Act Now to Score New Year's Eve Rooms From 8k Choice Hotel Points per Night

New Year's Eve is still over three months away, but the early bird gets the best rooms. This is especially true for award nights at Choice Hotels, since most properties within the brand make all of their rooms available for the same award rate. This means you could end up in a suite, a city view room or an upgraded room for the same number of points as a standard room.

Award nights at Choice Hotels are bookable up to 100 days before your stay begins. So, award reservations with December 31 check-ins became bookable on September 22. But, why not make a long weekend out of your New Year's Eve trip and check in on Friday December 28? If you check in on Friday December 28, then the booking window opened September 19.

[table-of-contents /]

What to Know About Choice Award Bookings

Choice offers award nights for between 6,000 Choice points and 30,000 Choice points -- TPG's latest valuation values these points at $36 to $180. So, even properties that charge the maximum 30,000 points per night can be a great steal for New Year's Eve -- especially if the property is well-located.

Award nights that cost 8,000 Choice points or more can also be obtained using points and cash. You'll pay 6,000 Choice points plus the cash rate of the remaining point cost, where Choice values points at 0.75 cents apiece. For example, a night that costs 30,000 Choice points can be booked for 6,000 Choice points + $180.

In the past, higher-tier elites could book award nights further out than lower-tier elites or those without status. But those days are in the past, and now everyone can book award nights up to 100 days before the stay begins.

It's always good to double-check the cancellation policy before booking, but most Choice Hotels award nights allow free cancellation until relatively close to the stay. Free cancellation is easy, can be done online and your points will be immediately returned for future use.

Some Options for New Year's Eve

Although Choice properties can be booked for as low as 6,000 Choice points per night, I was unable to find hotels in any particularly appealing locations for New Year's Eve that are bookable for 6,000 points. But, I found many rooms and suites that are available and bookable -- some for as low as 8,000 points per night, which TPG's latest valuation pegs at $48. But act quick, as I expect many of these hotels will sell out very soon.

When searching for yourself on Choice's website, be sure to sign in to your account. If you don't sign in, you won't see any award availability.

New York City

About a million people fill New York's Times Square and its surrounding streets on New Year's Eve. Whether you want to be one of the people in Times Square or you simply want to enjoy the festivities in another part of the city, New York is certainly a popular destination for New Year's Eve.

