A star-crossed trip to Tahiti; Why I canceled Bora Bora again

As the travel industry reopens following COVID-19 shutdowns, TPG suggests that you talk to your doctor, follow health officials' guidance and research local travel restrictions before booking that next trip. We will be here to help you prepare, whether it is next month or next year.

Americans can go to Tahiti, but...

It looks like French Polynesia just isn't in the cards for me in 2020. My star-crossed trip to Tahiti has summed up 2020 perfectly.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

You may remember that I had booked a dream vacation to Tahiti late last year. I was supposed to be headed for paradise in mid-March, and we all know what happened then. The outbreak of COVID-19 forced me to cancel my trip very last minute. And it turned out it's a good thing I did too as the country basically closed its borders and my flight to Fa'a'ā International Airport (PPT) in Papeete, Tahiti was cancelled.

Fortunately, I was able to cancel my trip and get most of my money (and points) back.

As part of our series on booking dream destinations during coronavirus, I went ahead and booked the trip again back in April never dreaming COVID-19 would still be an issue come end of September. So much for that.

Related: Dreaming of French Polynesia; How to book on points and miles

It wasn't coronavirus restrictions forcing my hand this time (though they did factor into it) or cancelled flights. This time my hotel canceled on me!

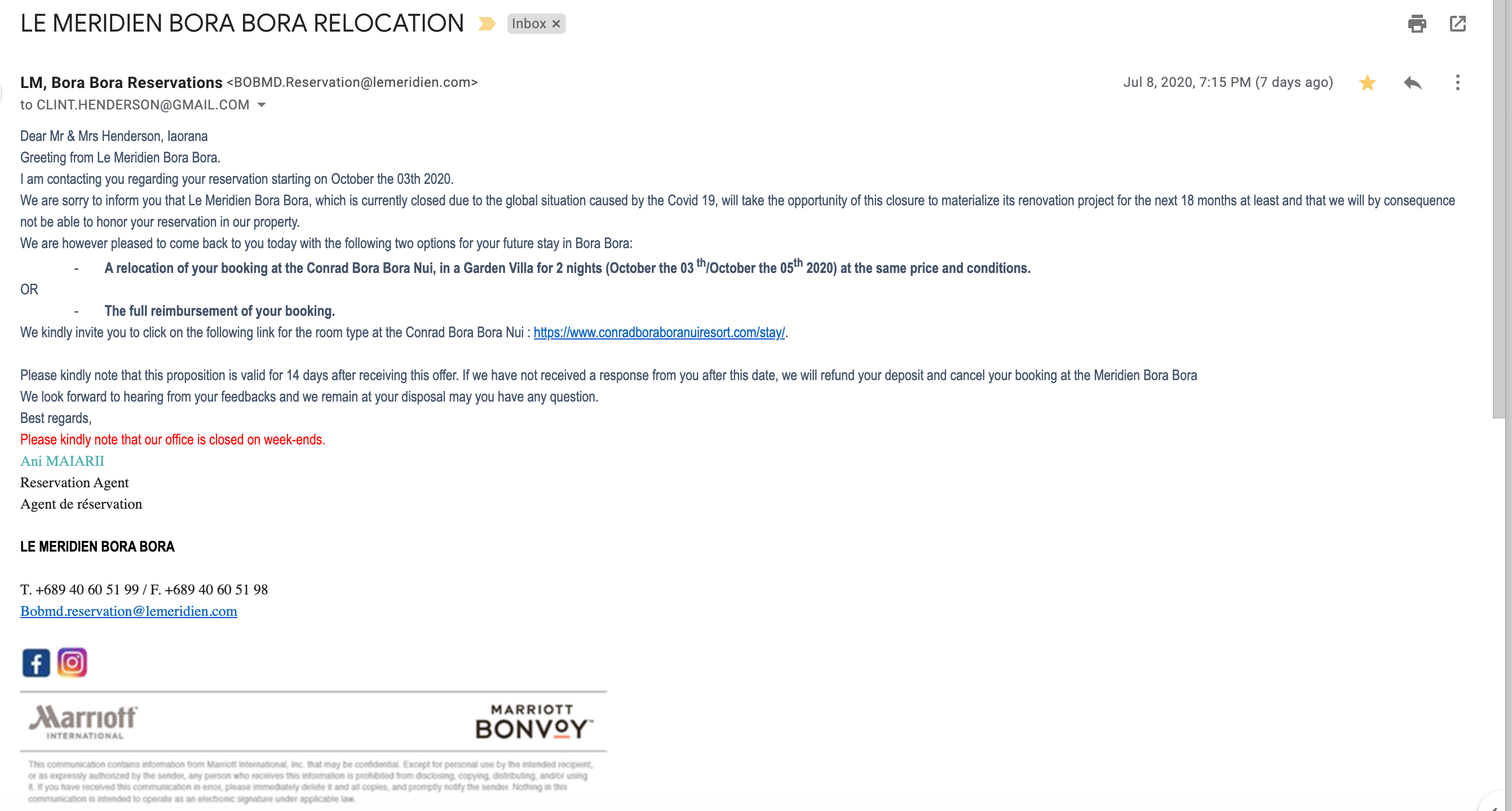

Le Meridien Bora Bora closing for 18 months

