Marriott's Eat Around Town dining program: Earn 500 Marriott points every time you dine in June

Update: Some offers mentioned below are no longer available. View the current offers here.

If you're going to dine out, you might as well earn lots of points and miles. Using one of the best credit cards for dining is a good start, along with joining restaurant loyalty programs. But you can earn even more points and miles by enrolling in a dining rewards program and then dining at participating restaurants, clubs and bars.

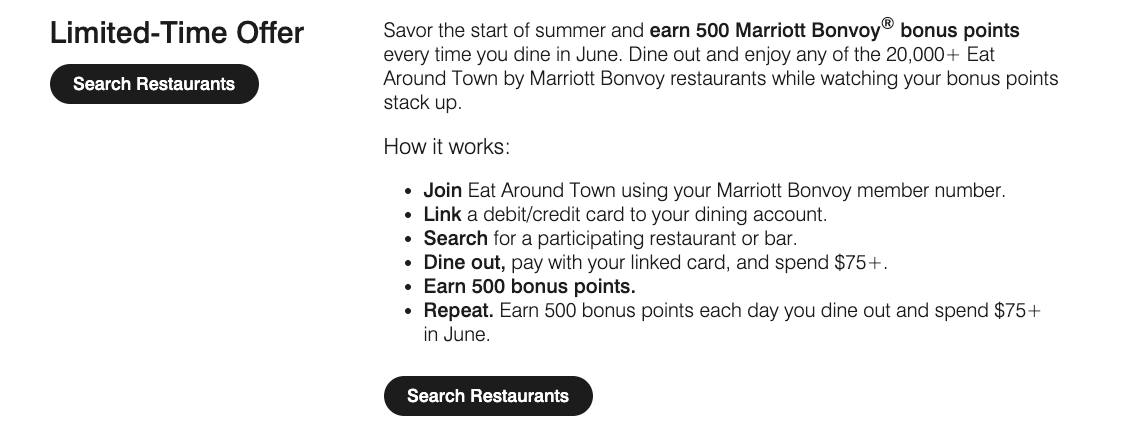

This month, the Eat Around Town by Marriott Bonvoy program is a particularly compelling option because all members will 500 Marriott Bonvoy bonus points every time they spend at least $75 on dining in June, and there's a new-member bonus if you haven't joined yet. Here's what you need to know about Marriott's Eat Around Town program.

Related: The best Marriott hotels in the world

How to join Marriott's Eat Around Town dining rewards program

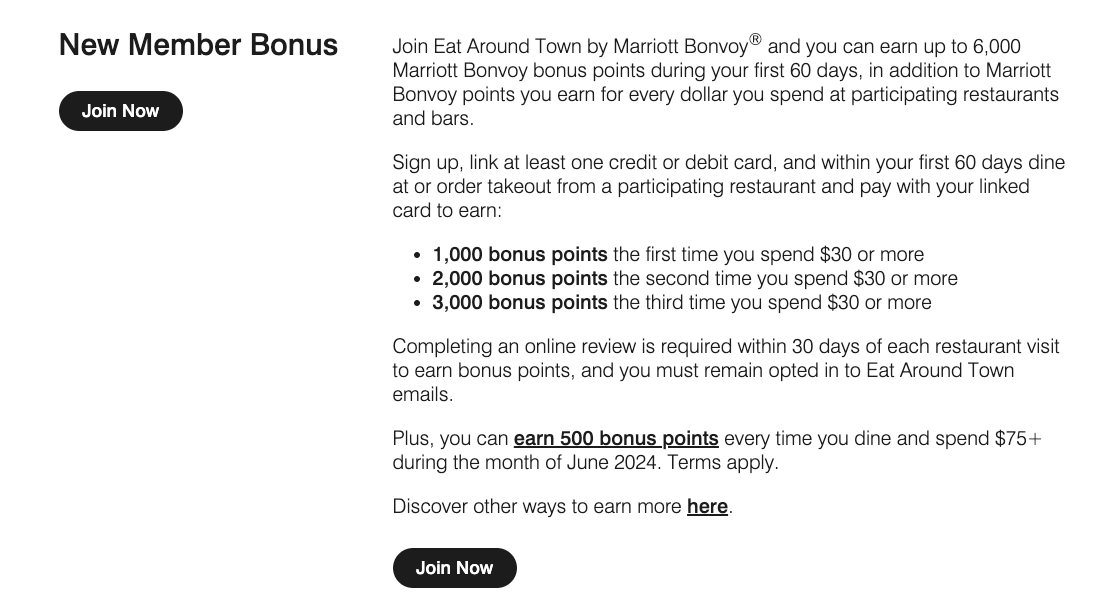

The Eat Around Town by Marriott Bonvoy program is free to join. Go to the Eat Around Town website, where you'll find a new-member bonus. For example, if you enroll and link an eligible credit or debit card to your account by Dec. 31, you can earn up to 6,000 Marriott Bonvoy bonus points during your first 60 days in addition to the points you'd normally earn.

