Is American Airlines Flagship First worth it?

During the COVID-19 crisis, our team has temporarily ceased taking review trips. However, we have resumed the publication of new flight, hotel and lounge reviews, from trips taken before the lockdown. We have also been publishing a selection of our most popular reviews from the past year. We hope this will help you choose once we're all ready to start booking trips again.

Bear in mind that for the foreseeable future, service on board will be greatly reduced to lower the risk of contamination, and that the ground experience — with lounges closed or without food and amenities — will also be very different from what was available before the pandemic.

Of the Big Three U.S. airlines, American is the only one to offer a true first-class product on its transcontinental routes. Both Delta and United have invested significantly in their Delta One and United Polaris business-class products, but neither airline has bet on appreciable demand for first class between New York and Los Angeles or San Francisco.

That leaves American's Flagship First as the most exclusive way to fly commercially between the coasts. With just 10 first-class seats at the pointy end of the Airbus A321, it's a really nice way to fly. On a recent flight from LAX to JFK, before lockdowns caused by the coronavirus pandemic, I had a great experience thanks to the top-notch ground experience and well-above-average service. Plus, the reverse-herringbone seats in a 1-1 layout are a big upgrade compared to the 2-2 arrangement in biz.

https://www.instagram.com/p/CADQuzOACj3/

But American's Flagship First is extremely expensive. American's business-class pricing is similar to the other airlines flying the route, but first class is often priced much higher. So, should you ever consider paying extra for Flagship First on the transcon?

For more travel tips and news, sign up for our daily newsletter

[table-of-contents /]

Buying outright

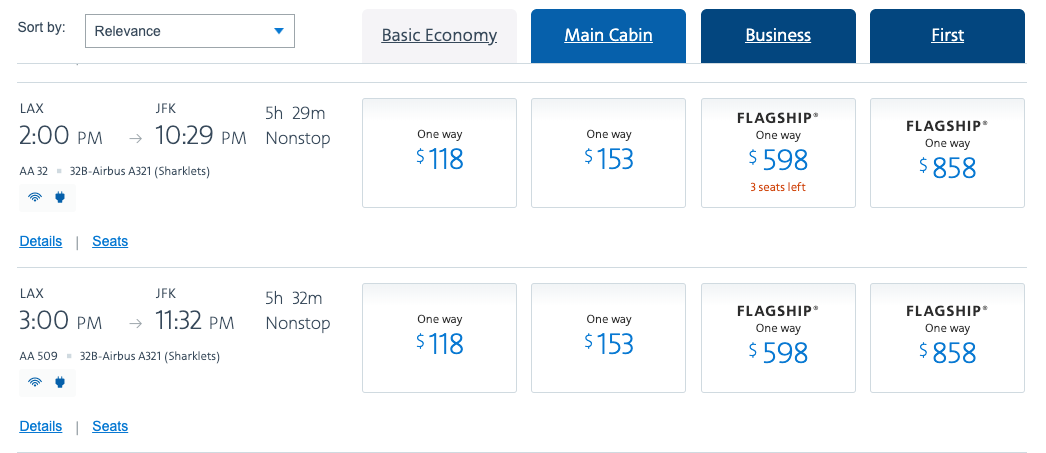

Buying a one-way, first-class ticket outright could set you back up to $3,000 or more! But it's not just the sticker price that you should consider — it also pays to look at the differential between biz and first.

Sometimes, I've seen the buy-up to first as low as $200 to $300. That could definitely make sense if you have trouble sleeping on a red-eye next to a neighbor or just prefer more personal space. This calculation will also differ if you're expensing the flight or have a good corporate contract with AA.

I can't tell you how to value your (or your business') money, but let's take a look at the points-and-miles side of the equation. If you were to find saver award availability for the flight from New York to L.A. or San Francisco (good luck with that!), you'd be looking at 32,500 AAdvantage miles in biz or 50,000 in first. TPG values AA miles at 1.4 cents per point, making the buy-up worth about $250, which is just about where I'd be on the fence about the upgrade.

Upgrade using miles

Another option to confirming a first-class seat is to upgrade using miles. In order to do that, you'll need to have paid for a biz ticket and find "A" fare class inventory in the first-class cabin. Note that you can't double-upgrade from coach into first.

The cost to upgrade with miles is 15,000 AAdvantage miles and a $175 co-pay if you're ticketed in the discount "I" fare class. If you're on a more expensive biz ticket (fare classes "J," "D" or "R"), you're exempt from the cash co-pay.

Those 15,000 AAdvantage miles are valued at $210. Combined with the cash co-pay, it's most likely not a great deal to upgrade to first. If you're already on an expensive biz ticket, it could make sense, but I'd also inquire about the buy-up to first. It may be less than the value of the 15,000 AAdvantage miles.

Upgrade certificates

Upgrading using certificates is the best way to confirm a first-class upgrade on this route.

AA Executive Platinum members and Concierge Keys get four systemwide upgrades (SWUs) each year. These can be used to confirm a one-cabin bump on any flight worldwide. (For more about systemwide upgrades, check out this guide). Personally, I prefer to hold my SWUs for upgrading international flights from coach to biz, but some people may not travel much internationally or get their biz tickets paid for by work. In that case, upgrading to first using a SWU represents a good value (especially if it's expiring soon).

But perhaps the best way to get a bump to first is using a Business Extra BXP1. That's the code for a one-segment upgrade on any flight within North America or between North America and Hawaii or the Caribbean. We've got a full guide to the Business Extra program, but one of my favorite redemptions in that program is the BXP1 certificate.

These certificates cost just 650 points, which are earned after spending $3,250 on AA flights. As such, they're much easier to acquire than systemwide upgrades, making them the best way to upgrade from biz to first on an AA transcon.

Bottom line

Flying in Flagship First between New York and California is perhaps the best way to fly (commercially) within North America. But flying up front isn't cheap.

You could purchase your ticket outright, but that's often too expensive for most. Therefore, the best way to sit in Flagship First is by upgrading — not with miles, but with certificates. I'd highly recommend using a BXP1 to confirm the one-segment upgrade. But if you don't have access to one of those, a systemwide upgrade will do the trick.

All photos by the author.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app