Should you buy IHG points or transfer rewards from Chase?

Many award travelers overlook the IHG One Rewards program, but it's easy to get good value when redeeming IHG points, regardless of whether you're staying at your local Candlewood Suites or an aspirational InterContinental resort.

Especially if you don't frequently use the IHG One Rewards program, you may need to earn IHG points so you have enough to cover a stay at an IHG property with points. Two quick ways to earn IHG points are to buy them or transfer Chase Ultimate Rewards points. We'll look at both options in this guide so you can determine which is best for you.

Buy IHG One Rewards points

You can typically buy IHG points at this link for the following rates:

- 1,000 to 10,000 points: 1.35 cents per point

- 11,000 to 25,000 points: 1.15 cents per point

- 26,000 to 150,000 points: 1 cent per point

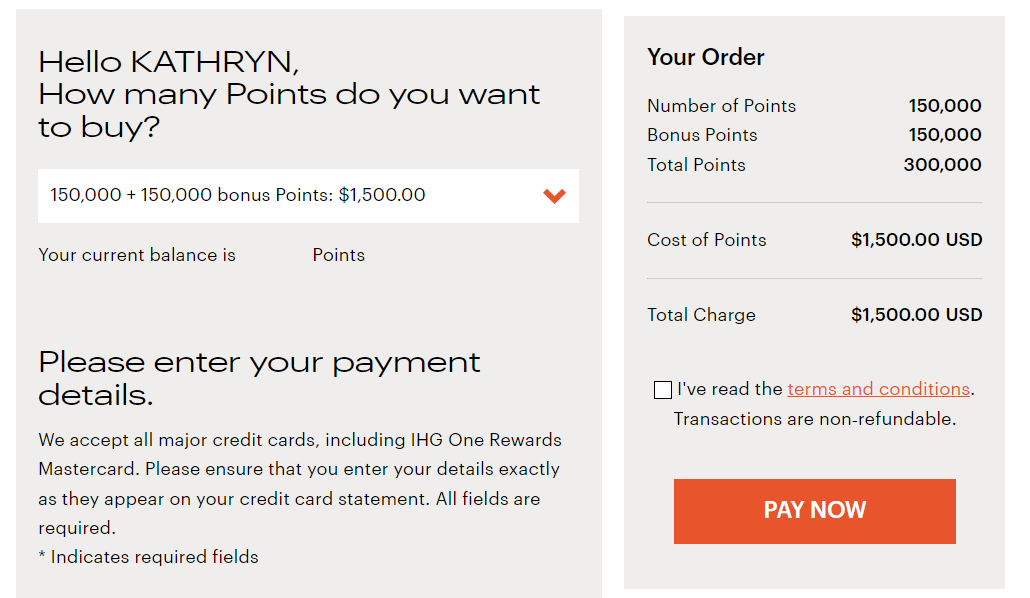

However, IHG frequently runs promotions to buy points. The best offer you'll see — which IHG typically offers several times per year — provides a 100% bonus. During sales with up to a 100% bonus, you can purchase IHG points for as little as 0.5 cents per point. For example, during a recent sale with up to a 100% points bonus, I could have bought 150,000 IHG points and received 150,000 bonus IHG points for $1,500.

IHG allows its members to buy up to 150,000 points each calendar year, and some IHG members can transfer up to 500,000 points each calendar year to other members. Purchased points don't count toward IHG elite status and aren't refundable. Once you buy IHG points, the points should appear in your account within 72 hours. However, in practice, the points usually appear within 10 minutes.

When you buy IHG points, you'll make your purchase through points.com. This is important because it means the purchase will not be coded as a travel purchase on your credit card. As such, you may want to use an everyday spending card — like the Capital One Venture Rewards Credit Card or the Citi Double Cash® Card (see rates and fees) — that earns bonus rewards on all purchases.

Remember, though, that the IHG One Rewards Premier Credit Card (see rates and fees), the IHG One Rewards Premier Business Credit Card (see rates and fees) and the IHG One Rewards Traveler Credit Card (see rates and fees) let you save 20% on IHG points purchases. You can't combine this discount with other promotions — such as a 100% bonus — but if you are buying IHG points without a bonus, it's likely worth using an eligible IHG credit card to pay and save 20% on your purchase.

Related: How much value does IHG One Rewards status provide when you book directly?

