Redeeming Wyndham points with Vacasa is a great deal — with a catch

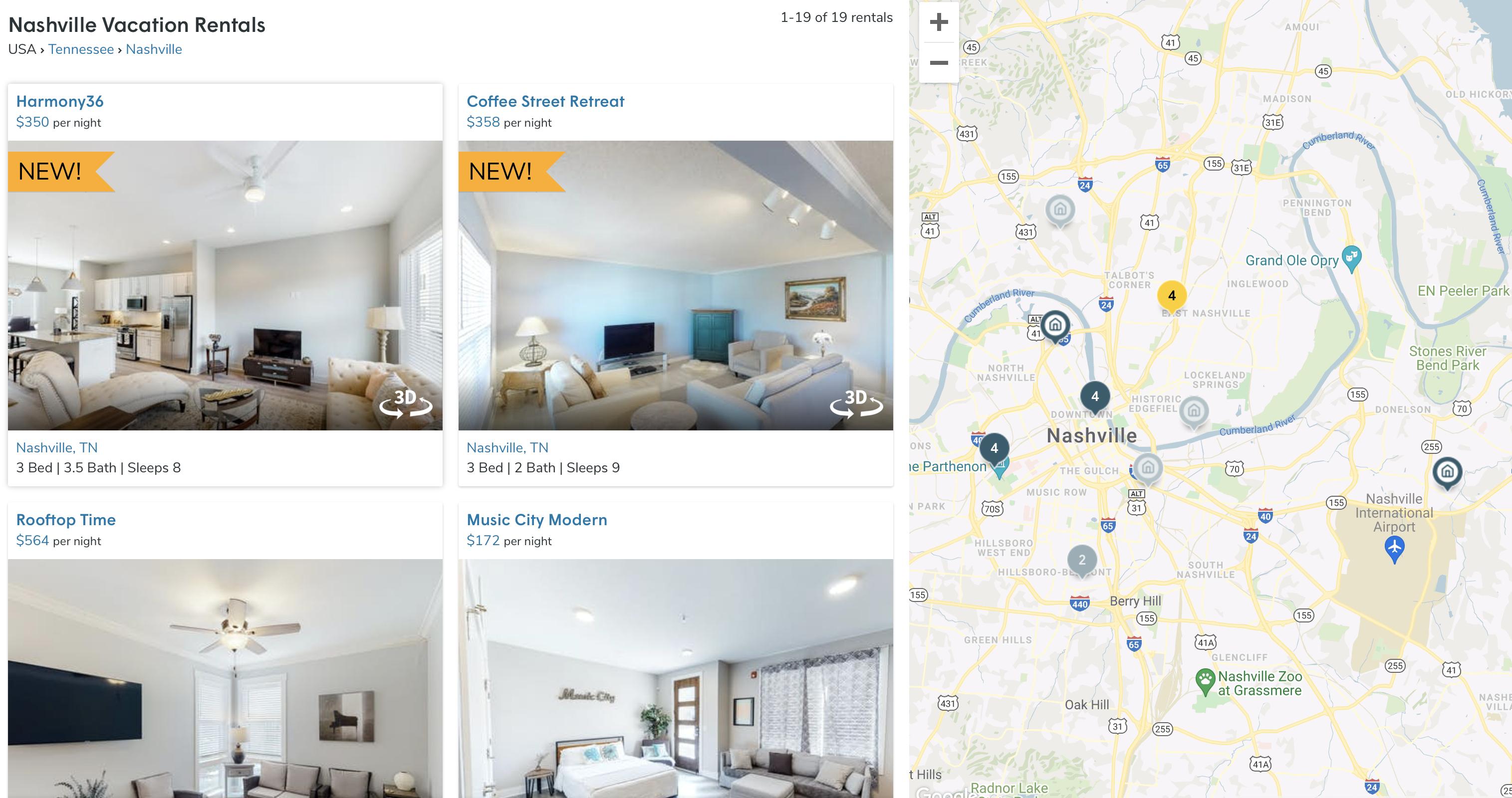

Last month, Wyndham announced a partnership with Vacasa that allowed members to redeem their points at over 15,000 vacation rentals around North and Central America — up from just a few thousand earlier in the partnership. Vacasa has properties in major tourist destinations in Texas, Upstate New York, Florida and others. These properties range from one-bedroom and studio apartments to high-end homes.

This provides tons of interesting new redemptions and — much to my surprise — makes Wyndham Rewards more valuable than ever. But there are a few caveats you should be aware of.

