How to use your preferred name on a credit card or debit card

Editor's Note

Many people use a preferred or chosen name rather than their legal name or the name on their birth certificate. This can be as simple as someone whose legal name is Elizabeth going by Liz or Beth in their daily life.

It also includes transgender people. In the largest study ever conducted on this topic (warning: PDF document), nearly 70% of transgender individuals said they didn't have any ID or banking documents matching their preferred name.

Nearly a third of people whose documents don't match their current physical presentation reported being denied services, being asked to leave a business or even being physically assaulted when trying to use these outdated documents.

Roughly a quarter of these people said they didn't know how to change to their preferred name on their documents or believed it wasn't possible. However, some banks allow people to use their preferred or chosen name on their credit or debit cards — even when it doesn't match their legal name.

This allows people to have banking documents that match the identity they present in their daily lives. The most widespread of these programs is Mastercard's True Name program, launched in 2019 and available in North America and Europe.

Let's examine the positions of the major banks and credit card issuers in the U.S. on using preferred names so you can understand your options.

Understand: The bank still needs your legal name

Before we review bank and credit card issuer policies, it's important to understand that some require you to open the account first and then submit a request for a new card with your preferred name on it (others allow you to do this during the account opening process).

You must use your legal name when applying for any type of bank or credit account in the U.S. That's because of a provision (Section 326) in the USA Patriot Act; this rule went into effect in 2003.

The rule requires banks, credit unions and credit card issuers to establish a customer identification program to comply with government regulations. This program requires you to provide your personally identifying information so the bank can verify that you are who you say you are. One requirement is providing your legal name.

The question is what comes after this. Can you change the name displayed on your credit or debit card to a preferred name rather than your legal name? Let's look at your options with some of the major banks.

Related: Can you get through airport security without ID?

American Express

With a few exceptions, American Express has allowed users to use a preferred name on their credit cards for several decades. During the application process for an American Express card, users can select the name they want displayed on their card.

If you want to change or update this later, you can call the number on the back of your card. Amex allows cardmembers to use a preferred name so long as it's not the name of someone famous or profane, and a phone representative can help you make this change.

