You can now book JetBlue Mint to London with Emirates Miles — and it's a good deal

Editor's Note

Despite not being a member of a major alliance, Emirates lets you earn and redeem Skywards miles with more than a dozen partner airlines. Among them is JetBlue.

For years, you could only use Emirates miles to book JetBlue economy flights. However, that changed in July when Emirates added the ability to redeem Skywards miles for JetBlue Mint (business class) flights.

The award chart is reasonably priced and offers some valuable sweet spots. But there's been one major restriction: JetBlue's flights to or from the U.K. have not been available using Emirates Skywards miles.

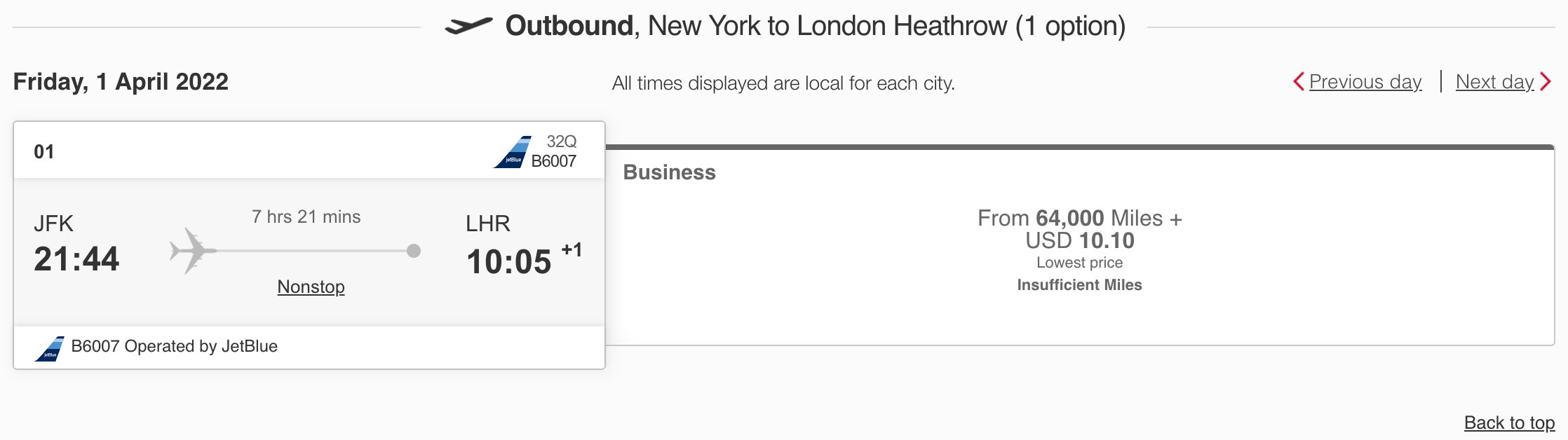

However, this is no longer the case. As first discovered by One Mile at a Time, JetBlue's entire network is now bookable through Emirates Skywards, including its London routes. Plus, we're seeing wide-open business class availability on the transatlantic routes.

Emirates' JetBlue award chart

As with most of its mileage partners, Emirates now prices JetBlue awards based on the distance flown. In the past, these awards were priced by specific routes.

Emirates' award chart for JetBlue flights is as follows. As you can see, Mint is always double the price of economy.

| One-way distance (miles) | Economy | Mint |

|---|---|---|

0-250 | 8,000 miles | 16,000 miles |

251-500 | 10,000 miles | 20,000 miles |

501-1,000 | 14,000 miles | 28,000 miles |

1,001-2,000 | 20,000 miles | 40,000 miles |

2,001-3,000 | 26,000 miles | 52,000 miles |

3,001-4,000 | 32,000 miles | 64,000 miles |

4,001-5,000 | 38,000 miles | 76,000 miles |

5,001-6,000 | 44,000 miles | 88,000 miles |

6,001-7,000 | 50,000 miles | 100,000 miles |

7,001-15,000 | 60,000 miles | 120,000 miles |

JetBlue's Mint product is offered on select routes, including transcontinental flights, select Caribbean flights and flights between the East Coast and London. As such, most Mint awards will cost between 40,000 and 64,000 miles each way.

