Price freeze and cancel for any reason trip insurance could be coming to more travel providers

Now more than ever, flexibility is the name of the game when it comes to the travel industry. It's an area travel book app Hopper has focused on, offering features such as price freeze and "Cancel For Any Reason" trip insurance alongside its price prediction tools to help travelers save money and have peace of mind during the booking process.

Until now, those features have been exclusive to trips booked through Hopper, but thanks to an expanded partnership with travel industry giant Amadeus, that could be about to change.

Want more travel news and advice delivered to your inbox daily? Sign up for our newsletter.

Hopper and Amadeus expanded partnership

Hopper created a B2B initiative earlier this year called Hopper Cloud, where it offers the company's fintech products to partners. Capital One was the first to partner up with the travel booking app, and Hopper technology will power Capital One's new travel portal set to launch later in 2021.

Now, Amadeus is also partnering with Hopper to offer price freeze and Cancel for Any Reason trip coverage to customers.

In return, Hopper will have access to Amadeus' global car rental inventory — which spans 40 car rental companies in more than 3,500 cities and almost 200 countries worldwide. Currently, Hopper works with Amadeus for global flight booking, so this is a significant expansion of the working relationship between the brands.

"Hopper has been a valued customer and partner for Amadeus, particularly in North America, which is a key growth market for us," said Peter Altmann, head of mobility and insurance at Amadeus, in a press release. "As travel technology leaders like Hopper and Amadeus collaborate to rebuild travel, delivering services that boost traveler confidence is critical."

What this could mean for travelers

For anyone unfamiliar with Amadeus, it's a travel industry giant that offers a global distribution system alongside IT solutions for the travel and hospitality industries. Most relevant to this partnership with Hopper, Amadeus provides reservation systems for global travel brands including Air France, British Airways, Qantas and more.

This partnership could lead to travel providers — from OTAs to international airlines and hotel brands — offering the price freeze and Cancel for Any Reason trip insurance.

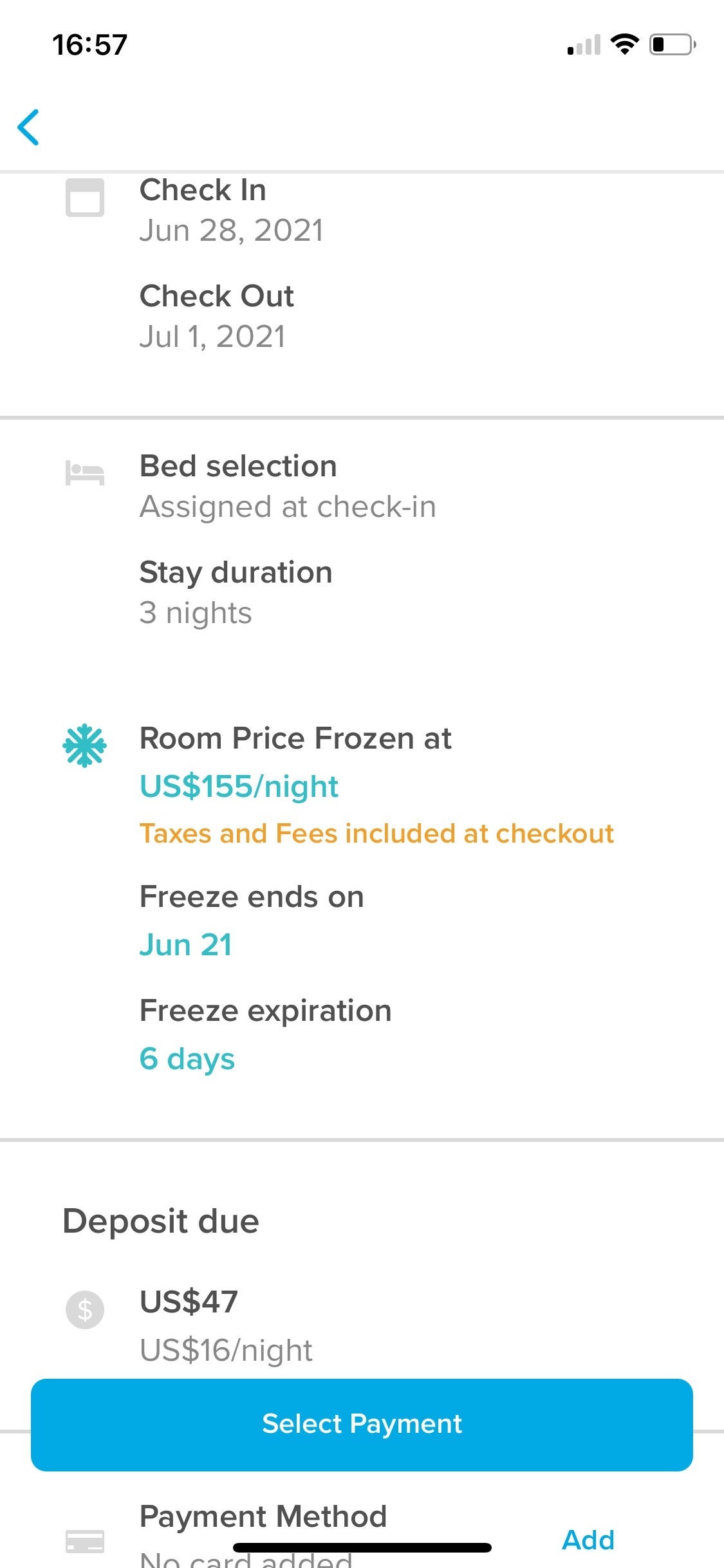

According to Hopper, customers save an average of $80 when they use the price freeze tool — which allows you to lock in a flight or hotel price for up to 14 days before booking for only a small deposit that you can then apply to your booking.

Cancel for Any Reason trip coverage is another useful offering — especially in the era of travel during COVID-19. Generally, independent providers offer the best coverage for the cost. Most credit card trip insurance won't cover cancelations due to hesitancy to travel because of COVID-19 risk and oftentimes the protections offered by airlines and hotels themselves are lacking.

However, if brands that use Amadeus start offering Cancel for Any Reason coverage at a reasonable price through this partnership, our tune could change.

Related: TPG's comprehensive guide to independent travel insurance

When I sat down with Hopper's head of hotel fintech, Anwesha Bhattacharjee, back in June to discuss the price freeze feature, it was clear Hopper is only just getting started in its development of tools and products that aim to empower travelers to book trips confidently while saving money.

There's no guarantee that airlines, hotels, travel agencies and other Amadeus customers will take advantage of the new Hopper-developed products now offered. But this does open the door for it to be possible.

As domestic and international destinations reopen and people continue to get vaccinated against COVID-19, it's very possible we'll start to see more brands embrace these fintech trip insurance products to entice customers to book those long-awaited trips.

Photo by izusek/Getty Images.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app