How to Avoid American Airlines' Worst Domestic Aircraft

Despite American Airlines and US Airways merging in 2013, AA's combined fleet remains frustratingly inconsistent. And that inconsistency is on full display when you look at AA's Airbus A321s — where there are lie-flat business class seats on some and no power, no entertainment and minimal-legroom recliner seats on others.

I rack up quite a few miles and flights on AA. From this experience and by learning from other travelers, I've picked up a few tricks and tips — which I've shared in various articles. But recently, I received a message from a TPG reader nicknamed "AmericanFlyer" that I figured I should address directly:

What is the best way to tell "good" business class seats on AA versus "bad" business class seats? I took a flight from JFK to SFO and it was full recline, upgraded for free via [Executive Platinum] status... awesome. However, on my red-eye home on that same trip (SFO to PHL) I found that business class (also upgraded) to have what I would consider standard seats with only a slightly better recline... major disappointment for a red eye! How can both of these cross country trips be considered business class?! How can others avoid this mistake?

My biggest tip to this reader and all other flyers of American Airlines: avoid US Airways. Now, let's go through how you can do this.

Connect Through AA Hubs

When I have the option, I'll always choose to connect in an LAA (legacy American Airlines) hub — such as Miami, Dallas/Fort Worth and Chicago O'Hare — instead of a LUS (legacy US Airways) hub such as Phoenix, Philadelphia and Charlotte.

In AmericanFlyer's case, the flight from the west coast to Philadelphia (PHL) was on the same miserable LUS A321 that The Points Guy railed about last year:

Meanwhile, the New York Kennedy (JFK) to San Francisco (SFO) flight he experienced is on an ultra-premium A321T. Besides short hops from Boston (BOS) to JFK, this aircraft type can only be found on American Airlines JFK-SFO and JFK-Los Angeles (LAX) routes and is one of the best upgrades AAdvantage elites can get without using a systemwide upgrade.

Due to the limited routes, the A321T is an outlier, but it's definitely worth experiencing for yourself if you're able to build it into your itinerary.

321 vs. 32B

However, the advice of avoiding US Airways hubs only works on some itineraries. Sometimes your itinerary can be between two hubs (e.g. Dallas to Phoenix) or on another route that sees a mixture of legacy AA and legacy US Air aircraft (e.g. San Francisco to Dallas). The key here is to book 32B — think book 32B — and avoid 321.