I got an email from Le Meridien in Bora Bora that they were cancelling my reservation at Le Meridien which I'd been aching to experience (and review). Apparently because of coronavirus the hotel is shutting down, and decided to take the time to do a full renovation. A renovation that will last 18 months!

Other issues with travel to French Polynesia

I had already been super nervous about getting a test within 72 hours of departure which is the new rule for tourists who want to visit Tahiti. In fact, French Polynesia is one of the few countries even accepting Americans right now. But I was increasingly worried about how long testing is taking in the United States. There are no guarantees that you can even get COVID-19 PCR test results in the required three-day timeline.

Related: What you know to visit French Polynesia when it reopens in July

I was also, frankly, feeling very guilty about even considering international travel since coronavirus is still spreading across the United States including in the city where I would have to layover before my flight on Air Tahiti Nui. Los Angeles is in the middle of a new spike and reported more than 2,800 cases on Sunday July 19 alone. The mayor is even reportedly considering further restrictions there.

Then there are the fears over a lack of health care resources in places like French Polynesia. As my colleague, Victoria Walker has written, countries in the Caribbean don't always have the facilities and expertise to handle any outbreaks. She called on tourists to follow the rules and carefully consider trips. Perhaps the most responsible thing I could do, in this instance, was not take the chance.

Related: The Caribbean is reopening; recovery depends on you

In any case, the hotel cancelling felt like a sign from the universe.

