United pulls its Star Alliance partner award chart as it transitions to dynamic pricing

United's been busy making adjustments to its MileagePlus loyalty program.

It started with great news when the carrier announced that it was extending all currently valid Premier status until Jan. 31, 2022. Additionally, UA lowered the Premier qualifying thresholds for the rest of the year and removed award change and redeposit fees for modifications made 30 or more days before departure.

And that's when the good news stopped.

For more travel tips and news, sign up for our daily newsletter.

Last night, we were the first to report that the carrier will be capping how many Premier Qualifying Points (PQPs) you can earn through Star Alliance partner tickets. This will make it much harder to earn status with the airline going forward.

And now, just a day later, the Chicago based carrier is making some negative changes to how you redeem your miles. Specifically, the carrier is removing its Star Alliance partner award chart in a move that will usher in dynamic pricing for all award tickets.

Related: United Airlines makes it harder to qualify for status with partner flights

On Nov. 15, 2019, United started pricing awards for flights on its own metal dynamically, and it's now setting the stage to do the same for flights operated by its partner airlines.

As of today, the Star Alliance award chart is extinct — it's already removed from the carrier's website. There was no advance warning like there was when United made the same move for its own flights.

By removing the award charts, there's no telling how much an award will cost. United can change the price as it sees fit, and you'll have no idea if you're getting a good deal.

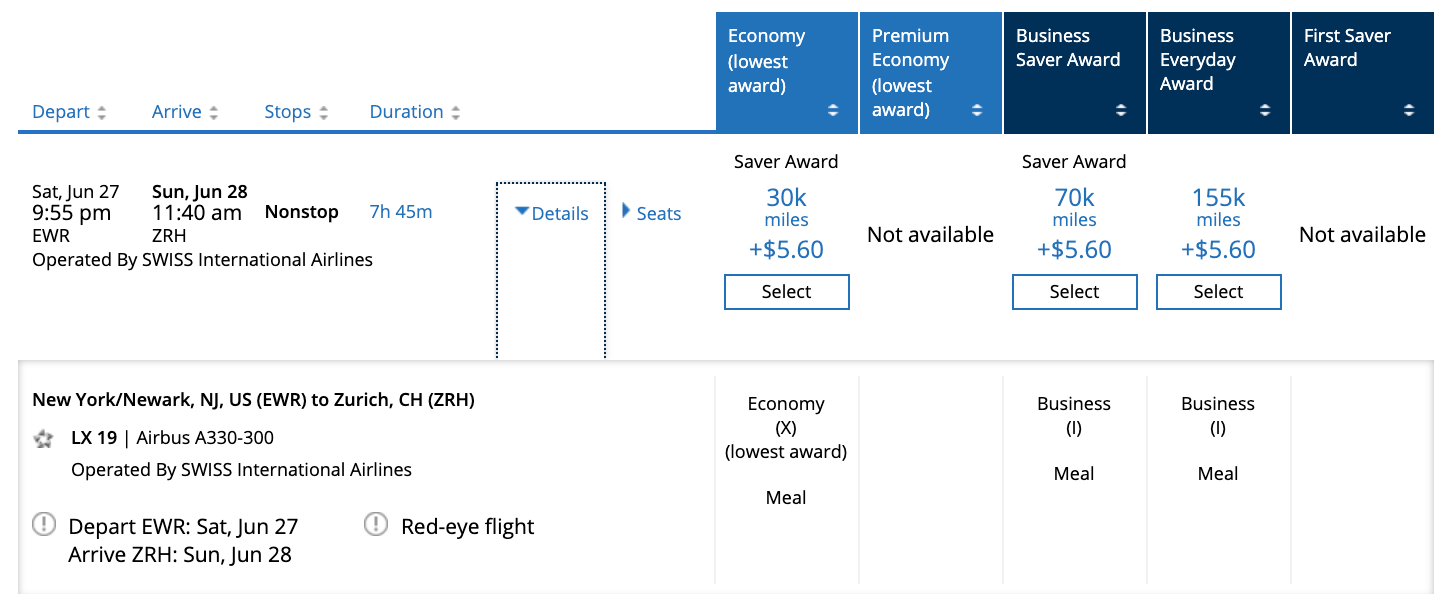

For the moment, the few partner awards we checked are still pricing at the lowest "saver" level from the now-extinct award charts. But it's anyone's guess when we'll start seeing the dynamic pricing applied to Star Alliance award tickets. Since these changes go into effect immediately, I'd make any speculative bookings you were considering now.

In explaining these changes, a United spokesperson offered the following statement to TPG:

"We announced in April of last year that all award pricing will be dynamic beginning November 2019. This change is consistent with other major carriers and allows us to align information regarding all MileagePlus award flights, whether it is for travel on United or one of our partner airlines."

Back when United announced that it was removing award charts for its own flights, we asked what does it mean for partner awards. At the time, the airline told TPG that they are, "looking more broadly at what best and the most effective way to move forward there." Clearly, they've decided that's what's "best" is to remove all award charts to "better align" the program.

Related: The day has arrived: United award charts are no more

Aside from the devastating news itself, the airline couldn't have chosen a worse time to make these changes. For one, it's not providing any advance notice. Devaluations are never a good thing, but I don't mind them as much when there's ample notice. And secondly, as airlines look to recover from the coronavirus, they're going to need to do whatever they can to get passengers back on their planes.

Since United's bleeding cash, I'd expect them to make their loyalty program more rewarding during this crisis, not less. After all, loyalty programs are large and important revenue streams for airlines.

But alas, here we are. Rest in peace, United's partner award charts.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app