How to plan your Delta SkyMiles Medallion qualification strategy for 2025

It's that time of year again, when elite status junkies' thoughts begin turning to re-qualifying for status in their preferred airlines. With Delta Air Lines, it's an even more fraught decision this year, since Delta announced a slew of changes ... not only to the Delta SkyMiles Medallion loyalty program, but also to its cobranded credit card portfolio.

One of the biggest changes is that Delta is now determining status based solely on one metric: Medallion Qualification Dollars, or MQDs. These are essentially a measure of how much you spend with Delta Air Lines in its many iterations.

But what if you already earned enough MQDs for next year?

That's just one of the many questions we've gotten at TPG from readers about the future for status, and what the strategy should be for the rest of 2024, especially for those elites who may have already hit needed thresholds for status either via flying, credit card spending, or through the not-long-for-this-world MQM rollover.

For me, for example, I've been happily not paying much attention to re-qualifying for top-tier Delta Damond status, since I was able to choose to extend my status by a year via a special one-time Choice Benefit that allowed me to take my unused rollover MQMs and turn them into Diamond status through 2025.

Other Delta elites have already earned status for 2025 the old-fashioned way, by a combination of spend and flying.

Here are some things to think about as you go about planning the rest of the year.

- How (and when) to decide on your rollover MQM selection.

- How to plan your credit card spending strategy for the rest of the year.

2025 Delta SkyMiles status requirements

Related: Delta Medallion status: What it is and how to earn it

As a reminder, here are the new requirements for status with Delta.

- Delta Silver: You'll need to earn 5,000 MQDs.

- Delta Gold: You'll need to earn 10,000 MQDs.

- Delta Platinum: You'll need to earn 15,000 MQDs.

- Delta Diamond: You'll need to earn 28,000 MQDs.

That's a lot of spend on Delta Air Lines or on its credit cards (more on that below).

