I booked a flight I couldn't take — and changed it with no penalty

The coronavirus pandemic has had a multitude of impacts on the travel industry, but one notable, customer-friendly shift was the nearly-universal removal of airline change fees here in the U.S. During a frenzied period in late August and early September, the major airlines that previously punished travelers for adjusting flights simply did away with them — and further tweaks in the months since have (amazingly) offered even more leeway for flight changes.

And just this week, I got a chance to experience this new-found flexibility first hand.

Here's how a simple mistake that would've cost me $375 a year ago set me back exactly $0 in fees.

The initial booking

After postponing a long-awaited trip to Asia (twice) due to the ongoing effects of the pandemic, I was sitting on a pile of miles with Alaska Airlines Mileage Plan. While the carrier's recent entrance into Oneworld will introduce some notable new redemption options over the rest of 2021, I remain skeptical that its existing award charts will remain wholly intact in the process.

As a result, I started looking at burning this stash for my daughter's 2022 spring break next March.

(And yes, we almost always plan our international trips 10-11 months in advance.)

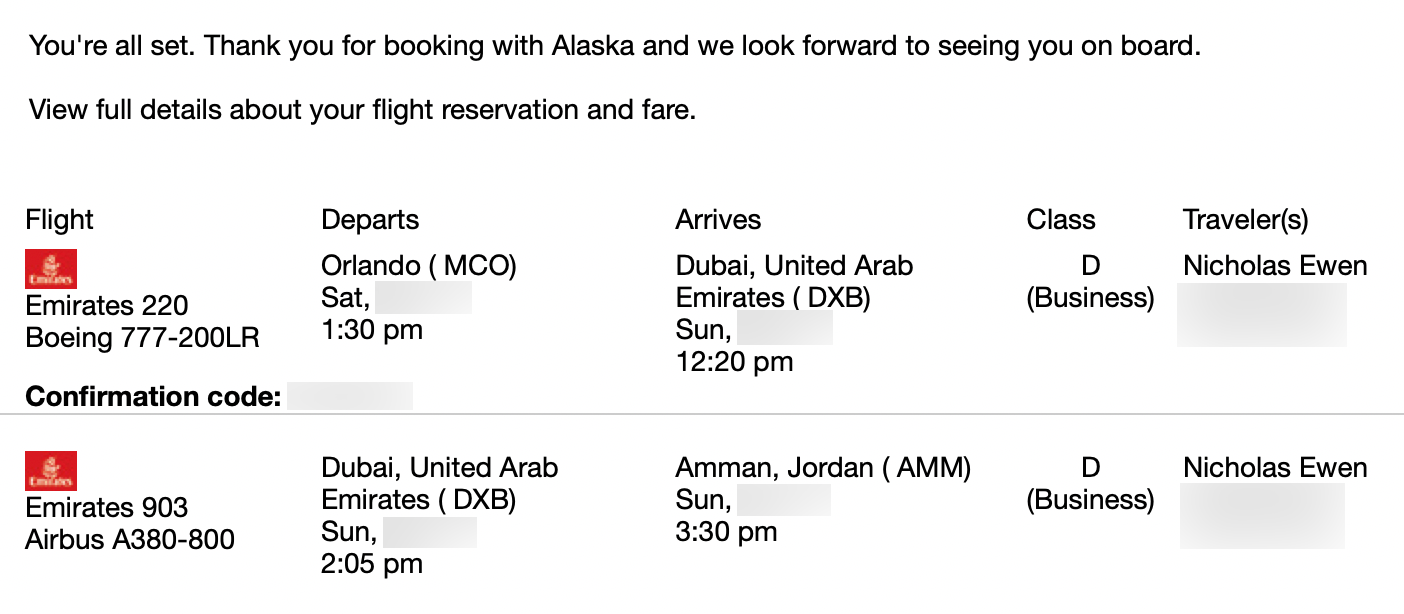

The country of Jordan has been on our travel wish list for quite some time, and after some research, it appeared that March was a great time to visit. Shoulder season meant fewer crowds but still temperate weather — and we were thrilled to find a convenient, one-stop routing in Emirates business class from Orlando (MCO) to Amman (AMM) via Dubai (DXB).

The Saturday departure meant that we could work (and our daughter could be in school) all day Friday. This would give us the chance to finish our packing that night and enjoy a relatively-leisurely Saturday morning before the early-afternoon flight.

Unfortunately, I pulled the trigger a bit too soon ...