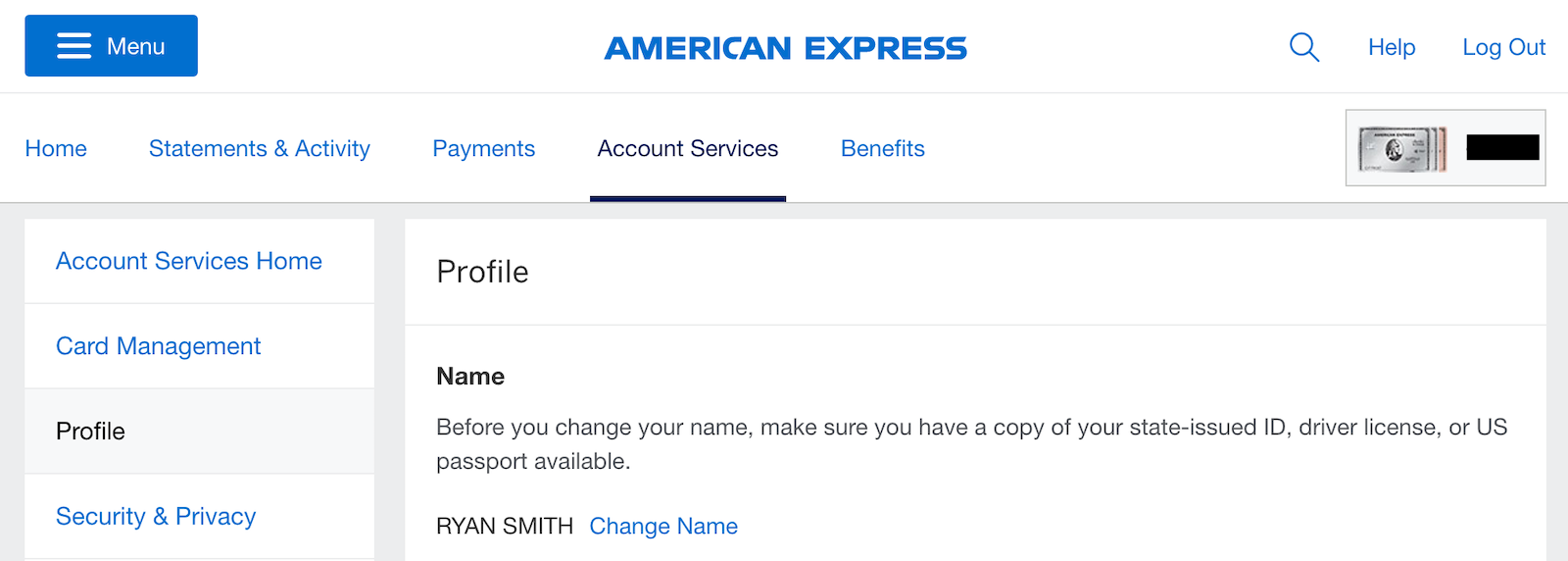

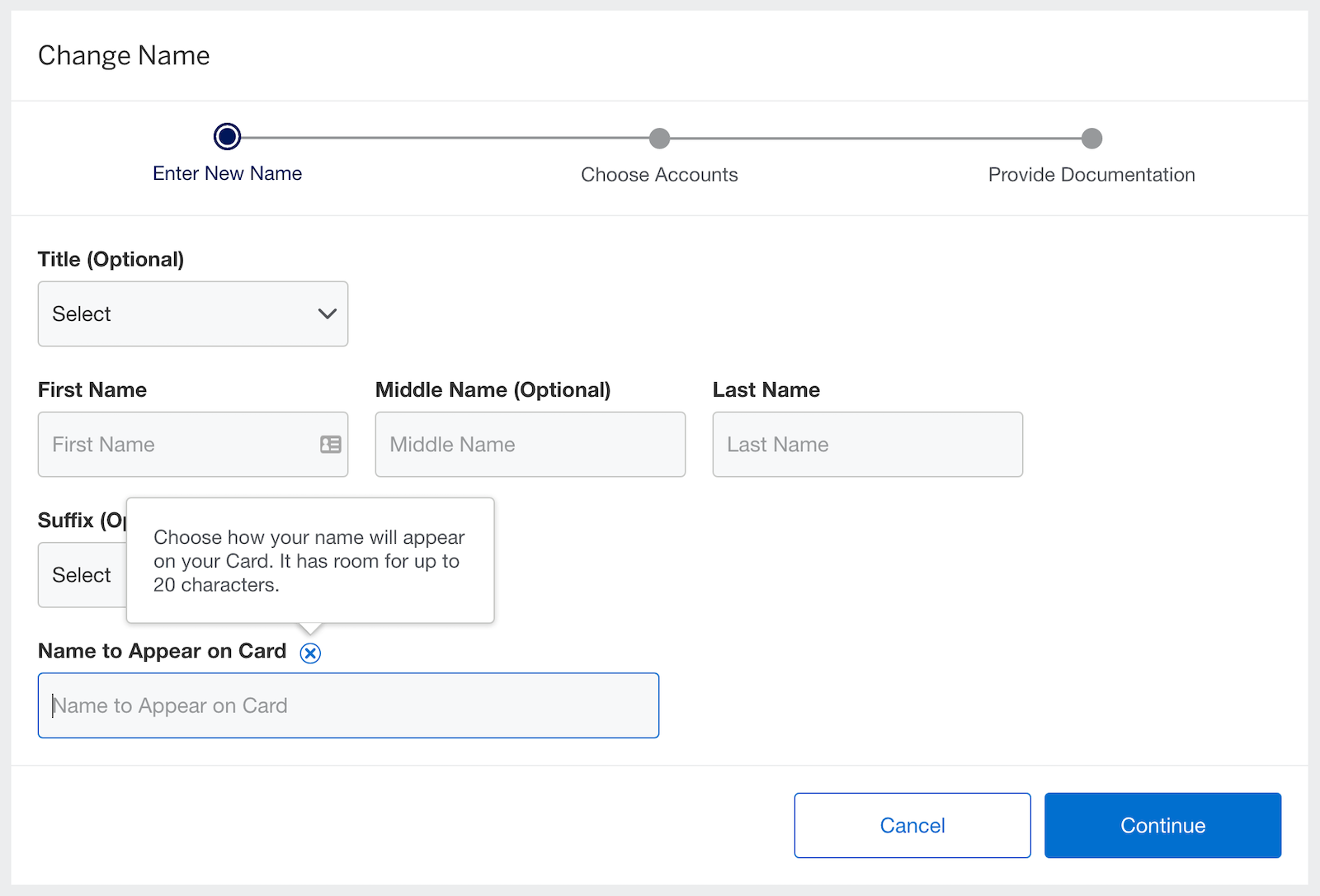

If the name change coincides with a change in your legal name, you can request this change through your user profile on the website. After logging in, select the card you want to update in the top right corner, then click "Account Services." From here, a new menu will appear on the left side; choose "Profile." Next to your name, you'll see the option for "Change Name."

The next page will allow you to provide your legal name and then a name to be displayed on your card.

After moving forward, you must submit documents to support your request. This online option works best for those who have already successfully changed their name on their ID cards. If you request a preferred name that doesn't match your legal name, a phone call is your best option.

Bank of America

Bank of America declined to provide information for this story.

Barclays

A spokesperson for Barclays confirmed that it's not possible to use a preferred name on its credit cards at this time, providing TPG with the following statement:

"We strive to meet the needs of all of our cardmembers, including those in the LGTBQ+ community. While we don't currently offer this feature, it's something we have explored and are looking to implement in the future."

BMO Harris

BMO Harris operates a nationwide network of fee-free ATMs in addition to branches in eight states. Its True Name initiative allows you to use your preferred name on a credit, debit or ATM card, including business cards.

If you bank with BMO Harris and want to request your preferred name, call 888-340-2265 or visit a local branch (locations are available here).

Capital One

An update to its policy allows Capital One credit card holders to use preferred names, even if these aren't a derivative of the person's legal name. When requesting the change, there is no requirement to submit documentation related to the preferred name you want on your card.

"At Capital One, our customers are at the forefront of everything we do, so we're proud to share that customers now have the ability to choose to display their preferred name on their credit card before a legal gender change or legal name change," according to a spokesperson for Capital One.

"Customers are not required to provide any documentation or justification for the name they prefer to have appear on their credit card plastic."

You can request a change to your preferred name by calling the number on the back of your card.

Related: Capital One Travel portal: What to know about redeeming your miles for flights, hotels and more

Chase

With Chase, customers must presently use their legal name on their credit and debit cards. However, this may change in the future. A spokesperson for Chase said in 2022 that the bank is "working on giving our cardmembers the option to use their preferred name instead."