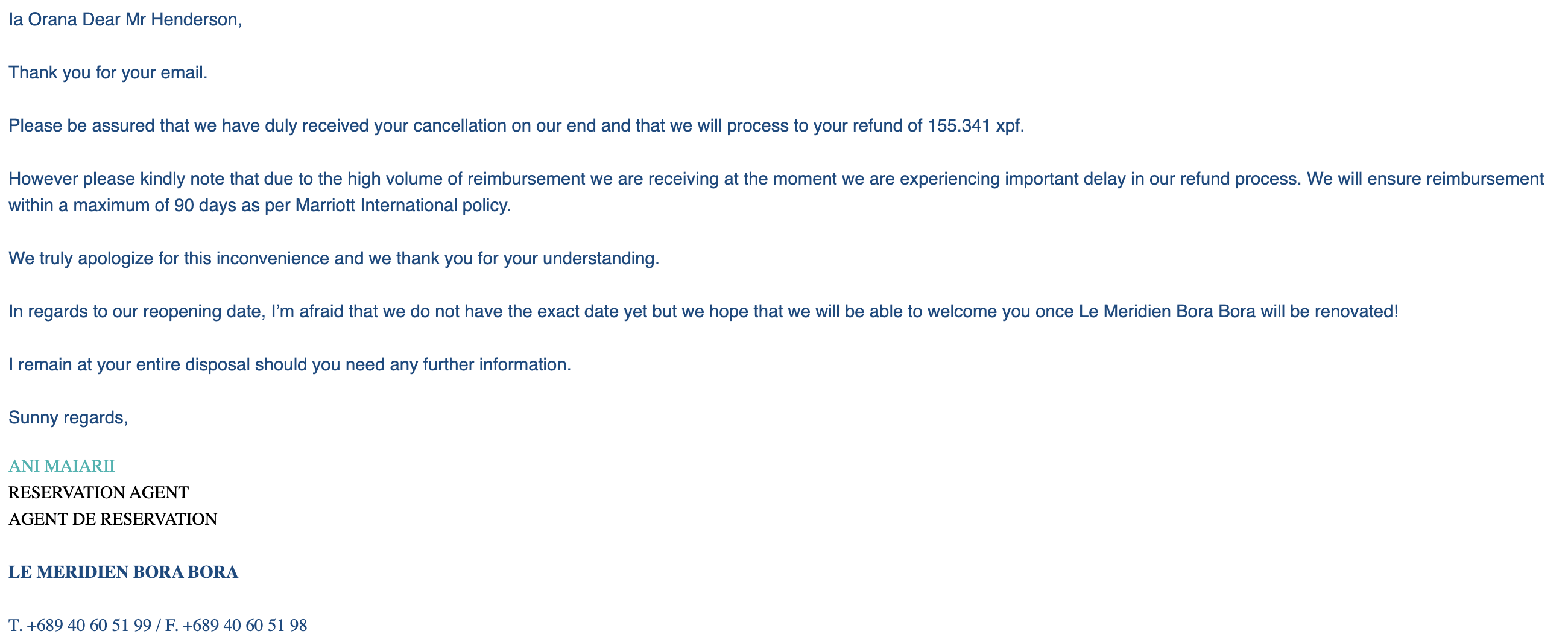

I went ahead and responded to the email from Le Méridien Bora Bora to cancel the reservation. The next day, I got a response back that I was a bit taken aback by. They would happily refund my money, but it would take up to three months! Yikes.

The email reads, in part, "We will ensure reimbursement within a maximum of 90 days as per Marriott International policy."

That's got me really concerned, but in a worst-case scenario, I can dispute the charge if I don't get my refund. I'll report back on what happens.

Related: Here's where Americans can go

Meantime, I had to deal with the other reservations.

