I said I’d never mileage run ... but now I want United's top-tier 1K status

Mileage run (noun)

Pronunciation: mile-age run/ mī-lij ˈrən

Definition: A flight or series of flights you did not otherwise need or intend to book, undertaken for the primary purpose of earning miles, usually of the elite-qualifying variety, to achieve a higher tier of airline elite status and perks.

Sample usage: I found a cheap same-day round-trip itinerary, so I booked a mileage run in order to close the gap between earning Gold and Platinum status for next year.

Now that we have the definition of a mileage run out of the way, the idea of actually doing one and spending more time on an airplane than is absolutely necessary -- while always a niche, some might say weird, phenomenon driven by slightly obsessive frequent flyers -- feels like something from a bygone era.

An era before a modern-day worldwide pandemic, before more serious considerations of sustainability, and when airline elite status was based on how far you flew instead of how much money you spent. In short, a time when it was easier to exert brain space "worrying" about frivolous things like elite status in a loyalty program.

I've done my share of mileage runs in years past, but have gone on record saying I'm retired from mileage running because it really wasn't my favorite thing. And that is still probably true. However, I'm being sorely tempted at the moment.

I've found myself unexpectedly close to United's benefits-rich, top-tier, elusive Premier 1K status (short for 100,000 miles). It's dangling right in front of me ... if only I take a few flights I don't really need.

How I got so close to top-tier status while not flying a ton

To be honest, I'm surprised I'm as close to reaching Premier 1K as I am.

Because of the pandemic, I didn't fly at all in January or February of this year. After that, I only averaged a trip a month. I'm sure that's well over the 2021 flight frequency for most people this year, but normally, that number of domestic trips wouldn't get you anywhere close to flirting with top-tier airline status.

But this year -- as we all know -- was odd.

To shore up the dwindling ranks of elites on planes, United has done several things in 2020-2021. First, it reduced the requirements to earn status. Then, the airline gave a head-start to those who had status in 2020. And then on top of that, it also handed out elite bonuses to existing members of its frequent-flyer program like candy on Halloween. If you timed the flights you were taking this year correctly, you could earn several times the normal amount of points toward status.

Without much strategy involved, it just so happened that many of my flights were eligible to rack up bonus qualifying activity. Add in some extra help from hefty credit card spending on a cobranded United credit card and I hit United Platinum status with a full quarter of the year to go. Now, I've got to game out the rest of my year to see if I want to go for 1K.

Why I want 1K status — badly

The United Platinum status I earned this year is pretty rewarding already. It's possible to snag extra-legroom seat assignments for free in advance for myself and up to eight people on my reservation. I also have a decent shot at first-class upgrades on leisure-heavy routes. What's more, I receive 40 United PlusPoints, which translates to two domestic first-class upgrades I can confirm in advance if there's available space.

But 1K status is so much better than the step below it.

Instead of 40 PlusPoints, I'd get 280 PlusPoints. That's enough for 14 domestic upgrades or even enough for some nice international upgrades to the fancy-pants Polaris lie-flat seats that I could enjoy with the rest of my family.

Related: What is United elite status worth?