To give you an idea, here are the rates for some popular Mint routes:

- New York-JFK to Aruba (AUA): 40,000 miles (1,951 miles in distance)

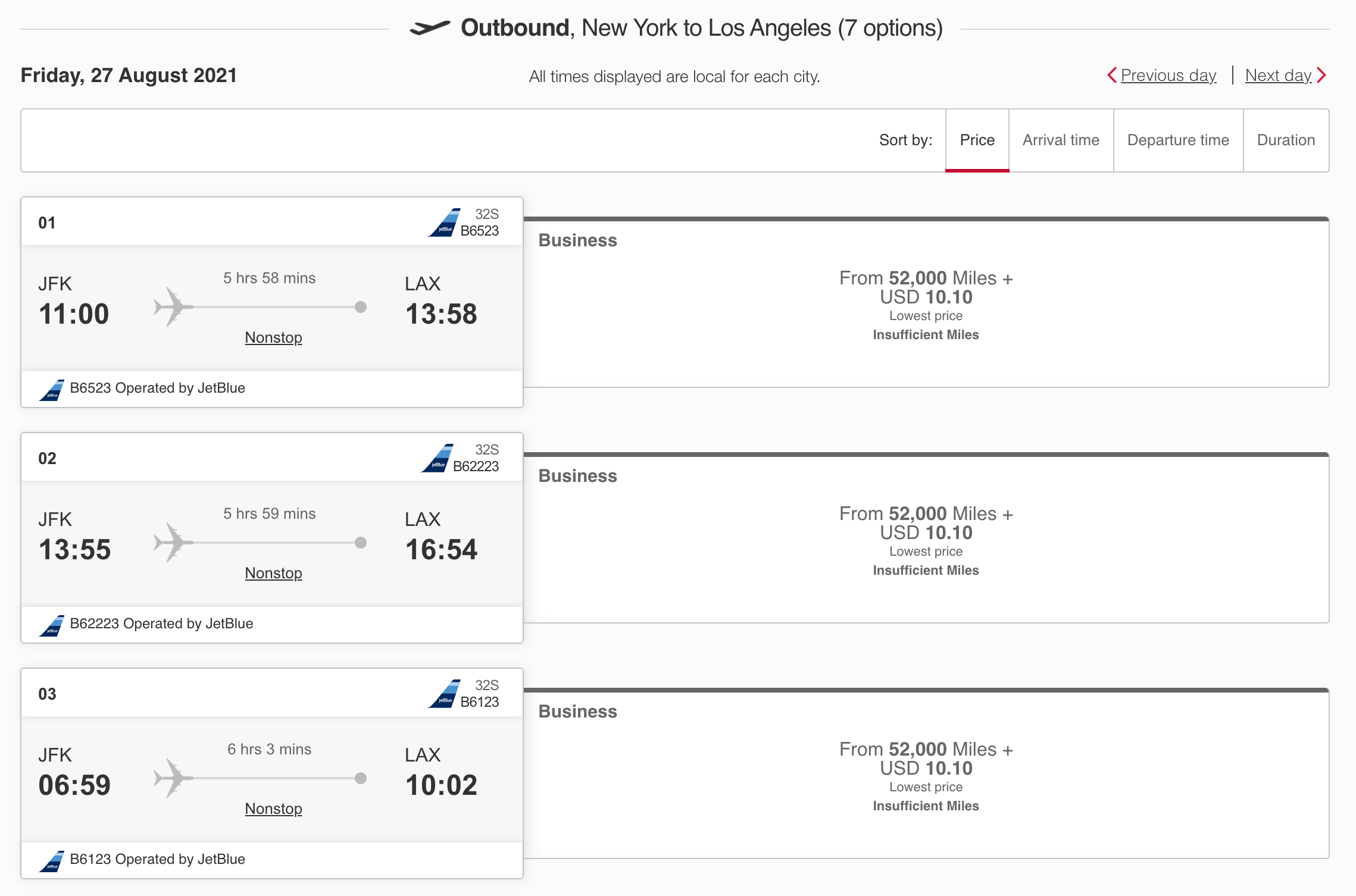

- New York-JFK to Los Angeles (LAX): 52,000 miles (2,475 miles in distance)

