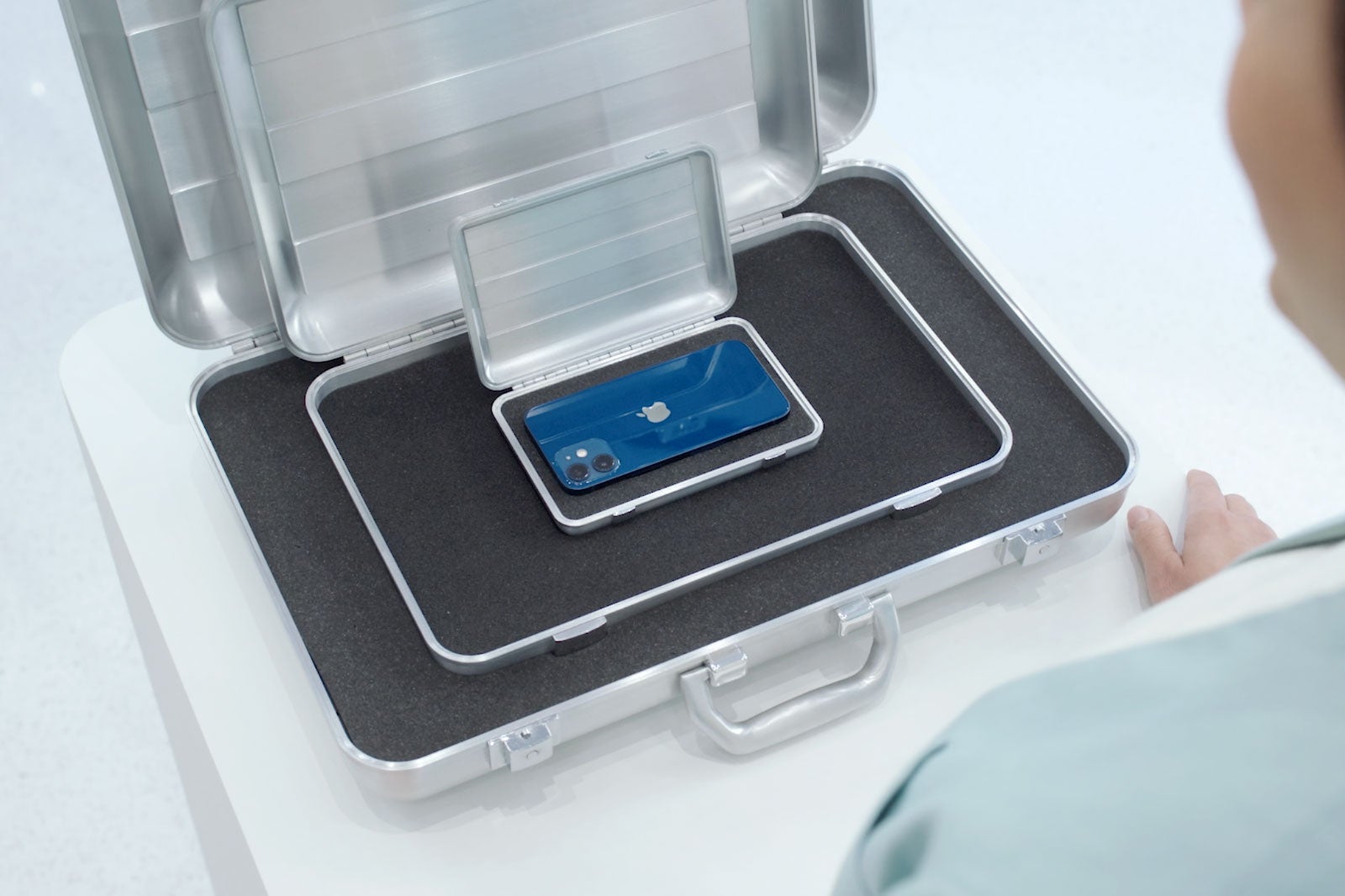

8 reasons to upgrade to Apple's iPhone 12, Mini, Pro and Pro Max

"Should I get the new iPhone?"

If you're a tech enthusiast like me, there's a good chance your friends and family members have been asking you this question for days, weeks or even months already.

Now that it's finally "out," the answer is clear for many iPhone users: Yes, you should definitely consider the upgrade.

Yes, the iPhone 11 remains an incredibly powerful device, and should perform quite well for some time. For someone like my girlfriend — who takes approximately 75 photos a month and uses her iPhone 11 Pro to browse Instagram, play the occasional game and check emails and texts — a new phone isn't necessary.

If you're like me and take approximately 75 photos in the span of minutes over a single weekend, having the latest and greatest smartphone camera is more or less a must.