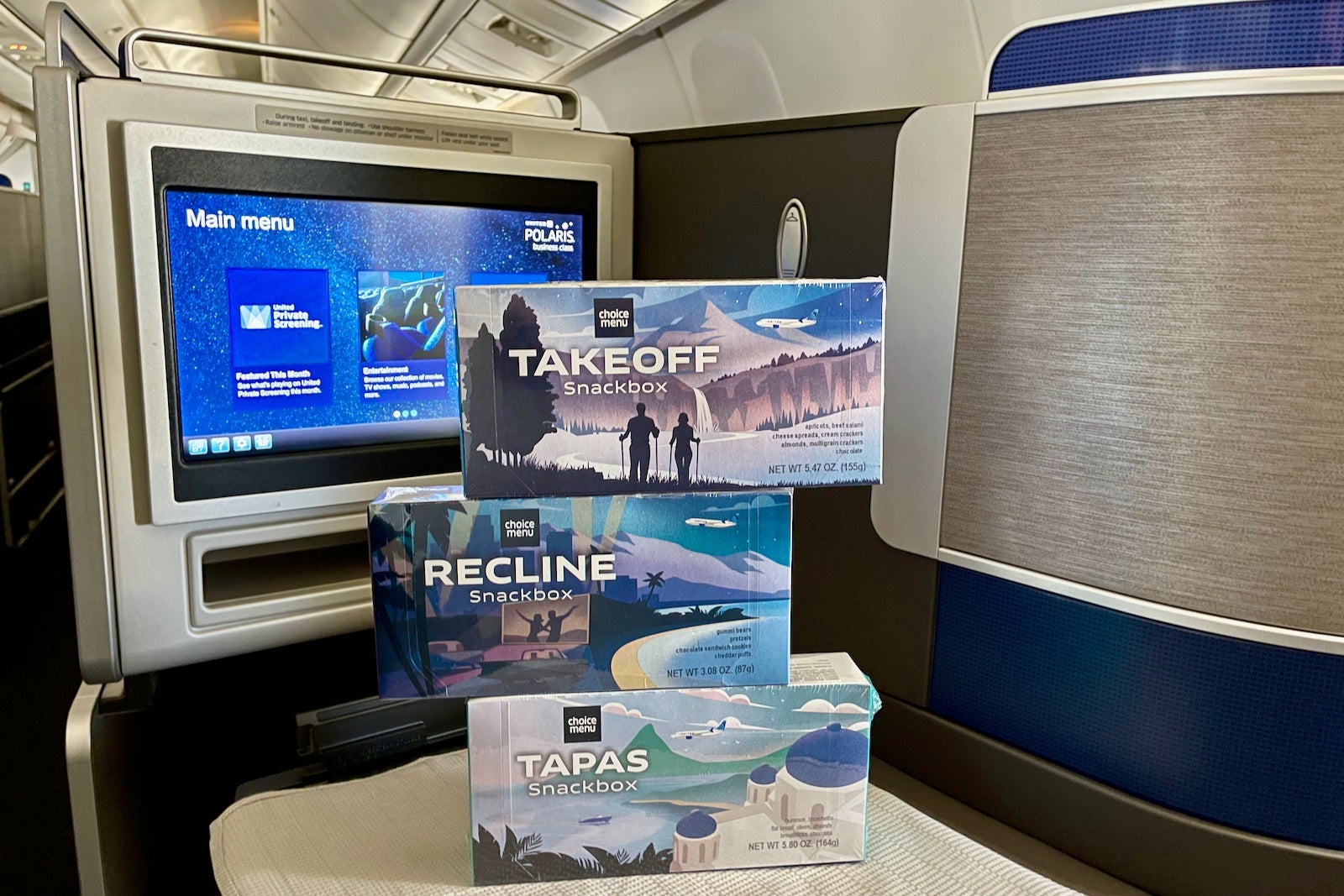

Among other things, United 1K members also have a much better shot at free upgrades to first class, get better (and faster) service over the phone, get a free snack and a drink when flying economy, can be among the first to preboard flights and basically have an entirely different flying experience than the average passenger.

Airline elite status isn't always worth chasing anymore -- but if what you are chasing is the cream-of-the-crop status, it's still pretty sweet.

What I'd have to do to get it

Ultimately, to unlock the lavish 1K lifestyle when cruising at 36,000 feet, you have two options.

This year, you need either 13,500 United Premier qualifying points and 36 Premier qualifying flights or 15,000 PQPs with no PQF requirement. In normal human terms, PQPs roughly equate to dollars spent on airfare and PQFs are flight segments (so the number of times you took off on a United flight).

I currently have 10,381 PQPs and 27 PQFs, meaning I'm about 3,000 PQPs and 9 flight segments short with just under three months left in the year. For the record, I haven't really spent over $10,000 with United this year, as those PQPs may imply. Likely almost half of those PQPs came from credit card spending, the jump-start they gave elites toward status this year and various promotions.

Since I'm building a house and have plenty of expenses at the moment, I'd guess I could earn at least another 500-1,000 PQPs with credit card spending. I may even pick up a couple of PQFs that way thanks to a special bonus.

That would leave me with a little over 2,000 PQPs and roughly four round-trip flights to go for 1K status (if at least one had one connection). I'd guess I'd earn a third to half of that naturally with normal travel I'm already planning if nothing unexpected comes up.

That leaves me with just a handful of flights and dollars needed beyond what I'm likely to do fly already in order to earn 1K status.

In other words, it may all come down to whether I'm really retired from mileage running ... or not.

Deciding if airline status is worth it

I'm not sure if I am really willing to take any extra flights just for status. But if I were, the calculation would come down to how much time and money I will have to spend and how much the perks that I'd earn at the end of it are worth.

Ignoring the time and segment quotient for now, if I had to spend $1,500 more on flights to close the gap, I'd need to be darn sure I'd get more than $1,500 in perks.

TPG values United 1K status in a regular year at over $9,000.

But looking at tangible perks, like the 280 PlusPoints that could get you 14 confirmed domestic upgrades, if you valued each set of 20 points for a domestic upgrade at $125 (a totally made-up number), that perk is worth $1,750. Obviously, if you used 40 PlusPoints for a lie-flat upgrade to Europe, that is probably worth more to you than two upgrades from Houston to Miami, so adjust your values as needed. My example numbers are likely under-valuations.

Then how much do you value a snack and drink on each flight you'd take? Maybe $100-$200 over the course of a year? The better shot at upgrades? Waived fees? Faster service? You get the idea.

I'd argue that, for me, 1K status probably could be worth an extra $1,500 spent, especially because many of the perks would extend in different ways to more than just me since I fly with my family several times a year. But that will all depend on how much travel we plan to do in 2022 and beyond as well, and it's too soon to tell.

Related: Is it worth earning elite status by flying?

Bottom line

Ultimately, I can't just write United a check to unlock the higher status and perks even if I decided I wanted to (actually, sometimes you can, but that's a different non-guaranteed scenario).

Unless something changes, based on the current trajectory, to earn United 1K status I'd have to not only spend more money on United flights this year than I had planned to, but also rack up at least a few more flight segments than I think I'd naturally take.

My plan, for now, is to wait and see what naturally develops over the next six weeks with my own travel plans and with any potential end-of-year United credit card and program-specific bonuses. If it comes down to one or two additional flights I need to schedule in order to unlock a year of upgrades and perks, I'd seriously consider doing it as I'm sure there's at least one more place or person I would like to see this year.

However, if I'd need to take multiple expensive and otherwise unwanted flights, the odds that I would actually partake in that sort of old-fashioned, multistop mileage run isn't high ... no matter how tempting the perks.

Or at least that's what I'm telling myself today.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app