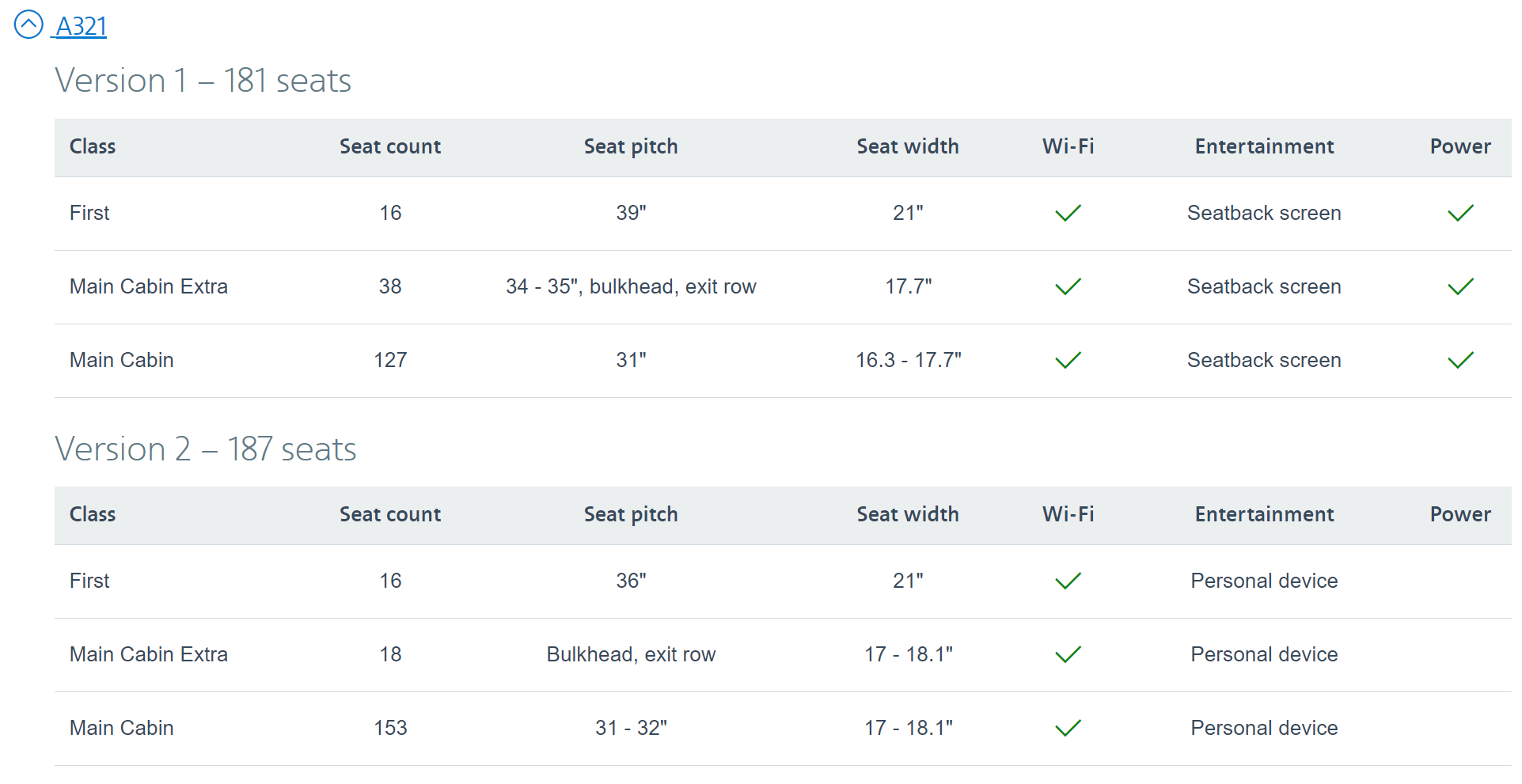

What's the difference? Well, here's how AA's website describes the two planes. American Airlines planes (LAA 32B) are Version 1 and US Airways planes (LUS 321) are Version 2:

- LAA planes have power outlets. LUS planes do not.

- LAA planes have seatback entertainment screens. LUS planes do not.

- LAA planes have 3 more inches of pitch in first class.

- LAA planes have 20 more extra-legroom seats in economy (and free alcohol). The only Main Cabin Extra seating on the LUS planes are at bulkheads and exit rows.

