Loyalty programs continue to limit non-travel redemptions

Editor's Note

This is a recurring post, regularly updated with new information.

While many frequent flyer and hotel loyalty programs offer a wide array of redemption options, at TPG we tend to focus primarily on the ones that get you the most bang for your buck. This almost always means travel-specific redemptions, using your frequent flyer miles for flights and your hotel points for free nights.

For a long time, many programs have expanded their non-travel redemption options, allowing you to use your points for things like gift cards, merchandise, car rentals and more. The catch is that these redemptions usually represent pretty bad values, with your hard-earned points often being worth less than 1 cent each — though we have seen higher options from credit card issuers like Chase and Capital One in recent months.

As the novel coronavirus first burst on the scene, we saw a number of loyalty programs restrict the ability to use points and miles for non-travel related redemptions. This is a logical move to protect cash flow, especially if a large number of customers without immediate travel plans decided to suddenly cash out their points for something else.

Unfortunately, as the pandemic continues to stifle travel demand both in the U.S. and internationally, this trend continues — with Delta Air Lines as the most recent culprit.

Here's a run-down of the significant changes that we've seen from loyalty programs in 2020.

Stay up to date on the outbreak by bookmarking our coronavirus hub page and signing up for our daily newsletter.

[table-of-contents /]

Hertz Gold Plus Rewards

The coronavirus is affecting every corner of the travel industry, not just airlines. Hertz is one car rental company that's been hit hard, formally filing for bankruptcy protection in late-May. Unfortunately, around that time, Hertz blocked the ability for Gold Plus Rewards members to redeem points for things other than rental cars, including transferring points to airline partners and using them to bid on experiences.

Related: Maximizing points and miles with Hertz car rentals

Virgin Australia

While many airlines around the world are in precarious financial positions, Virgin Australia has been the first major airline to buckle under the pressure. Earlier in the year, Virgin Australia voluntarily entered into administration (similar to bankruptcy protection in the U.S.) and almost immediately suspended all redemptions from its Velocity frequent flyer program for four weeks. Thankfully, redemptions have since resumed for domestic flights within Australia.

Velocity is run by a separate company within the Virgin business that is itself not under administration. However, Virgin promised customers that their miles would be protected and would not expire or disappear during this suspension.

American Airlines

Doctor of Credit reported that American Airlines has also begun limiting non-travel redemptions, specifically by blocking redemptions via points.com. This partnership was somewhat limited to begin with, in that you needed to hold American Airlines elite status or have at least 25,000 miles in your account. But through points.com, you were able to convert your miles into gift cards from a variety of different merchants.

Related: How to redeem miles with American Airlines AAdvantage

Delta SkyMiles

Delta has always been a leader in innovative redemption options, and it was the first of the U.S. legacy carriers to switch to dynamic award pricing. Through its SkyMiles Marketplace, Delta allows customers to redeem their miles for merchandise, gift cards, car rentals, hotel stays, cruises and more.

On March 16, 2020, Delta added restrictions to the SkyMiles marketplace. While this has always been limited to Medallion elite members and Delta Amex cardholders, the option to redeem miles for gift cards disappeared entirely.

Then on Aug. 27, 2020, Delta took the SkyMiles Marketplace completely offline. Members are now greeted with a "Check back soon for updates to the SkyMiles Marketplace" screen when attempting to load the site. The airline told Rene's Points the following:

"Given the evolving nature of the COVID-19 pandemic and its impact on our business, we have decided to pause SkyMiles Marketplace. Existing SkyMiles Member Marketplace purchases will be honored."

Related: How to redeem miles with the Delta SkyMiles program

Southwest Rapid Rewards

Southwest's customer-friendly fee structure, cheap fares and easy-to-use rewards program have made it a customer favorite for many years. Rapid Rewards members also have the ability to redeem their points for non-travel options like merchandise, gift cards and more via the "More Rewards" portal.

As of now, More Rewards has been temporarily suspended and most Southwest members can only use their Rapid Rewards points to book Southwest flights. Similar to Delta, the airline is only allowing Chase Southwest Rapid Rewards credit card members to redeem points for things other than flights.

