United's new flexible booking policy could leave you out a lot of cash

Update 5/18/20: This post has been updated to reflect the extension of United's covered booking period, with change fees now waived on all tickets issued by May 31, 2020. Additionally, customers may have the opportunity to cancel an itinerary and receive an Electronic Travel Certificate (ETC) at no additional charge, allowing them to book multiple trips and avoid losing any residual value from their original booking. See this post for more details.

We're all working to stay isolated right now — travel is clearly off the table for the time being, leaving many of us with more wanderlust than ever before. Fortunately, the airline's current flexible booking policies have made it possible to plan for the future without much risk — or so it seemed.

As a United Premier 1K member, I try to book flights operated by United or Star Alliance carriers whenever possible, so I began thinking about booking trips to Hawaii, New Zealand and even the Island Hopper, and ticketing everything by May 31, 2020, so I could take advantage of United's current policy of "no change fees for new bookings."

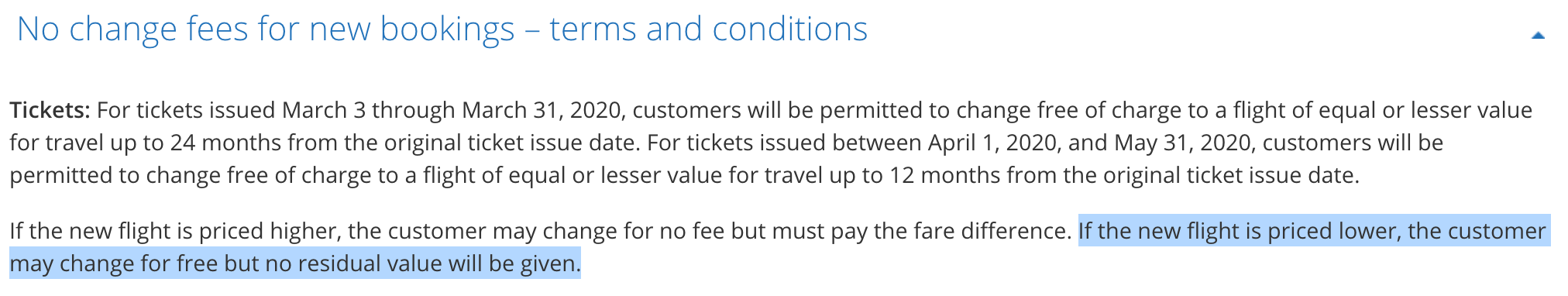

But, hidden in the terms and conditions, is a very important note I nearly missed — while changes can be made without a fee, "If the new flight is priced lower... no residual value will be given."

In other words, if I book a $1,000 round-trip to Hawaii by May 31, then later decide to change it to a $200 round-trip to Florida, United gets to pocket the $800 fare difference. In the past, I would have received an $800 travel voucher for the difference, after paying a $200 change fee. Yowza! I figured there was a chance I was misinterpreting the policy, but a United spokesperson confirmed that it was accurate.