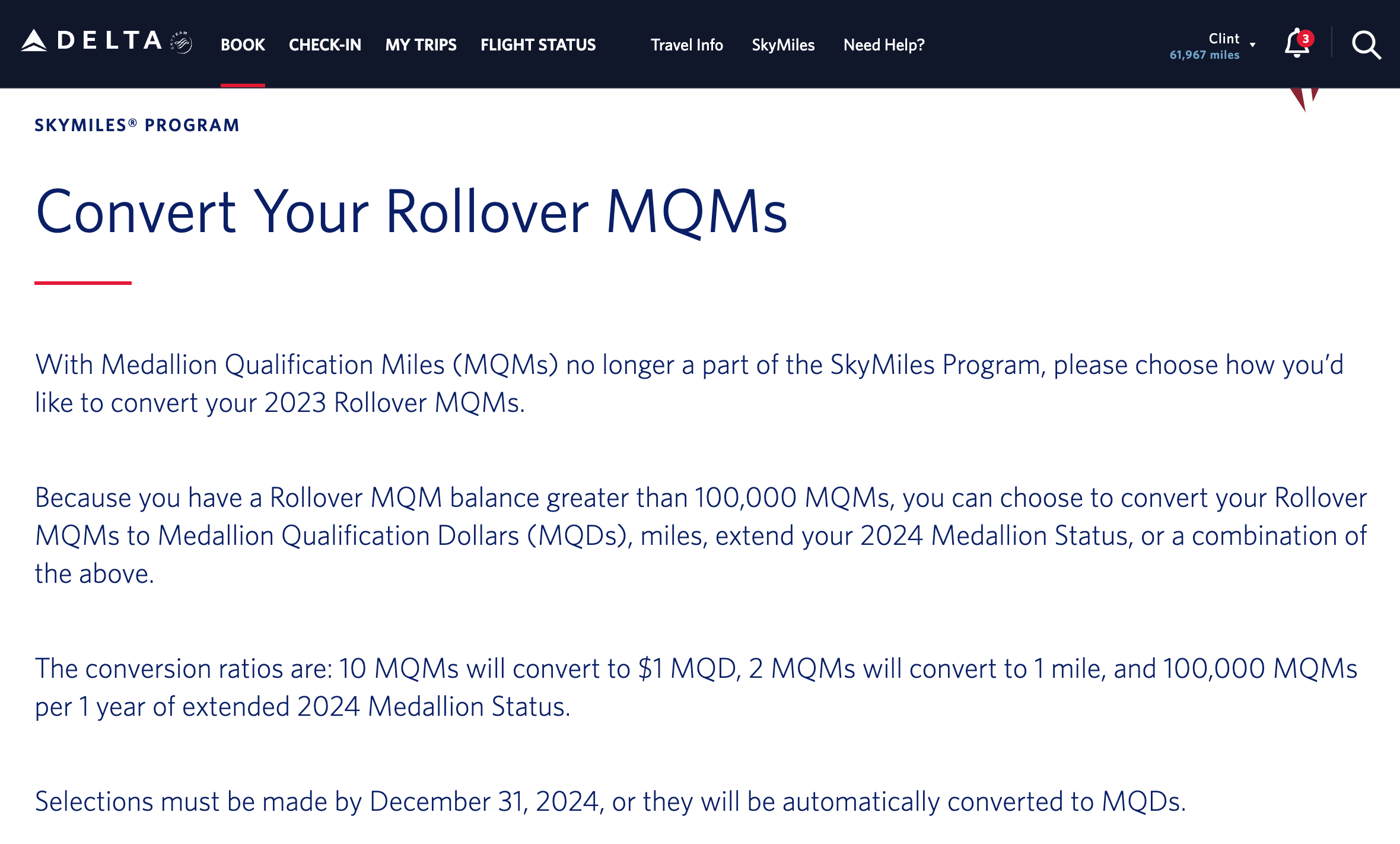

MQM rollover choices

The earning metric known as Medallion Qualification Miles (MQMs) is gone as of this year, which means that Delta has also removed the annual rollover benefit. Prior to 2024, Medallion members could begin each year with an MQM boost — specifically, the number of MQMs earned beyond last year's qualification threshold.

The good news is that any extra MQMs from 2023 can still be very useful. Delta made several one-time conversion choices live in your Delta SkyMiles account earlier this year.

You can choose to convert your MQMs to MQDs (10 MQMs = 1 MQD), redeemable miles (2 MQMs = 1 mile) or a combination of both. Here are those choices:

- 100% redeemable miles, 0% MQDs

- 75% redeemable miles, 25% MQDs

- 50% redeemable miles, 50% MQDs

- 25% redeemable miles, 75% MQDs

- 0% redeemable miles, 100% MQDs

Members with MQM rollover balances over 100,000 can also choose to extend their 2024 Medallion status for one year for every 100,000 rollover MQMs.

Please note that you must make those choices by Dec. 31, 2024. It's a use-it-or-lose-it situation, so be sure to make your choice by then. However, your selection is final — so it's important to carefully consider your options.

I had 108,671 rollover MQMs, so I used one hundred thousand of those MQMs to extend my Diamond status by a year. That means I'll be Delta Diamond through 2025 (and part of 2026) just via MQMs. I knew my chances of reaching Diamond organically were slim, so I opted for the guarantee of another year of Diamond. This has enabled me to focus on re-qualifying for American Airlines Executive Platinum status with American instead of going out of my way to fly Delta this year.

Excess MQDs will not rollover

One thing to flag is that, unlike MQMs in previous years, excess MQDs you earn beyond a qualification threshold do not roll over.

Delta is very clear about this on its Medallion website: "MQDs will not extend or roll over from year to year, and MQD balance will be reset to zero on or about January 1 each calendar year."

The carrier also made that clear in a communication with TPG. "Just as a reminder, any excess MQDs above a status threshold will not roll over," a Delta spokesperson said.

This is a powerful reason to wait until your 2024 travel and spending activity is closer to final before converting your rollover MQMs. Many of those with rollover MQMs have taken a wait-and-see approach. That allows you to gauge your progress to your desired Medallion tier before determining whether you'd benefit from additional MQDs — or would be better off with miles to use for your next trip.

For example, Nick Ewen, TPG's senior editorial director, is waiting to make a decision. He qualified for Platinum Medallion last year and only has 9,024 rollover MQMs. Converting those entirely (or even partly) to MQDs will only make sense if they help push him to the next status tier. Otherwise, he'll take his 4,512 redeemable miles — which is better than nothing.

Strategy for spending towards status on Delta cobranded cards

Another thing to consider is your card spending strategy.

