Starting 2016 Off Strong With Starwood Preferred Guest

Update: Some offers mentioned below are no longer available. View the current offers here.

Starwood Preferred Guest is one of my absolute favorite rewards programs. Starpoints are widely regarded as the most valuable loyalty currency, and that is reflected in my monthly valuations. It's added several new chains to its portfolio, which now includes 11 brands, the newest of which being Design Hotels, as well as new airline transfer partners — unlike some programs which constantly devalue and lose partners. But one of the biggest reasons I love SPG so much is because of the way you can start the year strong with elite-qualifying nights and stays.

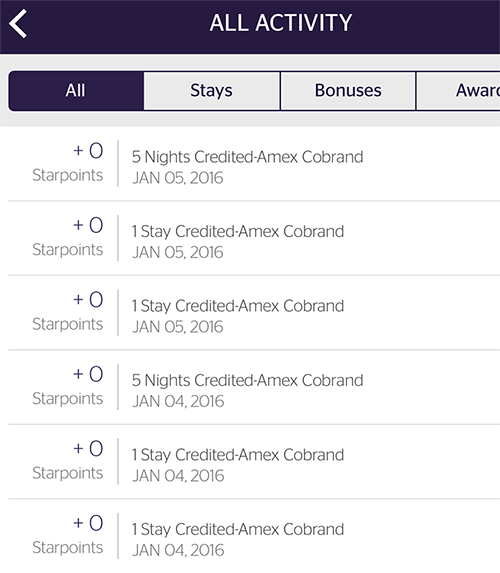

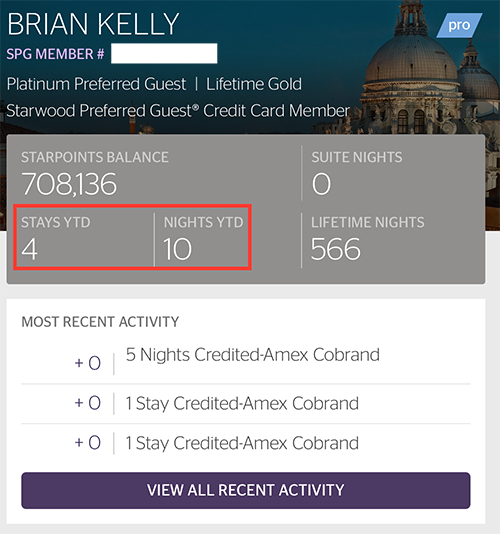

Because I'm a cardholder of both the Starwood Preferred Guest Credit Card from American Express and its Starwood Preferred Guest Business Credit Card from American Express, I'm already 20% of the way toward Platinum status requalfication — and I haven't even stayed in a hotel one night this year. It isn't one of the key advertised perks, but for each of the two co-branded cards, you receive credit for five nights and two stays each year — so a total of four stays and 10 nights each year. For that reason alone, I know I'll always keep these cards alive — they're well worth the annual fee ($95, which is waived the first year) and always pay off in the end, not to mention the other benefits that come with the cards and accruing valuable Starpoints from everyday spend.

SPG Platinum status requires 25 stays or 50 nights and can earn you late check out, room upgrades, complimentary club access, among other benefits. Starting my year off 20% of the way to reaching Platinum status is a huge bonus. Also, I'm 10% of the way to 100-night Platinum Ambassador, which will get me many more benefits on top of the standard Platinum status. Having this option available makes being an SPG Amex cardholder completely worth it in my eyes.

Other Perks

If you don't already have the card, the current welcome bonus is 25,000 Starpoints after spending $3,000 in the first three months and the $95 annual fee is waived the first year, making it a total no-brainer. If you wait until August/September, the bonus may jump to 30,000 points, as it has the past several years. As of August 2015, there is complimentary and unlimited Boingo Wi-Fi, complimentary premium in-room internet access and no foreign transaction fees on both cards.

The Starwood Preferred Guest Business Credit Card from American Express will earn you 25,000 Starpoints after spending $5,000 in the first three months. You'll earn the same previously mentioned benefits, as well as Sheraton Club access when you book rates that are eligible to earn Starpoints. For both cards, you'll earn up to 5 Starpoints for each dollar of eligible purchases at participating SPG hotels — 2 for charging your purchase to an SPG card in addition to the 2 or 3 for which you may be eligible as an SPG member — and 1 Starpoint for all other purchases.

My SPG Hoarding Situation and Looming Merger Anxiety

I use my SPG Amex cards for all spend where I'm not getting a bonus on another card. And, as you can see in the picture above, I've been hoarding them a bit, which is a bad long-term investment. So, I'm making 2016 the year of the #TPGSPGBURN as we near the Marriott merger. Who knows what will happen to Starpoints when the merger is complete, but I plan to burn them on some nice resort stays and SPG Moments in the meantime. Stay tuned!

How are you using your Starpoints this year? Use #TPGSPGBURN to join the conversation on Twitter, Facebook and Instagram.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app