To join Eat Around Town, click "Join Now" and sign in to your Marriott Bonvoy account. Once you sign in, Marriott will prefill your email address and ZIP code in a form. Check the terms and conditions box and click "Join Eat Around Town" to move to the next step.

Next, you must link at least one credit or debit card to your account. Ideally, it should be a card that earns bonus points on dining. Use this card when dining at participating restaurants, bars and clubs to earn extra Marriott Bonvoy points through Eat Around Town. If you use a debit card, you must request that it be processed as credit. That way, the transaction qualifies for earning points with Eat Around Town.

Related: The best Marriott beach hotels in the United States

How to earn points with Marriott's Eat Around Town dining rewards program

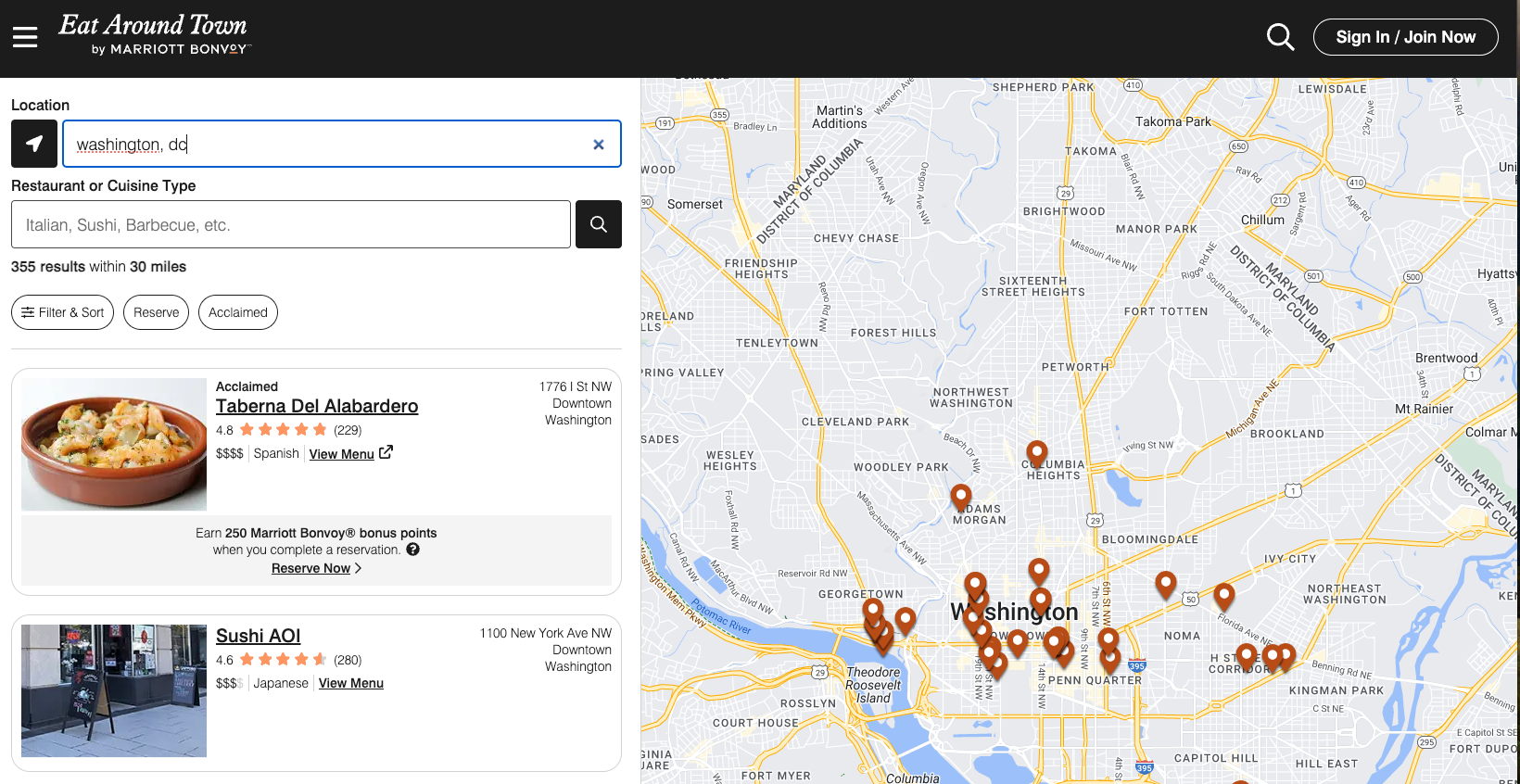

Members earn points with the Eat Around Town dining rewards program when using an enrolled card at eligible restaurants, bars and clubs. Register a credit card (preferably one that earns bonus points on dining) and use it at a participating restaurant. You can search for eligible locations on the Eat Around Town website.