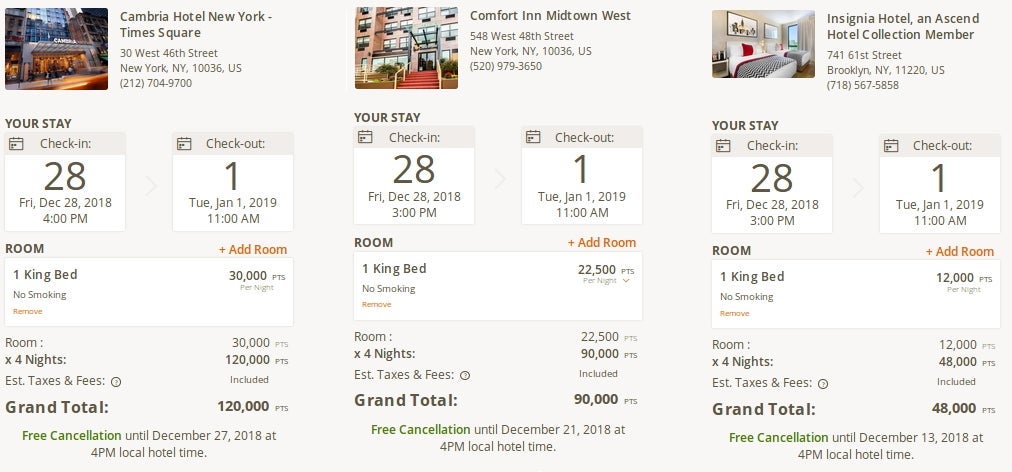

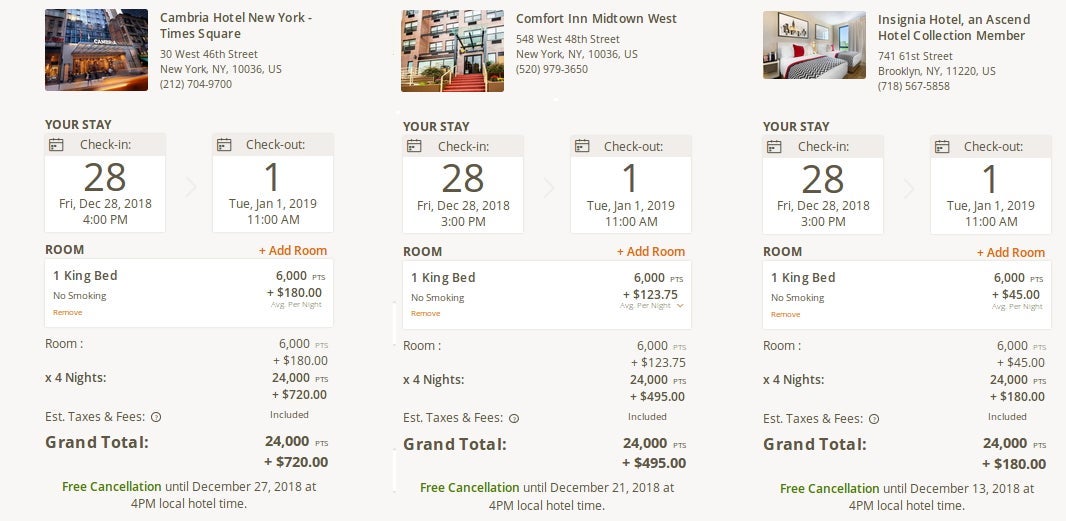

Luckily, there are many Choice properties with availability for a long weekend over New Year's Eve, including multiple 30,000 points per night properties very close to Times Square as well as a 12,000 points per night option in Brooklyn:

Or, you can book these properties with points and cash:

Sydney

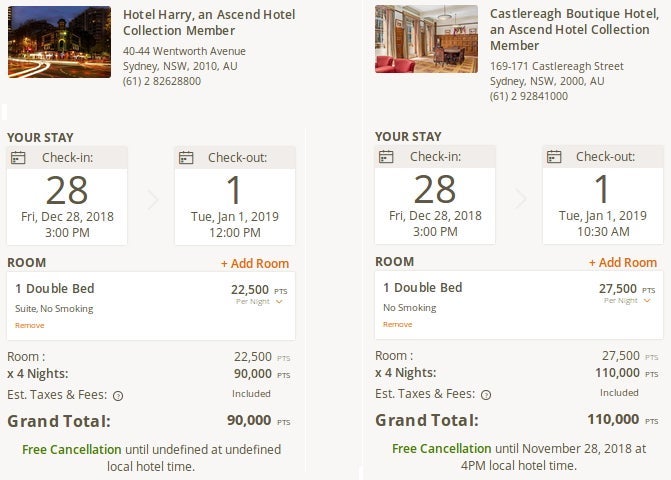

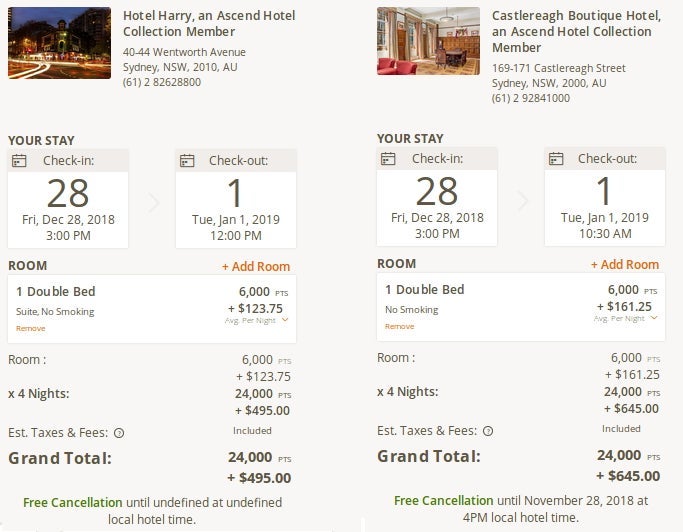

Sydney is the first major city to bring in the new year. Sydney celebrates with a huge fireworks show, boat parade and air show. There are a few centrally located Choice properties with availability for a long weekend over New Year's Eve. Note that although you can get a suite at Hotel Harry, the property doesn't offer free cancellation for New Year's Eve bookings:

Or, you can book these properties with points and cash:

London

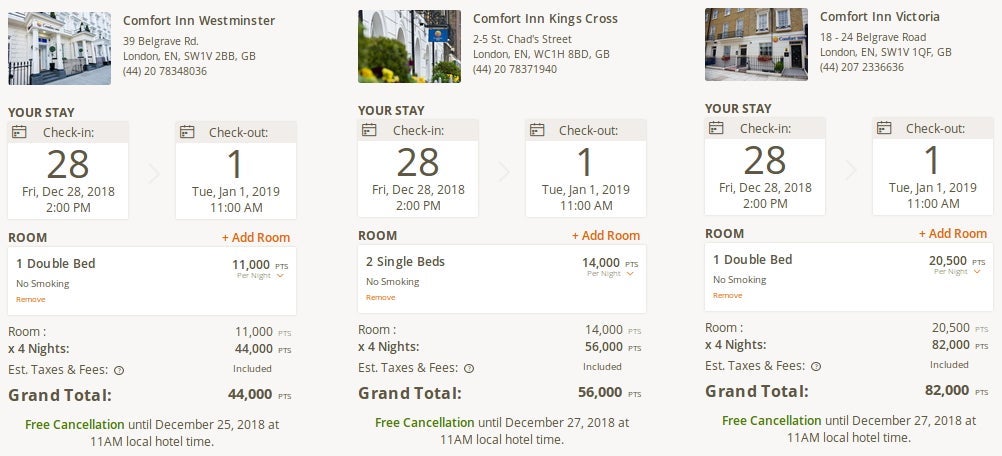

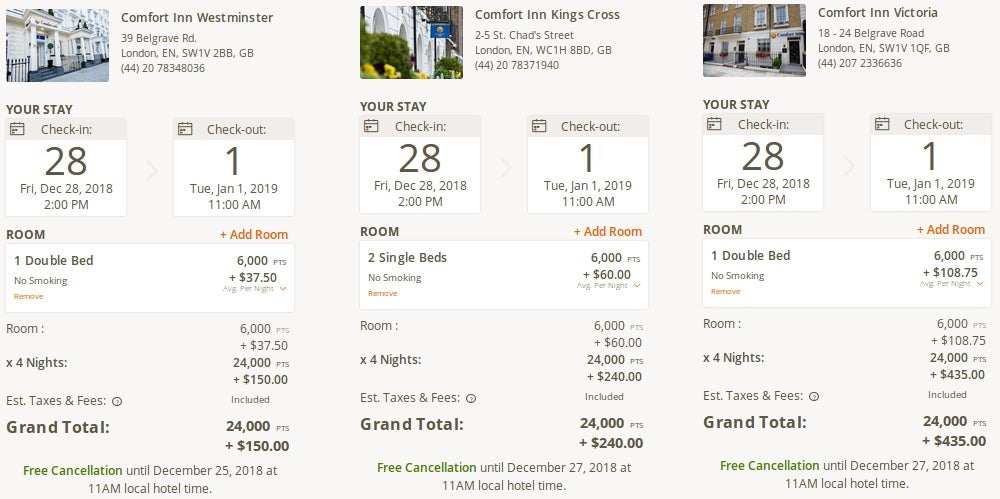

London has fireworks and other festivities along the Victoria Embankment and South Bank areas of the River Thames. Here are a few centrally located Choice properties with availability for a long weekend over New Year's Eve:

Or, you can book these properties with points and cash:

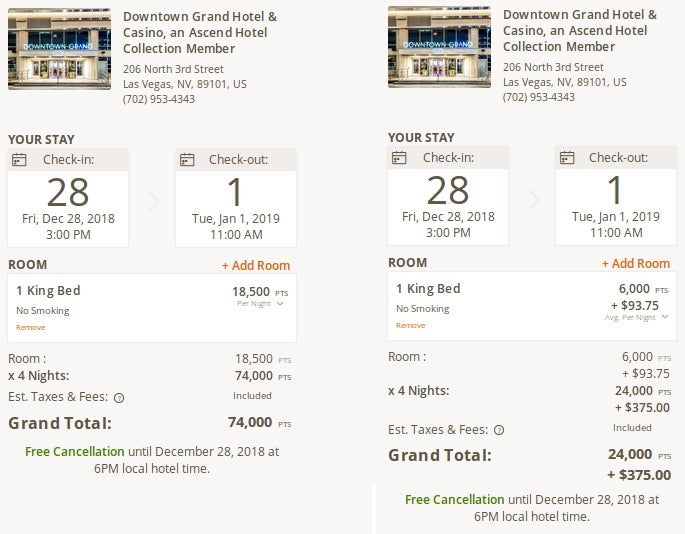

Las Vegas

Las Vegas has epic parties, fireworks and street festivities to celebrate New Year's Eve -- the entire Strip is even closed to traffic on New Year's Eve. Here's one Choice property that is in Downtown Las Vegas and has availability for the long weekend over New Year's Eve:

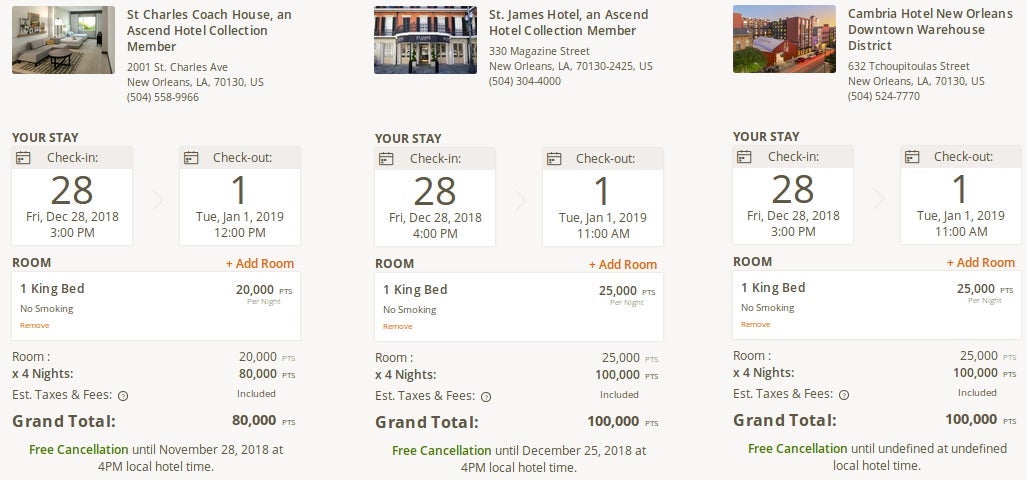

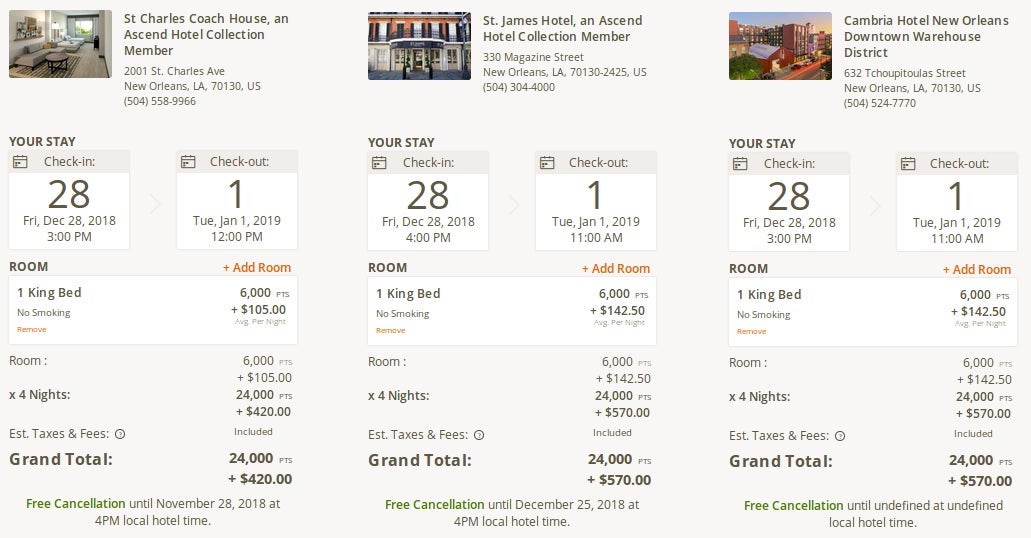

New Orleans

Baby New Year is dropped from a brewery at midnight in New Orleans on New Year's Eve. Then, there's a massive fireworks show before the festivities continue on Bourbon street until morning. Luckily there are a few centrally located Choice properties so you won't have to stumble too far. But, note that the Cambria doesn't offer free cancellation for New Year's bookings and the St Charles' free cancellation ends more than a month before the stay.

