I rarely stay at major hotel chains — here’s how I maximize my reward travel anyway

There are many great reasons to stay at independent hotels and vacation rentals. Unfortunately, the ease of earning rewards on these stays is not one of them — or so you might think. Over the years, I've enjoyed a variety of unforgettable stays and picked up several tricks to maximize my savings and rewards on them. Here's what I've learned.

Related: Best hotel rewards programs in the world: Which one is right for you?

Why I love independent boutique hotels

Sometimes I stay at independent boutique hotels or vacation rentals out of necessity — maybe the small mountain town I'm visiting doesn't have any chain hotels, or my friend group needs more space and can save big bucks by splitting an Airbnb. Other times, I choose independent hotels because of the unique amenities and experiences they provide.

For instance, I once spent a night outside Mount Rainier National Park in a cabin with an authentic Ukrainian restaurant and "cannibal" hot tub heated by a wood fire. Another memorable stay was at a Kyoto ryokan complete with a seven-course Japanese meal and an in-room onsen. I also spent a week in an Airbnb in Paris, which gave me more of a glimpse into "real" Parisian life than I could get at a points hotel in the prime tourist neighborhood.

The downside is that there are usually no elite benefits or points to be earned at these properties. Thankfully, I've still found plenty of ways to maximize my travel when I stay at independent hotels and vacation rentals.

Related: How to use points to book vacation home rentals

How I save money on independent hotel stays

It is possible to redeem rewards for stays at independent hotels, such as by booking with points or miles through a credit card travel portal. But since this doesn't provide great value for my rewards, I usually book these stays with cash and focus on trying to save money.

Use credit card travel credits

I hold the Chase Sapphire Preferred® Card (see rates and fees), which provides an annual $50 hotel credit for properties booked through Chase Travel℠, and the Capital One Venture X Rewards Credit Card, which provides a $300 travel credit for flights and stays booked through Capital One Travel. Both of these come in very handy when I book independent hotels.

For instance, I recently used my Venture X credit on a two-night stay at a bed-and-breakfast in the Wicklow Mountains outside of Dublin (no points hotels there) and a rental car to get there. After my $300 credit was applied, I spent a grand total of $4 on my two-day hiking trip.

Here are some other cards with travel credits that you can put toward stays at independent hotels:

- The Platinum Card® from American Express: Get up to $600 back in statement credits each year ($300 biannually) on prepaid bookings with Fine Hotels + Resorts or The Hotel Collection properties with American Express Travel. (The Hotel Collection requires a minimum two-night stay.)

- Chase Sapphire Reserve® (see rates and fees): Get a $300 annual travel credit each account anniversary year on any purchases that code as travel.

