When are your negative test results checked when flying back to the U.S.?

If you've flown during the pandemic, especially internationally, you know that traveling these days isn't as easy as simply showing your passport and boarding pass.

In early July, I flew to Thailand to cover the island's reopening as part of the Phuket Sandbox program. Before traveling back to the United States, all passengers had to get a viral test within three days before departure. Knowing the rule, my hotel arranged a PCR test for me to take the day before leaving. The flight (including a long connection in the Middle East) is well over a day's worth of travel, so I wanted to ensure the test I took didn't fall out of the three-day time frame.

The U.S. allows international air passengers to show proof of their test results either on their phone or via a paper copy. I arranged for paper and digital copies of my negative RT-PCR test results, which the testing facility happily provided. But, fearing that even these forms of proof wouldn't be enough, I also paid extra for something known as a "fit-to-fly" certificate. This certificate is typically signed by a doctor and confirms that someone has tested negative for the virus.

With my negative results in hand, I headed to the airport for my flight back to the U.S., where I discovered several instances in which the process could be improved. I took several international trips this summer, and the most head-scratching experience has been verifying test results to fly back to the U.S. Overall, I've found the process puzzling, not standardized among airlines -- and, if I'm frank -- a bit of "COVID theater."

Confusing verification process

One of the most significant travel policy changes was enacted in the waning days of the Trump administration when it announced that all U.S.-bound travelers needed to have a negative test to fly back to the country.