Citi

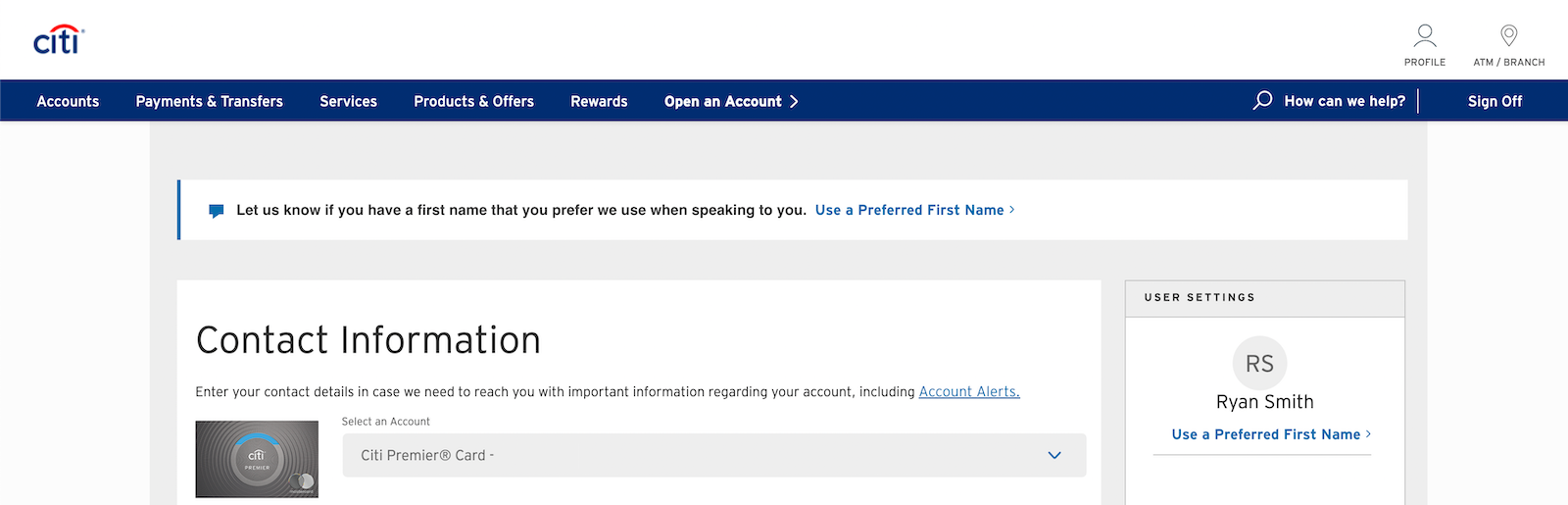

For years now, Citi credit card and debit card holders have been able to use their chosen first names.

Customers can update their names on debit cards by calling the number on the back of their card or by visiting a local Citi branch (which you can find here). Citi credit card holders can call the number on their card to request an update for multiple cards at once or make this update online (for just one account at a time) by logging in to their online accounts and clicking on "Profile" at the top.

From here, click on "Contact Information." You will see the option to use a preferred first name.

According to a Citi spokesperson, a replacement card will arrive within four to seven business days after updating your preferred name. You can track the status of your replacement card online.

Daylight

As a bank focused on the LGTBQIA+ community, all communication is done using the preferred name provided by customers. After providing your legal name during the account application process, every other communication point will use your preferred name. This name will also be shown on your debit card.

Discover

Cardholders cannot use a preferred name on debit or credit cards with Discover. However, a spokesperson added that the card issuer is "committed to determining a process for enabling methods by which customers can change their first name on their payment card to their preferred/chosen name."

U.S. Bank

Presently, customers cannot use a preferred name on credit or debit cards from U.S. Bank, according to a bank spokesperson. The same spokesperson provided the following statement:

Preferred names are an important part of individual identity, and we respect those preferences. Due to limitations on the identity verification process in place, we are currently unable to accommodate the use of a name that does not match with other legal records. We're continuously exploring process improvements to support all of our customers. [H]owever, we don't have anything firm to share at this time.

Wells Fargo

While using a preferred name may have been possible in the past, it isn't now with Wells Fargo. Those who previously used preferred names on Wells Fargo credit cards and debit cards have received letters stating they must bring their government-issued identification to a local branch to receive new cards with their legal names.

Thus, only the legal name on the account can be listed on these cards. However, when asked about preferred names in 2022, a spokesperson for Wells Fargo said the bank "continue[s] to explore this option."

Bottom line

As you can see, multiple banks presently allow customers to use their preferred name on credit and debit cards, including business accounts at several institutions. Others have committed to look at implementing the use of preferred names in the future. Superbia, a financial institution focused on the LGBTQIA+ community, is also preparing to launch and has guaranteed the use of preferred names as part of its core principles.

Whether you're looking to use a preferred name related to your legal name or one that isn't, inclusion matters. Everyone should be able to use the name they prefer in their daily lives — including the next time they pull out their credit or debit card to make a purchase.

Rather than experiencing the pain and embarrassment that can come from pulling out a card that doesn't match your true self, banking with an issuer that allows you to use your preferred name on your card can make you feel recognized.

However, it's important to note that a merchant may still ask to see ID on some transactions, and having a card with a name that doesn't match your identity documents could create a different problem. However, the world of tap-to-pay transactions and mobile wallets should make this simpler.

Related: How to navigate an LGBTQ+ name/gender change for travel-related documentation

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app