Coronavirus devaluations will hurt airlines long-term — here's why

The coronavirus pandemic took air travel from record-breaking demand to historic lows. We saw fewer than 100,000 people pass TSA checkpoints per day in April — a dramatic drop from the 2+ million passengers per day we saw during the same time in 2019. This caused airlines to slash service and — ultimately — lose a ton of money.

Things have started to improve slowly, but the future of the airline industry is still rocky. Airlines have all responded to the crisis differently — especially when it comes to loyalty programs. Some have beefed up elite status benefits while others — namely United — have taken it upon themselves to devalue their loyalty program during the pandemic.

Devaluations are never good for consumers, but rarely are they bad for the airlines themselves. After all, if they can lower liability by making a redemption more expensive, why wouldn't they? That said, I think this time is different.

Airlines have never seen this large of a drop in airfare demand at once. Analysts don't expect travel to recover to 2019 levels until 2024, which gives airlines even more cause for concern. Loyalty programs are a way for airlines to hedge against low travel demand. Devaluing in the middle of a travel slump makes for negativity, which will hurt these airlines in the long-run.

With that in mind, in this article, I'll discuss why COVID-fueled loyalty devaluations will hurt airlines long-term. I'll start with a brief on how airlines make money with miles and then dive deep into why devaluations can hurt this revenue stream.

Let's dive in!

Get the latest points, miles and travel news by signing up for TPG's free daily newsletter.

[table-of-contents /]

Understanding how loyalty programs make money

Before we dive into why airlines shouldn't devalue, it's important to understand how airlines make money with loyalty programs. In short, there are two ways: brand loyalty and partnerships. On the brand loyalty side, an airline wants to get you to fly with them and spend on their credit cards. The more airfare you buy, the more money they make — it's that simple.

Things get more interesting (and profitable) with partnerships. Whenever you spend money on a cobrand credit card, transfer miles from a transferrable points credit card or spend through a shopping portal. The partner you spend with effectively writes a check to the airline for the value of the points whenever a transaction is made.

Airlines make the bulk of their loyalty profits through credit cards and other partnerships. United recently reported that only 29% of miles are earned via flying, while 71% are "purchased" by third parties. In turn, MileagePlus generated $5.3 billion in cash flow, making up 12% of United's total revenue.

This is a massive chunk of revenue and is one that United can't afford to lose. Is especially when most travelers are grounded due to the virus. After all, people don't stop using their credit cards just because they're not flying in the immediate future.

Related: Cash cow: Why loyalty programs are a lifeline for airlines and hotels during COVID

Devaluing doesn't encourage earning with credit cards

The main reason airlines devalue miles is to save money on redemptions. If an award ticket costs more miles, a loyalty member will have to spend or fly more to earn the miles to redeem a ticket. In the short term, this means more money in the airline's pocket. But there's more to it when looking long-term.

Loyalty members will eventually catch on to rising award redemption rates. If a domestic ticket suddenly skyrockets in price by 200%, the member may start to look into opening a different credit card. Likewise, a member may opt to change transfer partners for booking a specific ticket.

A good example of this is United's recent devaluation. The airline recently removed its partner award chart and, in the process, increased partner award prices by 10%. Even in the award chart days, partner awards on international flights had a 10,000-mile premium. Nowadays, most U.S. to Europe Saver tickets cost 60,000 miles on United metal and 77,000 miles on partner flights. This is a 28% premium and is a higher cost than almost any Star Alliance partner program.

This makes me not want to transfer my Chase Ultimate Rewards points to United MileagePlus or spend on my United cobrand credit card. Instead, I'll spend on my American Express Membership Rewards-earning card and transfer to ANA Mileage Club, Avianca LifeMiles or Air Canada Aeroplan to book the same tickets at a lower cost.

If others follow my lead, this could mean enormous losses for United's MileagePlus program. This gives the airline less of a hedge against travel downturns, which can be detrimental the next time we enter a travel downturn. On the flip side, this could mean extra revenue for airlines that choose not to devalue when times are tough. This should be a serious consideration for airlines both now and in the future.

American Airlines learned this the hard way

Devaluations are proven to hurt airlines in the long term too. A 2017 article from View From The Wing notes that an American Airlines SEC filing shows that the airline lowered AAdvantage cobranded credit card earnings growth projections after it devalued its award chart. Why did this happen? American saw fewer cobranded credit card signups after it devalued its award chart. This shows a direct correlation between devaluations and credit card signups.

Related: The surprising reasons why 2020 is the year of cobranded travel credit cards

Drives future business travel away

Business travelers who are on the road four days a week value their airline miles and hotel points. It's payback for spending time away from family, which they can use to take a family vacation. Some companies have corporate contracts with airlines that dictate which airlines they travel with. At the same time, many small companies — especially consulting firms — don't, and let travelers book their own flights.

In cities like New York City and Chicago, where multiple domestic airlines have hubs, business travelers may choose their airline based on elite status benefits and mileage earnings. Airlines that choose to devalue loyalty programs now may see business travelers move elsewhere once business restarts. After all, if another airline treats you better, why wouldn't you move your business?

This is an especially big deal when you consider status matches. Most major airlines and hotels let travelers match their status between programs. For example, if you're a United Premier Gold member, you can match your status to Delta Gold Medallion. These matches usually award immediate elite status for a short period and can be extended by flying a certain amount with the airline you matched your status with.