Earn cash back with shopping portals

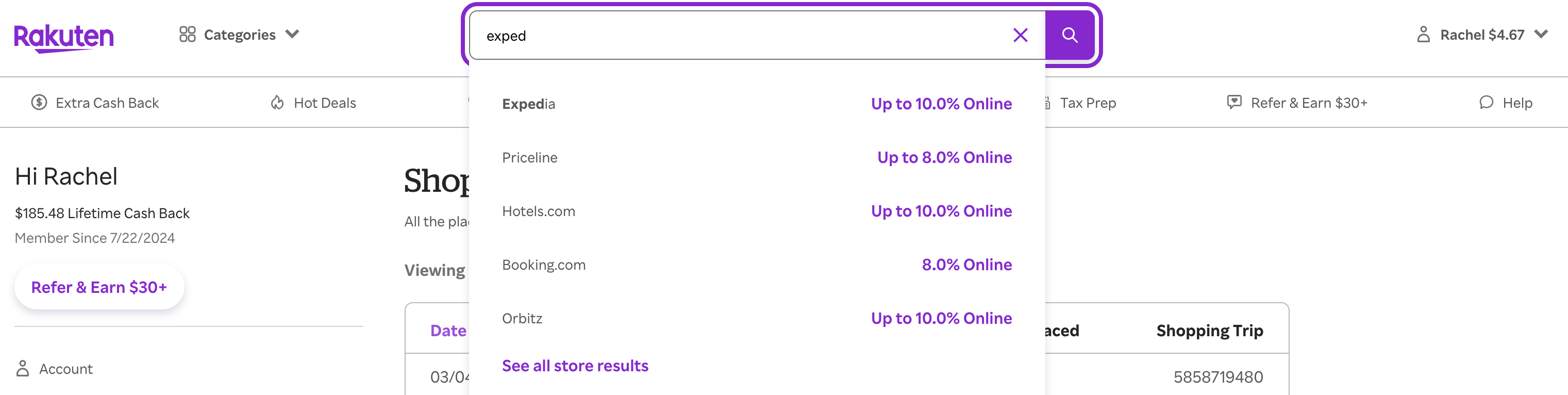

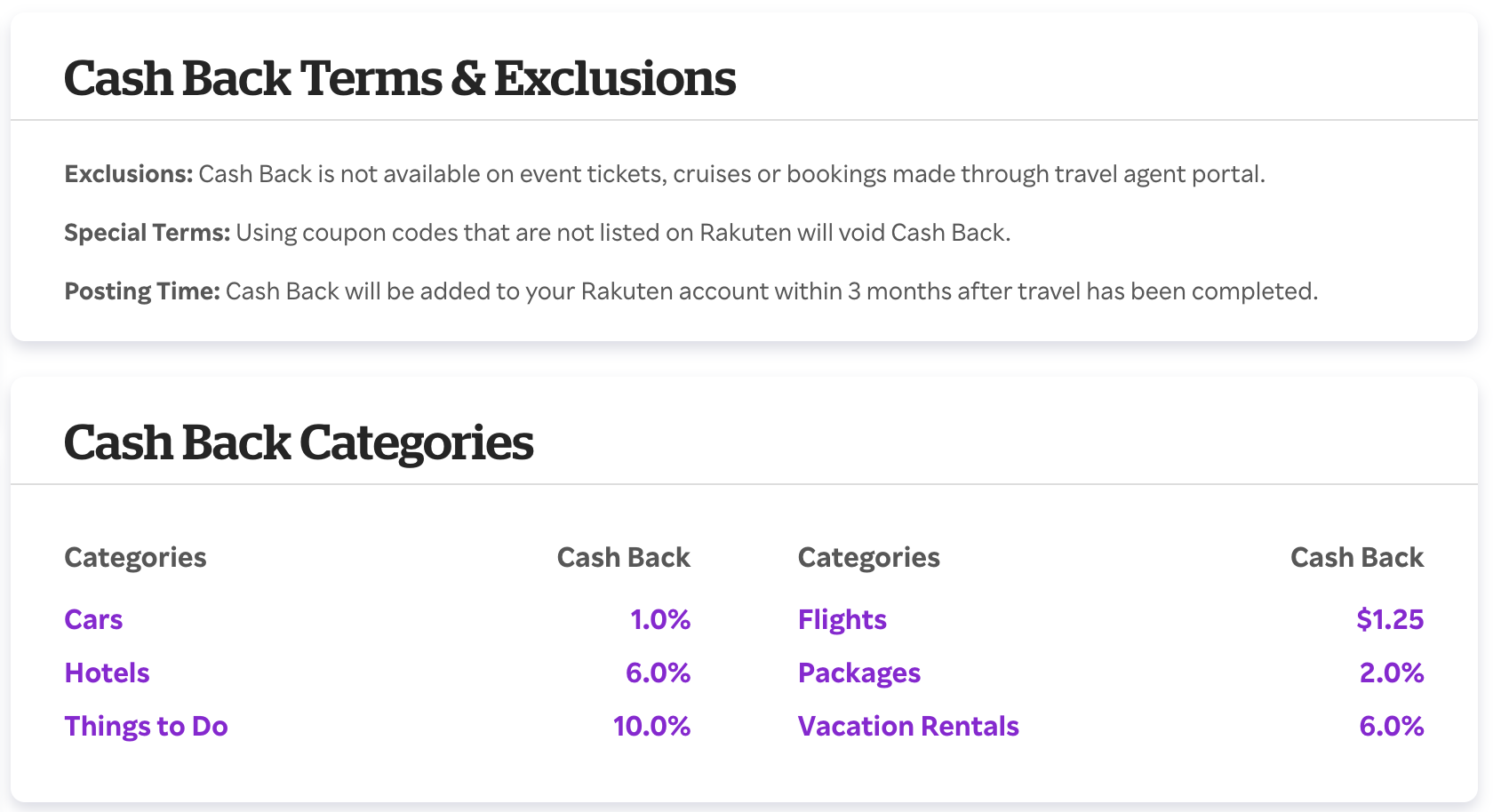

I love using shopping portals to earn cash back on my everyday purchases. But they're not just for retail shopping — you can earn cash back at many hotel-booking platforms, like Booking.com, Hotels.com, Expedia, Priceline, Orbitz and Tripadvisor.

Though reward rates vary from day to day, they often aren't too shabby. At the time of writing, Rakuten was offering up to 10% cash back at some of these sites.

However, it's important to read the fine print on Rakuten before you decide which site to book through. In this example, Rakuten is offering 6% back on hotels and vacation rentals but only 1% back on cars and a measly $1.25 back on flights.

Travelers who hold a card that earns Amex Membership Rewards points can get extra value out of Rakuten by switching their earning preference to Amex points instead of cash back.

Other shopping portals to consider include Extrabux, Mr. Rebates and TopCashback. You can also sometimes find hotel-booking sites on airline shopping portals and credit card portals like Capital One Shopping. A shopping portal aggregator like Cashback Monitor can help you spot which portals offer the best returns for your purchase.

Search for deals

Before I book a stay, I always check multiple sites because prices can vary widely. For instance, part of my recent trip to Dublin involved spending two nights in the city with my husband and a friend. We wanted an apartment with room for the three of us, but most Dublin Airbnbs required a four-night minimum stay. I settled on an apartment-style hotel with multiple bedrooms and a kitchen that was running a sale for 10% off on direct bookings — saving me roughly $100 on our stay.

Price isn't the only thing I compare from one site to another. I look at cancellation policies too, and I often prioritize booking through a site with a flexible cancellation policy, even if it costs a little more. That way, if my plans change or I find a better rate later, I can cancel for free and rebook.

