Rakuten (formerly Ebates) adds Amex Membership Rewards earning to all accounts

One of the fundamental The Points Guy principles is to click through a shopping portal before making any online purchase, whether its buying clothing or booking hotels. For years, online shoppers had to decide between earning miles through an airline shopping portal or earning cash back through a cash-back portal.

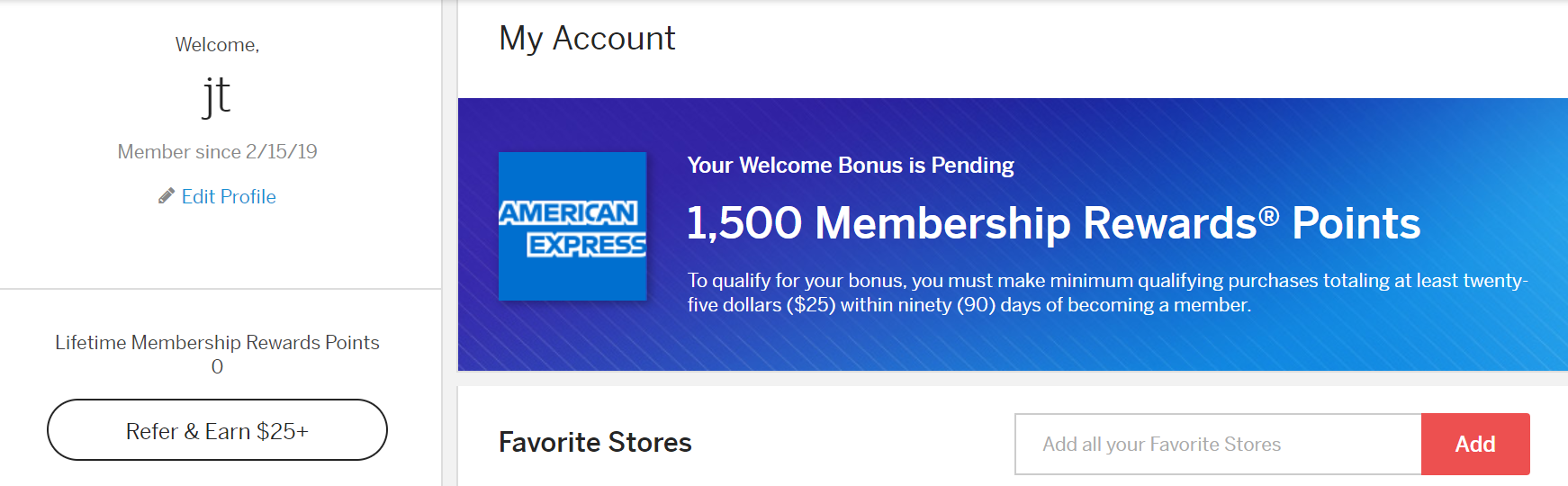

In February 2019, Rakuten — formerly known as Ebates — shook up the market. Instead of limiting members to only earning cash back, new members could elect to earn American Express Membership Rewards points when they signed up for a new account through a special landing page.

As of today, Oct. 30, Rakuten and American Express are expanding this partnership to allow all existing accounts to opt into earning Amex Membership Rewards points instead of cash back.