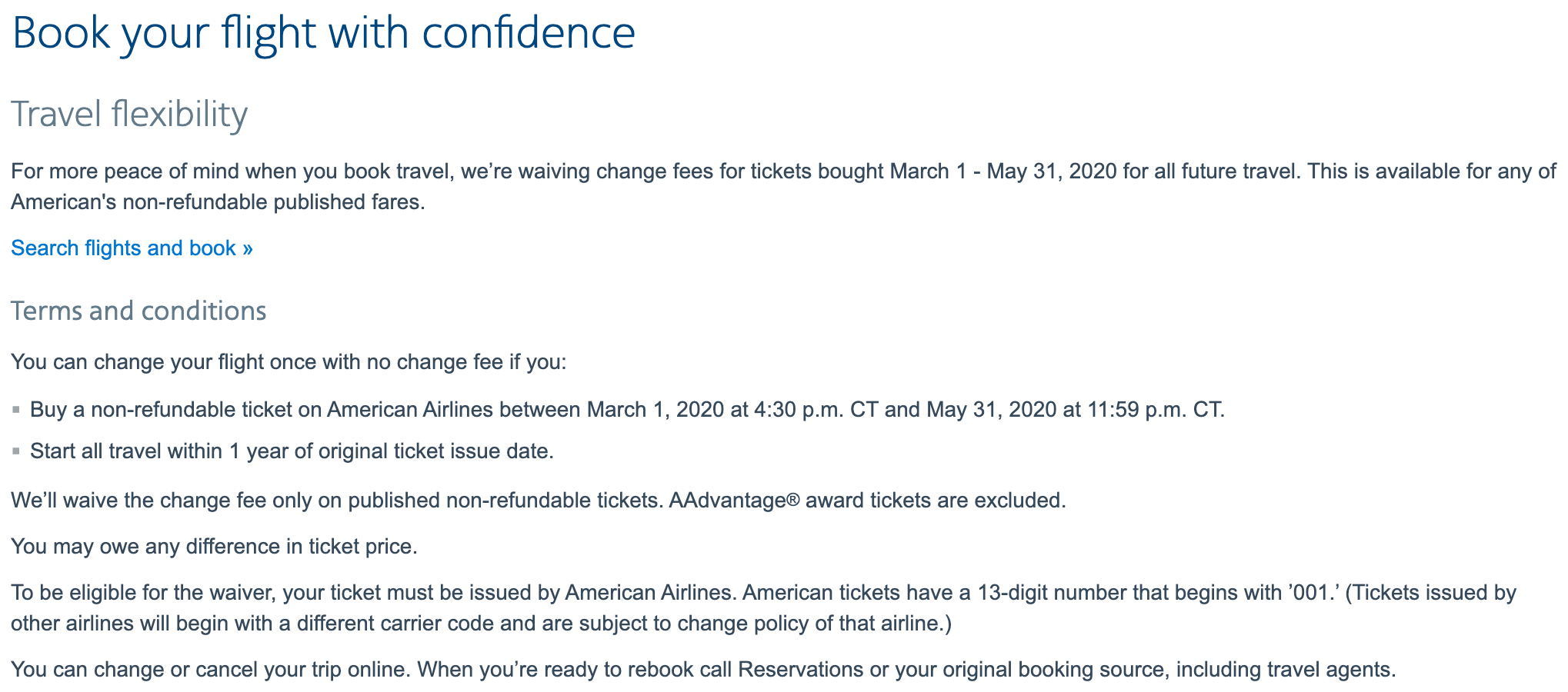

Since the major US airlines tend to roll out fairly consistent policies, I checked in with American Airlines to see how the carrier was handling its own waived-fee policy, valid for new flights purchased by May 31. The same language doesn't make an appearance here, though, and an airline spokesperson confirmed that, yes, if you book new flights with a lower fare, "the residual value would be issued back in the form of an electronic travel voucher."

