Book now: Lots of business-class award seats from the U.S. to Australia

Over the last several weeks, Australia has been dealing with massive wildfires. The scale of the damage is devastating, and the impact to the country's economy — especially tourism — is also notable. And since one of the best ways to help may just be to visit, you could get there in comfort over the next few months. Qantas has currently opened up a large amount of award space on its nonstop flight from San Francisco (SFO) to Brisbane (BNE).

This is especially good news, since getting to Australia using points and miles in premium cabins can be exceedingly challenging. At the time of writing, we're seeing up to six business-class awards for many dates in February and March. The flight only operates three days per week (Sundays, Tuesdays and Thursdays in both directions), and the vast majority of those are currently available.

Here's a breakdown of dates for these flights, including the number of business-class seats on each one. All are flown with the Boeing 787-9.

San Francisco (SFO) to Brisbane (BNE)

February 13: four seats

February 16: one seat

February 18: two seats

February 20: four seats

February 23: two seats

February 17: one seat

March 1: two seats

March 3: one seat

March 8: five seats

March 15: one seat

March 17: four seats

March 19: six seats

March 22: six seats

March 24: four seats

March 26: five seats

March 29: six seats

Brisbane (BNE) to San Francisco (SFO)

February 9: six seats

February 11: two seats

February 13: two seats

February 16: one seat

February 23: one seat

February 27: one seat

March 1: two seats

March 5: one seat

March 10: three seats

March 12: three seats

March 15: three seats

March 17: five seats

March 19: five seats

March 24: three seats

March 26: four seats

March 31: three seats

How to book

Qantas occasionally releases large quantities of award seats to members of its own program, but in this case, it appears that all of these flights are bookable through partners. Since Qantas is a member of the Oneworld alliance, you should be able to use any frequent flyer program from a member airline to book these flights. American AAdvantage would likely be a popular choice for U.S.-based readers, as the carrier will charge 80,000 miles in each direction (plus minimal fees).

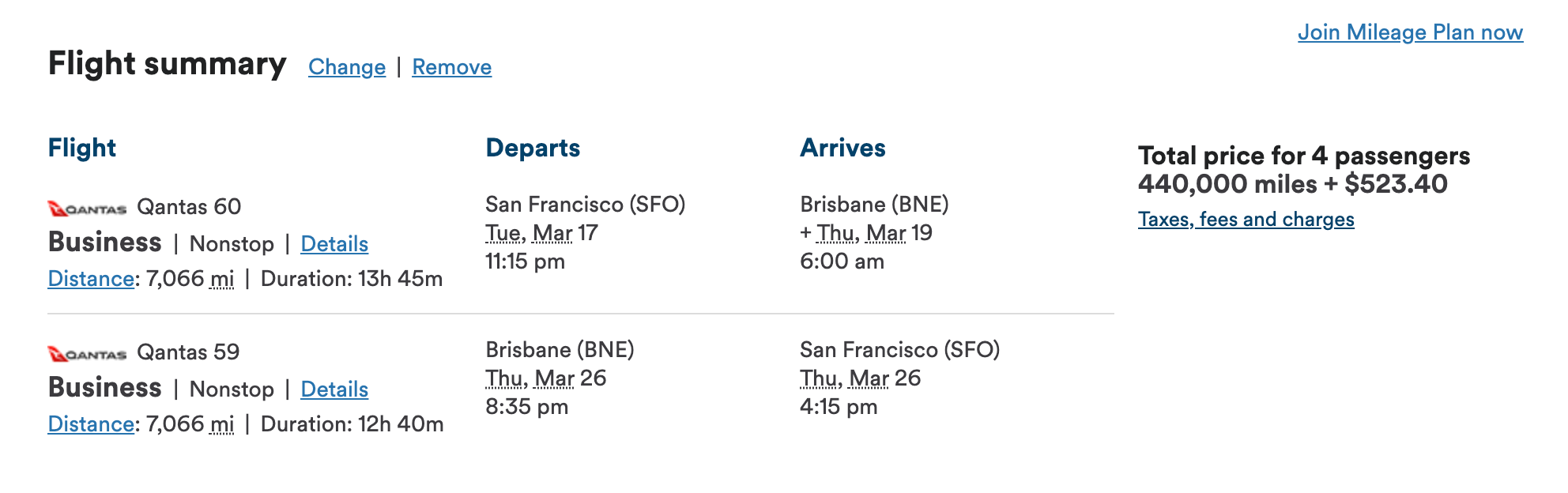

However, the best option for booking is likely through Alaska Mileage Plan. This non-alliance partner of Qantas will only require 55,000 miles each way plus roughly $130 in taxes and fees — one of the best sweet spots in the world of award travel. And it appears that all of these flights are currently bookable through Alaska, like this award for four travelers in mid- to late-March:

This is a fantastic price for one of the harder destinations to reach with points and miles — especially in premium cabins.

Adding connecting flights

If you don't want to end your trip in Brisbane, both American and Alaska allow you to add connecting, domestic flights at the beginning or end of your long-haul ones — without any additional miles. However, you would need to find award availability on all segments, which isn't always easy, especially in the U.S. While Alaska's routing rules don't allow you to combine two or more partners on a single award ticket, you could add a connecting flight to San Francisco operated by Alaska.

Bear in mind too that Alaska allows stopovers on international award tickets — even one-way itineraries. This could be a great way to fly to Brisbane, spend a few days, and then connect to another part of Australia for the same award rate (55,000 miles in business class each way).

READ MORE: How to book stopovers with Alaska Airlines Mileage Plan

What about the wildfires?

As noted above, Australia has been ravaged by wildfires, so it's important to bear that in mind as you finalize your plans. However, TPG Australia-based contributor Amanda Woods recently wrote about how booking a trip down under may be one of the best things you can do to support the country. Tourism dollars are critical to the recovery after a natural disaster, and there are many areas of Australia that aren't affected by these fires. At a time when many hotels, tour companies and other businesses that rely on tourists' money are struggling, any infusion of cash from a trip may go even further than a donation.

And of course, if you're not able to take advantage of this particular glut of award space, there's still plenty you can do to support Australia, including donating to the following:

TPG's own fundraiser from last week raised over $20,000 for the Australian Red Cross, but any additional money you can donate will go a long way toward the recovery efforts.

Bottom line

Natural disasters like the Australian fires may make travelers think twice about booking a trip to an affected area of the world, but visiting Australia in the next couple of months could provide a nice boost to the country's economy. If you have a stash of Alaska miles and have been eyeing a trip down under, I'd jump on this award space sooner rather than later, as it likely won't last.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app