Uber and Lyft wait times improving as more drivers hit the road

Things appear to be improving for passengers looking to use ride-hailing services after the pandemic put the industry through the same type of upheaval seen throughout the travel industry. For riders, it has often meant unpredictable wait times, as well as unexpected surge pricing, over the last couple of years.

Some travelers still report challenges with wait times or higher prices than they remember from years past. However, the largest ride-hailing services have numbers they believe point to a major rebound – and a situation that should continue to improve. Most significantly, both Uber and Lyft tell TPG they're seeing their workforce of drivers on a sharp incline, even as gas prices continue to hit record numbers.

More drivers mean more predictability

In May, Uber reported it had 78% more drivers on the road compared to that same month last year. Meanwhile, Lyft said it had 40% more active drivers during the first quarter of 2022 compared to that same time in 2021, and pointed to a marketplace that's getting "steadily healthier."

Of course, these companies having more drivers is critical because it directly translates to how long you wait for a ride. It can also have an impact on what you end up paying.

That's not to say things have improved entirely. Some passengers in our TPG Lounge on Facebook said they've experienced continued frustrations in recent months, with a particular concern about prices. A solid majority of riders we heard from, though, reported improved experiences.

"Never waited more than 10 minutes," Susanne Fleeman said of her recent weekend trip to Chicago during which she used Uber regularly.

Tricia Klocke reported the same – "no issue" – when it came to her Lyft service at the airport in Las Vegas. "Maybe waited 5 minutes," she said.

I can personally attest that while on assignment for TPG in New Orleans a few weeks ago, I didn't wait more than two or three minutes for a ride at the airport or near the French Quarter. In fact, I haven't run into any sort of long wait time on Uber or Lyft in months.

That certainly has not been the case throughout the pandemic, though.

As TPG reported last summer, much of our staff ran into delays and higher-than-expected prices in recent years as the major ride-hailing companies dealt with a significant drop-off in drivers.

Consistent with a travel industry trend we've seen play out everywhere from airlines to airports, the smaller workforce produced fewer disruptions in the early days of the pandemic when so many stayed at home. However, it became a much bigger issue in 2021 as mass vaccinations led to travel picking back up.

While Uber acknowledged Friday that things are "not totally back to normal," it's also celebrating some marked improvements.

The company saw wait times improve to the "best levels" in a year, according to Uber CEO Dara Khosrowshahi in a presentation last month.

