Why I love the Amex Business Platinum’s Pay with Points perk

Editor's Note

The Business Platinum Card® from American Express offers frequent travelers several ways to add luxury to their travel plans. From flight discounts to hotel elite status and a comprehensive airport lounge access benefit, the Amex Business Platinum Card delivers unparalleled travel perks that you can only find with a premium travel rewards card. Enrollment is required for select benefits; terms apply.

The card features a $895 annual fee (see rates and fees). However, the plethora of travel perks and a generous welcome bonus for new applicants can offset this fee.

Let's dig into one of my favorite benefits of the card — the Pay with Points perk — which gives me a discount on business- and first-class flights.

Related: Is the Amex Business Platinum worth the annual fee?

An overview of the Amex Business Platinum

Here are just a few of the valuable features that accompany the Amex Business Platinum:

- Up to $150 in statement credits on U.S. purchases made directly at Dell and an additional up to $1,000 statement credit after spending $5,000 or more per calendar year

- Up to $209 statement credit for a Clear Plus annual membership fee per calendar year (subject to auto-renewal), up to $200 in annual airline fee statement credits per calendar year on one selected airline.

- Up to $200 per calendar year in statement credits for eligible Hilton purchases (up to $50 per quarter) after separate enrollment in Hilton for Business.

- Up to $600 in statement credits each calendar year for hotel purchases (up to $300 biannually).

Enrollment is required for select benefits.

Combined, these five benefits alone can more than offset the card's annual fee. But the perks don't stop there.

Additional travel benefits include access to Amex Centurion Lounges and Delta Sky Clubs (when flying on same-day Delta flights)*, hotel elite status with Hilton Honors and Marriott Bonvoy (enrollment required) and cellphone protection**.

Right now, new cardmembers can earn 200,000 bonus points after spending $20,000 in eligible purchases on the card within the first three months of card membership.

But the one Amex Business Platinum perk I hold near and dear to my heart is the Pay with Points bonus.

*Eligible Platinum Card Members will receive 10 Visits per Eligible Platinum Card per year to the Delta Sky Club or to Grab and Go when traveling on a same-day Delta-operated flight.

**Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Related: Everything you need to know about Amex Pay with Points

What is the Amex Pay with Points bonus?

Most travel-focused premium cards offer flight-related benefits or credits, such as reimbursing you for fees incurred when traveling throughout the year. But the Amex Business Platinum has a unique airfare bonus for anyone who redeems their Membership Rewards points to pay for qualifying flights through Amex Travel.

By utilizing the Pay with Points function to pay for airfare through Amex Travel, Membership Rewards points are worth 1 cent apiece. On the face of it, that isn't too exciting; TPG's May 2025 valuations place Membership Rewards points at 2 cents apiece when utilizing Amex's many airline and hotel transfer partners.

However, the Amex Business Platinum card offers a unique perk: you can get 35% of your points back for eligible flights with your selected airline.

When using this benefit, you can get up to 1 million points back each calendar year, meaning you would need to use 2,857,143 points to pay for flights with Amex Travel before exhausting this benefit in a year.

You can also use the Pay with Points feature toward purchases on your card, gift card purchases and car rental and hotel bookings through Amex Travel, but you will be redeeming points at less than 1 cent each, well below the 2 cents apiece that TPG values Membership Rewards points, so using it toward airfare is a better proposition.

These Amex cards for small businesses that offer a Pay with Points bonus, offering from 35% to 50% of your Membership Rewards points back when you pay with points (terms apply):

- The Business Platinum Card from American Express: 35% Pay with Points bonus for eligible flights with your selected airline

- Business Centurion® Card from American Express: 50% Pay with Points bonus on eligible flights; applications by invitation only.

The information for the Amex Centurion Business card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

How does the Pay with Points bonus work?

For the Pay with Points bonus, cardmembers will receive a 35% bonus for eligible flights with their selected airline — up to 1 million points back per calendar year.