- Boston (BOS) to San Francisco (SFO): 52,000 miles (2,704 miles in distance)

- Los Angeles (LAX) to Miami (MIA): 52,000 miles (2,342 miles in distance)

- New York-JFK to London Heathrow (LHR): 64,000 miles (3,451 miles in distance)

Related: What it was like to fly JetBlue's new Mint business class

Booking JetBlue awards with Emirates

Although Emirates' search tool can be wonky, you can book these awards online.

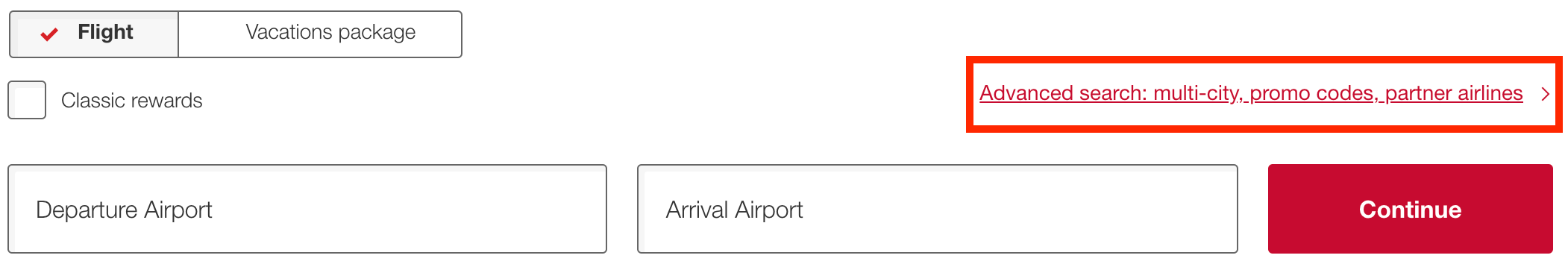

In the search box on Emirates' website, click "Advanced search: multi-city, promo codes, partner airlines."

