A pilot and mechanic explain what’s needed to bring the 737 MAX back

On Wednesday, American Airlines flew its first civilian passenger flight on the Boeing 737 MAX since its 20-month grounding.

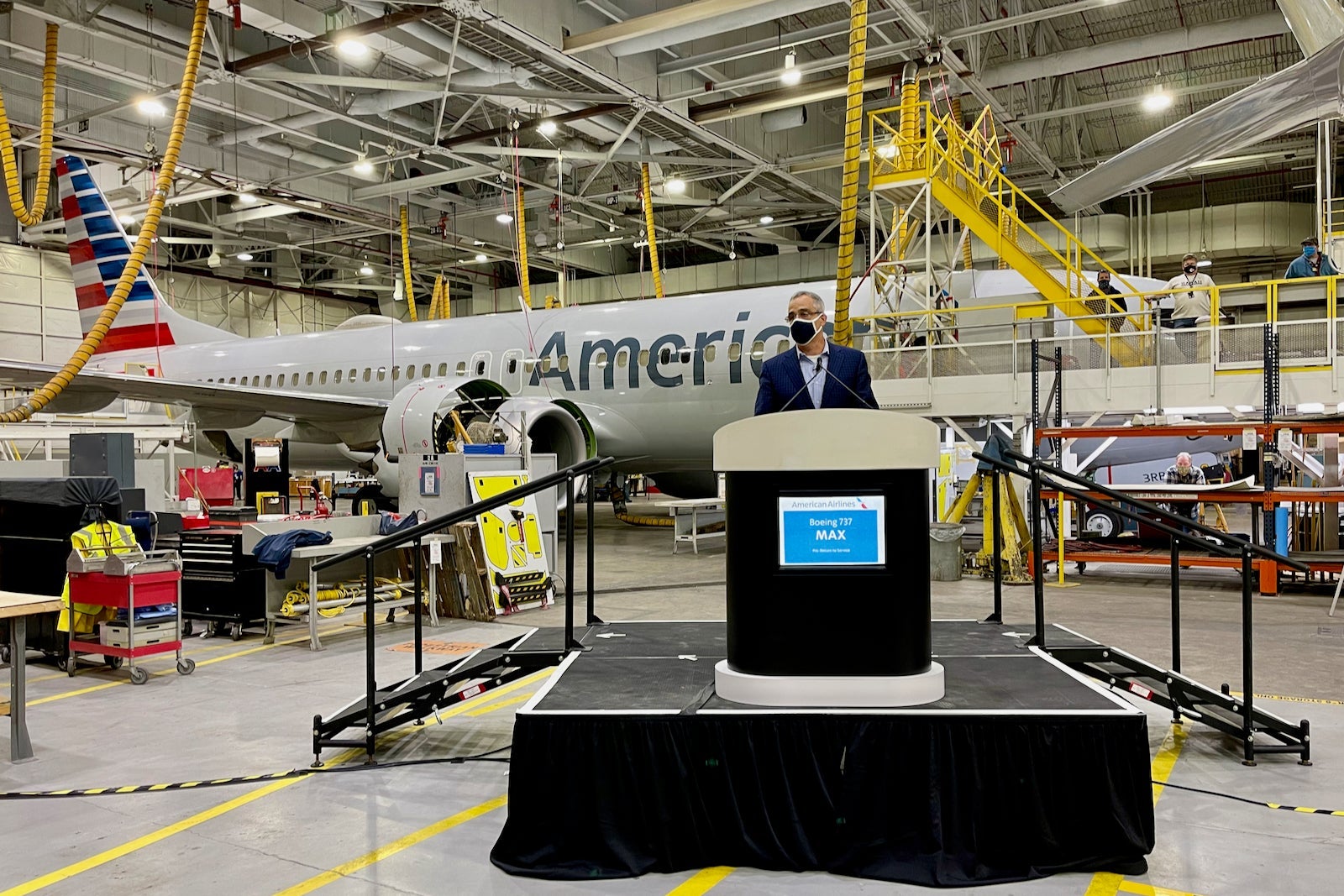

Instead of operating a "flight to nowhere" — like it's doing for employees — American brought the 95-or-so invited guests to its maintenance facility in Tulsa, Oklahoma. After pulling up to the aptly-named "Boeing 737 Center of Excellence" hangar, journalists — myself included — had the opportunity to hear first-hand from the top brass of American Airlines' pilots and mechanics as to how the carrier is bringing the MAX back.

As part of the media blitz, the Fort Worth-based carrier is working to convince the flying public that it's safe to once again fly the troubled jet. For some, flying on the MAX, which suffered two catastrophic accidents that took 346 lives, won't be in the cards.