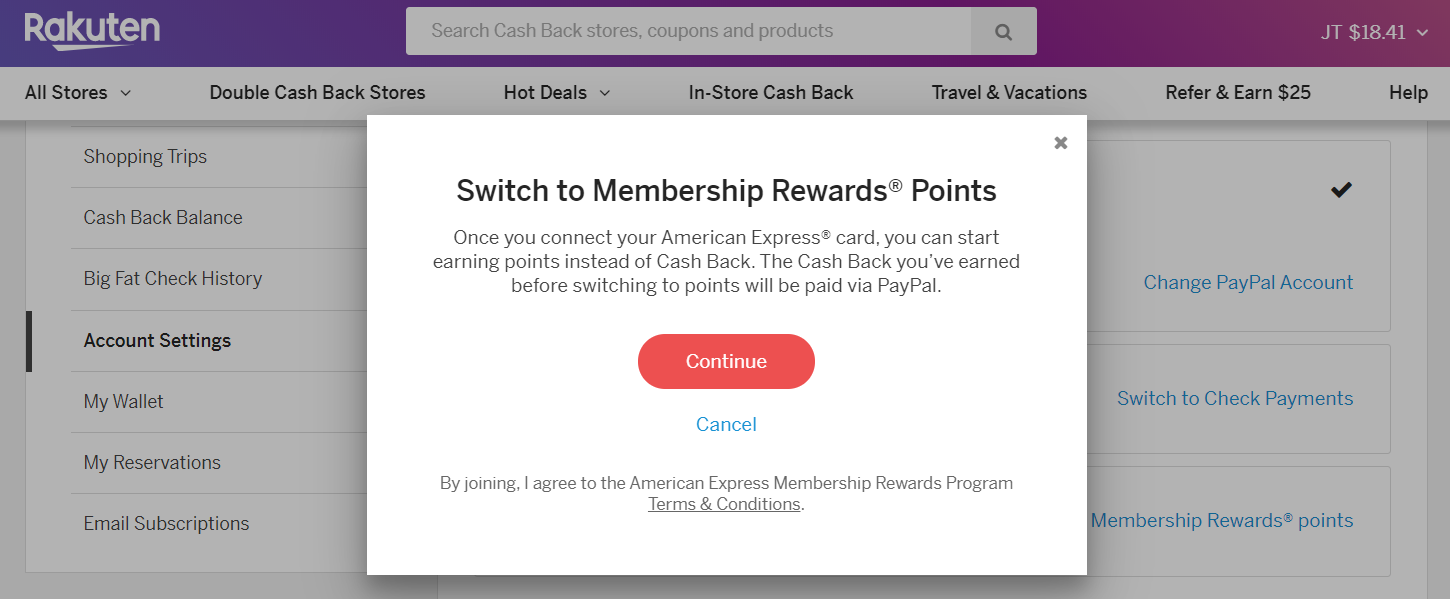

To be eligible, you'll need to be a U.S. American Express card member with a card enrolled in the Membership Rewards program. To opt in, you'll need to link that card to a new or existing Rakuten account and select in your account settings to earn Membership Rewards points.

Back in February, this new earning opportunity was good enough for a number of existing Rakuten members to abandon their old accounts and sign up for a new account, and I was one of them. While earning cash back is great, the ability to earn Membership Rewards points — which TPG values at 2 cents each — instead of cash back meant I was doubling my return.

In discussing this expanded partnership with Rakuten, I asked if members like me will be able to combine duplicate accounts. Unfortunately, the answer is no. So, if you set up a new MR-earning account since February, you won't be able to merge that account into an existing account.

Rakuten also confirmed that members that have an accumulated balance in their non-Membership Rewards earning account won't be able to convert that balance to Membership Rewards. Members will be able to opt into earning MR points on future transactions, but any accumulated cash back earnings will pay out by PayPal or check -- based on your current earning preference.

