The day has arrived: United award charts are no more

It's Nov. 15 and, as expected, that means that United Airlines officially no longer has published award charts for United-operated flights. Let's all pause for a moment of silence over the loss of yet another award chart.

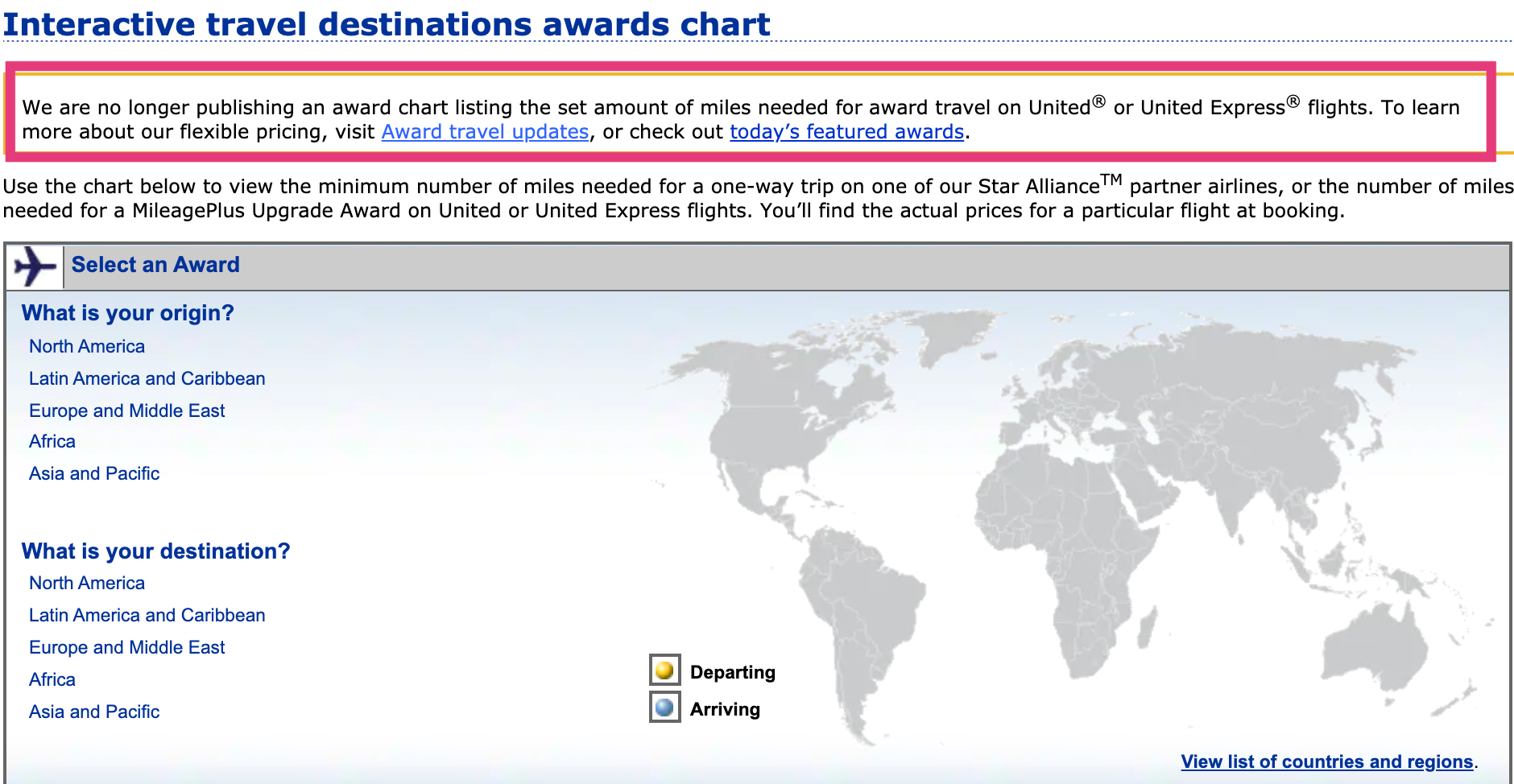

Free from an award chart, the airline's frequent-flyer program can now charge whatever it wants for award flights, and the award prices can change as frequently as the program desires for United-operated flights. (Partner award charts do remain, at least for now.)

United is hardly the first frequent flyer program to go down this road. Delta SkyMiles led the way among the "Big 3" carriers in the U.S. with dynamic award pricing and award-chart free living beginning in 2015. American Airlines is now also actively inching toward dynamic award pricing. This trend is largely not great news for those of us who like to get outsized value from our miles at the pointy end of the plane, but the good news is that today didn't bring with it any surprises.

Update: Maybe it did. Further updates below.