I'll give you an overview of Wyndham's new partnership with Vacasa, discuss when it makes sense to redeem your Wyndham Rewards points for vacation rentals and run through the issue of blackout dates.

[table-of-contents /]

Overview of Vacasa's partnership with Wyndham

Wyndham and Vacasa's partnership is very straightforward. Wyndham Rewards members can book Vacasa properties for 15,000 Wyndham points per bedroom, per night. This means that a studio or one-bedroom apartment costs 15,000 points per night, while a four-bedroom house costs 60,000 points per night.

According to Wyndham, over 15,000 Vacasa properties in North America, Belize and Costa Rica are bookable with Wyndham Rewards points. There are blackout dates, but they aren't published on the Vacasa or Wyndham websites. Wyndham will inform you of property-specific blackout dates during the booking process — more to come on that shortly.

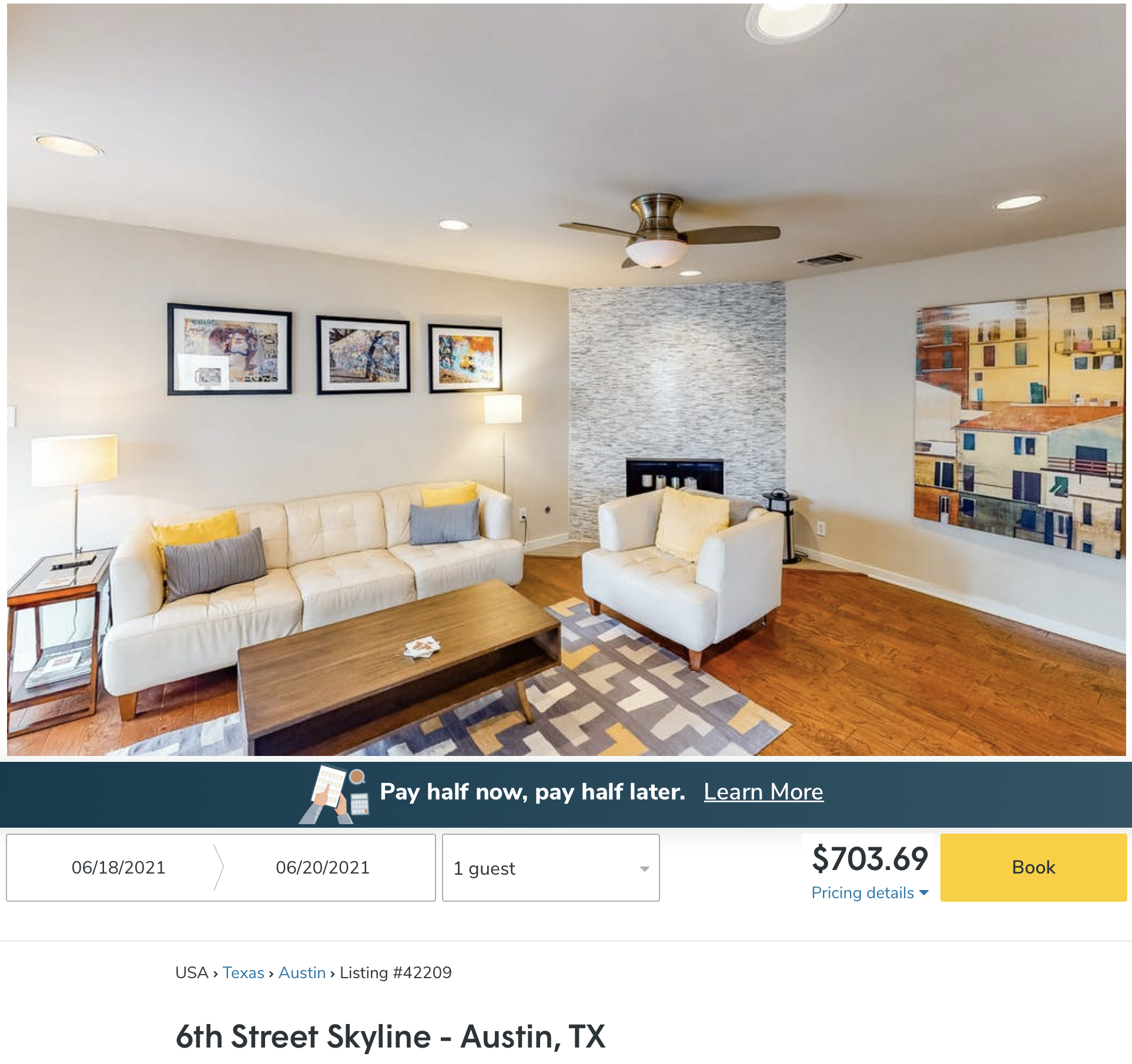

Vacasa redemptions can potentially provide great value, depending on the cost of your stay. Take this Vacasa property in Austin, Texas: A two-night stay at this one-bedroom apartment costs $703.69 after taxes and fees. The same stay would cost 30,000 points, giving you 2.34 cents per point in value. This is more than double TPG's Wyndham Rewards valuation of 1.1 cents per point.