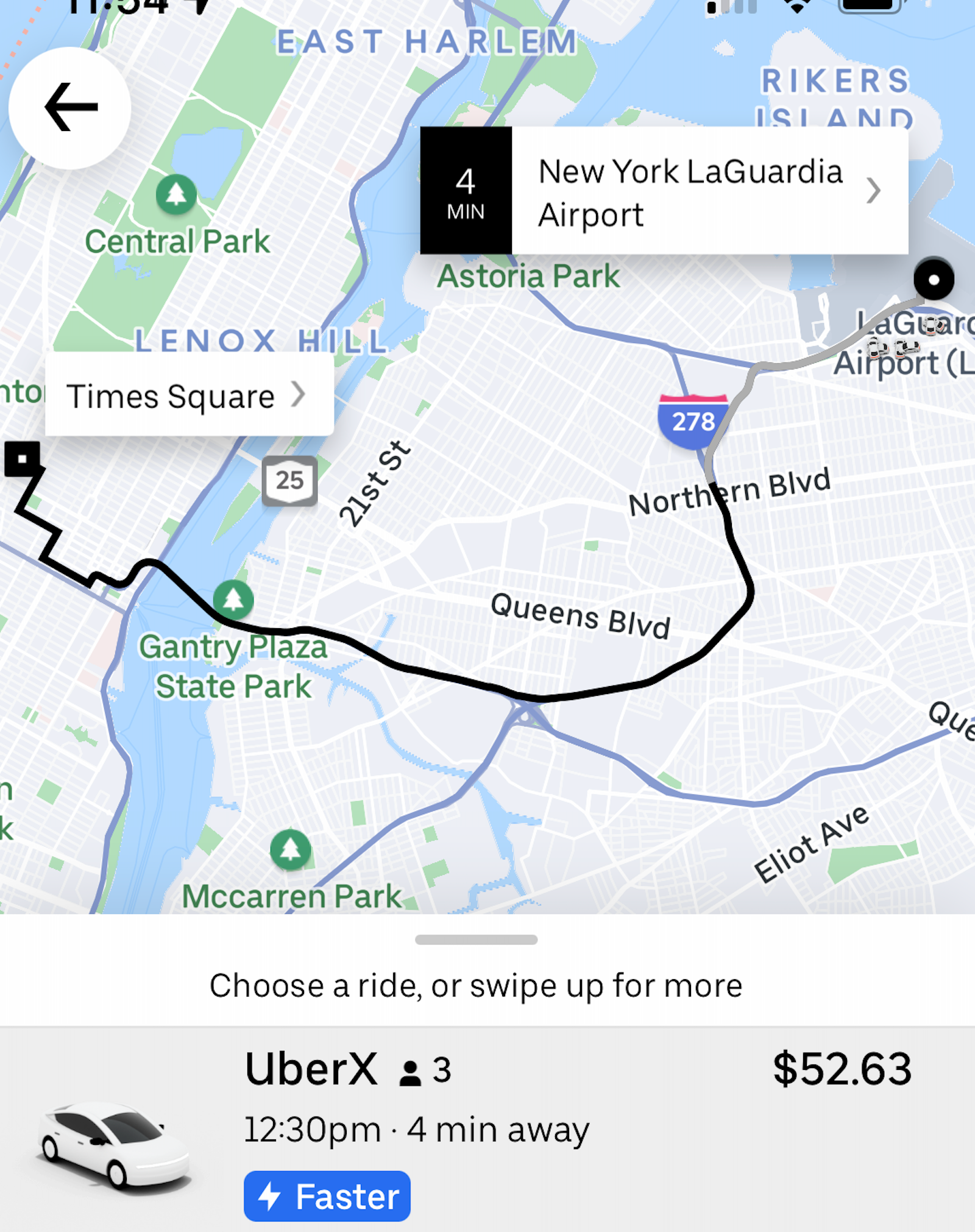

Plugging a potential ride into the Uber app as I wrote this story midday Sunday, I checked on wait times for a ride from LaGuardia Airport (LGA) to Times Square in Manhattan. Uber said I'd wait four minutes for a ride in an UberX. The ride would cost about $52.

