How United Handled an Oversold Flight in a Post-BumpGate World

In a post-BumpGate world, it's increasingly interesting to see how airlines — and passengers — handle overselling situations. Last month, we wrote about how Delta handled an oversold flight wonderfully by bumping the compensation for volunteers up to $1,100 within a few minutes. Sure enough, passengers jumped at the opportunity to pocket the cash.

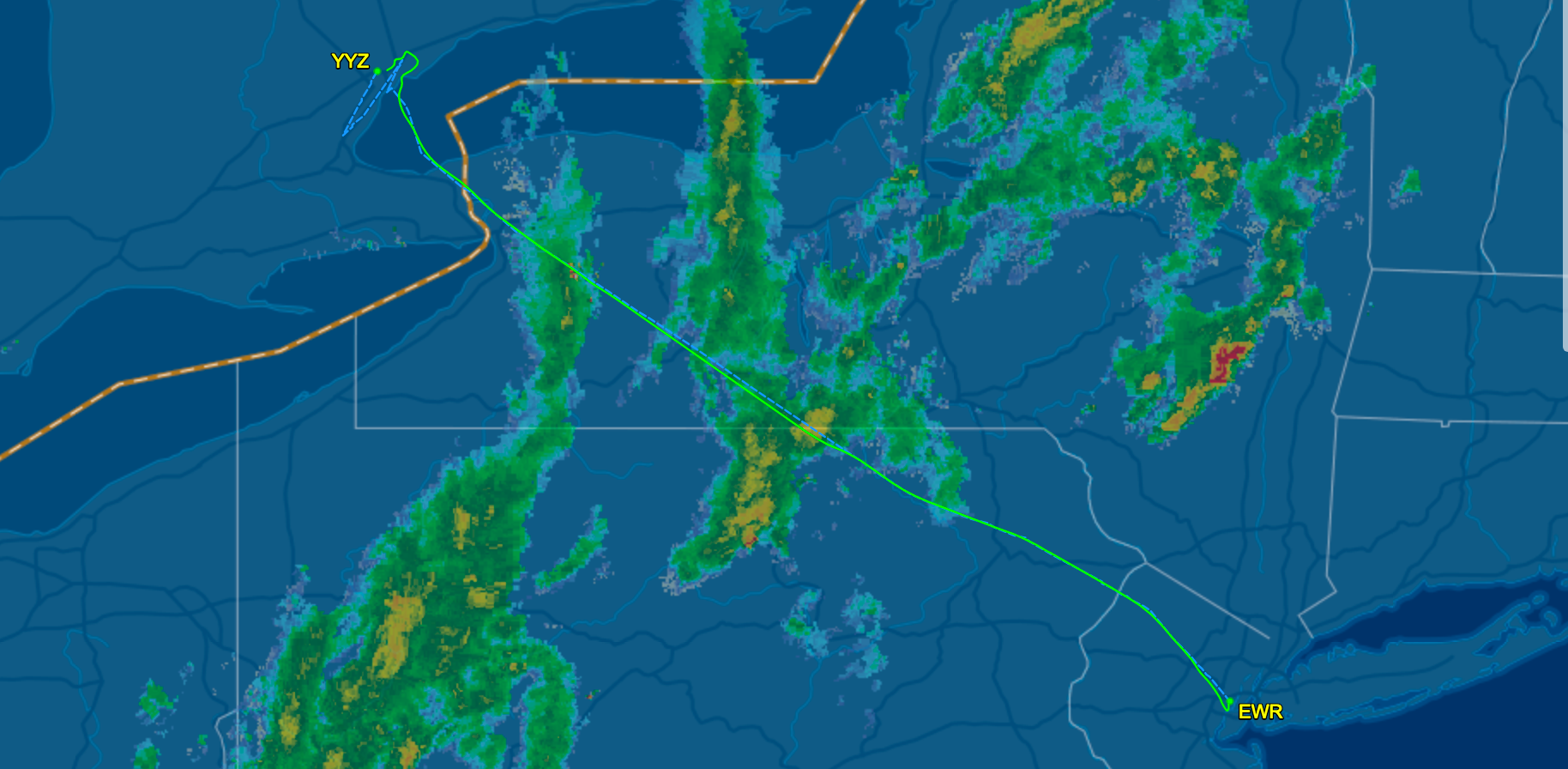

Now, we're hearing about how United recently dealt with a similar situation — in this case, United Express Flight 4199 was set to depart from Newark (EWR) for Toronto (YYZ) and TPG reader Sam was on board. When checking in on the app, Sam didn't get any notification that his flight was oversold, so there was no indication of any monetary offering. However, when he got to the gate, the attendant made the dreaded announcement that the flight was, in fact, oversold and one volunteer was needed.

According to Sam, the gate agent started the bidding at $2,000 worth of United travel vouchers for the one seat, but there were no takers (madness!). United then offered up a seat on an alternative flight, which would arrive three hours later and require a connection in Syracuse (SYR) before continuing to YYZ. The gate agent offered the $2,000 twice at the gate and both times, no one jumped at the generous amount. (Presumably, there were a lot of businesspeople on board who needed to get to Toronto quickly.)

With no takers, a United agent came on board the plane with the same $2,000 offer, but once again, no one went for it, so the agent then bumped the offer up to $2,000 plus meal vouchers. Just like that, the addition of the meal vouchers sealed the deal and one person volunteered to get off the flight. According to Sam, the agent didn't say how many meal vouchers there would be or how much money they were worth, but in his experience, each one is usually worth about $7 and you'll get a few of them.

It's interesting/hilarious/surprising that the $2,000 wasn't enough for someone to volunteer to bump themselves from the flight, but once the meal vouchers were added in the mix, someone was eager to be bumped. As you'll remember, United Airlines was the carrier implicated in the infamous BumpGate scandal when Dr. David Dao was forcibly removed from his seat. Since then, the airline has changed its policies for oversold flights — we can already see some of those efforts in place with this example, since the offer was started at an astounding $2,000. It seems like, in our eyes, United did everything right in this situation and continued to up the offer until someone volunteered to leave the flight.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app