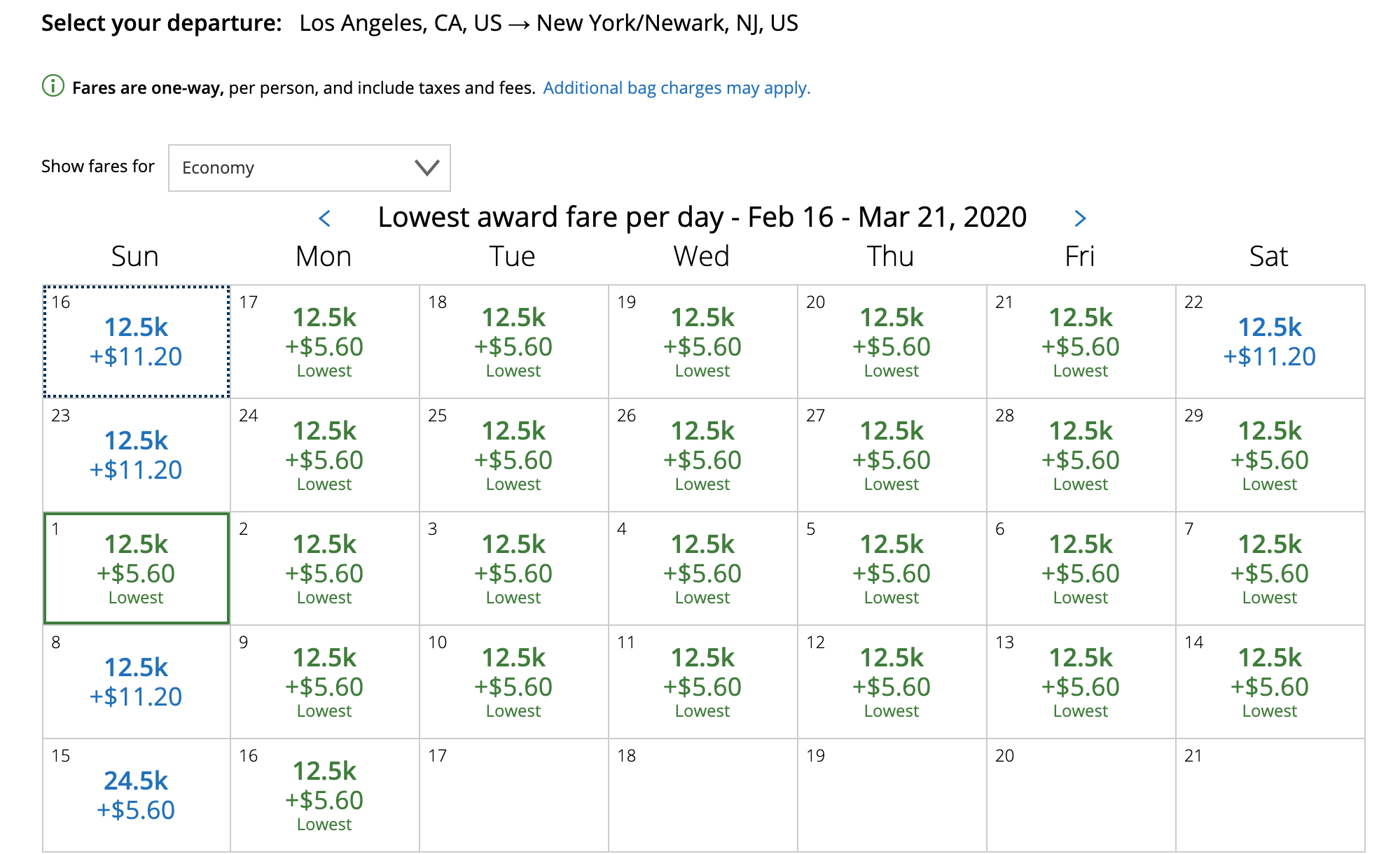

Today, in a post-award chart world, United-operated flights still price at saver-award levels as we knew them, especially in economy. That means 12,500 miles for most domestic awards, 22,500 miles to Hawaii, 30,000 miles to Europe, etc. The program doesn't charge that award price every single day, and it can charge as much as it wants, but those tried and true award amounts are still very common.