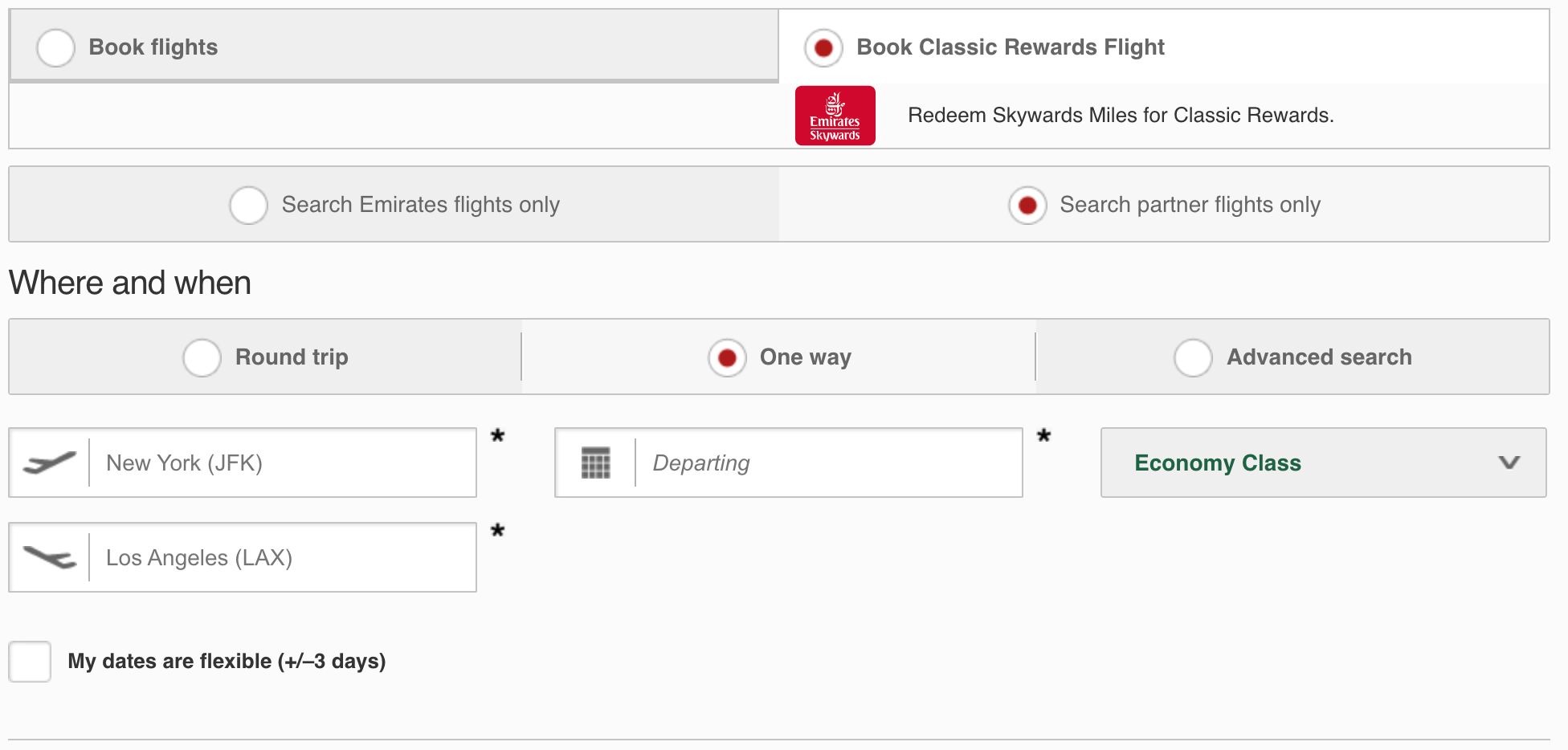

Then, select "Book classic rewards flight," "Search partner flights only" and type in your itinerary. Based on our experiences, you shouldn't check the "Flexible dates" box as that results in an error message.

As long as there's 'I' fare availability, it should be bookable through Emirates. Your best bet would be to use ExpertFlyer to search inventory and set alerts if there's no availability. (ExpertFlyer is owned by TPG's parent company, Red Ventures.)