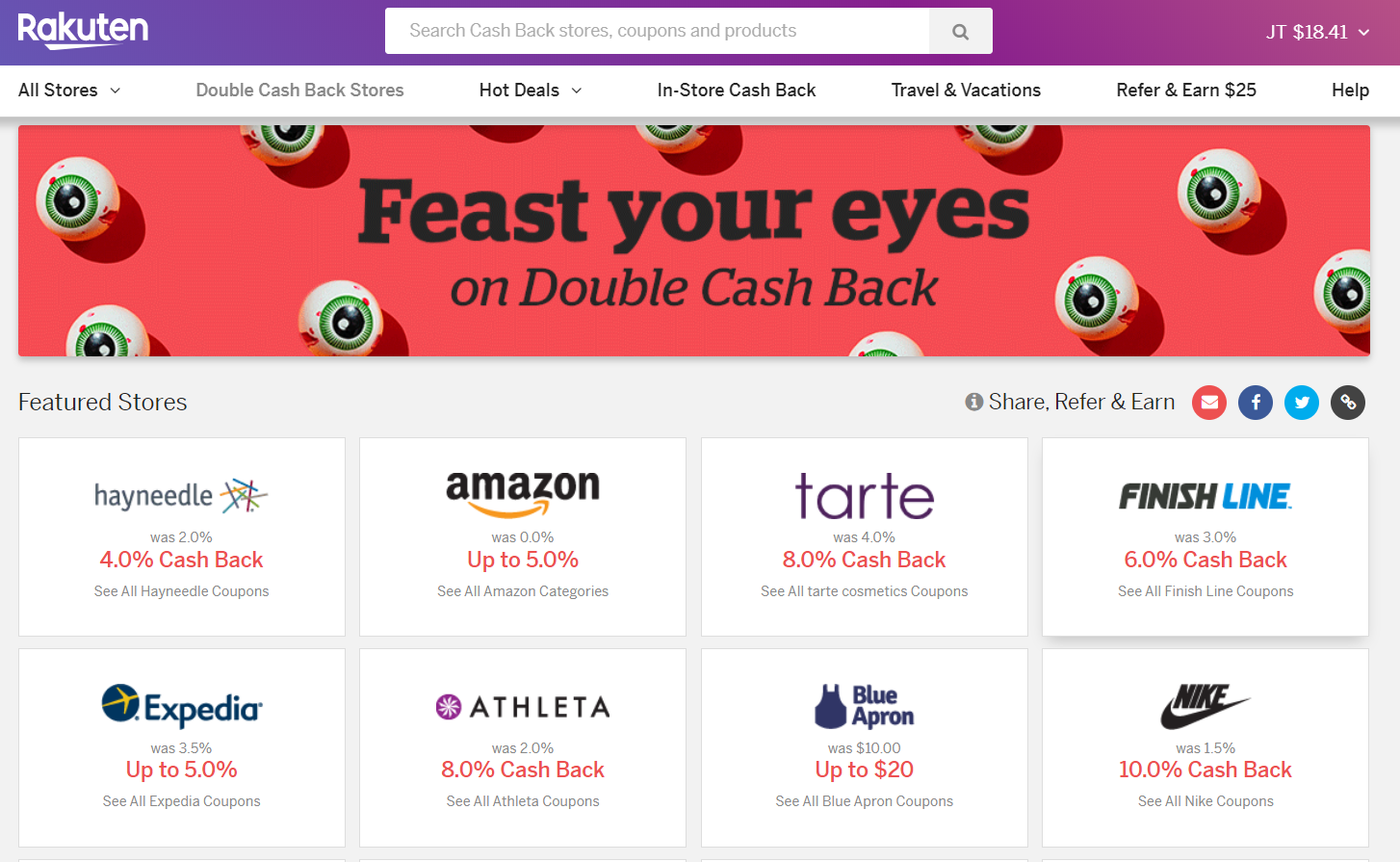

If you're unfamiliar with Rakuten, now's a good time to learn about this way of double-dipping on the earnings from your online shopping. Members earn cash back or Amex Membership Rewards points for making a purchases online at one of over 3,500 online retailers after clicking through a Rakuten affiliate link.

The earnings rate depends on the merchant and whether or not Rakuten is running a promotion. We've written about Rakuten a few times during especially good deals — such as:

- Earn up to 20% cash back or 15 Amex points per dollar shopping online at hundreds of retailers

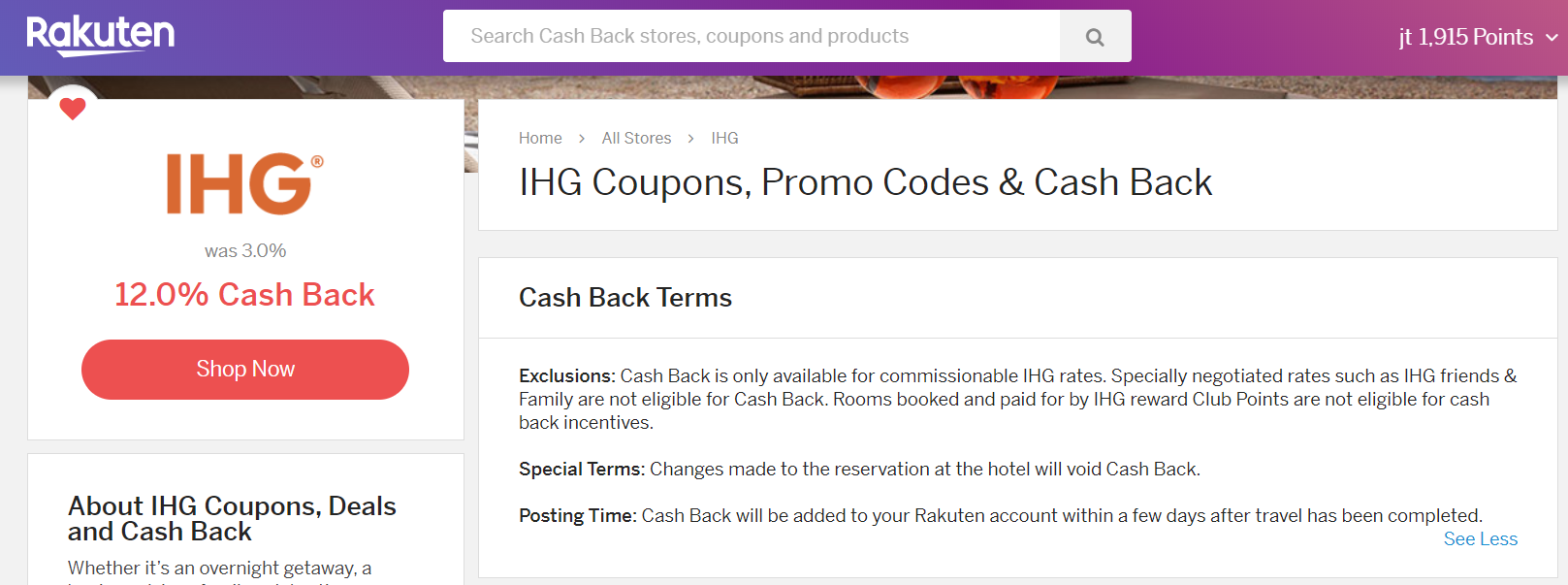

- Earn 12x Amex Membership Rewards points on hotel bookings

- Earn 10x Amex points per dollar shopping at big name retailers

- Earn 5% back (or 5x Amex MR) at restaurants through Rakuten Dining

At the end of each calendar quarter, members get paid their accumulated earnings for the quarter — by check for those that earn cash back or by automatic transfer to Membership Rewards for those who've elected to earn points. Note that you'll need to have earned at least $5 or 500 points to get a payout. Otherwise, your balance will roll forward to the next quarter.

If you want to make sure not to miss out on earning points, miles or cash back on future purchases, Rakuten and a number of airline shopping portals — including Alaska, American Airlines, Southwest and United — have browser extensions. You can install these in certain browsers to be reminded to use the portal whenever you're shopping at a participating retailer website.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app