You'll soon be able to book some of the world's best restaurants, bars and wineries with Chase points

Editor's Note

Update: Some offers mentioned below are no longer available. View the current offers here.

Editor's note: This post as been updated with new information provided by Chase on 2/5/20.

Chase has announced an expansion of its partnership with the Tock culinary reservation platform. Later this year, Chase Sapphire, Freedom and Ink cardholders will have access to a new dining page within the Chase mobile app that will be integrated with Tock's platform. You'll be able to browse, book and use Ultimate Rewards points to pay for unique dining experiences at restaurants, bars, pop-ups and wineries.

Chase and Tock first launched their exclusive partnership in 2018 with Tock's integration with Chase Pay, which also gave Chase Pay users access to special experiences not offered to any other customers and allowed them to use Ultimate Rewards points to pay. With that app closing on Feb. 24, 2020, it made sense that both companies would be looking at new ways for the relationship to move forward.

For those unfamiliar with the Tock platform, it allows users to book standard reservations and unique culinary experiences at renowned restaurants and wineries in select cities around the world. I'll be honest — it's not the easiest platform to navigate in terms of distinguishing between restaurants where you can simply book a reservation versus experiences that require pre-paid tickets or special menu pricing. But for those looking for a special night out or celebratory event, Tock provides a wide range of unique experiences available for booking.

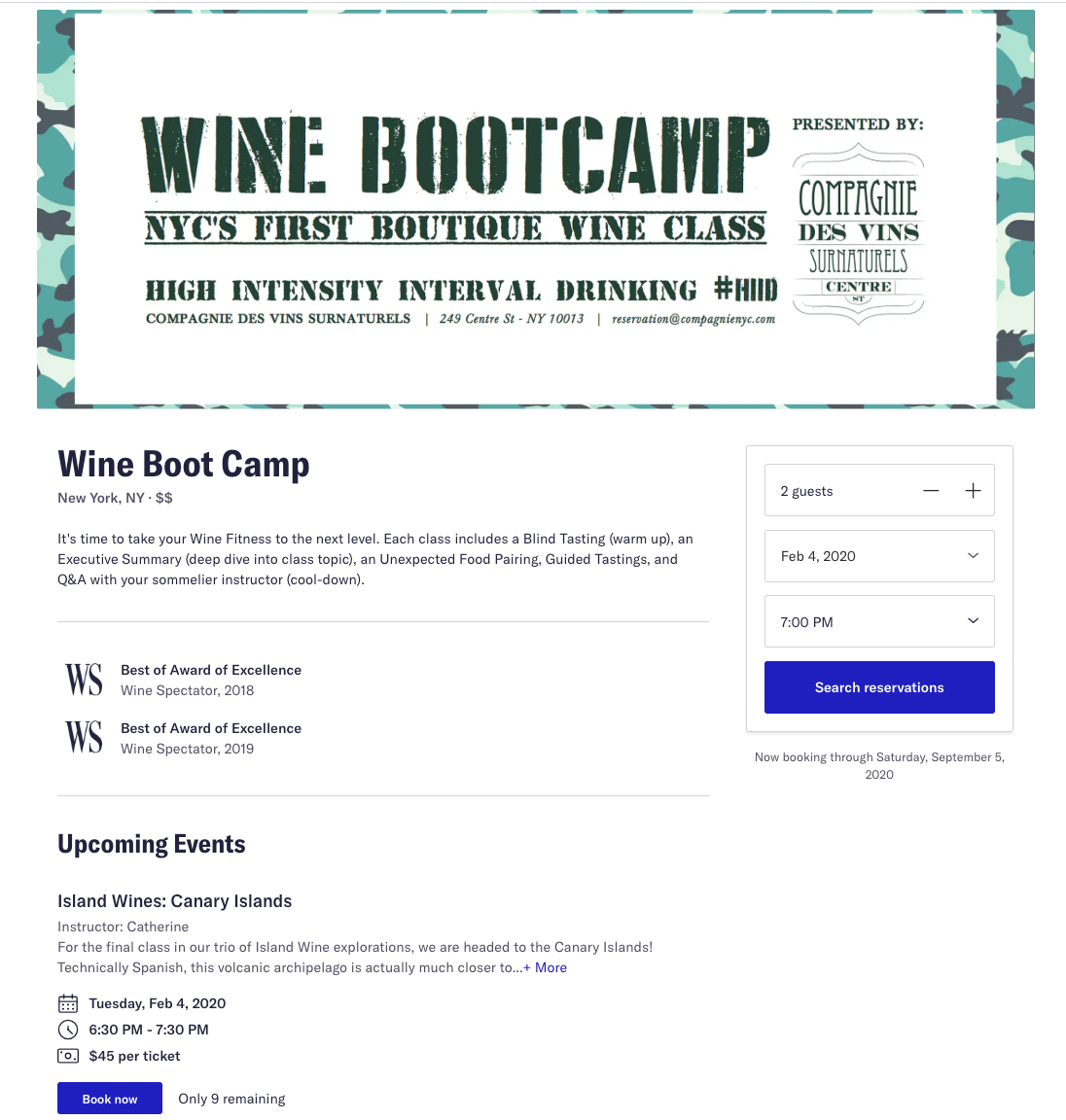

For example, New Yorkers can book tickets to a Wine Boot Camp pop-up event on select dates in February and March that includes a blind tasting, deep dive into a wine topic, an unexpected food pairing, guided tastings and a Q&A session with a sommelier instructor. Or couples looking for Valentine's Day fun in Seattle can book a special five-course menu and dining experience at Canlis, an award-winning dining spot on the edge of Queen Anne Hill.

This expanded partnership with Tock is not Chase's first foray into the world of dining experiences. The issuer has clearly made dining a priority going into the 2020 year, giving eligible cardholders access to DashPass perks through DoorDash, an on-demand dining platform. Part of the significant Chase Sapphire Reserve changes announced in January also included a $60 annual dining credit to DoorDash (up to $120 credit, $60 credit in 2020 and $60 credit in 2021). While integration with Tock offers more elevated dining experiences than food delivery, this future addition to the Chase Ultimate Rewards portal is just another way Chase is looking at how they can provide value to customers through more than just travel benefits.

"With Ultimate Rewards we aim to give our cardmembers options to connect with the things they love, along with the flexibility to unlock more value with points," said Lisa Walker, managing director of Chase Ultimate Rewards, in a press release. "We know that our cardmembers are passionate about amazing dining experiences, and we look forward to working with Tock to bring new and unique access for Chase cardmembers."

Bottom line

Unfortunately, the press release gave very few specifics available on the details of this Chase/Tock integration. I did reach out to Chase for specifics, but they were unable to share an exact launch date at this time. They did confirm that the redemption rate for using Ultimate Rewards points on prepaid or deposits through the new Ultimate Rewards dining tab would be 100 points = $1. The new dedicated dining tab will also allow Sapphire cardmembers will be able to access the popular and long-standing Private Dining Series experiences directly through the app.

But for those who already use Tock or who are interested in booking exclusive dining experiences using Chase Ultimate Rewards points, this is a potentially exciting new benefit that will be added for eligible Chase cardholders. Stay on the lookout for more details as Chase continues to roll out plans for this expanded partnership.

To stay updated on credit card news and advice, sign up for the TPG daily newsletter.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app