Related: When plans go wrong: Your guide to booking refundable travel

How I maximize rewards on independent hotel stays

The more points I can earn on a hotel I booked with cash, the sooner I can redeem those points for my next free flight or Hyatt stay.

Earn transferable points with credit card travel portals

Many popular travel cards offer portals through which you can book hotels, flights, rental cars and more — and earn bonus points on these purchases. The number of points you'll earn depends on which card you hold, but it's typically 5 or more points per dollar spent.

For example, I can earn 10 Capital One miles per dollar spent on hotels booked through Capital One Travel when I pay with my Capital One Venture X Rewards Credit Card. And I can earn 5 Chase Ultimate Rewards points per dollar spent on hotels I book through Chase Travel with my Chase Sapphire Preferred Card.

Other cards that earn bonus rewards on their respective booking platforms include:

- The Platinum Card from American Express: Earn 5 Membership Rewards points per dollar spent on prepaid hotels booked with American Express Travel®.

- Capital One Venture Rewards Credit Card: Earn 5 miles per dollar spent on hotels and vacation rentals booked through Capital One Travel.

- Chase Sapphire Reserve: Earn 8 points per dollar spent on all Chase Travel purchases.

- Citi Strata Premier® Card: Earn 10 ThankYou points per dollar spent on hotels booked on CitiTravel.com (see rates and fees).

Since I'm not loyal to any one hotel program, earning transferable points is extremely valuable to me. I can transfer my Chase points to Hyatt or Marriott, for example, or transfer my Capital One miles to Choice or Wyndham, depending on which hotel chain makes the most sense for my trip.

Related: How (and why) you should earn transferable credit card points

Earn extra miles with airline booking platforms

Most airline booking platforms offer subpar earning rates. However, I love Southwest Hotels because you can earn up to 25 points per dollar spent on select properties, so I always search here first.