Remember that Delta and American Express made a bunch of enhancements to its American Express cobranded credit cards. Those changes included a status boost for current cardmembers with one (or more) of the following cards:

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

For each of these cards you hold, you get 2,500 MQDs at the start of each year just for being a cardmember. These stack for travelers with multiple eligible cards. That means if you have two of those cards, for example, you'd get a 5,000 MQD head start on status for the year.

Related: Best credit cards for flying Delta

Additionally, Delta also issued a one-time status boost for some cardmembers. Travelers with the Delta Reserve card prior to Feb. 1 received an extra 1,000 MQDs this year as a "token of appreciation."

You also earn MQDs on spending you put on those cards. Cardmembers earn 1 MQD per $20 of purchases for Platinum cardmembers and 1 MQD per $10 of purchases for Reserve cardmembers.

However, as mentioned earlier, any MQDs you get beyond a given status threshold mean nothing if you can't reach the next tier.

If, for example, you reach the MQDs needed for Platinum status, and you don't think you can earn the 13,000 additional MQDs required to obtain Diamond status by the end of the calendar year, then it might be a better option to switch to a different credit card that earns more than a mile per point.

Should you put your spending on a different credit card?

Some readers will decide to stop some of their spending on Delta credit cards (for example, those who have automatically extended status like myself). For me, it doesn't make sense to spend a lot on my Delta Reserve card since I don't need the status boost this year. Instead, I'm using other credit cards.

TPG reader Jay Joyce wrote to us wondering what other cards he might want to use instead of spending more on his Delta card.

"I expect to reach 12,000 MQDs by the end of June from my American Express Reserve card. My one time MQM rollover will allow me to convert to 16,000 MQDs. Together, I would have the 28,000 MQDs needed to give me diamond status in July of this year and enjoy it through January 31 of 2026 as I understand it. But any additional spend on my American Express Reserve card is worthless. So it will be time to find another card."

Another reader was in a similar quandary.

Greg Bixby told TPG he'll be able to reach Diamond Medallion status easily this year, but is a bit frustrated overall with Delta. He's president of Bixby Consulting Group, and said if he had known last year that Delta would be ending rollovers, he would have pushed harder to make Diamond status (He earned Platinum last year).

He added, "In years past, I would continue to spend as much as I could on Amex even after I reached the status I wanted [in order] to max out the bonus miles and MQMs for rollover. Now, sitting here evaluating where to direct my spend, with MQDs not rolling over towards 2026 status, it seems that I have no incentive to put any more spend on Amex ... "

You'll still earn redeemable miles for spending on your Delta Amex cards, and your calendar year MQDs do play a role in your spot on the upgrade list, so continuing to do so isn't totally worthless. Nevertheless, Delta's new qualification metric (and lack of rollover MQDs) may lead some travelers to look elsewhere once they've qualified for their desired status levels.

TPG has plenty of recommendations for alternate travel rewards cards. I'm personally a fan of The Platinum Card® from American Express, and the Chase Sapphire Preferred® Card (see rates and fees) both of which earn points that can be transferred to multiple programs.

Related: TPG's guide to getting started with points, miles and credit cards

Still, you need to consider the best strategy for your own credit card spending this year.

Other ways to earn Delta SkyMiles status

There are other new ways to earn status this year too. You now earn 1 MQD for every $1 spent on Delta Vacations (excluding taxes and fees).

Delta sometimes offers limited-time methods to earn MQDs for select activities. For example, through June 24, you can earn 1 MQD for every dollar spent on hotel stays and car rentals booked through Delta Stays (with a checkout date on or before Sept. 8).

Bottom line

As we reach the halfway mark in the race towards status, it's time to get serious about your Delta Medallion status strategy.

While it's increasingly difficult to achieve Delta's highest status tiers (and much more expensive), there are lots of interesting ways to earn Medallion status without necessarily flying. You could spend your way to status via the airline's cobranded credit cards, or you could leverage your rollover MQMs to extend last year's status by a year (or more). Maybe you just fly a lot on expensive last-minute tickets.

But for many of you, it will make sense to think strategically about how much status is worth to you and if you might be better off putting that spend on a credit card that earns transferable currency instead of less-valuable SkyMiles.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app