First look at the revamped Google Pay app with a new look, rewards and much more

Step out of the way, Venmo. Google has just completely overhauled its mobile payments app, introducing a new look and a slew of new features.

The new Google Pay app shifts from being just an ordinary contactless payment method toward an all-in-one money app, with a focus on managing personal finances. It offers more intuitive peer-to-peer payments, engaging financial insights and integrates retailer rewards. Starting in 2021, users will also be able to open fully online "Plex" bank accounts through the app.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter.

Let's take a closer look at the app's three key tabs: Pay, Explore and Insights.

Pay

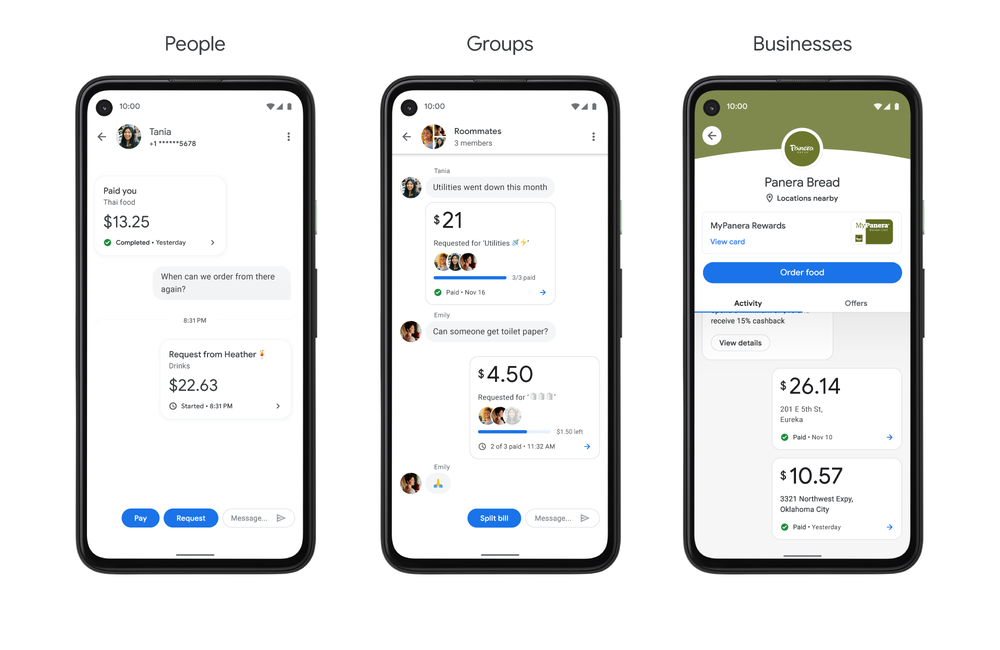

This is the center and primary tab on the app. Exactly as it sounds, it's where you manage your payments — both peer-to-peer and tap-to-pay at retailers. In addition to being able to send money to friends and make contactless payments, you can now use the app to split expenses with groups and place orders with businesses. More specifically, Google says that you can now order food at more than 100,000 restaurants, buy gas at more than 30,000 gas stations (i.e. Shell, ExxonMobil, and 76) and pay for parking in over 400 cities -- all from within the app. This means you'll need one less food delivery app on your phone and can reduce your contact with high-touch surfaces at gas stations and parking lots, which is very COVID-19-friendly.

Payments have a chat-like view so you can easily track when payments were made or see if you have any pending payments. If you have store loyalty cards stored in your account, they should automatically show up in your "conversation" with the corresponding business if Google Pay is available to associate them. You'll also be able to see special offers from businesses here, but we'll get more into that later on.