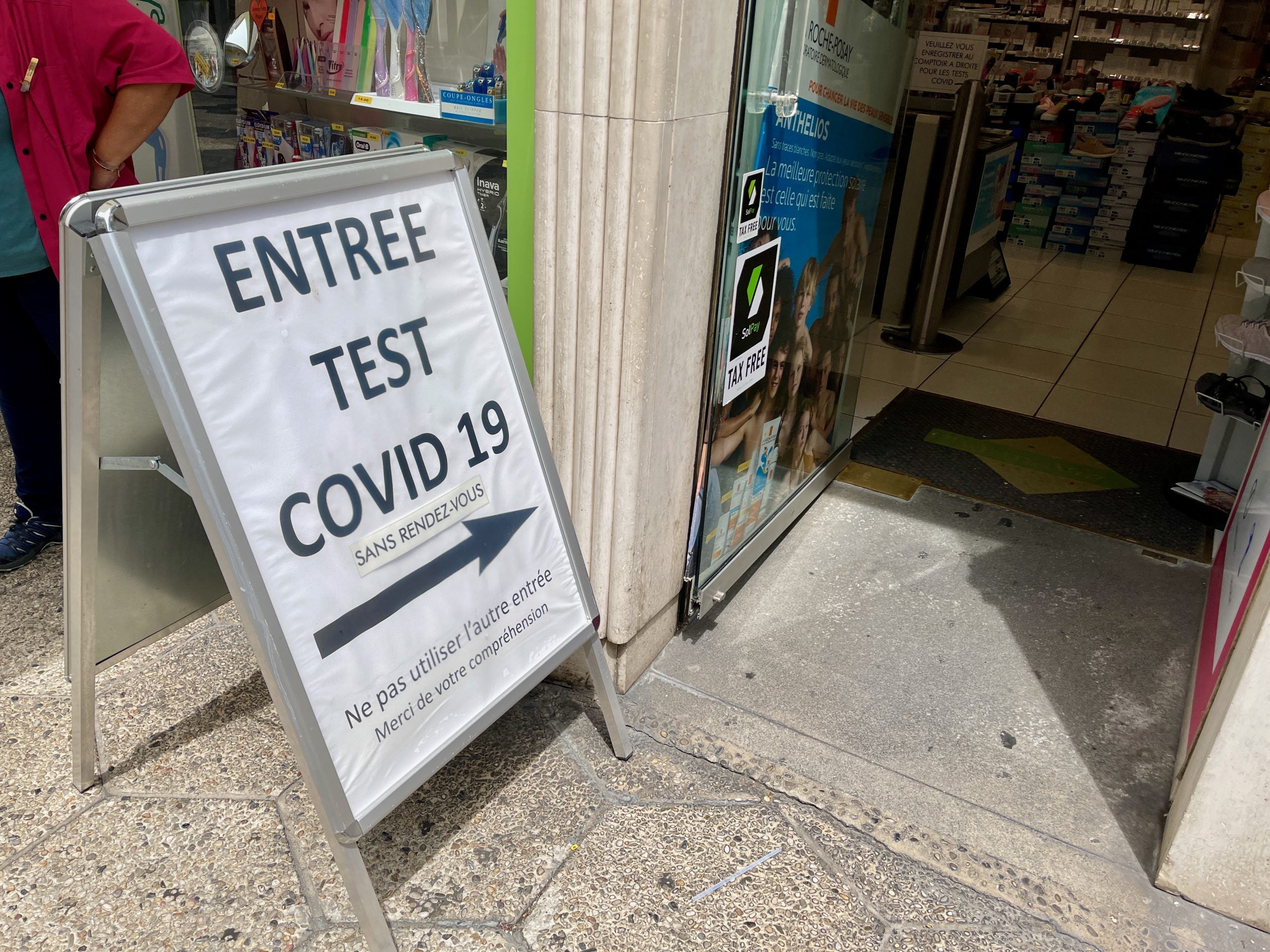

All travelers flying back to the U.S. from abroad have to show proof of a negative COVID-19 test taken no later than three days before departure. Those without documentation, either printed or digital, will be denied boarding. There are few exemptions to the rule, but employees such as flight crews don't have to follow the mandate. Travelers flying to U.S. territories like Puerto Rico and the U.S. Virgin Islands, and those arriving via a land border like Mexico or Canada, are also exempt.

The rule was put into place to combat surges of the COVID-19 virus and was seen as a way to make air travel safer. While the idea, in theory, is smart, it's evolved into a bit of what I call "COVID theater" -- implementing a policy to make travelers feel better, even if it may not keep them safer.

And healthcare facilities abroad, knowing that U.S.-bound passengers need a COVID-19 test to fly, have taken advantage of the mandate by hiking up prices for these travelers. Indeed, my own results cost a whopping $80.

According to the mandate, your airline is supposed to confirm your COVID-19 negative test results (documentation of recovery from COVID-19 is also accepted) before boarding.

The U.S. Centers for Disease Control and Prevention (CDC) has a pretty thorough checklist for airlines to verify test results. For instance, the guidelines state that travelers who present a negative COVID-19 test are subject to meeting five requirements:

- The test must be a viral test, such as a nucleic acid amplification (NAAT) or antigen.

- The test must be negative.

- The test must also include where the test was performed and the name and contact information of the lab or healthcare provider who performed the test.

- The test must be collected three days or less before flight departure to the U.S.

- The test must include information that identifies the person and must have the person's name and at least one additional identifier such as date of birth or passport number.

During my trip to Phuket and an earlier trip to Turks and Caicos, the thought that I could test positive did weigh heavily on my mind. Here, the policy is a little clearer. CDC rules state that travelers may not board with a positive test result (or without a test at all). But passengers can provide documentation stating that they've recovered from COVID provided the credential meets certain requirements. There are also rules on whether antibody tests are allowed (they aren't) and whether handwritten tests are accepted (they aren't).

Room for improvement

I expected it would take longer to verify COVID-19 test results for U.S.-bound flights given such thorough requirements. I even allotted extra time for document verification at Phuket Airport, opting to leave the hotel hours before my flight, just in case. But, in practice, I've found that there were several problems actually enforcing the rule.

I knew that my negative results would be checked in Phuket by Etihad, the airline I flew on the flight home. That's simple enough. Wanting to get the negative test verification out of the way, I first handed over my test results. The friendly check-in agent took one passing glance at the result -- before motioning for my passport and boarding pass. I doubt these criteria could be examined with a second's glance. In contrast, my negative test results were scanned thoroughly by two gate agents before I was allowed to board my flight to Phuket.

This is problematic for several reasons.

For one, there is a so-called "black market" for negative COVID-19 test results. There have been several horror stories of travelers buying fake test results to defeat the testing requirement during the pandemic, and a thorough inspection of health documents is needed to combat it. And, if the U.S. does require international travelers to show proof of vaccination, there's another black market for just that. According to my colleagues over at CNET (which is also owned by TPG's parent company, Red Ventures), online prices for fraudulent vaccine cards doubled after the White House ordered businesses with over 100 employees to require proof of vaccination.

Another issue I ran into, again during my Phuket-New York journey, was exactly when the credentials were supposed to be checked. As I said above, my test results were reviewed in Thailand. The flight from Phuket to Abu Dhabi is roughly six hours, and then I had a nearly eight-hour connection in the United Arab Emirates. Abu Dhabi Airport serves as a preclearance facility for U.S.-bound flights, meaning that passengers clear customs there and land domestically in the States. There was a long line, so I was expecting travelers who had connecting flights, such as myself, to verify their test results again. But nobody even asked for them in Abu Dhabi.

While Abu Dhabi didn't have to check my results, given they were scanned in Phuket, I did find it surprising. Suppose my flight had been delayed, putting me out of the testing window? I doubt my out-of-date results would have been allowed for travel. According to the mandate, I would have been denied boarding.

Bottom line

Pre-travel testing is a good thing. And truthfully, I'm in favor of it even for vaccinated travelers like myself, given the delta variant's high transmission rate. But the process needs to be reworked.

Airlines need to better train their employees to spot fake credentials and ensure that all passengers are actually cleared to travel. And the CDC also needs to make it precisely clear when travelers' test results should be checked, particularly for connecting itineraries. COVID-19 is something all travelers are trying to navigate, so making the process easier will speed up the travel experience and get travelers to where they need to go safely.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app