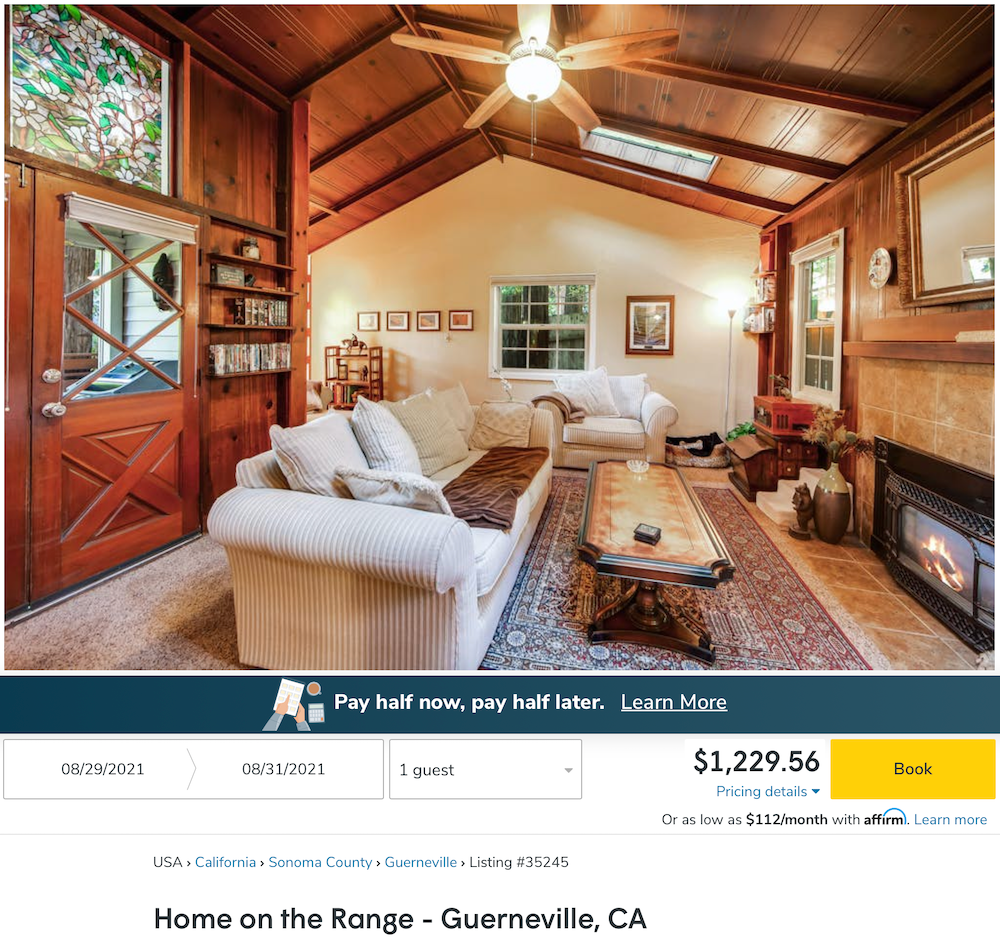

There are some even more expensive Vacasa properties out there. A two-night stay at this one-bedroom property in Guerneville, California, costs $1,229.56. Instead, you can redeem 30,000 Wyndham Rewards points, giving you a value of 4.01 cents per point in value.

