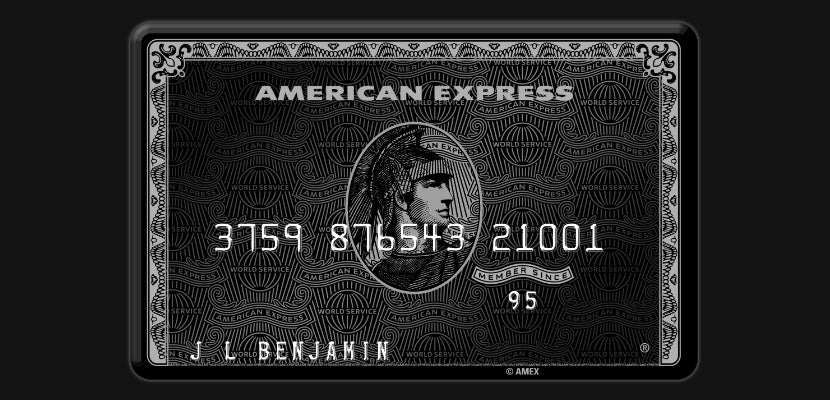

Should I Get the American Express Centurion Card?

Update: Some offers mentioned below are no longer available. View the current offers here.

TPG reader Ee Chien tweeted at me to ask about a targeted sign-up bonus offer from Amex:

"I got an offer from Amex for 180,000 points after spending $20,000 in 6 months on the Centurion card. There's a $4,000 sign-up fee and $4,000 annual fee. Should I get it?"

The Amex Centurion Card is considered by some to be the pinnacle of the credit card world. Its clandestine benefits and exclusive membership have made it almost legendary. However, just like with any other card, the decision of whether or not to sign up (if you're fortunate enough to be invited) comes down to comparing the cost with the value you expect to get from it.

Looking at the specific offer Ee Chien received, the large sign-up bonus stands out. After meeting the spending requirement (and including that $20,000 in spend), you'd have 200,000 Membership Rewards points, which is worth $3,800 based on my latest monthly valuations. That's a lot, but it doesn't make up for the $8,000 you'll spend on the annual fee and initiation fee. You'd still need to find another $4,200 of value just to break even in your first year.

That's certainly possible; the card offers high-end benefits like Hilton Honors Diamond and Delta Platinum Medallion status, the 24/7 Centurion Concierge and WOW promotions like a free night at a luxury hotel. There's a plethora of other useful benefits (like SPG Gold status, a $200 airline fee credit and more), but many of those are also available on the much more affordable The Platinum Card® from American Express.

Another consideration is the opportunity cost of actually using the Centurion Card to make purchases. Cardholders are expected to maintain a high level of spending ($250,000 annually), but the card doesn't offer bonus categories, so you'll be earning just one point per dollar. You could do worse than earning Membership Rewards points at that rate, but you could certainly do a lot better.

If you're in a position to maximize the Centurion Card benefits, then I think getting it could make sense. I recommend doing some more research and thinking carefully about how likely you are to use them based on your travel and spending patterns. The sign-up bonus is impressive, but it shouldn't be the deciding factor, since it doesn't make up for the high membership fees. Some people also prize the Centurion Card as a status symbol, but you'll have to decide what that's worth to you individually, if anything.

I think the Platinum Card from American Express and The Business Platinum Card® from American Express provide better value for most people, and both cards have had targeted sign-up bonuses of 100,000 points or more in the past year. If you're looking for an entry into the Membership Rewards program, holding out for one of those offers is likely a better bet.

Check out these posts for more details on the Centurion Card, Platinum Card, and Membership Rewards:

- The Inside Scoop on the Amex Centurion Card

- Maximizing Benefits with the Amex Platinum Card

- Redeeming Membership Rewards for Maximum Value

- Choosing the Best American Express Card

If you have any other questions, please tweet me @thepointsguy, message me on Facebook or send me an email at info@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app