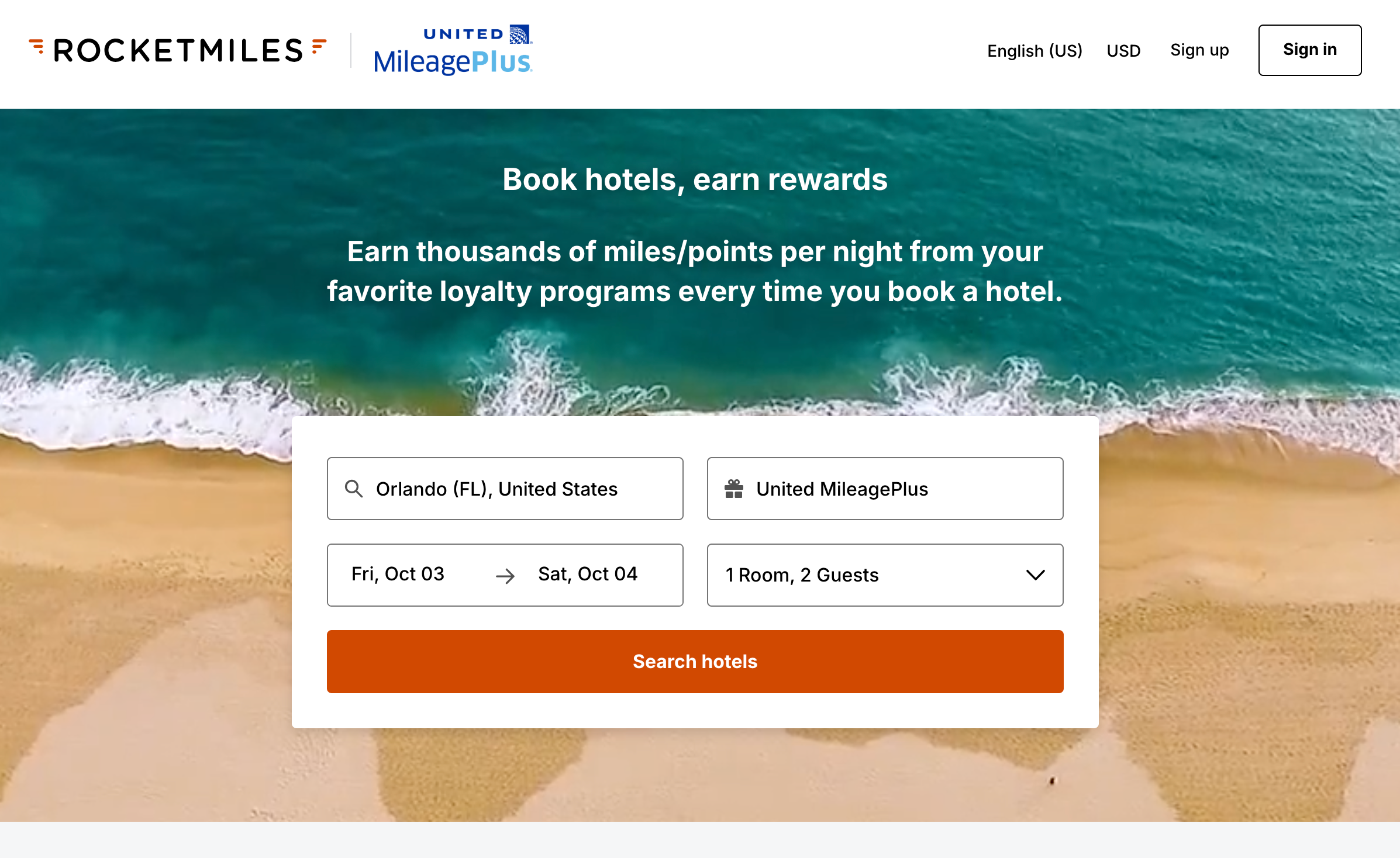

Rocketmiles works similarly but lets you choose which rewards to earn from a long list of airline loyalty programs, including Alaska Airlines Mileage Plan, Air France-KLM Flying Blue and United MileagePlus.