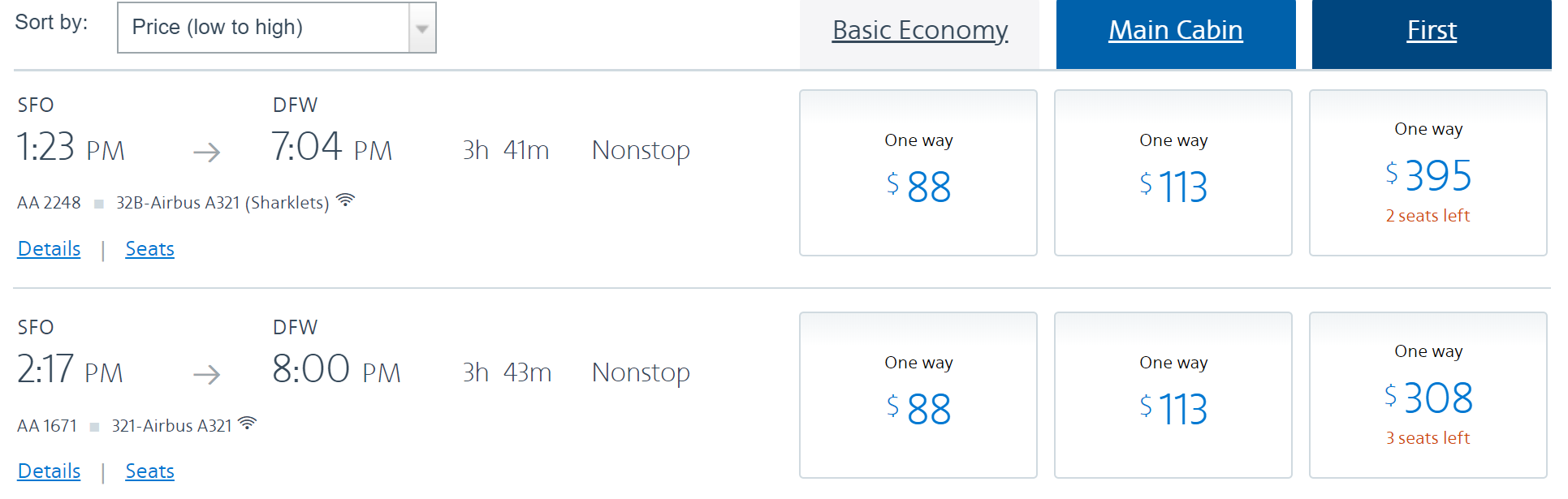

How do you avoid the LUS aircraft? Let's take SFO-DFW as an example. American Airlines flies both types of A321s on this route. I've flown this route numerous times and have experienced the stark difference between aircraft for myself.

At first glance, these two flight options may seem rather similar in economy. They are the same price in both basic economy and Main Cabin and have similar departure, arrival and duration times. However, when you look closely, you'll see 32B for the 1:23pm departure and 321 for the 2:17pm departure. If you value in-flight power, extra-legroom seating and in-flight entertainment, you're going to want to opt for the earlier flight.

