Booking a Hilton Points & Money Award — Reader Success Story

Today I want to share a story from TPG reader Kavi, who used points to book a hotel stay when rates were high and availability was low. Here's what he had to say:

Looking to book a quick weekend getaway this past fall, I had my sights set on a night in Providence, Rhode Island, followed by two nights in New Haven, Connecticut. I booked an Airbnb in New Haven, but couldn't find one I liked in Providence, so I began looking at paid rates across the larger hotel chains (Hilton, Marriott, IHG). Much to my surprise, a lot of hotels were already sold out on the particular night I needed, so I shifted my attention to points.

I have a stash of Chase Ultimate Rewards points I could have dipped into, but I'd much rather save those for my planned trip to Europe next year, when I can transfer to partners and get a more worthwhile redemption. Luckily, I had just over 37,000 points in my Hilton Honors account from past stays during weddings I attended. I found a Hilton Garden Inn right in Providence for 40,000 points, so I was less than 3,000 points shy.

Purchasing the last 3,000 points from Hilton would have cost me $30, but the Points & Money option was a little cheaper, as I could book the room with the 37,000 points I had plus $18. Paid rates for the one night were $399, so I got just over one cent per point in value and didn't have to buy additional Hilton points (as I don't stay at their properties often). It's a small win, but having a cash and points option is really helpful to lower out-of-pocket costs and avoid overpaying for miles.

Unlike most cash and points award options (which are only offered at a few fixed rates), Hilton's Points & Money awards let you redeem on a sliding scale. You can use however many points you want (starting at 5,000 and going up in intervals of 1,000), so there's a lot of flexibility to book awards with an insufficient balance and to get a decent return from small balances. Kavi only saved $12 compared to the cost of buying points outright, but the amount is less important than the underlying principle that the Points & Money option can help you redeem Hilton points more efficiently. Redemption rates vary widely, so even if you have enough points to cover a standard award, I recommend playing around with the points/money slider to see what kind of value you're offered.

One caveat: Be careful about booking these awards if you're staying at a property that charges nightly resort fees. Hilton Honors generally waives resort fees for award stays when you pay entirely with points, but the fees will be added if you select a rate with even the minimum cash portion. In that scenario you may be better off buying the remaining points you need, since booking a standard award will probably cost you less overall.

I love this story and I want to hear more like it! To thank Kavi for sharing his experience (and for allowing me to post it online), I'm sending him a $200 airline gift card to enjoy on future travels, and I'd like to do the same for you. Please email your own award travel success stories to info@thepointsguy.com; be sure to include details about how you earned and redeemed your rewards, and put "Reader Success Story" in the subject line. Feel free to also submit your most woeful travel mistakes. If your story is published in either case, I'll send you a gift to jump-start your next adventure.

Safe and happy travels to all, and I look forward to hearing from you!

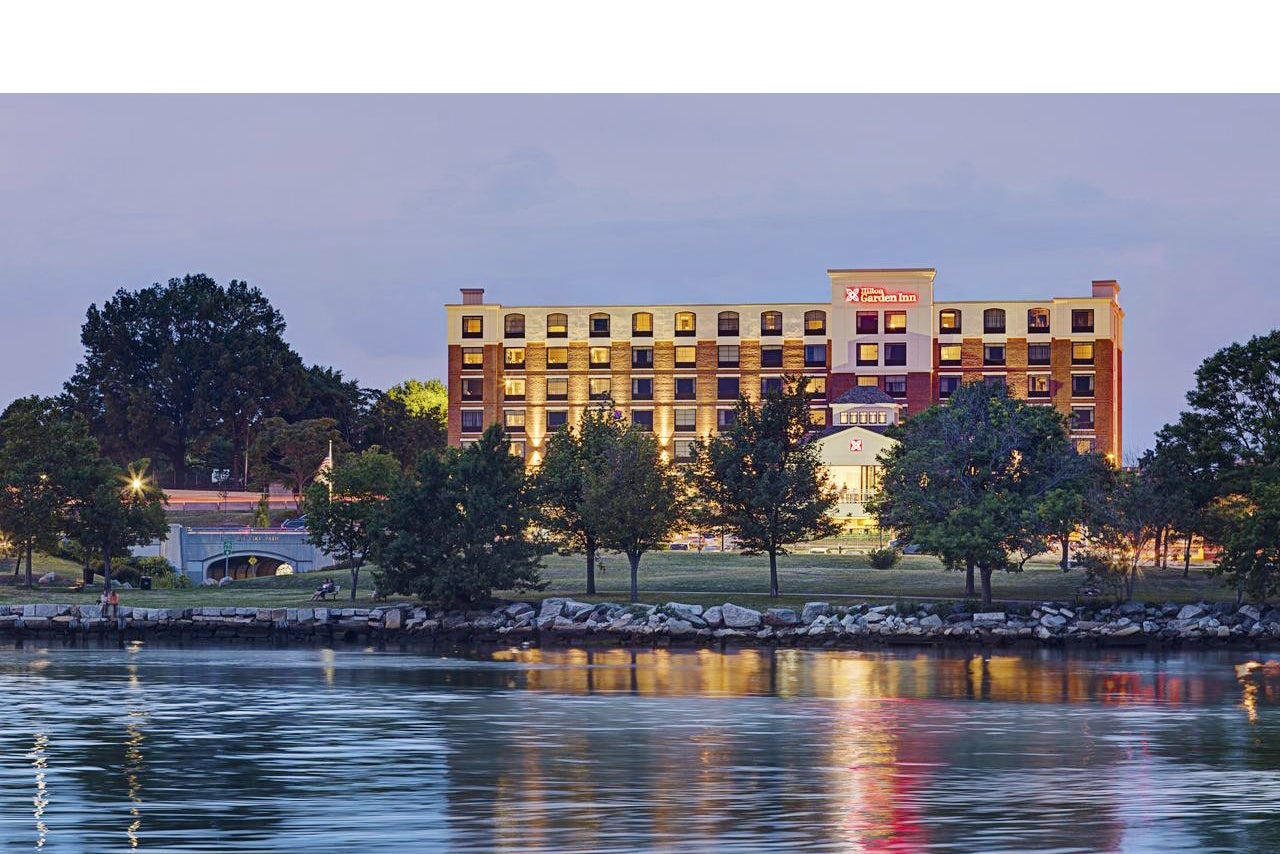

Photo courtesy of the Hilton Garden Inn Providence.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app