Transfer Chase points to IHG

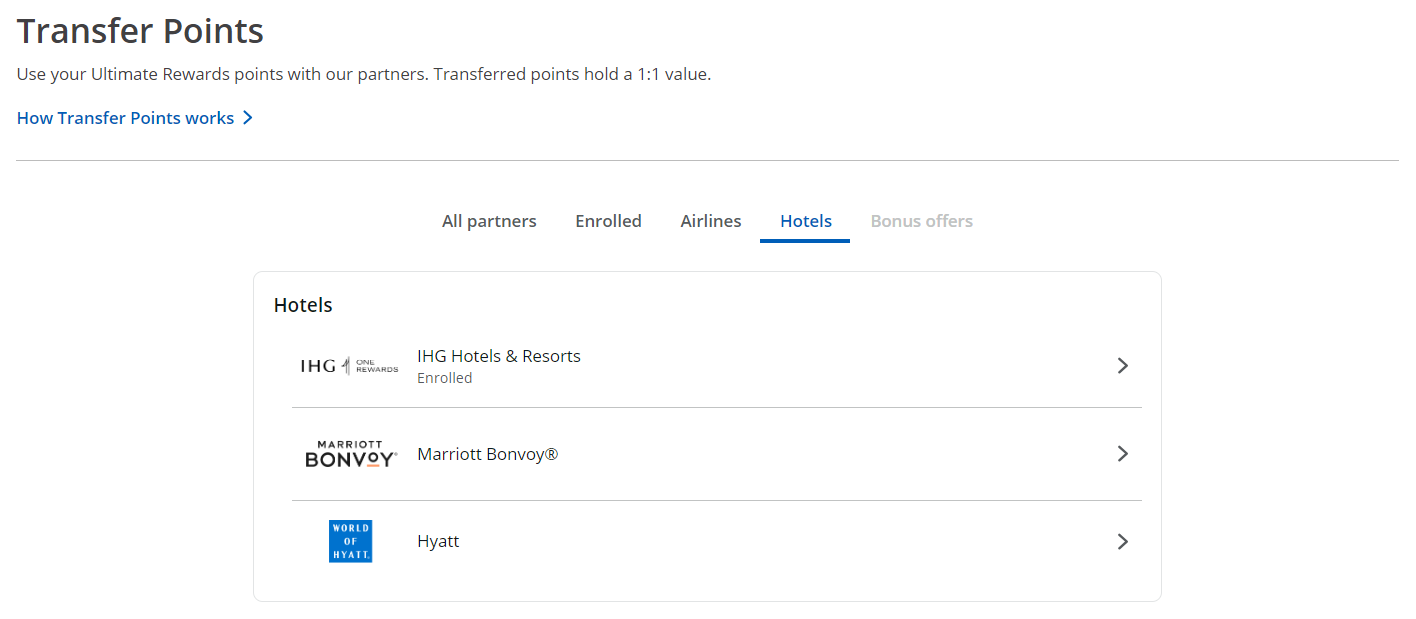

You can also transfer Chase Ultimate Rewards points to IHG One Rewards in increments of 1,000 points at a 1:1 ratio. Chase Ultimate Rewards points are the currency earned by select Chase credit cards, including the Chase Sapphire Reserve (see rates and fees), the Chase Sapphire Preferred Card (see rates and fees) and the Ink Business Preferred Credit Card (see rates and fees).

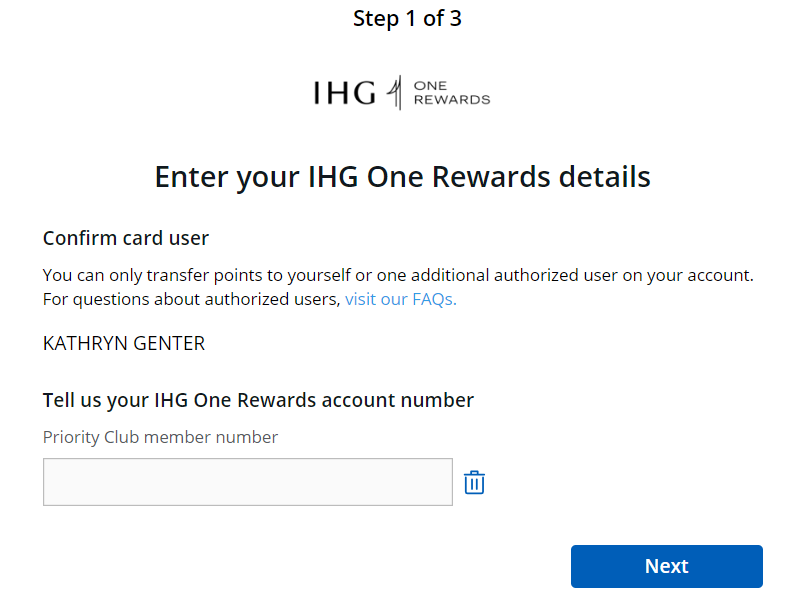

To transfer Chase points to IHG One Rewards, navigate to the Chase Ultimate Rewards portal here. You may need to log in and select which Ultimate Rewards account you want to use. Click the three little dots on the upper navigation bar, select "Travel" and click "Transfer points to partners." On the next page, select "Hotels" and click on the "IHG Hotels & Resorts" tile.