The realization

A couple of weeks after booking, we received an invitation to an engagement party for some family friends. We weren't able to attend, but when looking at the couple's registry for a gift (using an online shopping portal, of course), I was dismayed to see the date of their wedding: the Saturday of our flight!

That's right. My wife — who had known the wedding date for weeks — had forgotten to put it on her calendar (and neglected to let me know). This was completely out of character for her, but all blame aside, we were left with a choice: take the flight and miss the wedding, or adjust the itinerary to make it work.

Thankfully for us, Alaska Airlines updated its change-fee policy back on Sept. 1, 2020. Instead of needing to fork over $125 per passenger to switch our flights, we could make the change for free.

Related: Complete guide to changing and canceling award tickets

The outcome

Once we realized our mistake and decided we didn't want to miss the wedding, I started looking at alternate options. Initially, I figured we could simply postpone our departure by a day — but at the time of writing, Emirates is only operating its Orlando-to-Dubai service 4x weekly (departing from MCO on Mondays, Wednesdays, Fridays and Saturdays). As a result, pushing to Sunday wasn't an option.

Fortunately, our return flights from Jordan back to the U.S. weren't booked yet, so I began to investigate changing the itinerary to get home. And sure enough, the exact date we needed was available.

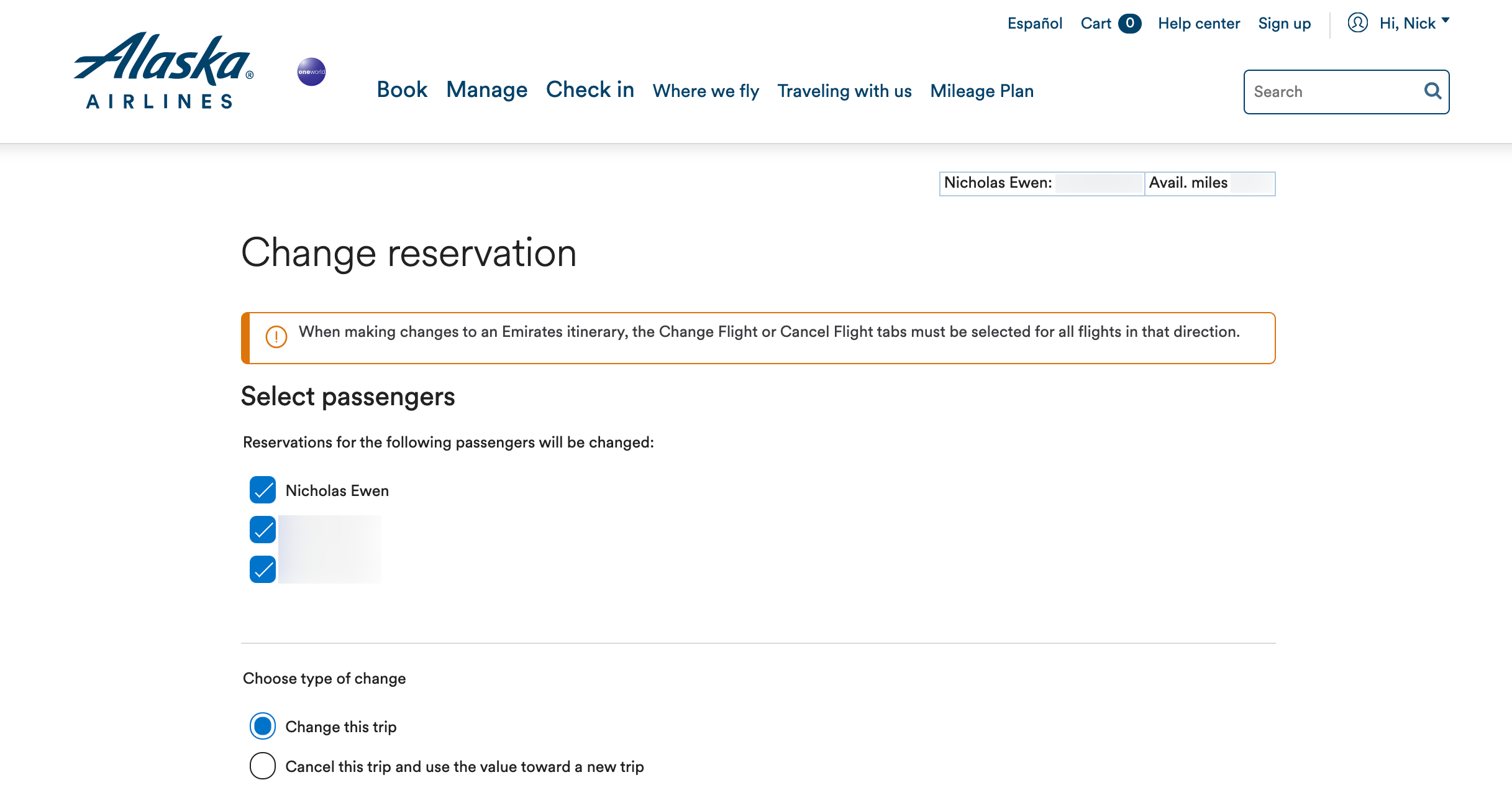

Even better? I could make the change with just a few clicks online:

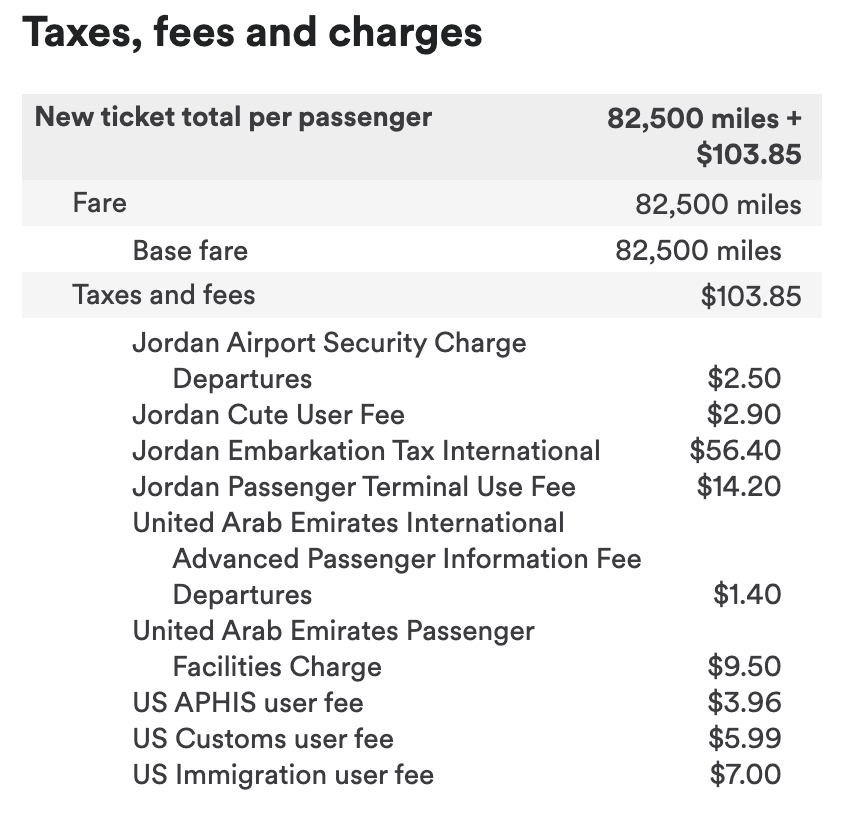

When I first discovered our error, I was afraid that I would need to pay a second round of partner booking fees for making the change. Alaska charges $12.50 per passenger in each direction, and it's typically non-refundable.

Thankfully, the cost breakdown on the new ticket showed that I was only responsible for the additional taxes and fees (which would've been imposed on any flight originating in Jordan and returning to the U.S.).

After just a few minutes, the three of us were confirmed on a new itinerary.

Bottom line

The airline industry is far from perfect. We continue to receive reports of long hold times with certain carriers, and there's lingering frustration from refund issues that occurred at the height of the coronavirus pandemic.

That said, it's critical to point out just how fantastic these new, no-change-fee policies are. Simple modifications to a flight — like a new date of travel or a different destination — used to cost hundreds of dollars on most U.S. airlines. Now, you typically can adjust your trip without a penalty, and with many award tickets, you can even cancel them outright for a full refund.

If you're feeling under the weather, there's no charge to postpone your flight.

If you have a last-minute emergency, it won't cost you to switch.

And if you forget to tell your spouse the date of an upcoming wedding (I'll admit that this is a very specific example), there's no penalty to change your trip.

Perhaps Delta CEO Ed Bastian put it best on our recent Return of Travel webinar:

"Any revenue source that has a punitive characteristic to it is not a stable and durable revenue stream for your business."

No one can argue that exorbitant change and cancellation fees were punitive to consumers, and the sudden lurch away from them is one of the most important trends to emerge from the coronavirus pandemic.

And it just saved my family nearly $400.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app