I flew over 100,000 miles last year and still didn't earn elite status with an airline

If you spend enough hours in the air each year, odds are you'll eventually qualify for elite status with your primary airline. The perks go up the more miles you fly (and with many airlines now, the more money you spend), but they generally include some form of free seat selection/complimentary upgrades, bonus points, priority boarding, free checked bags and maybe even airport lounge access.

I flew over 100,000 miles in 2019 for the first time in my life, but despite spending several full days of the year up in the air I still didn't qualify for elite status with an airline. Here's why that happened and why I don't really mind not having access to elite benefits.

Get the latest points, miles and travel news by signing up for TPG's free daily newsletter.

My busiest year yet

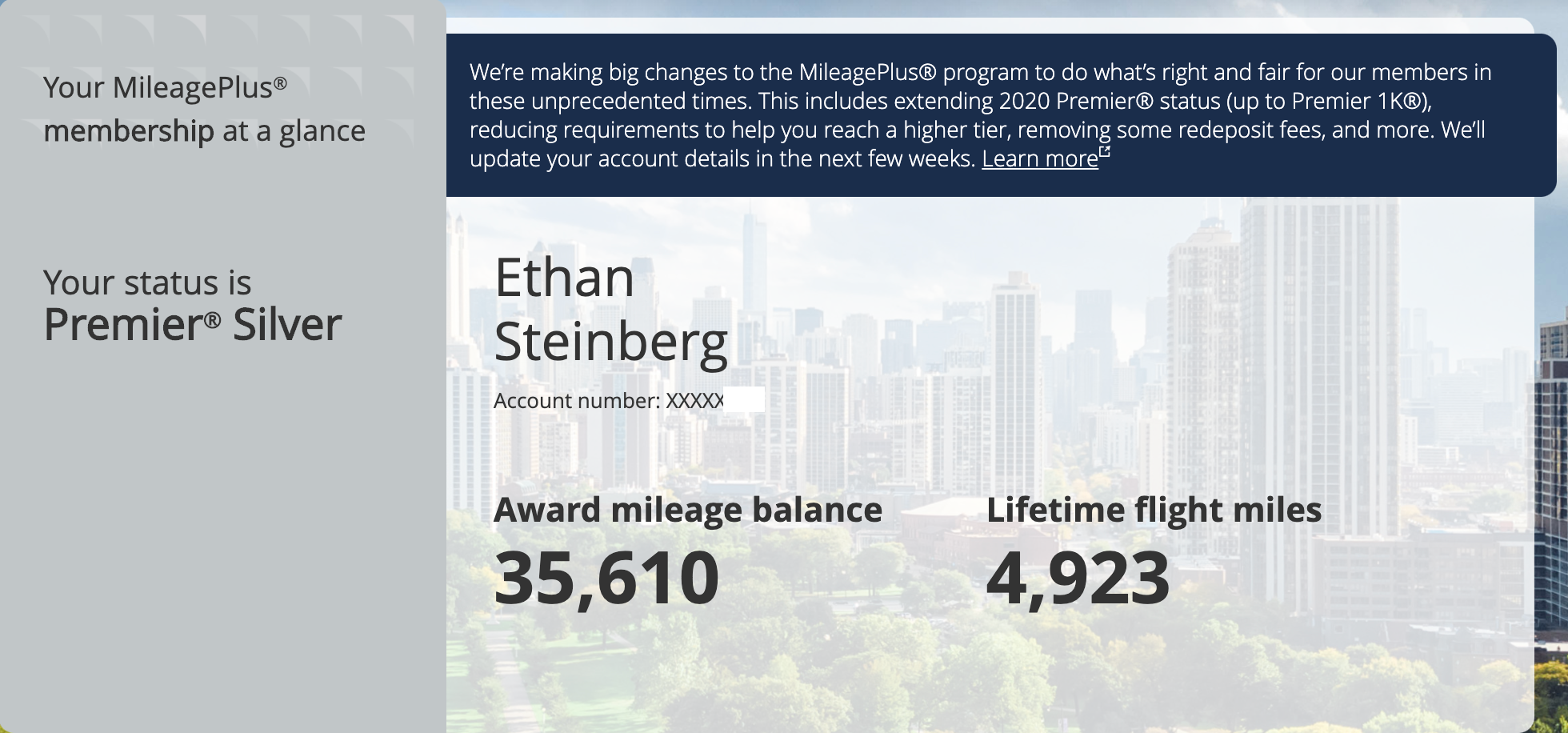

In the interest of complete honesty, I want to mention that I do technically have elite status with one airline: United Premier Silver elite. I've held this status for a few years now thanks to my Marriott Titanium elite status, and the RewardsPlus partnership between Marriott and United. I've only flown a grand total of 4,923 miles with United in my entire life, but since I'd still hold this status if I'd never flown with United before I don't count it for the purpose of this discussion.

I've been an avid traveler for as long as I can remember, but I've certainly picked up the pace since moving to China and joining TPG as a full-time writer roughly two years ago. In that time I've flown about 225,000 total miles, the bulk of which have come from a whopping 16 trans-Pacific flights.

Related: 8 reasons Delta One is my new go-to way to fly to Asia

Even if you split it up among different airlines/alliances, 100,000 miles a year should be enough to qualify for at least some elite status. But there's a big catch: Nearly all of my travel, especially the long-haul flights that made up the overwhelming majority of my flight miles, were booked using points and miles.

When you fly for free on an award ticket, you don't earn any miles toward your elite status qualification. This is notably different from hotels which tend to count award nights toward status qualification, which is why I've been able to maintain my Marriott Titanium elite status without spending much money at all.