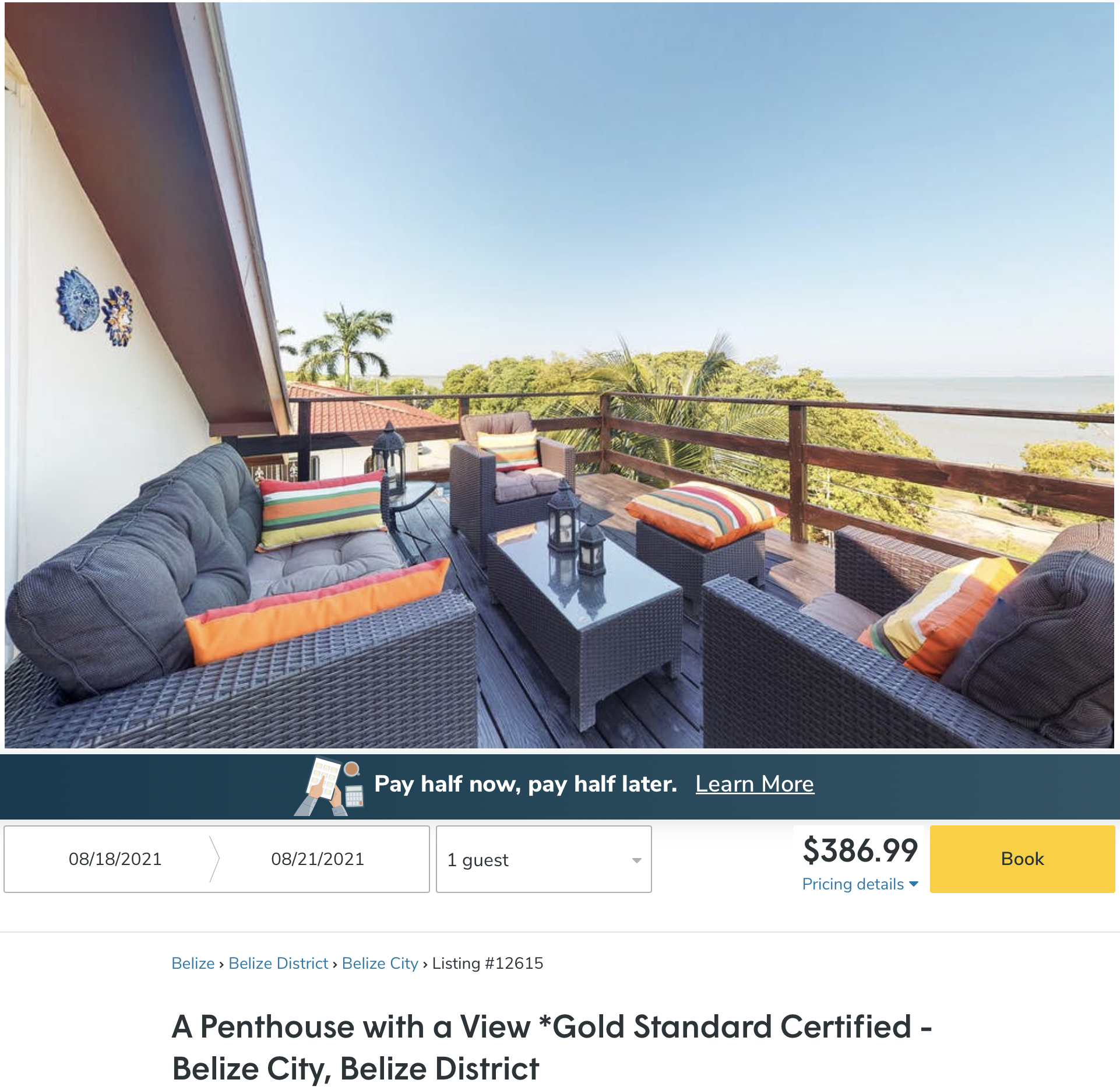

Of course, there are also times when you may want to stay away from booking Vacasa stays with points. This penthouse in Belize costs just $386.99 for a three-night stay this summer. This would cost 45,000 points per night, giving you 0.86 cents per point in value. In this case, I'd pay for the stay outright and save my Wyndham points for a future redemption.

