You can now request an invite to the Amex Centurion card

The American Express Centurion card (available in both personal and business versions) is one of the mosts exclusive credit cards on the market, available by invitation-only to Amex's biggest spenders. There are no clear guidelines on what it takes to earn an invitation, though multiple reports suggest that you need to spend at least $250,000 a year across all of your Amex cards in order to be considered.

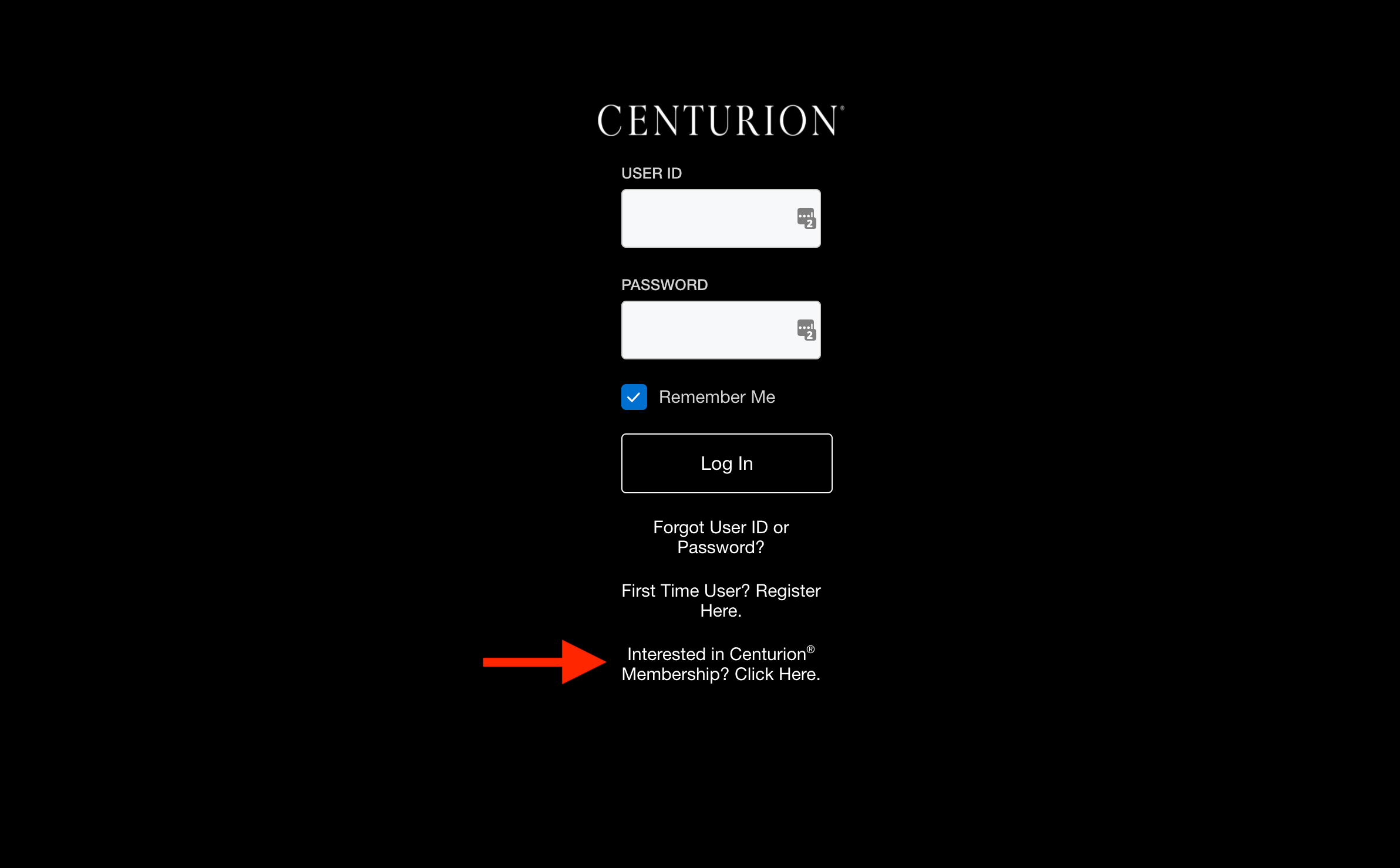

One Mile At A Time is reporting that it's now possible for certain cardholders to request an invitation directly on the Amex Centurion webpage, centurion.com.

If you click on the link at the bottom that says "Interested in Centurion Membership? Click Here" you'll be directed to a form that asks you to input the information from one of your Amex credit cards.

Submitting the form won't get you an instant decision, but rather if you're eligible, Amex will reach out to begin the application and initiation process.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter

Amex Centurion card

The Amex Centurion card has always been a very interesting and expensive value proposition. New cardmembers need to pay a $10,000 initiation fee and a $5,000 annual fee, making this one of the most expensive credit cards out there.

If you manage to get invited, this also isn't a card you'll want to put much, if any spending on, as it only earns 1 Membership Reward point per dollar spent, with a 50% bonus for purchases over $5,000.

So how does Amex justify such hefty fees, including a total of at least $15,000 in the first year alone? It all comes down to the soft perks of the Centurion card, which is sure to forever change the way you travel. Centurion cardholders enjoy Delta Platinum Medallion, Hilton Diamond and Marriott Gold status.

One of the biggest perks of Centurion membership, in addition to access to exclusive lifestyle events and some very expensive surprise gifts, is the personal concierge who can help arrange all of your travel, restaurant reservations and more. It's hard to put a value on an individual, but TPG loves his concierge enough to keep renewing his Amex Business Centurion card year after year.

The concierge was able to help evacuate TPG from Bali when a volcano eruption closed the airport. The concierge arranged a combination of vans, ferries and planes, at a time when thousands of other travelers were trying to get off the island. This is in addition to more "normal" functions like arranging tours and excursions and helping you score reservations at exclusive restaurants.

The information for the Amex Centurion card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Further Reading: The inside scoop on the Amex Centurion (black) card

Bottom line

For most people, the Centurion card is a hard-to-justify expense, even if you're one of the lucky few who gets invited to apply. There's been no indication that Amex is at all loosening the eligibility requirements for the card, but it's still interesting to see them making a very secretive product slightly more visible to the public.

(Featured photo by The Points Guy)

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app