How airlines may choose to make up for those recently eliminated $200 change fees

There's been a lot of praise for airlines over the last week. In a permanent expansion of their current change fee waivers, some of the largest U.S. carriers have followed Southwest's model of not charging change fees at all, saving customers up to $200 a pop.

United Airlines was the first carrier to announce the permanent end of change fees, almost a week ago. Then American and Delta followed suit, before Alaska and Hawaiian rolled out similar policies of their own.

On the surface, it's a boon for consumers. With a looming fee, travelers feel locked into their plans, giving airlines some certainty when it comes to whether or not customers will fly as booked. Worst case, carriers end up $200 richer if flyers end up changing their plans.

Related: How no-change-fee policies stack up against Southwest

The certainty required for that model to work simply doesn't exist during the pandemic, and may not for some time to come. Travelers don't know if evolving quarantine or entry requirements will leave them forced to cancel a trip, leading many customers to avoid flying altogether, opting for road trips, instead.

With change fees permanently removed, customers should theoretically feel more comfortable purchasing a flight, knowing that their plans may change. A $70 round-trip fare becomes even harder to ignore — if that trip to Vegas doesn't materialize when you originally expected, you can change your dates or destination, without that pesky $200-per-person fee.

There are three big exceptions to note, however. First, when it comes to American, Delta and United, change fees still apply to international travel, where they can be even more substantial — in the case of a premium-cabin ticket, up to $450 a pop.

The second, and this is a biggie, is that most airlines have not yet committed to issuing a credit if you move to a cheaper flight. Say you booked a ticket from Newark (EWR) to Los Angeles (LAX), and, since it's a long trip, you took the plunge and booked business class, for $1,200 round-trip. If you later decide to fly to Miami (MIA) on a $200 economy round-trip, you'd forfeit the difference in fare — a cool grand.

There are some exceptions to this policy. Southwest has long issued credits when moving to a cheaper flight, for example, and American has committed to doing the same.

Related: How to survive basic economy on American Airlines

Alaska and Delta have not yet confirmed their plans, however, and Hawaiian and United have both stated that the residual will be lost when moving to a lower-cost flight. In certain cases, this policy can be far more lucrative for the airline than a $200 change fee.

The most notable exception, however, is that basic economy tickets are specifically excluded from these waived-fee policies — and that, dear reader, is the third exception where I expect airlines to make up the majority of the difference.

Also: What to expect when flying Delta basic economy

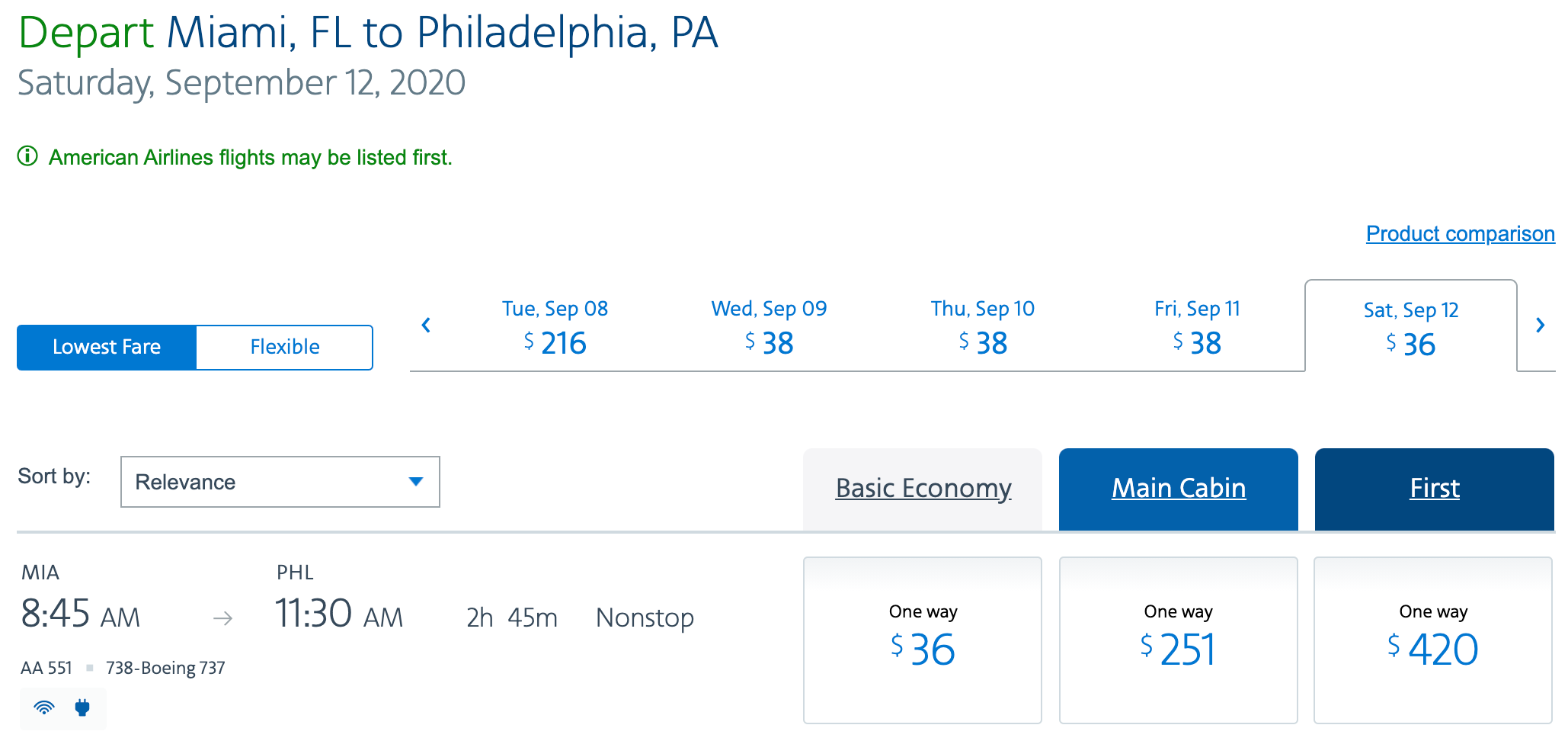

Flexibility just became a perk of all "standard" economy tickets, which can cost anywhere from $15 to hundreds of dollars more than a basic economy ticket, each way. Take this Miami (MIA)-Philadelphia (PHL) trip below. You can book seven basic economy tickets for the price of a single regular economy seat.

While basic economy tickets can be adjusted free of charge under current change-fee waivers, those policies are largely expected to expire at the end of the year. Beginning in 2021, flyers will likely need to buy up to regular economy to have any flexibility when it comes to changing their ticket, even if the pandemic's still impacting travel at that time.

I also suspect that we'll see even more differentiation when it comes to pricing in the future. In most cases, I've recently seen American and Delta offer regular economy buy-ups for $15 each way, with some exceptions here and there. United, meanwhile, consistently charges $35 to pay your way out of basic economy — buy-ups total $70 on a round-trip.

Related: How to survive Basic Economy on United Airlines

Once the basic economy change fee waivers are no more, and tickets become entirely unchangeable, customers will have much more incentive to pay a higher fee to move up to regular coach. As much as I hope $15 buy-ups stick around, we'll likely see rates jump significantly, giving airlines an opportunity to make up some of the revenue lost from these freshly eliminated fees.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app