JetBlue Targeting Virgin America Flyers for Points Match

Update: Some offers mentioned below are no longer available – JetBlue Plus Card

Update: A Virgin America representative reached out with a reminder that earlier this year, the carrier targeted JetBlue Mosaic members with a status match to Virgin America Gold status.

Earlier this year, Alaska Airlines announced that it was going to be purchasing Virgin America — beating out JetBlue for the Virgin America brand. Needless to say, JetBlue wasn't thrilled about not getting Virgin America — first, it targeted "JetBlue virgins" by giving away 500 free flights, and now it's offering Virgin America Elevate members a TrueBlue points match.

If you're a Virgin America Elevate member with a points balance in your account, you can send a screenshot of that balance to pointsmatch@jetblue.com by July 4 to be eligible for the JetBlue TrueBlue points match. In your screenshot, you must capture your first name, last name and points balance in order to be eligible. In your email to JetBlue, make sure to include your TrueBlue number.

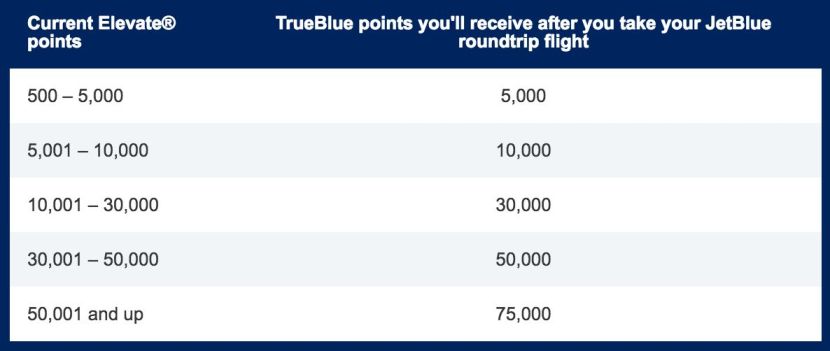

If you're deemed eligible (JetBlue will email you if you're officially enrolled), you must fly one round-trip flight with JetBlue before August 31, 2016, in order to get the points. If you successfully complete the round-trip flight, you'll get the same amount or more TrueBlue points than are currently in your Elevate account.

The TrueBlue points you earn will not count toward Mosaic status with JetBlue, and your round-trip flight with JetBlue must be a revenue ticket. If you successfully complete the match, the TrueBlue points will be posted to your account within 4-6 weeks.

It's worth mentioning that you could maximize this offer by transferring your SPG points. If you transfer 40,000 Starpoints (worth $1,000 based on TPG's most recent valuations) to Virgin America, you'll get 50,000 Elevate points with the two 5,000-point bonuses from SPG (worth $750-$1,150). Assuming you have at least 1 point in your Elevate account before this transfer, those Elevate points will be matched to 75,000 TrueBlue points if you fly one round-trip with JetBlue (worth $750-$1,050). Effectively, your $1,000 investment of Starpoints could be worth $1,500-$2,200 with this promotion.

If you have Elevate points with Virgin America and will be flying JetBlue before the end of August, there's no reason not to sign up for this promotion. If you're on the lower end of one of the Elevate points levels, you'll be awarded far more TrueBlue points. You can also increase your stash of JetBlue TrueBlue points by signing up for the JetBlue Plus Card. It currently has a sign-up bonus of 30,000 points after you spend $1,000 in the first 90 days. Even if you fly JetBlue only a couple of times a year, TPG recommends getting the card for its 6x points on JetBlue purchases, 2x points at restaurants and grocery stores and 1x points on all other purchases.

[card card-name='The JetBlue Plus Card' card-id='220811272' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app