How many points you earn through Eat Around Town typically depends on your Marriott Bonvoy elite status:

- 4 points per dollar spent for Marriott Bonvoy members without elite status

- 6 points per dollar spent for Marriott Bonvoy elite members

But Marriott frequently offers promotions that may allow you to earn more points when you dine. For example, throughout June, all members will earn 500 bonus points every time they spend at least $75 with an eligible card enrolled in the program.

MARRIOTT.COM

You should allow one to two weeks after dining for points to appear in your Marriott Bonvoy account. And bonus points from promotions can take even longer to reach your Marriott Bonvoy account. So, while the Eat Around Town program is an easy way to earn Marriott points, it isn't a quick way to top off your Marriott Bonvoy account for an upcoming redemption.

Related: Can I earn points and miles from 2 dining rewards programs at the same time?

Cards to use with Marriott's Eat Around Town dining rewards program

You can enroll almost any credit or debit card in the Eat Around Town by Marriott Bonvoy program. However, you'll want to enroll one or more of your best credit cards for dining to maximize your earnings. Here are some cards to consider:

- American Express® Gold Card: Earn 4 Membership Rewards points per dollar spent at restaurants worldwide (on up to $50,000 in purchases per calendar year, then 1 point per dollar).

- Chase Sapphire Preferred® Card (see rates and fees): Earn 3 Ultimate Rewards points per dollar spent on dining.

- Chase Sapphire Reserve® (see rates and fees): Earn 3 Ultimate Rewards points per dollar spent on dining.

- American Express® Green Card: Earn 3 Membership Rewards points per dollar spent at restaurants, plus takeout and delivery in the U.S.

The information for the American Express Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

To earn even more Marriott Bonvoy points, you may want to enroll a Marriott Bonvoy credit card in the program. You'll earn Marriott Bonvoy points from your credit card and the Eat Around Town program if you do so. Specifically, you may want to consider the following Marriott cards:

- Marriott Bonvoy Business® American Express® Card: Earn 4 Marriott Bonvoy points per dollar spent at restaurants worldwide.

- Marriott Bonvoy Bevy™ American Express® Card: Earn 4 Marriott Bonvoy points per dollar spent on up to $15,000 in combined purchases each calendar year at restaurants worldwide and U.S. supermarkets (then 2 points per dollar spent).

- Marriott Bonvoy Brilliant® American Express® Card: Earn 3 Marriott Bonvoy points per dollar spent at restaurants worldwide.

- Marriott Bonvoy Boundless® Credit Card (see rates and fees): Earn 3 Marriott Bonvoy points per dollar spent on the first $6,000 in combined purchases each calendar year on grocery stores, gas stations and dining.

Of course, the rates listed above are what you'd earn from spending on your credit card. You'd also earn Marriott points from the Eat Around Town program when you dine at participating locations.

Related: How to redeem points with the Marriott Bonvoy program

Is Marriott's Eat Around Town dining rewards program worth it?

Even if you live in an area with few participating restaurants, it's usually worth enrolling in a dining rewards program. After all, registering doesn't take long, and you may periodically pick up some bonus points.

However, you can only enroll each card in one Rewards Network-operated dining rewards program at a time. So, the more critical question is whether Marriott's Eat Around Town dining rewards program is best for you.

After all, many other loyalty programs have dining rewards programs. And some of these programs may give you a more significant return on your spending. Here are some of the other popular dining rewards programs:

- Hotels: Hilton Honors Dining, IHG One Rewards Dine & Earn and Choice Privileges Eat & Earn

- Airlines: American AAdvantage Dining, United MileagePlus Dining, Delta SkyMiles Dining, Alaska Mileage Plan Dining, Southwest Rapid Rewards Dining, JetBlue TrueBlue Dining and Free Spirit Dining

- Transferable rewards programs: Bilt Dining

Marriott's Eat Around Town program differs from most other dining rewards programs in one crucial way: Most programs base your earning rate on how often you dine with the program and whether you've opted in to receive emails. But Eat Around Town usually bases your earning rate on your Marriott Bonvoy elite status. So, if you have elite status with Marriott Bonvoy, Marriott's Eat Around Town program may be your best option.

Related: The best Marriott all-inclusive resorts for a perfect vacation

Bottom line

You can already earn plenty of rewards when dining out with the best credit cards for dining. However, you should also enroll your credit cards in a dining rewards program to maximize your earnings.

Since you can only enroll each card in one Rewards Network dining rewards program, it's essential to determine which dining rewards program is best for you. Marriott's Eat Around Town program is particularly appealing for Marriott members with Bonvoy elite status, as these members earn at the highest rate regardless of how frequently they use the program.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app