Aeroplan members can now earn and redeem with Etihad Airways

By far, the benefit I value most about frequent flyer programs is that members can earn and redeem miles for flights not only with the program's own airline, but with partner carriers as well. For Air Canada's Aeroplan, that means flights with all 26 Star Alliance member airlines, along with a small number of non-alliance partners, including limited redemption opportunities with Cathay Pacific, Cathay Dragon, GOL and Olympic Air.

Following an unintentional tease last year, Aeroplan confirmed a very exciting new partner on Wednesday. Effective immediately, Aeroplan members can earn and redeem miles for Etihad Airways flights, including Etihad's fantastic first-class product, The Apartment. Etihad Guest members can also earn and redeem miles for Air Canada flights, but that aspect of the partnership isn't nearly as valuable.

[table-of-contents /]

Earn miles

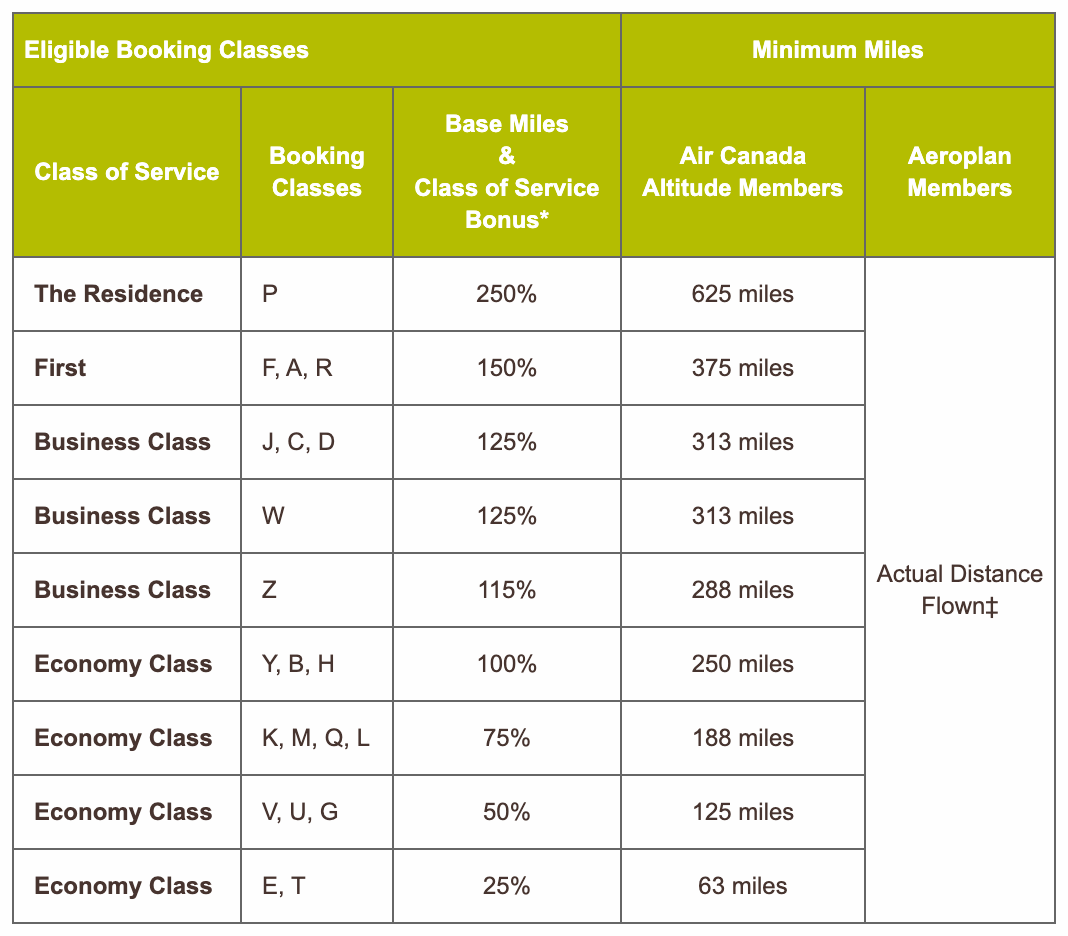

When Etihad passengers choose to credit their flights to Aeroplan, they'll earn miles based on the distance flown, combined with a multiplier that varies depending on the class of service and booking class. For example, you'll earn 10 times the number of redeemable miles when booking Etihad's flagship 'The Residence' product as you will with a discounted economy ticket.

Note that miles earned with Etihad Airways do not count toward elite status — these are simply redeemable miles, that you can use for travel, merchandise and other awards. You may also do far better crediting miles to a different partner — American's AAdvantage program, for example — so you'll want to shop around before you add a frequent flyer number to your Etihad booking.