Sign up for TPG's free new biweekly Aviation newsletter for more airline-specific news!

American, Boeing and the other MAX operators need to work to restore confidence in the jet. And what better way to do that than by speaking to the professionals responsible for restoring the planes to service.

"I have — and will continue — flying with my mother on this aircraft," said Roger Steele, American's senior mechanic overseeing the 737 retrofit program.

Steele, a 34-year veteran at the airline, explained the required changes begin with the aircraft software. For an American Airlines 737 MAX to get recertified, lines of code need to be added to the flight control computers that relate to the angle-of-attack sensors, which indirectly measure how much lift is generated by the wings.

Now, both of these sensors must be in absolute agreement as to their measurements before the MCAS, or Maneuvering Characteristics Augmentation System, kicks in. (Faulty angle-of-attack readings from just one single damaged sensor were cited by regulators as being partially responsible for the two MAX crashes.)

It takes about four hours to run the entire software update, similar to someone upgrading to the latest version of Windows on a laptop.

In fact, that's exactly how the MAX's flight control computers are updated.

An ethernet cable connects the flight deck computers to a laptop. The technician then loads the Boeing software fix to the plane, before rebooting the cockpit computers and running through a checklist to ensure that the software is up-to-date.

After the update is installed, American works with the Federal Aviation Administration to obtain an airworthiness certificate. The FAA checks the aircraft for compliance to all the new and existing documented procedures before an updated MAX is ready for its "ORF," or operational readiness flight. After a successful ORF, the MAX is approved to fly passengers.

Prior to Wednesday, all 24 of the carrier's MAXes were parked in Tulsa. Steele confirmed that the software fixes are on track to be installed fleet-wide by January 2021.

Two aircraft, including N308RD that flew media on Wednesday, have already been upgraded. American's first commercial flight on the MAX is scheduled to take place in just over three weeks, on Dec. 29 from Miami (MIA) to New York LaGuardia (LGA).

While the airline's mechanics are working to install the new software, American's pilots are going "back to school" for a deep-dive in how to fly the plane during emergencies.

Capt. Alan Johnson, American's senior manager for flight standards, said that "this has been a pilot-led initiative, and we're trying to honor the sacrifice of the 346 souls moving forward."

Johnson explained that all 2,700 of American's Boeing 737 line pilots will go through a simulator-based training exercise before being approved to fly a MAX. American has access to four multi-million dollar simulators nationwide: one in Miami and three in the Dallas/Fort Worth metro area. There's no firm timeline yet as to when all pilots will be retrained.

The new flight training requirements come directly from the Flight Standardization Board (FSB) report that the FAA unveiled when it formally ungrounded the jet on Nov. 18.

Related: How to tell if you're booking on a Boeing 737 MAX

Pilots, in groups of four at a time, will attend an hour-long classroom-based briefing led by a flight instructor, before heading to the simulator for a two-hour session of "what could go wrong with the MAX."

Boeing has created a new training module that simulates all types of emergencies, including a stall, runaway trim, go-around, incorrect angle-of-attack reading and more. The module was created to replicate real-world conditions. Boeing has already operated a series of test flights where it captured flight data that it could then load to the simulator profile.

Capt. Chris Hurrell, the 737 fleet captain is "very confident that these changes address all the issues that occurred during the two accidents." Capt. Pete Gamble, who piloted the demo flights, added that "we've made the links in the chain of safety much greater than it was before."

So far, 91 of the 95 flight instructors have been retrained, as well as eight maintenance pilots. These instructors will then train all the line pilots on the updated procedures.

After training, the "lines of communication" remain open; pilots are encouraged to ask questions and seek more data. "We can always ask Boeing for additional clarity," Gamble added.

Related: Behind the scenes of American's first Boeing 737 MAX demo flight

This open line of communication is how American plans to work with apprehensive crew members who might be displeased at the thought of working on MAX.

"Knowledge is power," said Gamble. "We try to make sure that the crew has all safety information and data available, far beyond what you need to safely operate the aircraft."

As to how American could recertify its MAXes so quickly — just two weeks after the FAA ungrounding — the mechanics cited the fact that American chose to keep its MAXes in an airworthy condition during the 20-month-long recertification process.

The aircraft didn't sit idle. They were powered up every 10 days, and they were moved around the Tulsa airfield to keep tires rotated.

So, how well did American do at convincing the public that it's safe to fly the MAX again? That answer will likely have to wait until the plane is back on the schedule to find out.

And until you're ready to fly the MAX, American, and other carriers, will be flexible. David Seymour, American's chief operating officer, confirmed that "if a customer doesn't want to fly on a 737 MAX aircraft, they won't have to — and they can easily be reaccomodated on another flight."

All images by Zach Griff/The Points Guy

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app