Note that you must select the same airline for your 35% bonus and for the airline fee statement credit (up to $200 each calendar year; enrollment required).

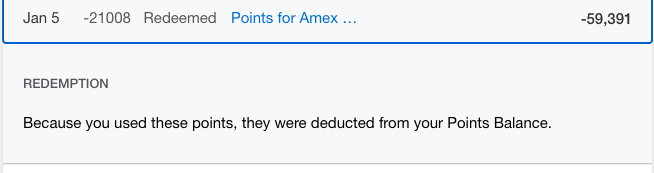

Assuming you have the Amex Business Platinum and redeem your points for eligible flights, you should receive the points bonus automatically. However, it can take up to a month.

As you can see from my screenshots, it took about a month to receive my 35% points bonus from a business-class flight I booked with Delta Air Lines using the Pay with Points option, flying from New York's John F. Kennedy International Airport (JFK) to Harry Reid International Airport (LAS) in Las Vegas.

With my original redemption, I spent 59,391 points for a $594 airfare, but that got slashed down to 38,604 points thanks to the 35% Pay with Points bonus on my Business Platinum Card.

Related: 9 things to do when you get the Amex Business Platinum Card

How to maximize the Pay with Points bonus

Amex Travel offers several ways to save on bookings, including "Insider Fares" and discounted "Recommended Fares." For international travel on certain airlines, you may be able to knock the price down even more when booking through the American Express International Airline Program (IAP).

When comparing your options for booking directly with the airline or booking through Amex Travel, you'll notice fares are sometimes equal. However, thanks to American Express Insider Fares and the International Airline Program, travelers can get even greater discounts when booking their flights with Membership Rewards points.

Here's how to stack those discounts along with the Pay with Points bonus to get even more value from carrying the Amex Business Platinum.

Stacking discounts and bonuses

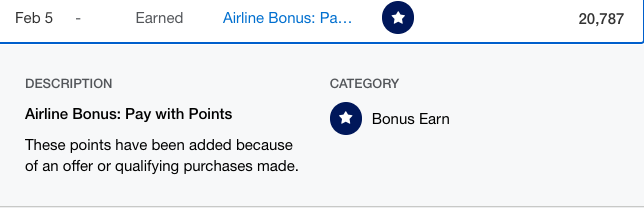

This round-trip Iberia flight in business class costs $3,791 via Google Flights, which is the price you'd pay if you booked directly with Iberia.

The International Airline Program through Amex Travel shows the same base fare, but it's discounted by $200. And instead of 379,068 Membership Rewards points, you'd need 359,068 at the standard 1-cent-per-point rate when making your payment.

However, when you stack the Amex Business Platinum's 35% points bonus on top of that, you'll get 125,674 points back. Your out-of-pocket cost is 233,395 points, which you redeemed at a value of 1.54 cents per point.

Earning miles and elite status

Aside from the tremendous points savings that are possible by stacking the benefits mentioned above, the other significant benefit to booking flights this way is that airlines treat these tickets like cash bookings. Instead of needing to search for award availability and avoid blackout or peak dates, you can simply book any available ticket.

Moreover, since the flights are considered paid tickets, you should earn award miles and elite-qualifying metrics just like you would if you'd paid cash directly to the airline.

Bottom line

The Business Platinum Card from American Express offers several great benefits, but the Pay with Points 35% bonus can be one of the most significant if you frequently fly with your selected airline. Not only can it save you hundreds of thousands of points per year, depending on how you book, but you can stack it with other discounts offered through Amex Travel.

This is a win-win in my book. It's my favorite card perk and is one of the many reasons I keep my Business Platinum Card year after year.

To learn more, check out our full review of the Amex Business Platinum.

Apply here: The Business Platinum Card from American Express

Related: 7 reasons you might want the Amex Business Platinum Card instead of the Amex Platinum Card

For rates and fees of the Amex Business Platinum card, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app