How I Used Points and Miles to Evacuate My Family During Hurricane Irma

When Hurricane Irma first set sights on potentially making a land fall in South Florida last weekend, the state went on alert. Food, gas, plywood, batteries and flashlights were the hot commodity for most people and they became hard to find. For me, my American Airlines AAdvantage were my hot commodity and thankfully I have an emergency stash for times just like this.

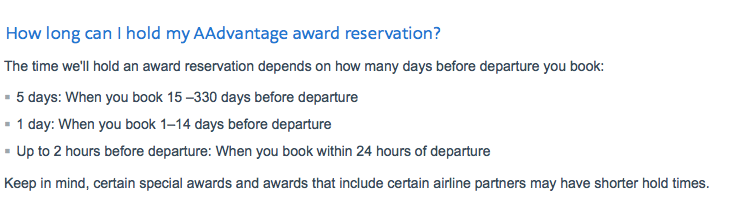

On Monday, I began looking for flights to New York City, or to Boston to be closer to family. Flights to New York were pricing at a modest $300 - $400 round trip, or available at the SAAver level using just 25,000 AAdvantage miles round trip, about a 1.2 - 1.6 cent redemption. That would put this award redemption in line with TPG's September valuation. I wasn't ready to book at that point and I knew I wasn't the only person looking at buying a ticket. American Airlines allows passengers to put award reservations on hold for 24 hours if you are traveling within 14 days of departure, so I put my award booking on hold for West Palm Beach (PBI) to New York (JFK) for Saturday September 9, and waited to see what Hurricane Irma was doing.

When I woke up on Tuesday, I learned that Hurricane Irma had became an extremely powerful Category 5 storm overnight. It was quickly becoming obvious to me that I would really need to leave. Whether that meant driving out of the state or flying was still to be determined. The flights I had booked from PBI to NYC were still on a 24-hour hold but would no longer work, because the storm's arrival would likely wreak havoc on weekend flights.

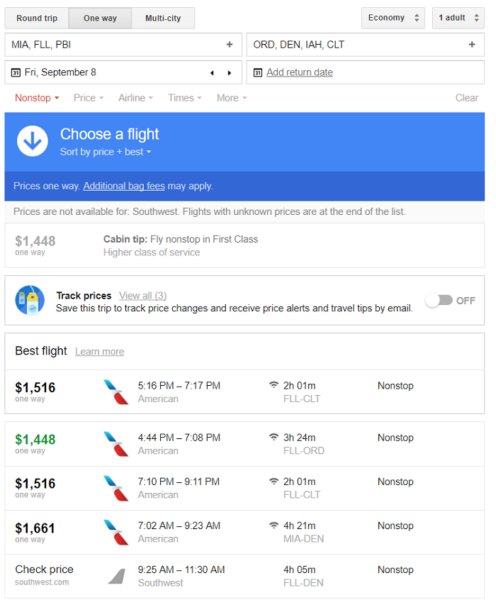

Nothing was officially cancelled but I knew that eventually it would be. I went to my American Airlines AAdvantage account and re-ran my search from South Florida to New York City. I was in shock at the initial results. Flights from South Florida to New York City were now pricing at around $1,600 round trip, or could be booked as an AAnytime Award for 40,000 miles per person round trip. While 40,000 miles would still be a great 4-cent redemption, it was a still a 60% increase in miles from the night before. I needed to move my three family members out of harm's way, and I wasn't ready to part with$4,800 or 120,000 miles for a domestic economy round trip ticket. I decided to wait until the evening before making any final decisions and kept my initial award booking intact.

In the early afternoon, American Airlines issued a travel waiver for South Florida. It was generous. It allowed anyone flying from September 5 to 12 to change their flights for free, and you could also change the departure or arrival city within 300 miles as long as your ticket was issued by September 5. When I realized that the waiver included flights booked on the same day the waiver was issued, I jumped into action. I booked my family on Saturday afternoon from PBI via Charlotte (CLT) to New York La Guardia (LGA) using just 25,000 miles per person. I could have purchased the flight, which was now pricing at around $1,700 per ticket, making this a 6.8 cent redemption. I called American Airlines after they ticketed to modify my flights under the waiver. I was able to adjust our flights so we would leave Friday evening September 8 at 7:55 PM from Miami direct to LGA.

On Wednesday as the storm inched closer and closer I was happy I had made my decision to leave and I was even happier that it didn't cost me an arm and a leg. Prices increased again and some airlines were getting accused of price gouging.

Some people on social media were accusing American Airlines of doing the same, too.

Unfortunately trouble struck around midday Wednesday, when I got an alert that my flight on Friday night was cancelled and that Miami International Airport would be shut down at 1 PM on Friday. American Airlines did not call me or rebook me right away, which was surprising since I have status with them. Instead it only offered to refund my miles. Once I was finally able to get an agent on the phone, they were only able to provide flights leaving early Thursday morning from an alternate airport with long connections. I had to work on Thursday and couldn't leave. I wasn't satisfied but I had to take what I could get. The phone agent told me to keep checking online and if I could find something, I should put it on hold and they would ticket it for the original cost. I spent the next couple of hours constantly refreshing my screen. Eventually I was able to secure three separate flights from Fort Lauderdale to New York City under each person's account. (You can not have multiple bookings on hold for the same route and the same dates on one account.) I was able to call in and everyone was ticketed and confirmed to leave on Friday morning, although unfortunately none of us were traveling together.

On Wednesday evening, JetBlue did the right thing and capped their fares out of Florida, but not after many flights had already sold. Eventually Delta, American and Southwest followed JetBlue's lead by capping fares at no more than $399, while United continued with egregious fares.

Thankfully after Wednesday there were no more unfortunate surprises. My family has made it safely out of harm's way to New York City. Hopefully my story will help you when you're booking flights for the next natural disaster. You should always keep a small stack of miles to help out with emergencies. If you think you may need to evacuate and you're given the opportunity to put a flight on hold, it is truly a no-brainer. It saved my family 45,000 miles and thousands of dollars. Make sure you book early and take advantage of any flexible change waivers. And for everyone still in Irma's path, stay safe!

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.