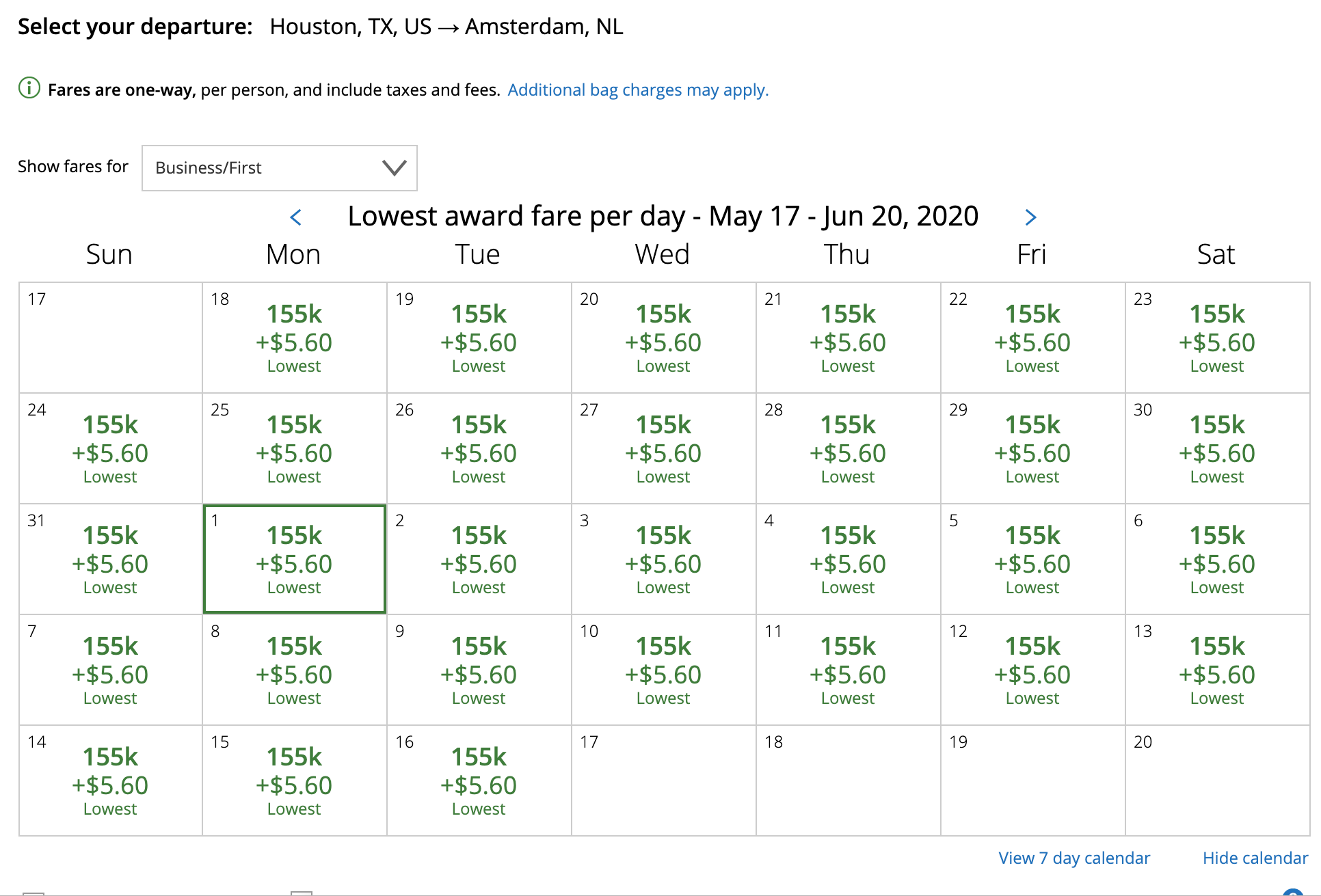

Nov. 15 evening update: These award searches were largely run in the mid- to late-afternoon on Nov. 15. However, as first reported by Running With Miles and confirmed with my own searches, many routes are now pricing a few thousand miles higher than they were a few hours ago. Most interestingly is that some partner awards -- specifically those on Lufthansa, at a minimum -- are also now pricing at levels above the posted partner award chart. You can read the full (new) story here. Short version: More changed on the evening of Nov. 15 than we expected and United did confirm the changes are not technical problems.

Just as there were when the airline first moved toward dynamic award pricing several months ago, there are award flights that price as few as 5,000 miles each way. There's even a part of the United site that will direct you to some of these lower-than-normal awards under the title of "Featured Awards".

The free Excursionist Perk — valid for a free flight for those booking bigger award trips across zones — is also, thankfully, still available.

Now, as you move to the front of the plane, business/domestic first class awards are much harder to find at the traditional saver-award levels. They still exist, but you can go months (or longer) without spotting one on some routes, such as on United-operated business class flights to Europe, Hawaii, etc. However, that situation isn't new, and certainly didn't just begin today.

As was calculated by TPG's Points Lab, having a United credit card still helps you save miles in this new pricing system. So, even in the current era of dynamic pricing, it's still worth it to have a United credit card if you fly United. None of that changed today.

One positive change that did kick in was the elimination of the close-in booking fee. Want to go to Europe tonight? That'll start at 30,000 miles and $5.60 in economy on lots of routes. Want to escape the cold to go to Hawaii tomorrow? That'll start at 22,500 United miles and $5.60 in economy. There's no longer a last-minute $75 booking surcharge.

Unlike with some other dynamically-priced programs, the United award price doesn't necessarily jump just because the flight leaves soon.

Bottom line

There's no question that today is a bit of a sad day for long-term fans of United's MileagePlus, and even Continental OnePass before that. However, we didn't wake up to a whole new program that looks different from yesterday, just because Nov. 15 arrived. MileagePlus has been inching toward today for months.

If you want to keep up with other upcoming United MileagePlus changes, check out these articles:

- United is taking the miles out of MileagePlus

- United making big changes to earning elite status in MileagePlus

- Last minute strategies for earning United elite status

- How to earn United elite status faster by flying partners in 2020

- United MileagePlus wrong for you? 3 Star Alliance partner programs to consider

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app