for the same award.

The airline doesn't doesn't impose any fuel surcharges on its flights, so you'll pay minimal taxes and fees with both programs.

The advantage of booking through KrisFlyer is that you'll find more dates with availability. Additionally, it partners with more transferable points programs.

If you opt to book with Aeroplan, you can transfer in points from American Express Membership Rewards (1:1 ratio), Capital One (2:1.5) and Marriott Bonvoy (3:1, with a 5,000-mile bonus for every 60,000 points transferred). On the other hand, KrisFlyer is a transfer partner of Amex Membership Rewards (1:1), Chase Ultimate Rewards (1:1), Capital One (2:1), Citi ThankYou Rewards (1:1) and Marriott Bonvoy (3:1, with a 5,000-mile bonus for every 60,000 points transferred).

Just be sure to pay close attention to the below transfer times, as these aren't always instant.

Related: A guide to earning transferable points and why they're so valuable

| Program | Transfer time to Singapore | Transfer time to Aeroplan |

|---|---|---|

American Express Membership Rewards | < 24 hours | Instant |

Chase Ultimate Rewards | Usually same day (up to two business days) | N/A |

Citi ThankYou Rewards | < 24 hours | N/A |

Capital One | 36 hours | Instant |

Marriott Bonvoy | < 48 hours | 4 days |

Important things to know

Obviously the big elephant in the room is that we're still in the midst of a global pandemic. International travel is still largely restricted around the globe and there's no telling yet on when travel will resume. Most international travellers are not allowed to enter Singapore. While the award availability is for travel in 2021, if the situation doesn't improve by then, you could be forced to cancel your ticket down the line.

Related: Airline coronavirus change and cancellation policies

Additionally, as previously mentioned, Singapore is currently restricting award availability to its partners due to the travel restrictions. Most partners, like Alaska Airlines Mileage Plan, are blocking Singapore award bookings entirely until at least Sept. 1, 2020. However, TPG has found that Aeroplan is showing availability for flights next year.

According to a Singapore Airlines spokesperson, the suspension should only affect flights through Nov. 2020. A TPG staffer was successful in ticketing one of the awards discussed above through Aeroplan for a flight in June 2021. However, it's possible that the situation will change so proceed at your own risk and keep in mind that point transfers to airlines are irreversible.

Here's the full statement a Singapore Airlines spokesperson provided to TPG:

"The temporary suspension of award seats on SQ/MI from partner airlines' frequent flyer programmes is aligned with Singapore Airlines' current policy to limit interline connections due to border entry as well as transit restrictions for connecting flights imposed by various countries. At present, the suspension of award redemptions is valid through November 2020, and is subject to further review based on market conditions.

Redemption inventory on SQ/MI segments may still appear in partner airlines' award searches depending on the itineraries requested, but bookings are not possible during this suspension period."

Bottom line

Now may be a great time to speculatively book award flights for next year. Award availability is off the charts, and it will be easier getting your miles redeposited than getting a cash booking refunded in the event you need to cancel your trip down the line. Most airlines are also providing unprecedented flexibility with change and cancellation policies.

Singapore Airlines offers one of the best business-class products in the world, and finding award availability on this route is usually extremely tough. Just be sure to familiarize yourself with the risks before you book a ticket.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app