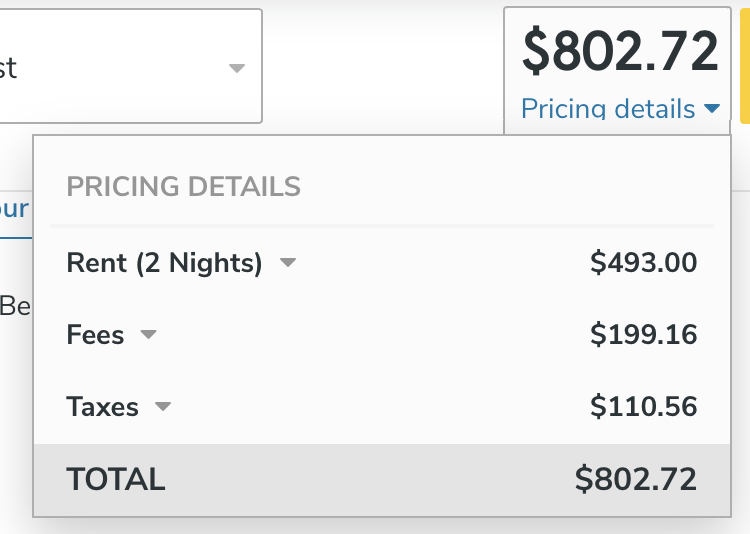

One last thing: You'll see that the nightly "rent," fees and taxes are listed separately when looking at the cash cost of a Vacasa rental. I confirmed in a test booking that you do not need to pay any of these fees when redeeming points.

In the end, there is some potentially great value to be had with using Wyndham points for Vacasa awards. As with any points redemption, I'd shoot for high-value Vacasa redemptions that provide the most value possible. Always make sure to find the cent-per-point value for your specific redemption and see if it matches or exceeds your personal Wyndham Rewards valuation.

Related: 5 ways to use points to book vacation home rentals

How to book a Vacasa vacation rental with Wyndham points

Unfortunately, you can't book Vacasa award nights online – you'll need to do it via phone or email. Start by browsing the Vacasa website and finding a property you'd like to book. You can estimate the points cost by multiplying the number of bedrooms by 15,000 points. Then, multiply that number by the number of nights you'd like to book.

Bookmark this property and write down the name. Then, call Wyndham at 866-996-7937 and tell the agent your Wyndham Rewards number, the property you'd like to book and the dates of your stay. The representative will verify that the Vacasa property is available on your requested dates and book it using your Wyndham Rewards points.

Further, Frequent Miler notes that you can email a Vacasa booking request to "triprewards.fulfillment@wyndham.com." The author stated that replies usually take a few hours. This is a huge benefit during busy call times, and I plan on doing the same when I make my next Vacasa booking.

Save points with a Wyndham credit card

All Wyndham cobranded credit cards offer a 10% rebate when redeeming Wyndham points for an award night. This discount does apply to Vacasa bookings, giving you even more value from these stays. These cardholders effectively pay 13,500 points per bedroom per night, which is an excellent deal.

Can you earn Wyndham points on Vacasa stays?

Unfortunately, you cannot earn Wyndham Rewards points on paid Vacasa stays. I'd love to see this added in the future. Marriott has a similar vacation home platform called Homes and Villas and allows Bonvoy members to both earn and redeem points on vacation home bookings.

Related: Why I'm earning more Wyndham points this year

The pros and cons of Vacasa vacation rentals

The only major issue I foresee with Vacasa redemption are blackout dates.

Thankfully, I was able to find award space relatively easily at properties I called Wyndham and asked for a points quote on. That said, this may not always be the case for high-end Vacasa properties. You may run into issues with blackout dates during high-demand times or holidays, depending on the property.

Unfortunately, we don't know how these blackout dates are determined. There are rumors that it could be price, demand or date-based, but no one has a solid answer. In turn, Vacasa and Wyndham can choose to black out a specific property whenever they'd like, causing you extra time on the phone and making it more difficult to plan a vacation.

You may be able to get your Wyndham phone representative to give you an overview of blackout dates for a specific property or help you find an alternate property nearby. Use this to your advantage if your dates are flexible during peak summer months.

Regardless, I think Vacasa redemptions can be an excellent value if the dates work out and you book the right properties. As seen in the examples above, there are plenty of redemptions out there that get you well over TPG's Wyndham Rewards valuation of 1.1 cents per point.

To get the best value, focus on large one-bedroom or studio properties you can book for 15,000 points per night. Larger properties with more bedrooms can add up quickly and they're not always worth the cost if the rooms are small. You may be able to save points if there are two beds in a room or a pull-out couch in the living room.

Related: 11 tips for choosing the perfect beach house rental every time

Bottom line

All in all, Vacasa and Wyndham's expanded partnership opens up a ton of interesting redemption opportunities for Wyndham Rewards members if you're flexible and can avoid blackout dates. I always recommend pricing out your Vacasa rentals before booking with Wyndham points to ensure you're getting a good deal. If you get more than 1.2 cents per point in value, I think it's worth using points to book.

Feature photo a Vacasa beach house in Bragg California courtesy of Wyndham

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app