An airline canceled my flight, then gave me $3,500 in travel credits

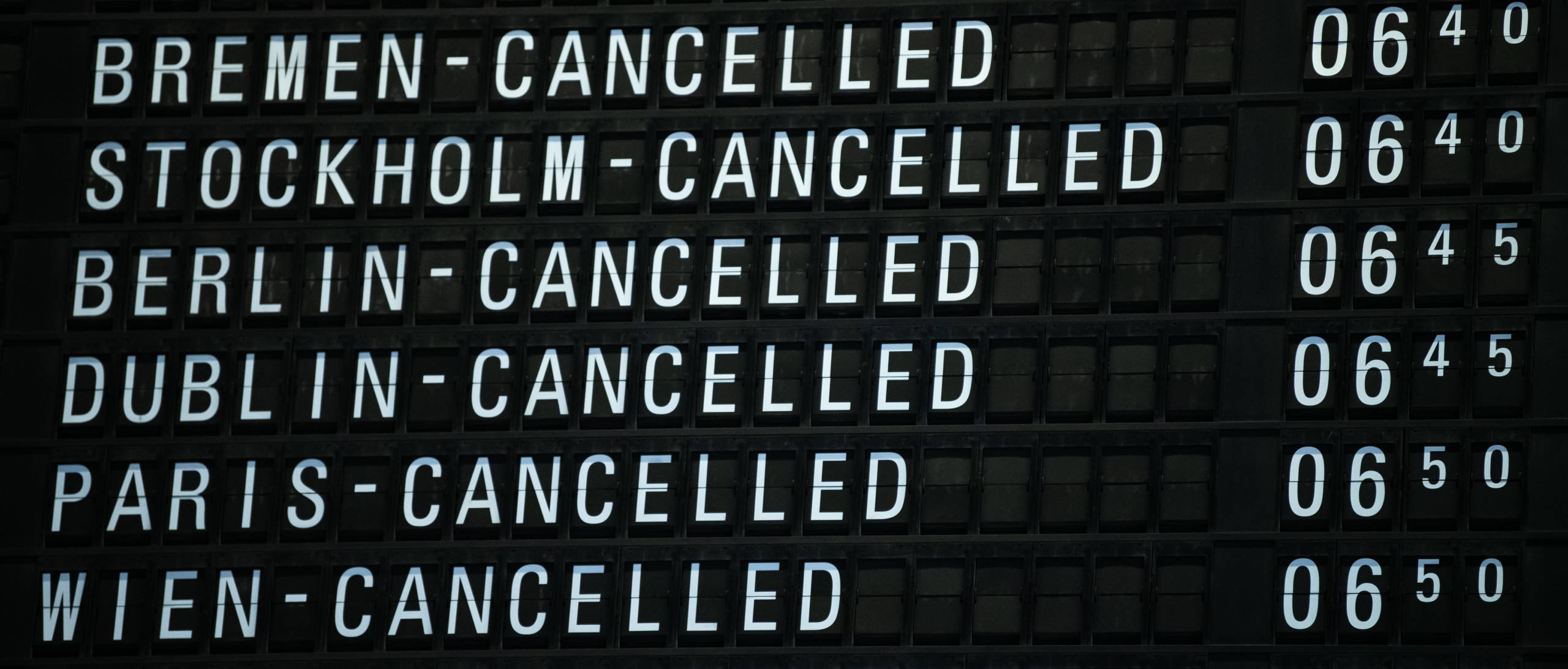

There's no worse feeling than checking your flight status only to find that your flight was canceled.

In my case, I wasn't scheduled to fly on a commercial airline, and there wasn't even a place to check flight status. Instead, I received a call from one of Aero's representatives five days before my flight profusely apologizing that my flight from Telluride (TEX) to Oakland (OAK) was canceled.

Sign up for TPG's daily email newsletter for more travel news and tips delivered to your inbox!

If you've never heard of Aero, you're not alone. Aero is a brand-new travel service provider that sells seats on a shared private jet on just a few select routes. Aero doesn't own any of its planes and instead acts as an agent of charter operators to provide their flights.

During the winter, they offer limited service between Oakland and Telluride on the most popular ski weekends like Martin Luther King Jr. and Presidents' Day weekend. Fares aren't cheap at $899 per person each way, but they're targeting a market of luxury travelers looking for the convenience of a nonstop flight at a price much cheaper than chartering a private jet.

Related: Why you might want to get a premium credit card instead of purchasing travel insurance

I was spending New Years' weekend in Colorado, so I figured that it'd be cool to test the service. I purchased my one-way ticket for $799 during a Cyber Monday sale and was getting really excited for this special flight. So, I was definitely quite dejected when I was told that the aircraft was grounded for maintenance and my flight would be canceled.

If I were flying a commercial airline, I knew I'd be protected in the event of a delay or cancellation. I purchase all my flight tickets with either The Platinum Card® from American Express or the Chase Sapphire Reserve, both of which offer trip delay insurance. However, my Aero charge didn't code as travel, and I wasn't sure if Aero would be considered a "common carrier" anyway.

Related: The king of luxury benefits: The Platinum Card from American Express review

Before the Aero agent could finish saying that "your flight is canceled," she immediately began apologizing and reassuring me that I would be taken care of. I wasn't sure what she meant, but Aero promises "world-class service" that's "personalized and attentive." It was time to see whether they live up to their word.

The first thing the agent did was offer an immediate refund for my canceled flight. No surprises there-- the flight was canceled, so I was definitely entitled to a refund. But what followed next was pretty incredible.

The phone representative then told me that Aero was committed to getting me to my final destination. Even though they just refunded me for the canceled flight, they didn't want to leave me to find my own way to Oakland. The rep then spent over 15 minutes on the phone with me going through different commercial flight options to the West Coast.

She explained that Aero would do whatever they could to get me on my way. And that they did. Due to the flight cancelation, I changed around some of my plans in Colorado. As such, I no longer needed to fly from Telluride, but rather from Denver. Not a problem according to the rep.

Then, I explained that my final destination was closer to San Jose (SJC) than Oakland, and again that wasn't a problem. Within 4 business hours after hearing about the cancelation, I'd been booked the last seat, a $1,700 J-class biz ticket, on a United flight from Denver to SJC -- which I later switched to PHX to cover the Centurion Lounge opening.

https://www.instagram.com/p/B6-x53yFAlU/

Plus, it certainly doesn't hurt that I got an early year boost to my PQP balance.

Related: The 9 best credit cards for United fliers

Not only did the agent book my replacement flight, but she made sure that I had all my ground transportation in order. It wasn't enough for her that I had a backup flight... She wanted to ensure that I would have a near-seamless experience like I would've had I been flying with Aero.

And before the agent hung up, she gave me another form of compensation-- an invitation to try flying with Aero again on a roundtrip flight from Oakland to Telluride later in the ski season, valued at $1,800. Hopefully my second try won't be canceled like the first.

Now, most people won't have the opportunity to fly with Aero (and hopefully won't experience a canceled flight). But, commercial carriers can definitely learn from the service I received.

Related: What to do if your flight is delayed or canceled

I've witnessed many airlines suffer from irregular operations. Sure, it sucks to have a flight canceled, but the recovery is arguably just as important. Throughout my time in airports, I've overheard customer service agents curtly tell aggravated customers that they aren't any other flight options or don't bother to offer meal or hotel accommodations during overnight delays.

Each passengers' situation is different. Sometimes there are no alternative flight options for days. But if airlines could borrow just a bit of the remarkable service I received after my canceled Aero flight, travelers around the world would be a lot happier-- even if they didn't get $3,500 worth of compensation.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app