Earn airline miles on vacation rentals

Vacation rentals may be a little behind the times in the world of points and miles, but this doesn't mean you can't earn any valuable rewards on your next home away from home.

I've set up my Airbnb account to earn British Airways Avios by entering my frequent flyer number here.

That's because I can earn 2 Avios per dollar spent on Airbnb bookings, and I've found Avios useful for booking international flights out of Denver. However, you can also opt to earn 1 Delta Air Lines SkyMile per dollar or 1 Qantas point per Australian dollar ($0.64) spent on Airbnb bookings. Choose the currency that's most valuable to you.

If you prefer Vrbo, you can earn 3 United Airlines miles per dollar spent on Vrbo rentals when you book through this page with your MileagePlus number.

Related: How to earn cash back or points when booking Airbnbs, Vrbo rentals, hostels and more

Earn free travel with One Key

Introduced in 2023, Expedia's One Key is a relatively new loyalty program for Expedia, Hotels.com and Vrbo. Members can not only save 10% on stays booked through these sites but also earn OneKeyCash to spend toward hotels, flights, rental cars and more ($1 in OneKeyCash saves you $1 on purchases through these sites).

Since OneKeyCash is redeemed at a flat rate, you won't get the outsize value that you could with other hotel loyalty programs' award charts and sweet spots. However, One Key's simplicity could be a draw for some travelers, especially since you'll be able to choose from the huge variety of hotels on three different sites.

Although I usually end up booking through a credit card portal instead, I'm very intrigued by the One Key loyalty program, and I'm considering adding a One Key credit card to my wallet. I'm also anxiously awaiting the day when Airbnb comes out with a cobranded credit card.

Which credit card should you use to book independent hotels?

If I can book a hotel through a credit card portal such as Chase Travel or Capital One Travel, I always use the applicable card to earn bonus points. It's a no-brainer.

But sometimes I need to book a hotel directly in order to get a deal, or I want to stay in an Airbnb, which isn't available on any platform discussed above. Though it is possible to redeem points for Airbnb gift cards, such as redeeming my Chase Ultimate Rewards points at 1 cent per point, this is far below TPG's March 2025 valuation of Chase points and doesn't get me the best value for my points.

Therefore, my best bet is to book with a card that earns bonus rewards on travel purchases — but that's not the only thing I consider.

Don't forget that many travel cards come with built-in trip insurance. If you end up canceling a nonrefundable hotel booking, these perks can put a lot of dollars back in your wallet. And if you're booking a hotel in another country, be sure to pay with a card with no foreign transaction fees.

For me, this means I book most independent hotels with my Chase Sapphire Preferred. This card offers trip protection and no foreign transaction fees, and it earns 2 Ultimate Rewards points per dollar spent on all travel purchases plus a 10% points boost every account anniversary. Since Chase points are worth 2.05 cents apiece based on TPG's March 2025 valuations, that's a 4.5% return.

Other cards that offer bonus earnings on travel include:

- Chase Sapphire Reserve: Earn 4 points per dollar spent on flights and hotels booked direct.

- Wells Fargo Autograph Journey℠ Card: Earn an unlimited 5 points per dollar spent on hotels and an unlimited 3 points per dollar spent on other travel (see rates and fees).

- Citi Strata Premier Card: Earn 3 points per dollar spent on other hotel purchases outside of Citi Travel (see rates and fees).

- Bilt Mastercard®: Earn 2 points per dollar spent on travel. You must use your card at least five times each statement period to earn points.

The information for the Bilt Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

There are plenty of ways to save money and maximize your rewards on independent hotels and vacation rentals. It may take a little extra effort to sift through these options, but it will pay off in the long run.

Plus, I love the variety independent hotels offer. Since there are so many choices, you're bound to find something unique and perfect to make for a memorable trip.

TPG founder Brian Kelly is a Bilt adviser and investor.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app