Or, you can book these properties with points and cash:

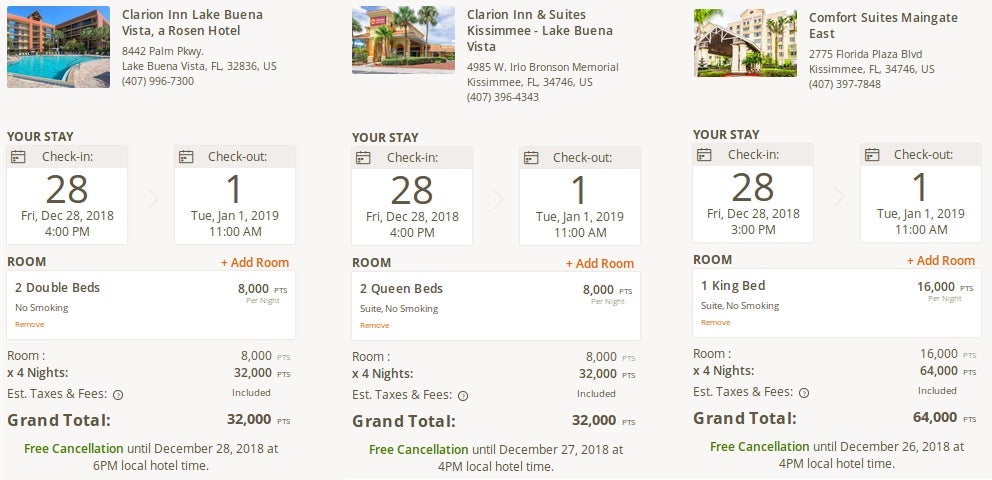

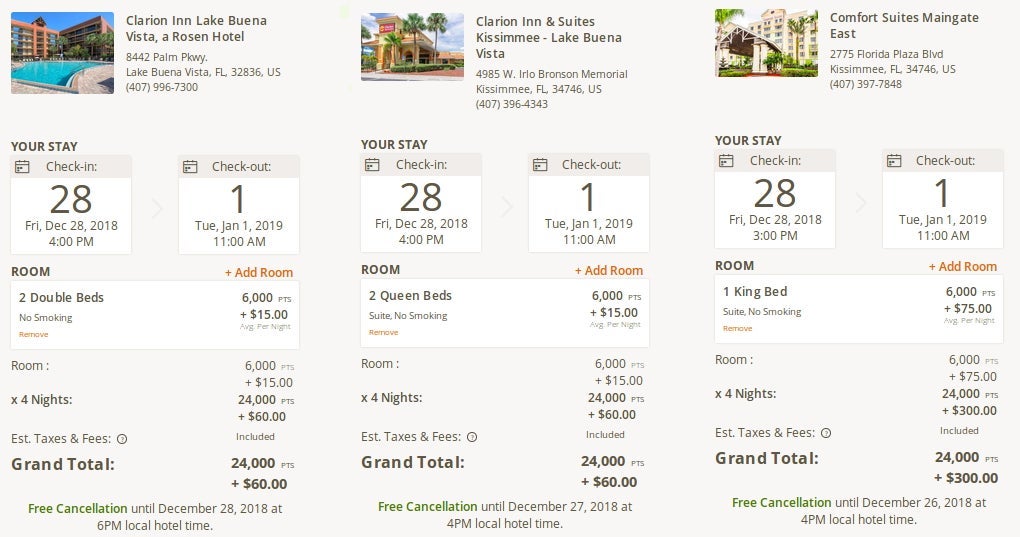

Disney World

Disney World might not be thought of as a destination for New Year's Eve, but Disney does put on some great shows -- so it's not surprising some couples and families flock to Disney for New Year's Eve. There are ample Choice properties surrounding the park, including suites for just 8,000 points per night:

Or, you can book with points and cash:

How to Get Choice Points

TPG values Choice points at 0.6 cents per point, though Choice pegs the value of its points at 0.75 cents apiece for points and cash bookings. Choice points can be difficult to obtain, though, so I'd personally consider doing a points and cash rate if my points supply was running low.

If you don't currently have any points, or don't have enough points for a booking you want to make, you have a few options.

If you need points now for a booking:

- Purchase Choice points at 1.10 cents per point: This might be better than paying cash for your New Year's Eve stay, especially if you buy just enough points to do a points and cash rate

- Transfer American Express Membership Rewards points at a 1:1 ratio: This is generally a poor use of a more valuable currency, but could make sense in some cases

If you're planning ahead but don't need additional Choice points immediately:

- Sign up and spend $1,000 in 90 days on the Choice Privileges Visa Credit Card to get 32,000 bonus points

- Wait for the next Choice buy points promotion

- Wait to purchase Choice points during the annual Daily Getaways promotion

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app