Here’s why you may not have to remove your laptop at TSA checkpoints this summer

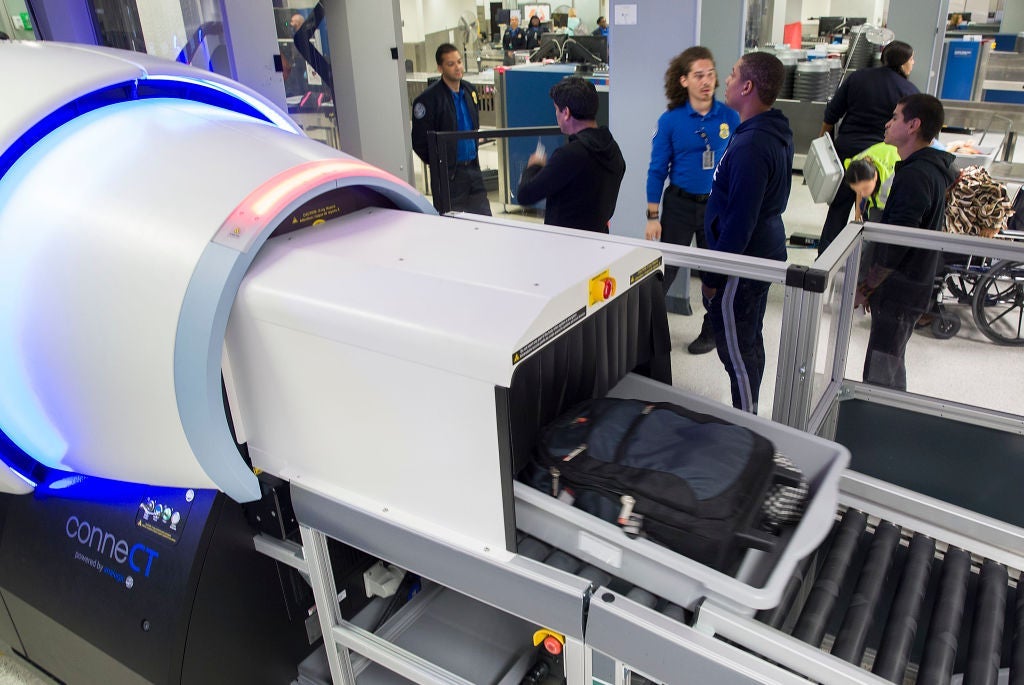

If you're tired of removing your laptop from your bag at airport security checkpoints, there's good news. The TSA recently approved a multi-million dollar contract that will bring hundreds of three-dimensional scanners to airport checkpoints across the country.

The $781.2 million contract awarded by the agency earlier this month will bring just shy of 1,000 Computed Tomography (CT) x-ray scanners to TSA checkpoints. The machines, which will be used to scan carry-on baggage, should start appearing in airports by this summer.

For travelers, this means more convenience and peace of mind, the TSA said.

"It brings a whole other level of security to checkpoints," TSA southeast spokesperson Mark Howell told TPG in an interview Friday. "It's much like the CT scan machines you see at the hospital. And the difference in security is really [like] the difference between a map and a globe."

The new technology also means travelers — including those without TSA PreCheck — would no longer have to remove items like liquids and electronic devices from carry-on baggage before they enter the scanner.

According to the TSA, the new scanners use "sophisticated algorithms" to detect prohibited items like guns, explosives and other items passengers are not allowed to carry on the plane. The technology creates 3D images of the items in a bag, and allows officers to not just view, but also rotate the image to analyze potential threats.

Related: Why you should get TSA PreCheck and Clear

This move represents the latest step by the TSA as part of an effort TPG has reported on for years to modernize and upgrade checkpoint technology. Just last summer, the agency announced a nearly $200 million contract for CT X-ray systems of a different size. The agency says those machines are in the process of being installed at checkpoints across the country.

With this larger number of scanners expected at airports this summer, Howell anticipates more opportunities for travelers to leave electronics like laptops in their carry-on luggage.

Related: Back to the future for TSA luggage screening?

It's a change that he anticipates will not be immediate. "It's going to take some time, obviously, [for] a deployment of that size," he said. But ultimately he expects the new technology will speed up security lines, too.

As the machines begin to roll out to airports, Howell suggests passengers pay close attention to what agents tell them as they wait in line. If their checkpoint has the new technology, he pointed out, "You may not have to remove your stuff."

It's important to note, the new technology does not change how passengers themselves are screened. That means those without TSA PreCheck would still have to remove their shoes, belts and outerwear in some cases.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app