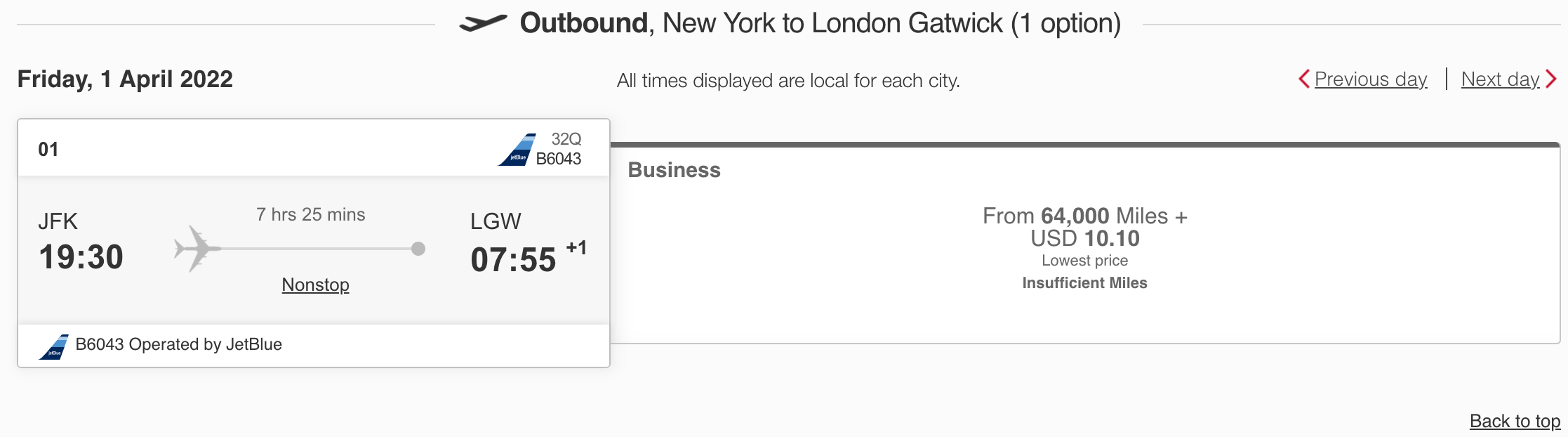

Based on our searches, availability is wide-open on JetBlue's flights between New York-JFK and London's Heathrow (LHR) and Gatwick (LGW) airports.

That said, as mentioned, Emirates' website isn't perfect. There may be times when an award should be available but won't show on Emirates' website. For instance, although we eventually got it to appear, we initially had trouble searching for flights to LGW — we were only able to search to LHR.

In these cases, call Emirates Skywards to book your awards over the phone. As an added benefit, phone agents can even put awards on hold for you. This is useful for when you want to book a flight but still need to transfer miles into your account.

Related: Best ways to redeem Emirates Skywards miles for maximum value

Is it worth it?

While redeeming Emirates miles for JetBlue economy flights is rarely a good deal, the same can't be said for Mint redemptions.