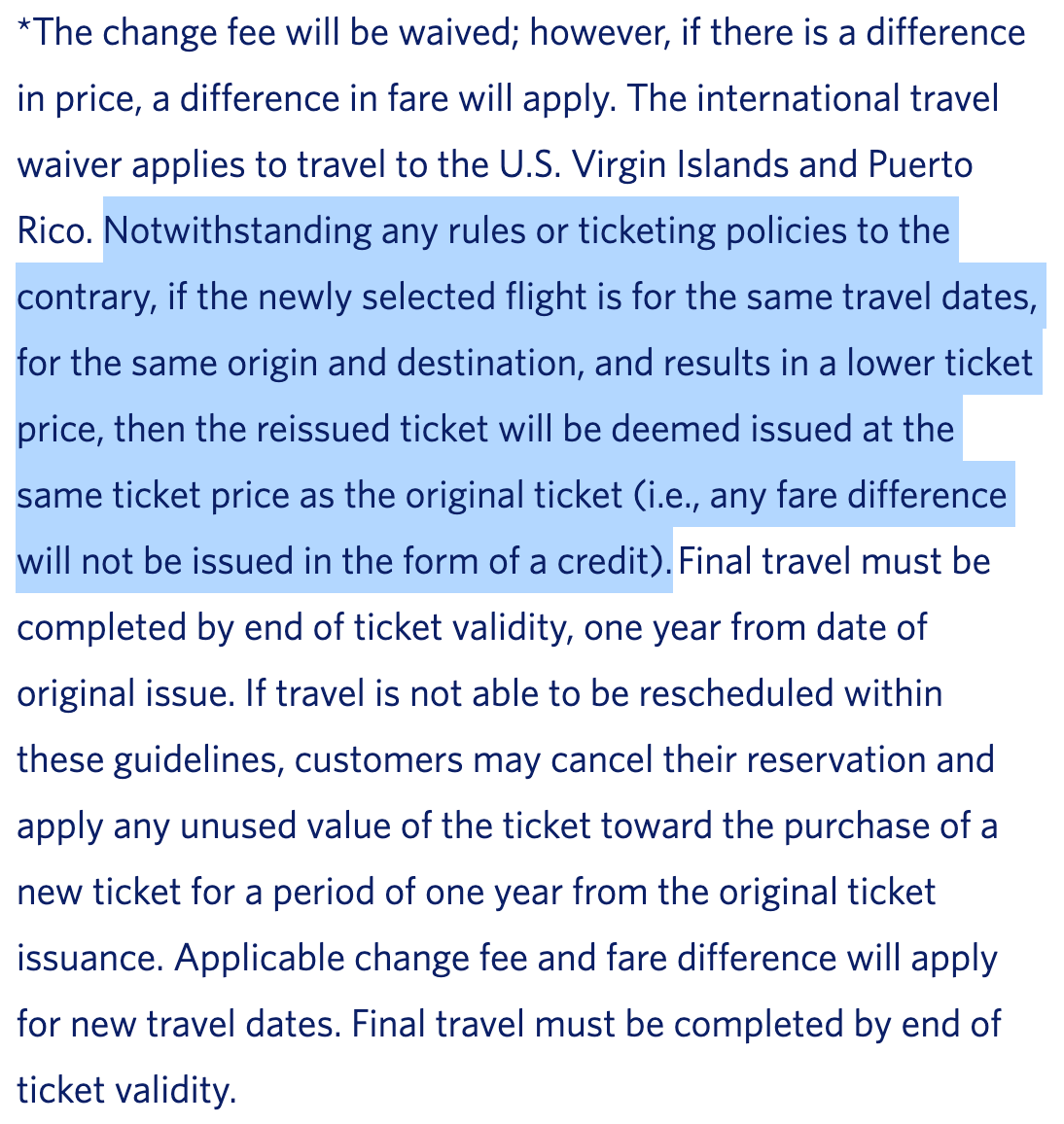

Delta, meanwhile, has a slightly different policy. If you choose new flights on the same dates, for the same origin and destination, you won't receive a credit if the new fare is lower — in other words, you can't take advantage of the policy to receive a credit if your fare drops.

However, a Delta spokesperson confirmed that other changes will result in a credit if the fare is lower, directing TPG to a note in the carrier's terms and conditions, stating "For tickets where we are permitting a one-time change without a fee, the fare for your new flight will apply. If the new fare is higher, we will collect the difference. If the new fare is lower, we will issue a Delta travel voucher for the difference (very limited exceptions apply)."

So, what should you do? Assuming you don't mind ending up with an American Airlines or Delta travel voucher if you move to a flight with a lower fare, I'd consider booking future travel with those carriers during the flexible booking period. If you're planning to fly with United, meanwhile, I'd only book lower-cost tickets, so you don't end up forfeiting a significant sum if you choose to take advantage of the waived change fee to move to cheaper flights. Unless United decides to relax this policy, of course, giving customers the peace of mind they really need.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app