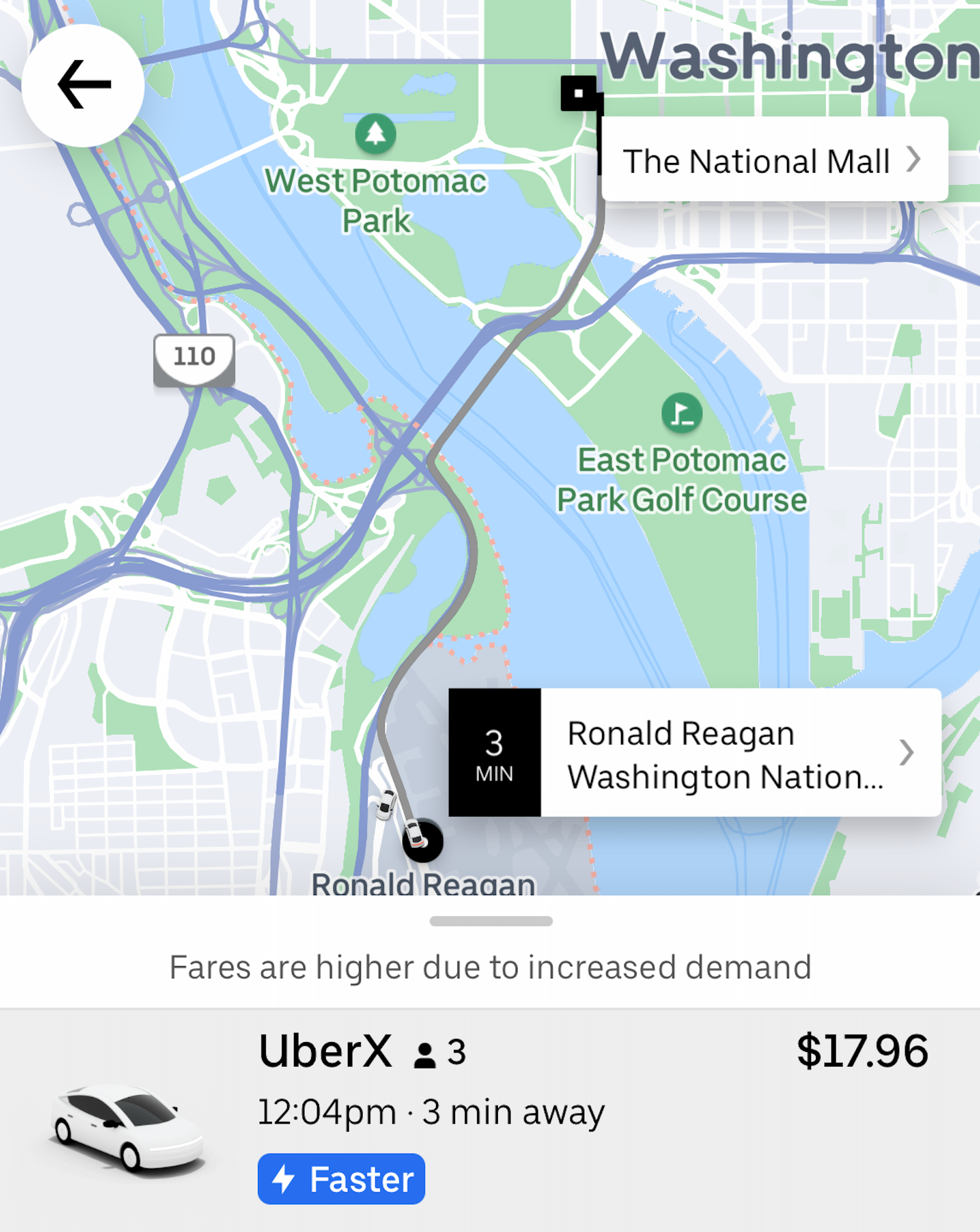

What if you were visiting our nation's capital? It'd be a three-minute wait for a ride from Ronald Reagan Washington National Airport (DCA) and $17.96 for the short UberX trip down to the National Mall.

Related: How to work the system so you aren't left without a ride

More planning and cost-saving features

On top of traditional ride bookings, TPG has reported on how both Uber and Lyft have rolled out or expanded features in recent years to help plan for demand, giving riders more options.

Lyft, for instance, points to its "Wait & Save" option. It essentially gives riders the chance to de-prioritize themselves, waiting a few minutes (and moving back in the queue) in exchange for a lower price.

Claire August mentioned that she regularly uses this feature, and often gets a ride far quicker than estimated. "Great for cheap rides, but not great for planning/predictability," she said.