The one notable exception to this is when you book an award ticket by paying with points through your credit card portal, like the Ultimate Rewards portal or the Amex Travel to name a few. Even though you're redeeming points for your ticket, your credit card issuer turns around and purchases a cash ticket for you, meaning you do still earn both redeemable and elite miles when booking this way.

Flying back and forth between the U.S. and Asia five or six times a year is exhausting, and so I did my best to always redeem miles for a business or first class ticket. This definitely reduced the toll that travel took on my body, and it gave me the opportunity to review some of the world's best airlines, including Korean Air's 747-8 first class, ANA 777-300ER first class and EVA 777-300ER business class. All of these flights were booked using points and miles, allowing me to fly in $10,000+ seats for pennies on the dollar. The trade-off was, these flights did nothing to help me qualify for elite status.

Why I don't miss elite benefits

Late last year, Hyatt started offering select top-tier Globalist elites complimentary AAdvantage Executive Platinum status. At first I was jealous watching my friends get handed AA's top published tier of elite status, but the truth is the benefits would've been wasted on me. Let's take a look at why:

- Bonus points for elite members: You don't earn redeemable miles when booking award tickets, so a bonus wouldn't have helped me. 150% of zero is still zero.

- Free checked bags: Excluding low-cost carriers like Norwegian, most airlines allow at least one free checked bag on international flights. Most Asian airlines allow two in my experience, and in any case the baggage limits for premium cabin passengers are more than enough to suffice.

- Free seat selection/complimentary upgrades/lounge access/priority boarding: All of these benefits are offered to premium cabin passengers in some form or another. In fact, a business or first class passenger will often have access to a better lounge and board the plane before an elite member traveling in economy.

Bottom line

I understand that my situation is relatively unique, and for most people, shorter domestic flights make up a higher percentage of their travel. In those cases, especially if you're booking economy tickets, elite status can go a long way toward improving your experience. Despite flying over 100,000 miles a year now, I don't come even close to qualifying for airline elite status because I book almost all of my flights with points and miles. And I don't mind either, as most of the benefits of elite status are already offered to premium cabin passengers.

Featured image by Ethan Steinberg/The Points Guy

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app