Airlines need to keep their most valuable customers in mind before devaluing. Business travelers with a choice may accept a status match from another airline if they feel let down by their current choice. In the end, this means a loss in both loyalty and airfare revenue in the long term.

Related: The Critical Points: What does the future of business travel look like?

Leisure travelers may also move business elsewhere

Airline competition in the U.S. is rampant. Americans have nine airlines to choose from in most markets: American, Allegiant, Alaska, Delta, Frontier, JetBlue, Southwest, Spirit and United. Plus, that's not taking into account foreign carriers that serve the U.S. for international flights. If a traveler is loyal to one of these airlines and it suddenly takes twice the number of miles for a set award, the traveler won't be happy.

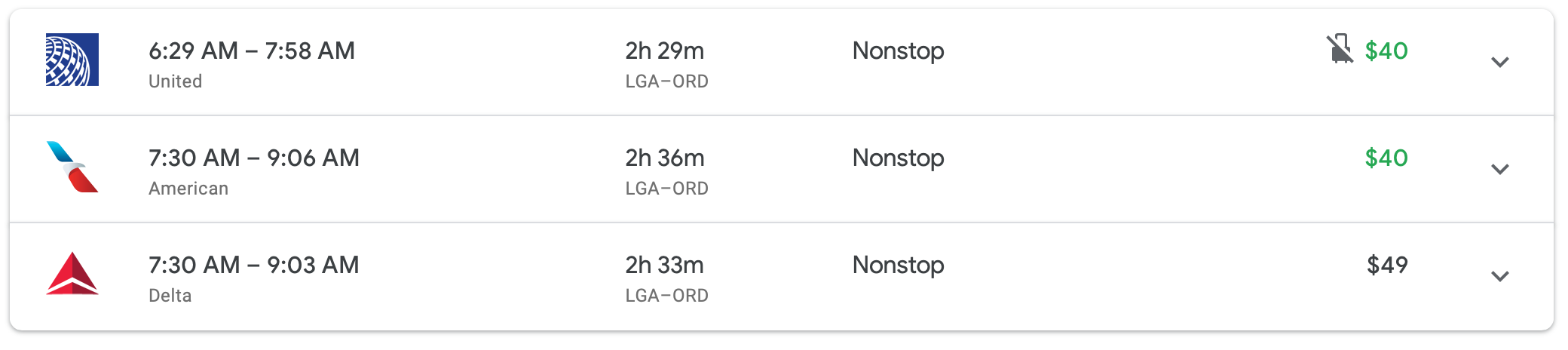

This has an equally important outcome for leisure travel. Travelers are less likely to book a flight with an airline if it won't earn a significant number of miles. This is especially true if two or more airlines are charging the same price for the same route. Price matching is common in major cities where airlines compete on the same routes. Just take New York to Chicago for example:

In this case, American and United have the same price on this flight and Delta isn't far off. These flights depart around the same time, so many travelers will book their flight based on onboard experience and the miles they'll earn.

Related: Best U.S. airlines of 2020: Who's doing it right in the COVID era

Devaluing during coronavirus hurts airlines' reputation

With so much competition, airlines need to fight for the best reputation — especially during the pandemic. With a better reputation, airlines have more wiggle room to charge more for fares and — in normal travel times — slightly devalue their miles. This leads to more revenue for the airline while keeping customers (mostly) happy due to an elevated onboard experience.

A good example of this is Delta. Despite having one of the weaker mileage currencies, it frequently tops the charts of best airlines. It was recently ranked at TPG's top airline during COVID and won the 2019 TPG Award for best domestic airline. This is mainly due to its on-time performance, superb onboard experience and excellent response to the coronavirus outbreak. It was the first to extend elite status and hasn't made any negative changes to the SkyMiles program during the pandemic.

On the other hand, United is often at the bottom of this list. In pre-pandemic times, the airline was plagued by customer service issues and poor on-time performance. According to a 2019 report from the Department of Transportation, United had the worst on-time performance of all the Big 3 carriers, with only 77.1% of flights arriving on-time in March 2019. Interestingly enough, budget carriers like Spirit and Frontier had better on-time performance that month.

The airline isn't doing itself any favors during the pandemic, either. On TPG's COVID airline rankings, the airline ranked sixth, only higher than Hawaiian, Allegiant, Frontier and Spirit. The reasoning? It was slow to process refunds and — you guessed it — the airline devalued its loyalty program.

United removed its partner award chart at the height of the pandemic and capped the number of PQP that can be earned from partner flights. These are terrible changes for United elites in a normal time, but making them during a pandemic makes is worse. I believe that United flyers will remember these changes for years to come, which could hurt the airline long-term.

Related: This is how United Airlines can improve MileagePlus for a post-COVID travel boom

Bottom line

The coronavirus pandemic is not the time for airlines to devalue loyalty programs. If the past has shown us anything, it can lead to reduced revenue and a tarnished reputation. Even if it's good for the short-term bottom line, it will eventually backfire and negatively impact airlines when travel resumes.

The best thing airlines can do right now is either make positive changes or make no changes at all. All airlines have extended elite status and made qualifying for 2021 elite status easier. Unless positive, further changes aren't needed and — if negative — will only further compound the stress of the current travel situation. So please, airlines, do us a solid on this one.

Feature photo by Markus Mainka/Shutterstock

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app