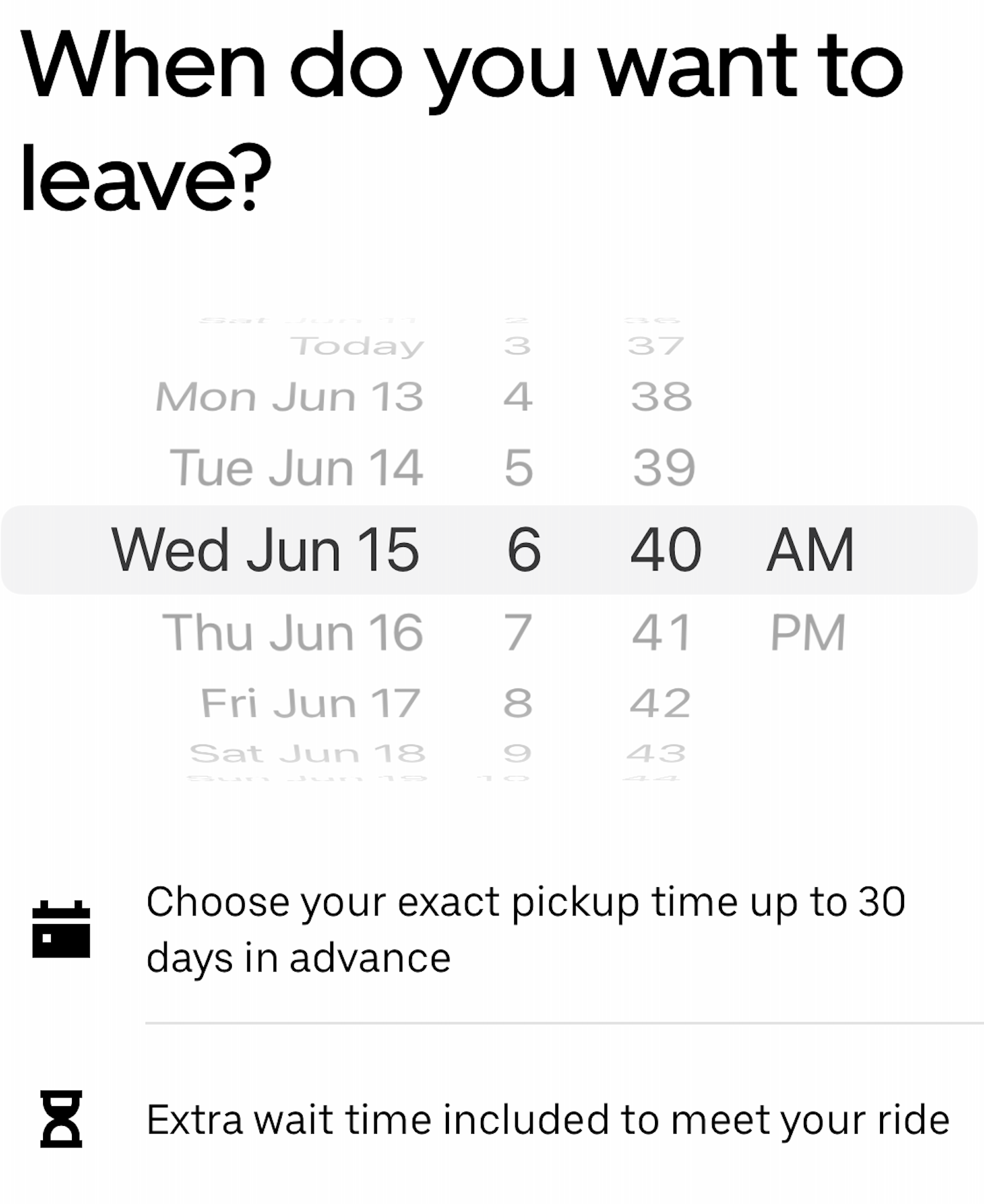

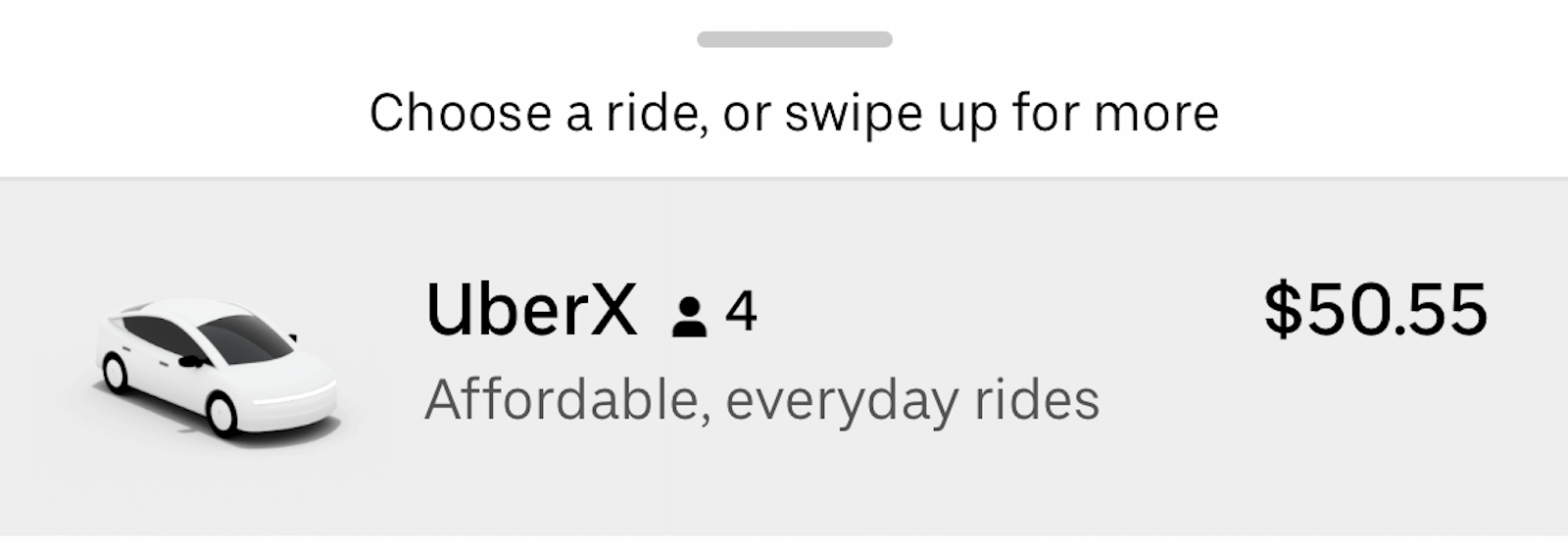

Uber now lets you plan a ride up to 30 days in advance by clicking on the "reserve" function in its app. You can input the time you'll need a ride, and the company works to match you with a driver right away.

Related: Everything you need to know about the Uber Rewards program

Keep an eye on the pricing, though. I live 10 minutes from Raleigh-Durham International Airport (RDU) and a ride to the airport usually costs me between $10 and $15. However, when I went to reserve an early morning pickup to catch a flight later this week, it was going to charge me $50, albeit with the extra convenience of knowing I'd have a ride. The reserve function also builds in extra wait time on the driver's end.

Both Uber and Lyft offer a variety of ways to save, including sharing a ride and splitting the fare – something Lyft returned to a number of cities (though not all) this year.

Related: Triple stack these offers to maximize your next Lyft ride

Fuel surcharges not going away

We first reported earlier this spring on both Uber and Lyft adding fuel surcharges to help offset rising gas prices. Not surprisingly, there are no plans at this point for either company to end those surcharges, especially as gas prices continue to reach record levels, with AAA reporting the national average topped $5 per gallon this weekend.

Lyft told TPG it's extending the surcharge until further notice.

Uber said it's "temporarily extending" the surcharge, pledging to continue listening to driver feedback before making any future changes.

Bottom line

Despite improvements, things certainly aren't perfect; few things are in 2022.

TPG reader Becca Gets frequently looks for rides in Denver, and said availability has improved, "but not enough to drive down prices consistently."

Indeed, the summer surge in travelers will put ride-hailing services to the test. More people flying also means more are looking for a ride to and from the airport, as well as at their destination.

Still, after the pandemic made things highly unpredictable for getting a ride in 2020 and 2021, the leading ride-hailing companies have more drivers coming online. That should lead to continual improvement in the coming months.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app