Related: COVID-19 is moving us closer to a contactless (and cashless) future

Explore

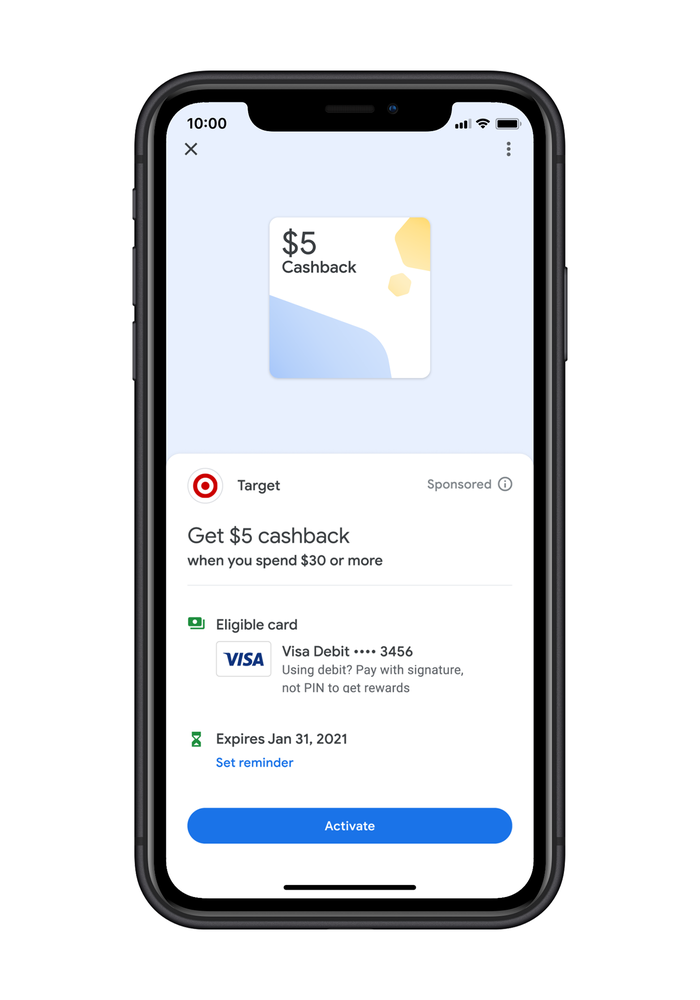

The Explore tab is essentially a deals page. At first glance, it looks similar to programs such as Amex Offers and Chase Offers.

On this tab, you're able to browse through various deals and link them to your account. As Google describes it, it allows you to save money and redeem offers without the hassle of clipping coupons or copying and pasting promo codes.

After activating an offer on the app, it will automatically apply when you pay in-store or online with any linked card. Similar to online shopping portals, any cash back you earn goes into your Google Pay account. It's not an instant rebate and you'll need to transfer it out if you want to deposit it into your bank account.

For now, you can expect offers from major brands including Burger King, Etsy, REI Co-op, Sweetgreen, Target and Warby Parker. If you give Google permission to monitor your transactions, you'll be able to get offers customized for you. It's important to note that Google Pay does not use your transaction history to personalize your experience within the app by default. Additionally, Google Pay says that it will never sell your data to third parties or share your transaction history with the rest of Google for targeting ads.

Related: The best rewards credit cards

In addition to the offers, the Explore tab is home to a QR and barcode scanner. This allows you to quickly compare prices of items with other stores when shopping. This is especially useful for stores like Target and Best Buy that offer price match guarantees.

Insights

The final tab on the app is Insights. Here you can see an overview of your spending with any banking or credit accounts you connected to the app.

You'll get spending summaries and can see your trends over time. For instance, on Mondays, you'll get a summary of how much you spent on the weekend. Google Pay's algorithms automatically categorize your transactions so you can search for keywords like "food" or "flights" and find all relevant transactions. Heck, according to Google, you can even search for more specific terms, such as "Mexican restaurants," or search by location. While most credit cards and bank accounts allow you to sort transactions, they don't allow you to search with this level of detail.

For more accurate results, you can also link your Gmail and Google Photos accounts. If you opt in, Google Pay will automatically scan for receipts and link them to the corresponding transaction. Once again, Google says that it doesn't share your transaction history with any third party and doesn't use it for targeting ads.

Related: The best apps for money management

Bottom line

Assuming you opt into all of the features, Google Pay offers all the tools you need from a money management app. It makes transactions simpler potentially and more rewarding. The biggest thing missing from the app is the integration of bank accounts, but that's coming next year. Google Plex accounts, which will be offered by banks like Citi and the Stanford Federal Credit Union, will be free to open and promise no monthly fees or overdraft charges. The app also doesn't let you track credit card points or miles, but you'll be able to use the new TPG app for that when it launches next year. Unlike Apple and its Apple Card, Google doesn't have plans to release its own credit card for the time being.

Screenshots courtesy of Google.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app