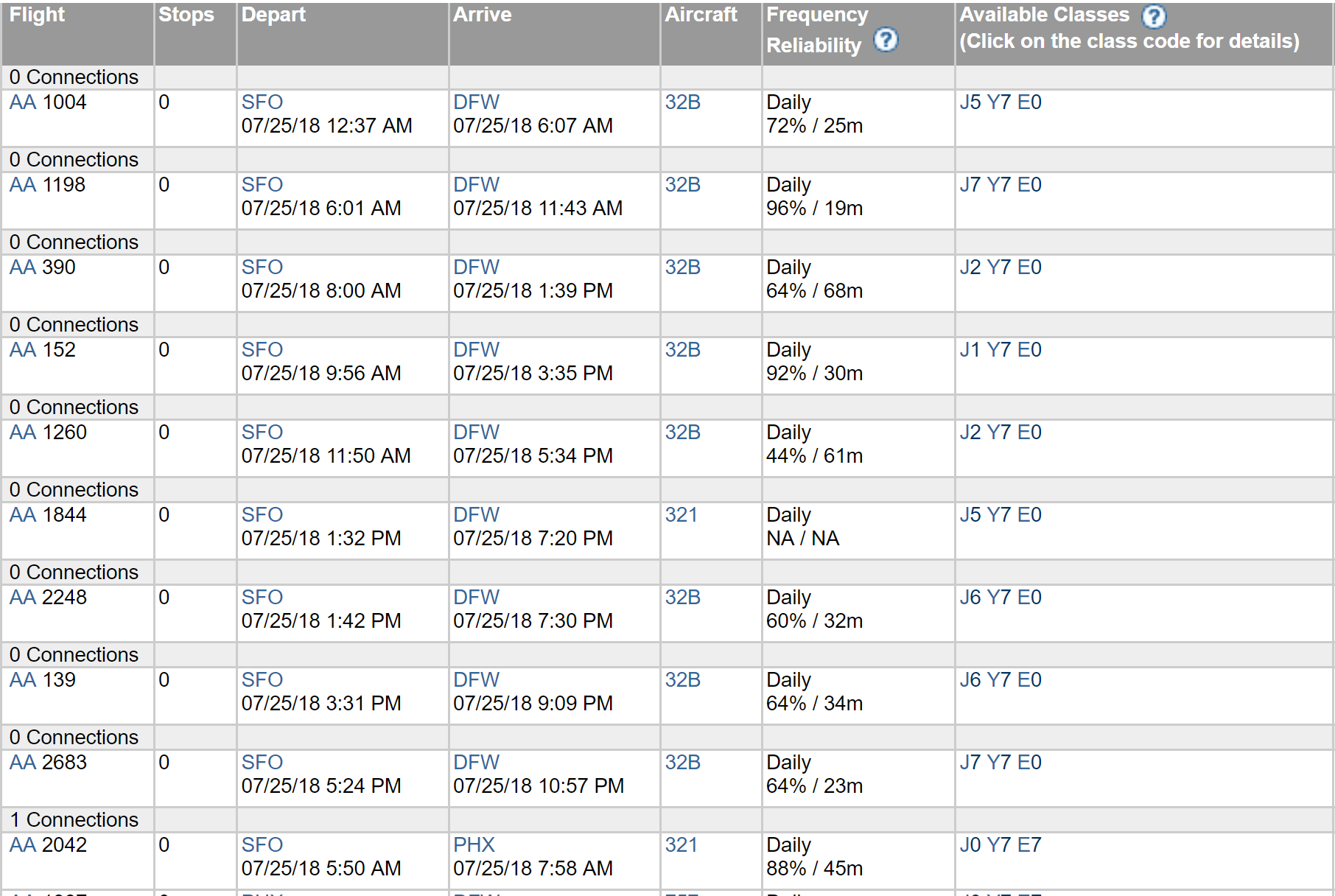

Instead of using AA.com, you can also find aircraft type on ExpertFlyer:

As I chronicled during a recent cross-country mileage run, I made sure to use my Executive Platinum elite status to get a free Same Day Flight Change from a 321 to a slightly-later 32B on this SFO-DFW route. That way, I could get extra-legroom seating and power after spending the day on LUS aircraft.

Avoid AA's "Going for Mediocre" Era Planes

Sometimes American Airlines will fly internationally-configured aircraft domestically. These aircraft are almost always better than the domestic fleet alternative — at least in the front cabin. However, if you've got the choice, you might want a domestic LAA aircraft rather than one of AA's Boeing 757 or 767 international aircraft.

Why's that? Well, before American Airlines management realized that having an awful product is a good way of losing passengers, it went through a cheap phase. And the 757 and 767 are legacies of that phase. While it installed lie-flat seats and power outlets in business class, AA passed on installing in-flight entertainment screens in any cabin. Instead, business class passengers are given a small tablet with limited entertainment options to use while at cruising altitude:

But, these tablets aren't typically handed out on domestic flights — leaving passengers in all cabins to BYOD (Bring Your Own Device) for entertainment.

As far as power goes, the 757s only have universal power outlets in extra-legroom Main Cabin Extra and the 767s only have DC power plugs at some economy seats. If you're lucky, you can get one of the few converters on the plane:

Mercifully, American Airlines has heard enough customer complaints about its 767s that it's phasing the aircraft out of the fleet sooner than planned. Even with this, the 767s will still be in the fleet into 2021.

Bottom Line

The biggest tips I can give American Airlines flyers to upgrade their AA experience:

- Avoid US Airways hubs (Charlotte, Phoenix, Philadelphia)

- Book 32B instead of 321 aircraft

- Avoid AA's crummy 757 and 767 aircraft

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.