You'll land on a page that explains what you should know before transferring Chase points to IHG. Scroll to the bottom of the page and click the blue "Transfer Points" button. Enter your IHG One Rewards account number and then select "Next."

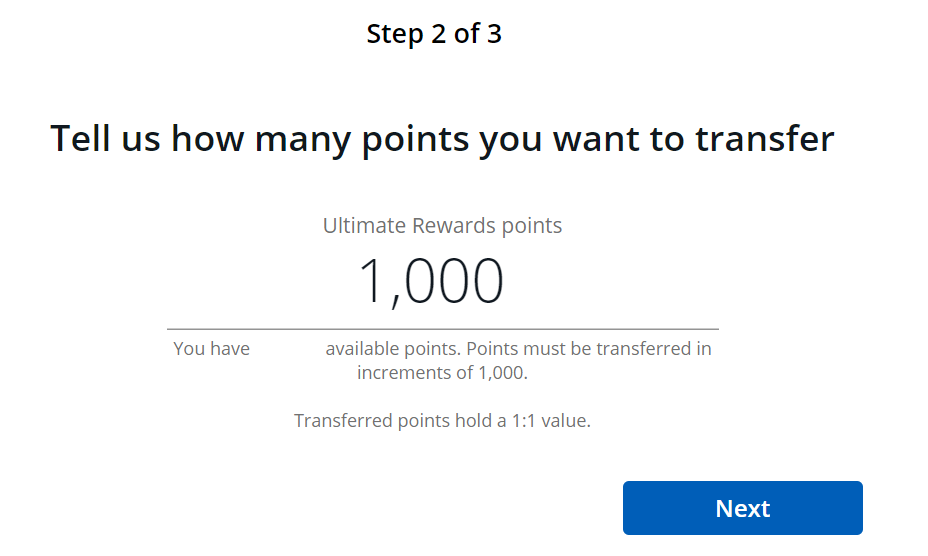

Then, enter the number of Chase points you want to transfer to IHG.

According to TPG's tests of how long Chase Ultimate Rewards take to transfer, you can expect the points to reach your IHG account instantaneously.

Related: The 19 best IHG hotels in the world

Should you buy points or transfer Chase points to IHG?

Whether to buy IHG points or transfer Chase points to IHG depends on your current situation. If you have ample Chase Ultimate Rewards points, are short on cash or have already hit the annual cap for buying IHG points, you may want to transfer Chase points. This is especially true if there's a transfer bonus when you transfer Chase points to IHG.

However, I wouldn't transfer Chase points to IHG even with a transfer bonus because there are many ways to redeem Ultimate Rewards points that will likely provide better value. Based on TPG's valuations, Chase Ultimate Rewards points are worth 2.05 cents each, while IHG points are worth just 0.5 cents each. So, on paper, you're losing 1.55 cents per point if you transfer Chase points to IHG without a transfer bonus. And the math isn't much better even when you can utilize a transfer bonus.

Meanwhile, you can buy IHG points for just 1 cent each as long as you purchase at least 26,000 points. Even better, during occasional 100% bonus sales, you can buy IHG points for as low as 0.5 cents each — which equals TPG's valuation of IHG points.

Related: How to maximize redemptions with the IHG One Rewards program

Why you want IHG points

Finally, let's quickly discuss why you might want IHG points. The short explanation is that many IHG stays are a better deal on points than cash. For example, I got 1.56 cents per IHG point across 45 award nights in 2023, significantly higher than the 0.5 cents per point at which I bought many of the IHG points I redeemed.

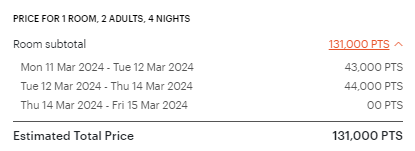

If you're planning to redeem IHG points for stays of four nights or longer, consider applying for the IHG One Rewards Premier Credit Card, the IHG One Rewards Premier Business Credit Card or the IHG One Rewards Traveler Credit Card. All three of these cards give you access to the IHG fourth-night-free reward perk, which means you'll pay the current points rate for the first three nights and zero points for the fourth night when you redeem IHG points for a stay of at least four nights.

Best of all, there's no limit on how many times you can use the fourth-night-free reward perk each year.

Related: Why you should get (and keep) the IHG One Rewards Premier card

Bottom line

I'll buy IHG points during sales with up to a 100% bonus, as I can get more than the 0.5 cents per point purchase price, but I wouldn't transfer Chase points to IHG even if there's a transfer bonus, as I'd rather save my Ultimate Rewards points for transfers to higher-value partners.

However, there are certainly some situations where transferring Chase Ultimate Rewards points to IHG could make sense. For example, you may earn Chase Ultimate Rewards points quicker than you can spend them, have already reached the maximum number of IHG points you can purchase within a calendar year or have more points than cash in your accounts.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app