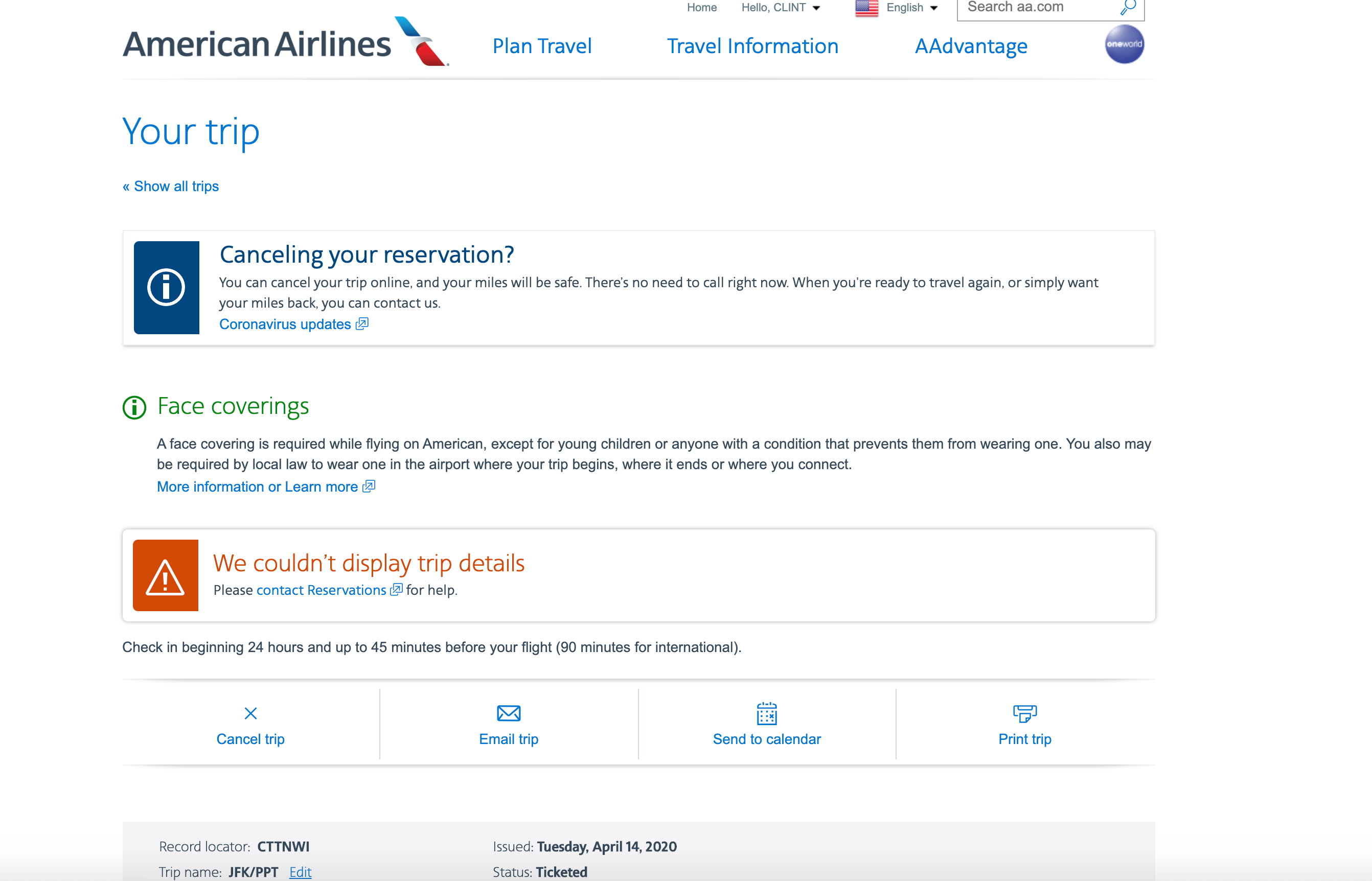

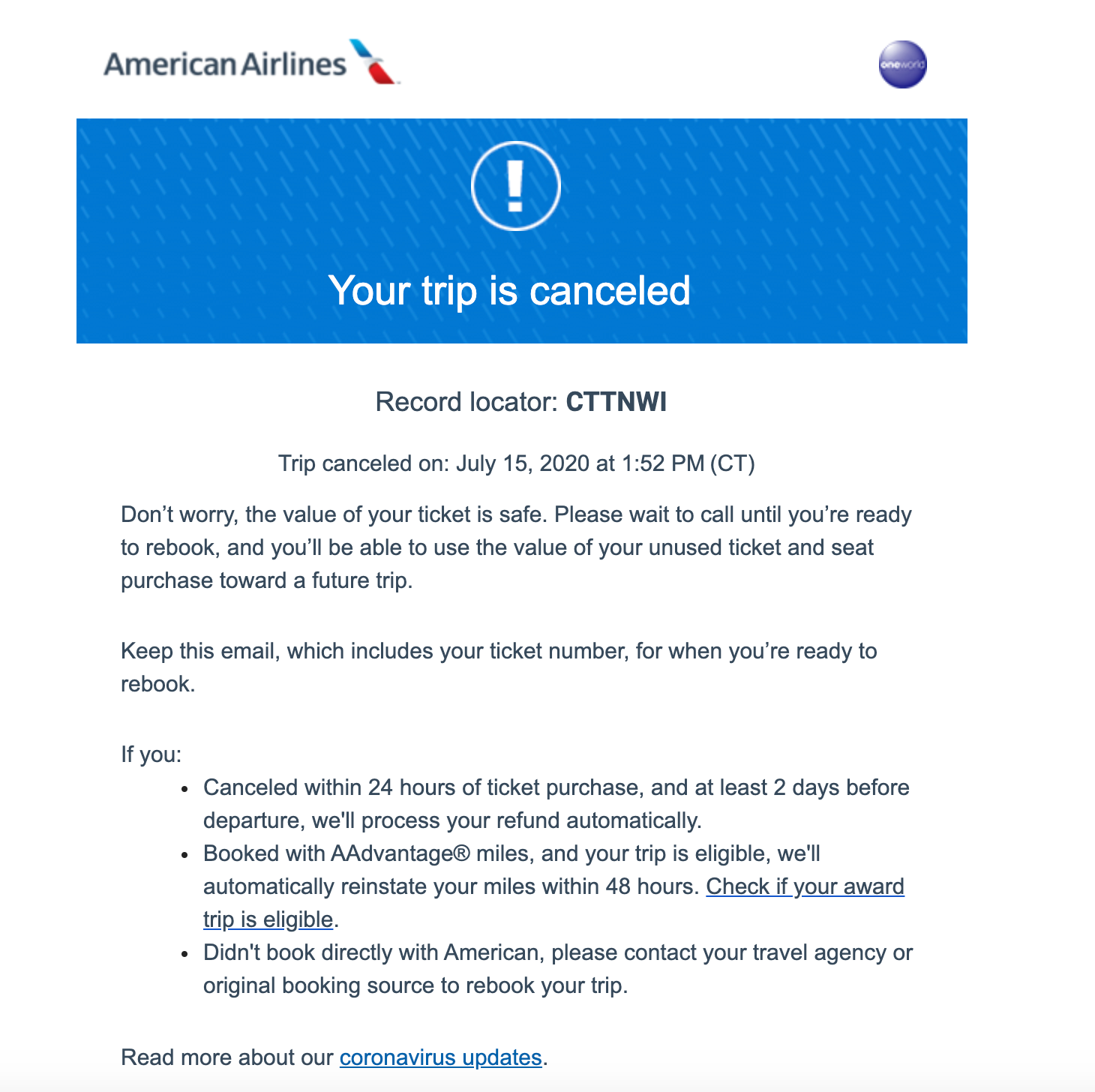

Easy cancelation from American Airlines for flights

On July 15, I called to cancel the reservation and spoke to a nice agent named Jane to cancel the trip (again) and get my points refunded. I got a $61.50 refund and 120,000 AA miles back into my account in 24-48 hours. That was for business class on Air Tahiti Nui one way, premium economy one way, and the connecting flights via Alaska Airlines from New York in first. (That would have a been a great redemption -- sigh.)

Jane told me that she was one of the few agents working from home and had 30+ years with AA. She said she was among many who were considering early retirement.

I got the points back within 24 hours.

I'm eager to rebook this trip, and I'll use some of the tips I've learned at The Points Guy to do it, but I'll wait for a firm date on when Le Meridien will open again before I do.