So, while my iPhone 11 Pro Max is still a top-notch device — powerful enough to serve as the primary shooter for an episode of Airplane Mode I'm shooting in Emirates' new suite later this week — I still plan to upgrade as soon as possible. And if you value the features below, you should consider getting the latest and greatest iPhone, too.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

5G connectivity

Some Americans now have access to gigabit internet at home, with download speeds of up to 1Gbps. According to Apple, customers using 5G-capable iPhones can generally expect download speeds of up to 3.5Gbps — more than three times the throughput of gigabit Wi-Fi.

From my experience testing 5G on other devices, speeds vary dramatically even at different spots on the same city block, but there's no question that it's far faster than LTE, especially if you're staying still, such as watching a television show from a park bench.

For travelers, it's important to note that the new iPhones may not be able to connect with every single 5G network around the world, though Apple claims that the iPhone 12 lineup offers more 5G compatibility than any other smartphone.

Smaller, lighter and more durable

The travel implications are obvious here — having a lighter, more compact device without compromising capability is definitely a pro for anyone who uses a smartphone on the road. The base iPhone 12 sports the same display size as the iPhone 11, in a device that's 11% thinner, 15% smaller and 16% lighter, with an OLED panel that offers far superior picture quality.

There's an even smaller version, too! The iPhone Mini is the most compact 5G phone available, with the same functionality as the iPhone 12, just with a smaller display. The iPhone 12 models are also more durable than their predecessors, with up to four times better drop performance than the iPhone 11.

A big pro upgrade

You don't need pro-level features to find Apple iPhone Pro models more appealing. While I have yet to check them out in person, the new finishes looked fantastic in the renderings and photos Apple shared during its Tuesday afternoon launch event.

They have a stainless steel finish, compared with aluminum for the iPhone 11 Pros, and larger displays in a similar-size body — up from 5.8 inches to 6.1 inches in the smaller model, and from 6.5 inches to 6.7 with the iPhone 12 Pro Max. Both devices are available in stainless steel, gray, gold and blue.

Improved low-light photos

I've been a big fan of Apple's Night mode, enabling low-light photos without a tripod. I even managed to capture some really cool shots of the northern lights with the iPhone 11 last year, and it sounds like iPhone 12 Pro would have offered even better performance, thanks to its larger sensor and improved processing.

Ultimately, that means sharper photos in low-light situations without flash, with finer details and less noise. You'll likely see the biggest difference when looking at prints, but you should spot a noticeable boost with social media photos, too.

More powerful telephoto

Apple's largest model, the iPhone 12 Pro Max, offers a new 2.5x telephoto camera, in addition to ultra-wide and wide (standard) cameras, for a total zoom range of 5x. While it's not quite as powerful as the telephoto cameras available with some other flagship phones, the jump from 2 to 2.5x is certainly noticeable and should enable higher-quality shots from a greater distance, while also making it possible to get even tighter in portrait mode.

Big video boosts

Most travelers won't be familiar with Dolby Vision, and for good reason: Applying this advanced video editing software used to require advanced expertise and high-end computer rigs. Now, you can edit with Dolby Vision directly on iPhone 12 Pro. You'll even have the ability to apply filters after the fact, all the way up to 60 frames-per-second, 4K video.

Apple has also updated its image-stabilization technology, moving from lens-based stabilization to sensor-shift. Now, the sensor itself will adjust to compensate for device shake, offering more precision than the heavier camera lens.

Better wireless charging

iPhone 12 is still compatible with the industry standard, Qi, but now you can charge your smartphone through special cases — there's even a special MagSafe Wallet that allows you to charge your device wirelessly without removing credit cards and cash, and a new travel charger that juices up your phone and Apple Watch at the same time.

Reasonable pricing

Apple's keeping the iPhone SE, iPhone X and iPhone 11 in the market, but with the iPhone 12 Mini priced at just $100 more than last year's model, it's definitely worth the $699 splurge for some. The iPhone 12 Pro is priced starting at $999, with 128GB of storage, while the Pro Max starts at $1,099.

Note that pricing may vary by carriers — AT&T and Verizon are pricing the Mini at $699, for example, though you'll need to pay $729 for the unlocked version.

The iPhone 12 models and iPhone 12 Pro will be available to preorder starting this Friday, Oct. 16, and ship for delivery on Oct. 23, while the iPhone 12 Pro Max will ship on Nov. 13, with preorders beginning on Nov. 6.

Bottom line

Ordering the latest iPhone may not be a priority to many travelers right now. Many people are enduring very real economic hardships because of the pandemic, and we've all taken fewer trips this year. Having the latest and greatest smartphone camera is less of a necessity if you're hardly leaving your home, and 5G connectivity, while nice to have, isn't essential considering the throughput available with LTE, especially if you're using your device on Wi-Fi most of the time.

That said, there are still plenty of reasons to upgrade, even if it will simply get you excited about all the photographs you'll take during future trips. In the meantime, having a better camera makes it easier to capture higher-quality photos and videos around your home.

If you do decide to buy a new iPhone, you'll definitely want to play your cards right. Check out our detailed guide to maximizing your iPhone purchase for ordering tips, credit card coverage and scoring the biggest return.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app