Related: How to redeem points with the Southwest Rapid Rewards program

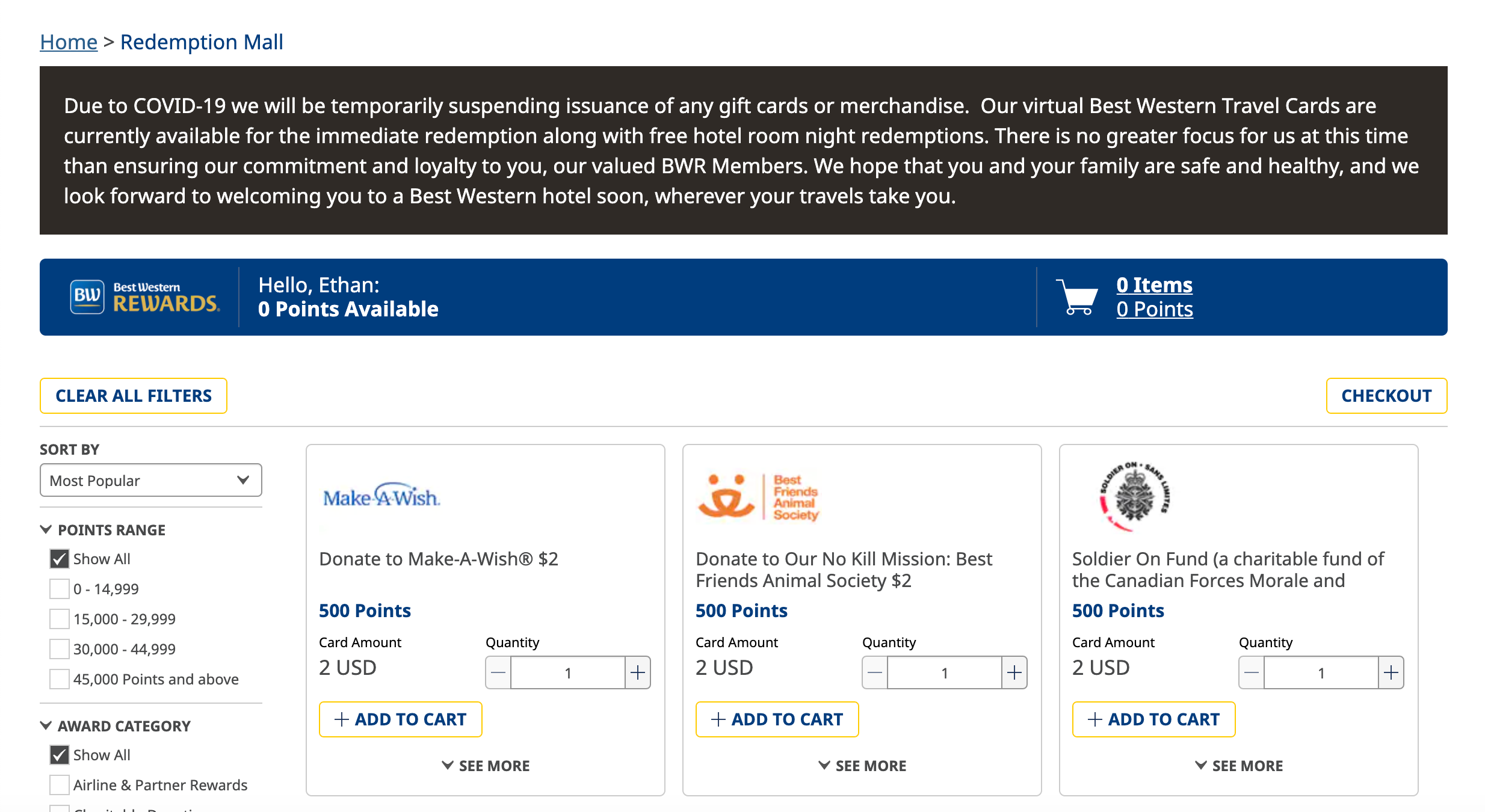

Best Western

Best Western has also paused the ability to redeem points for gift cards and merchandise through its Redemption Mall portal. However, as of now you can still donate your points to charity, convert them to miles with 14 different airline frequent flyer programs, or redeem them for a AAA/CAA membership, in addition to redeeming them for free hotel nights.

Related: The best hotel credit cards

Bottom line

Despite a record-setting government bailout, many companies in the travel industry are in very precarious financial positions. Expect to see more airlines and hotels follow the lead of these companies, and limit non-travel redemptions to protect cash flow.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app