Personally, I recommend heading to wheretocredit.com to compare eligible programs — just be sure to confirm that the earning rate is still valid on your selected partner's site. For example, tickets booked in 'The Residence' earn 400% of the distance flown when crediting to AAdvantage, compared with 250% for Aeroplan.

Redeem miles

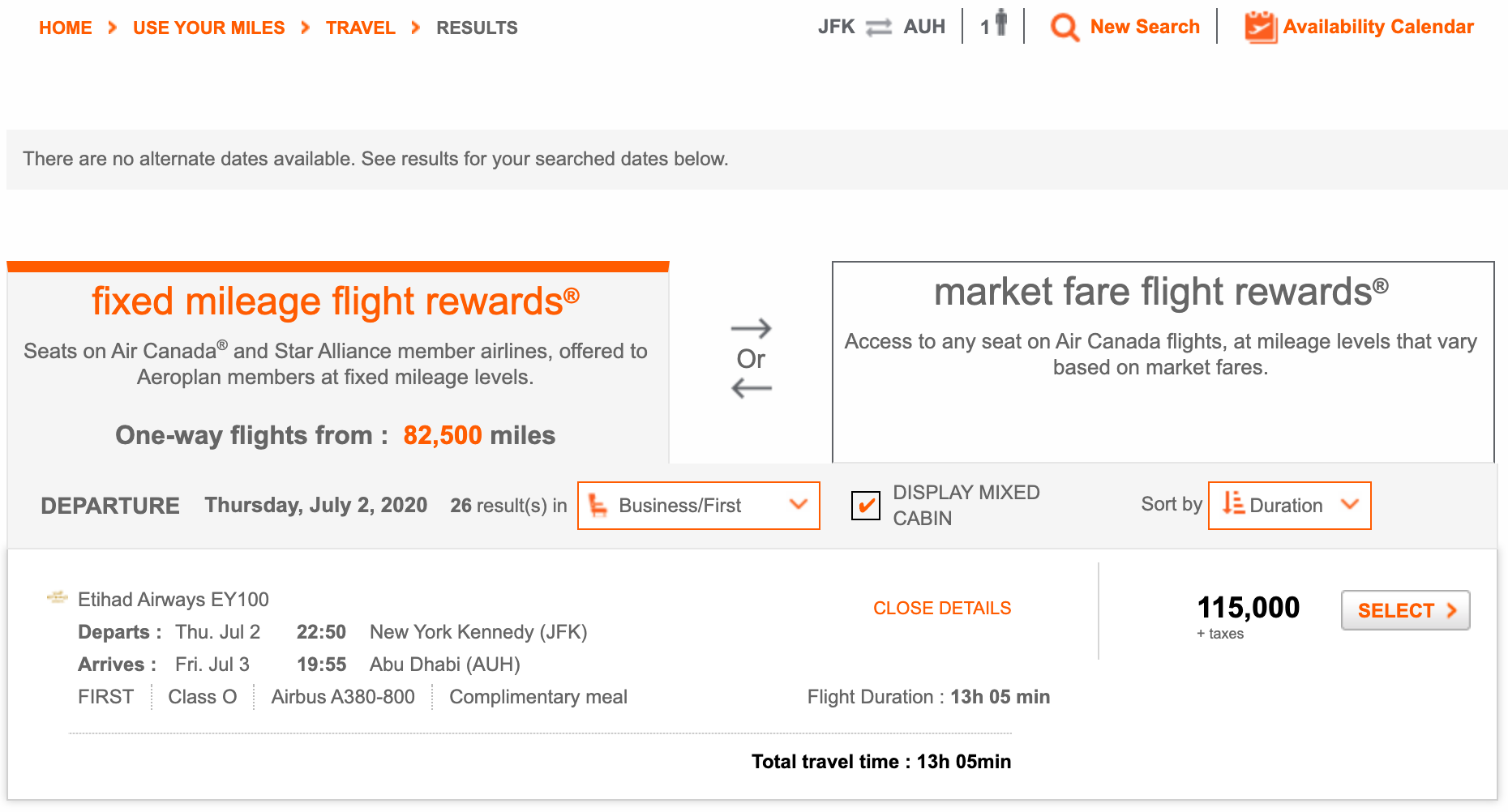

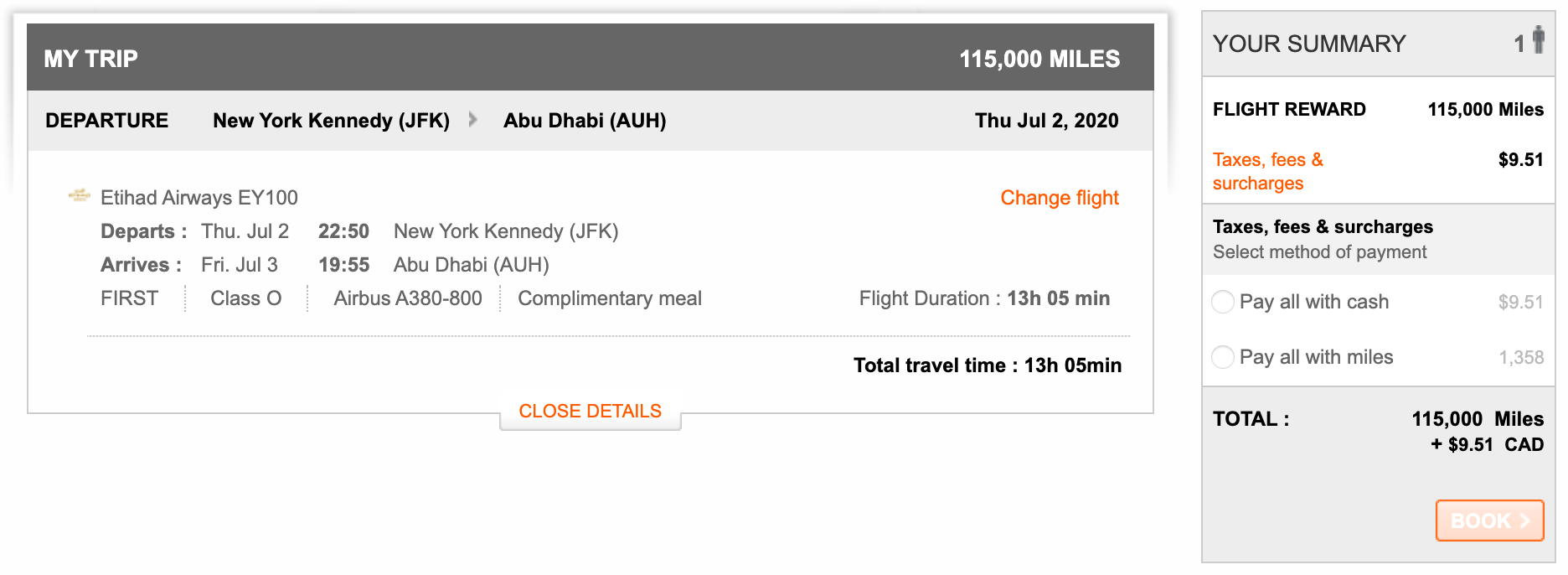

While Air Canada is planning to make changes to the program later in 2020, long-haul redemptions will likely remain tied to an award chart, hopefully at similar rates. Currently, you can book one-way flights between the continental U.S. or Canada and the Middle East as follows, including connecting flights on Air Canada:

- Economy: 40,000

- Business: 82,500

- First: 115,000

In some cases, you can save by continuing on to another destination. Etihad flies between Abu Dhabi and The Maldives (MLE), for example, and tacking on a flight to paradise will actually deliver some savings in premium cabins:

- Economy: 50,000

- Business: 75,000

- First: 105,000

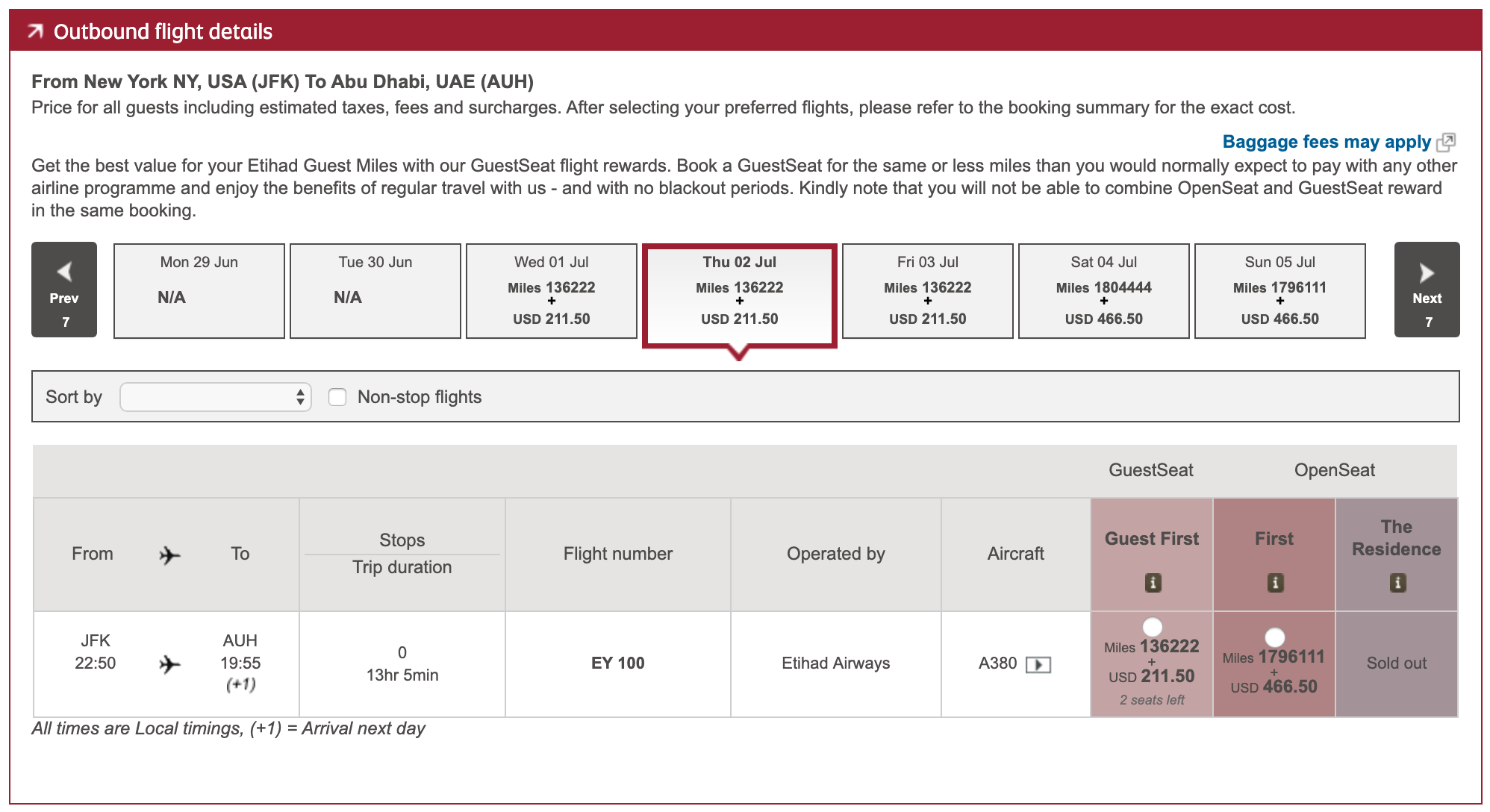

To book your flight, I find it best to first confirm award availability on Etihad's website, which offers a handy (and responsive) calendar tool. Flights that list "Guest" availability are available to partners, though the mileage amounts you see here apply only to bookings made through Etihad Guest.

Once you've confirmed "Guest" award availability, search for the same flight on Air Canada's website, or give an agent a call at 1-866-689-8080 to book your award. While some routes don't appear via Aeroplan's web tool, note that call center hold times can be extraordinarily long, so you'll be better off booking online if at all possible.

While Aeroplan adds fuel surcharges with some partners, you won't pay any extra fees with Etihad awards, saving you a considerable amount of cash.

Redemption levels are roughly in line with American AAdvantage, which also allows Eithad bookings — for example, for a one-way award between the U.S. and the Middle East via AA's program, you'll redeem 40,000 miles for economy, 70,000 for business and the same 115,000 miles for first class.

Boost your account

While you can earn Aeroplan miles when you credit partner flights, the easiest way to boost your balance is by utilizing transferrable credit card points. Currently, you can transfer points to Aeroplan at the following rates:

- American Express Membership Rewards: 1:1

- Capital One miles: 2:1.5

- Marriott Bonvoy: 3:1 (with a 5,000-mile bonus for every 60,000 points transferred)

Amex and Capital One transfers are completed instantly — generally, transfers cannot be reversed, so be sure to confirm award availability before you send your points or miles over to Aeroplan.

Bottom line

Etihad's fantastic first-class product, The Apartment, landed a fourth-place spot on my list of the best luxury suites in the sky, thanks to its unbeatable privacy, loads of personal space, on-demand catering and access to an inflight shower. I'm thrilled to have yet another option to book this product at a competitive rate — and, in this case, with easy-to-earn transferrable points.

An Air Canada spokesperson noted that the carrier is planning to add even more partners, as part of its upcoming relaunch, with more announcements expected in the "coming weeks."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app