Related: Air Tahiti Nui in business class from LAX to PPT

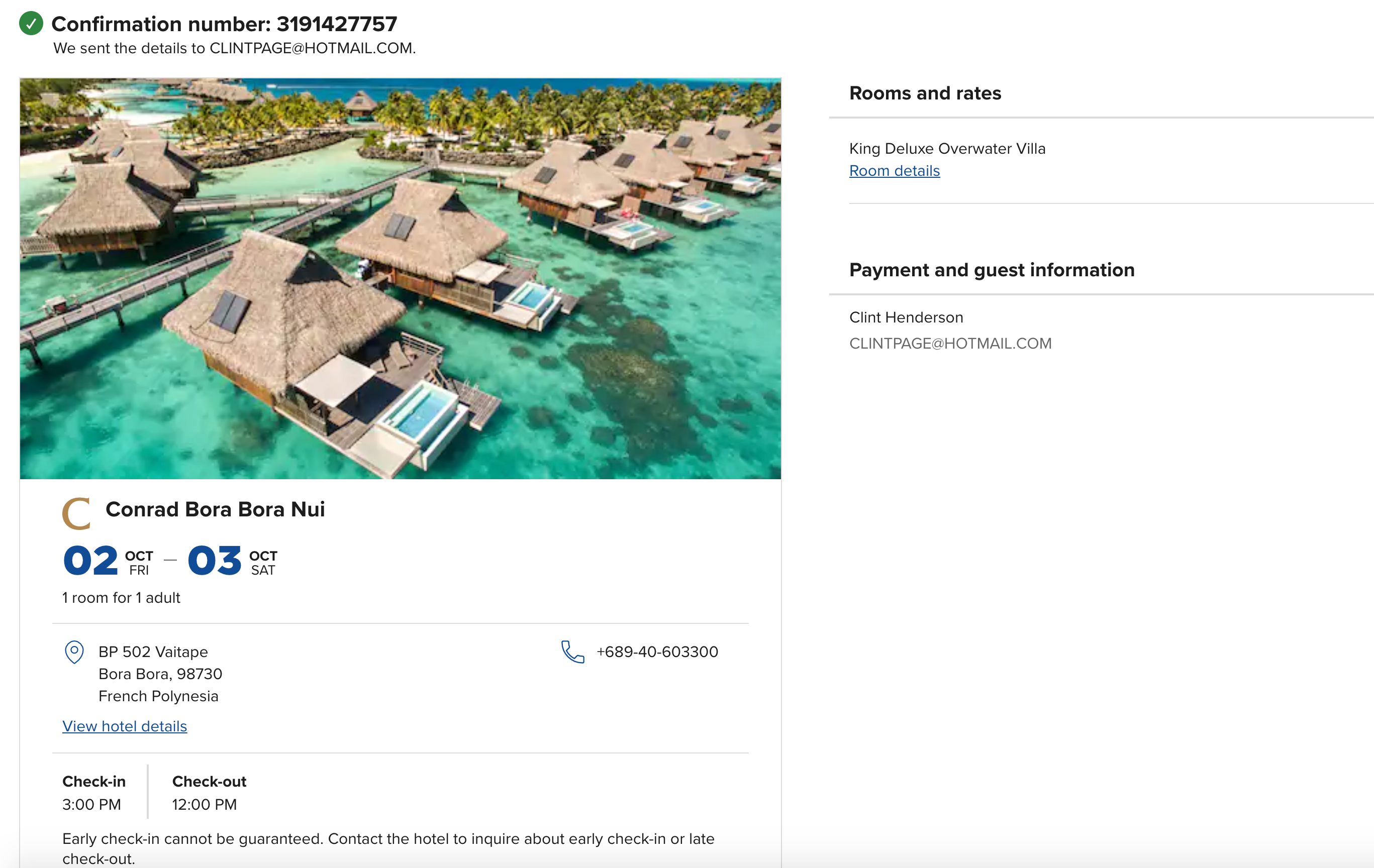

Canceling Conrad Bora Bora

Next I had to contact Hilton and see about getting my points back for my one night stay at Conrad Bora Bora. I talked to a customer service representative who was able to cancel the reservation and refund my 330,000 Hilton Honors points. The points showed back up in my account within a minute.

It was much easier than I expected. Again, I want to say how impressed I am with how American Airlines, Marriott and Hilton have been during these trying times. It pays to book direct!

Fortunately, I hadn't made any firmer plans or booked intra-island flights yet. I'm still smarting from losing $377.40 on Expedia for my original March Air Tahiti flight from PPT to Bora Bora (BOB). I am still planning on trying to get that money back, but I don't have it in me to try to get through to Expedia, which has been extraordinarily painful to deal with. Meantime, I went ahead and disputed the charge on 7/20, so if I don't get relief from American Express for that charge I'll fight that battle with Expedia and Air Tahiti another day.

Related: When will international travel return? A country-by-country guide to coronavirus recovery

So what now?

Now being twice-burned, I'm finally getting shy about rebooking this doomed trip. I really could use a week at a resort, but international travel is looking increasingly unlikely for 2020. I've already gotten to explore a few things that I would have normally skipped like Yellowstone and Glacier National Parks. It's maybe time to cross a few of the states in the U.S. I've never been to off my list instead.

Though living in Barbados for a year does have some appeal.

Related: Barbados reopening - What you need to know

Related: Barbados wants you to move there and work remote

Read more about traveling to French Polynesia:

- Transfer to paradise: How to take a cheap ferry from Tahiti to Moorea

- Moorea or Bora Bora–Which island paradise is right for you?

- Eating your way through Tahiti's famed food trucks

- Best French Polynesia hotels to book with points or Citi Prestige 4th Night Free

- Moorea or Bora Bora – Which is right for you?

- La Orana Tahiti: Polaris to PPT on United's 787-8 Dreamliner

- Last Leg to paradise: Air Tahiti (ATR 72) in economy from Tahiti to Bora Bora

Featured image courtesy Summer Hull/The Points Guy.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app