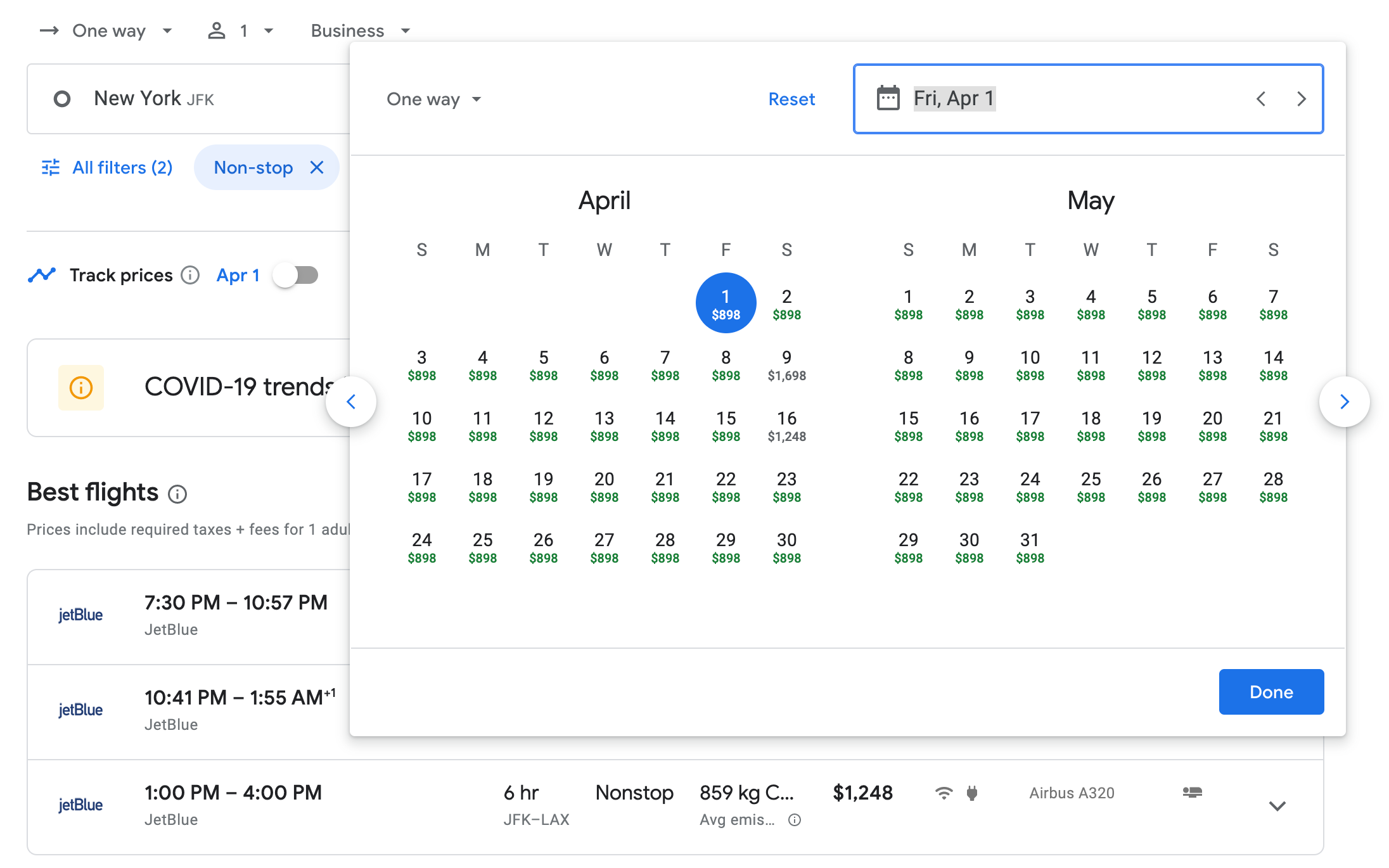

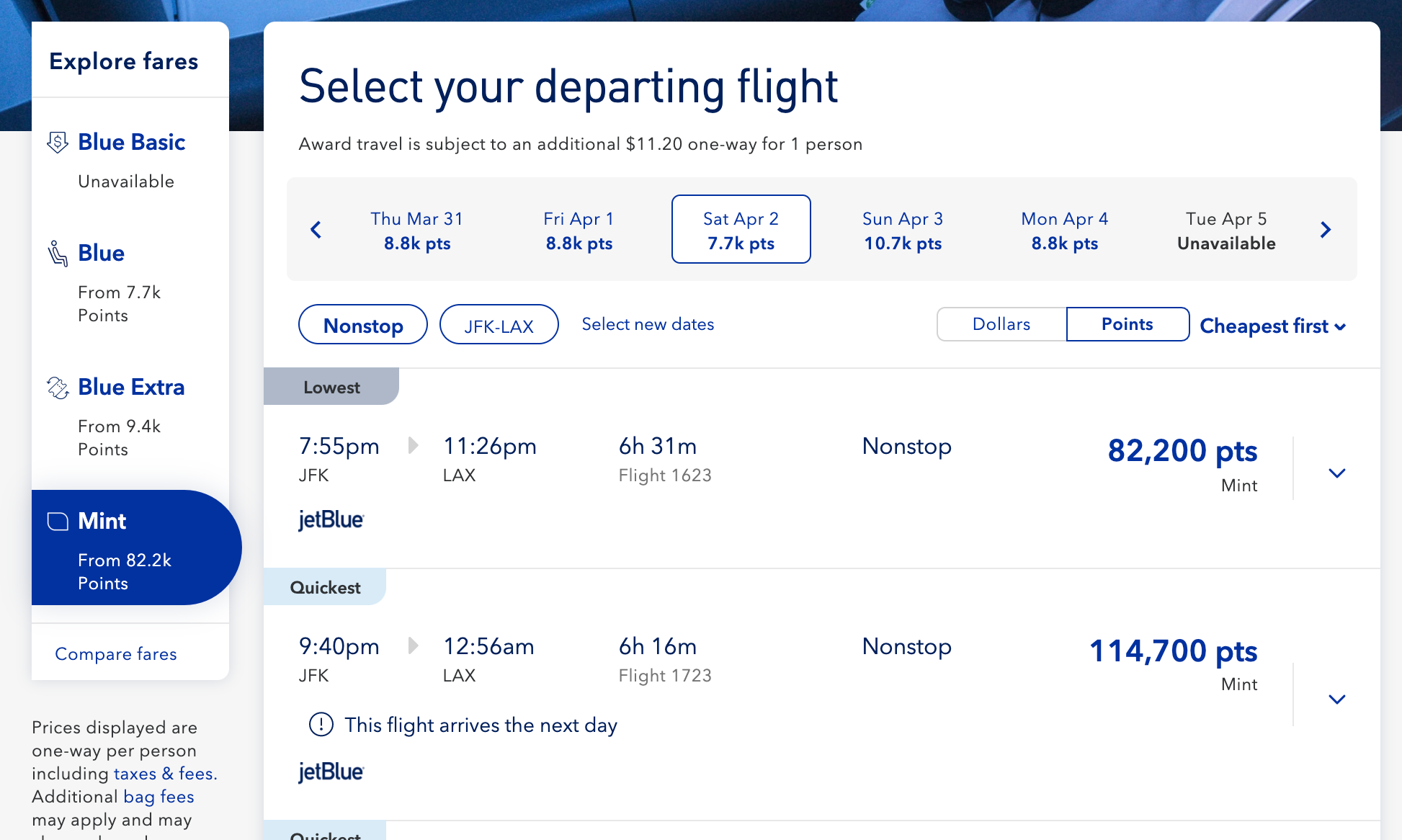

Let's take a look at the nation's most premier route: New York-JFK to Los Angeles (LAX). The cheapest Mint fare you can find on this route is normally around $898 one-way. When redeeming 52,000 miles for that ticket, you'll get about 1.7 cents in value per mile.

Is this the maximum value you can get from your miles? No, but it still is a very solid deal. After all, TPG valuations typically peg Skywards miles at just 1.2 cents apiece.

By comparison, JetBlue's own TrueBlue program is charging at least 82,200 TrueBlue points for the same flights. Since the program prices awards dynamically, you'll rarely get more than 1.3 cents in value per point.

Related: The cheapest way to fly in JetBlue's premium Mint cabin

You'll get a similar value from your Emirates miles when redeeming for JetBlue's flights to London. Flights across the pond are currently starting around $1,000 each way when booking a round-trip ticket, though often top $3,000. So, based on the 64,000-mile rate, you'll get at least about 1.6 cents in value per mile. However, if you only need a one-way ticket, the cash fare jumps to over $2,500. In that case, using miles is truly a no-brainer as you'll get nearly four cents in value per mile.

Obviously, the redemption value will vary based on the cash prices. But, as you can see, there will be times when it makes sense to redeem your miles. Considering JetBlue often offers Mint fares to the Caribbean for under $300 each way, those redemptions will likely be harder to justify.

Related: 6 things JetBlue should change about Mint business class

Earning Emirates miles

The most exciting part of all of this is how easy Emirates miles are to earn. Even if you've never flown on the Dubai-based carrier, you can transfer points to its Skywards program from all major transferable points programs. This includes Chase Ultimate Rewards (1:1 ratio), Amex Membership Rewards (1:1), Bilt Rewards (1:1), Citi ThankYou Rewards (1:1), Capital One Miles (1:1) and Marriott Bonvoy (3:1 with a 5,000-mile bonus for every 60,000 Marriott points transferred).

In other words, if you have a credit card that earns flexible points, then chances are you can transfer your rewards to Emirates to book these awards.

Related: The easiest airline miles to earn and why you want them

Bottom line

There historically haven't been many good ways to book JetBlue Mint flights with points. The best option has often been to book through Chase Ultimate Rewards or another travel portal and redeem your points at a fixed value.

Needless to say, the ability to redeem Emirates Skywards miles for JetBlue Mint is a welcome addition. Emirates miles are extremely easy to earn and the value to be had with these redemptions can be compelling. Depending on the route, there's a good chance you'll pay fewer miles than if you were to book through JetBlue's own TrueBlue program.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app