A combined Spirit and Frontier Airlines frequent flyer program could be interesting — here's why

One likes yellow planes, has first-class sized Big Front Seats and a route network heavy on the Caribbean and the eastern U.S.

The other likes animals, has a more subdued approach to cheap airfare and is stronger in the west.

Both have an a la carte approach to how you purchase your travel, run membership programs and have relatively recently revamped their frequent flyer programs. Now these two divisive airlines — Spirit and Frontier — have shared their desire to become one large low-cost airline. If the merger occurs, the combined airline will become the nation's fifth-largest, serving more than 145 destinations.

While Spirit and Frontier are certainly more similar than they are different, they are not the same airline by different names. Each brings with it some unique approaches to low-cost airfare.

While I am nervous about the risk of higher fares in the low-fare market with decreased competition between these similar carriers if the merger is approved, I'm also excited about the potential.

I've long loved both Spirit and Frontier when price and schedules align, and I'm intrigued with the prospect of what the combined route network could offer ... especially when it comes to a combined frequent flyer program.

Spirit frequent flyer basics

The Free Spirit frequent flyer program was just overhauled in early-2021. It did away with award charts but introduced true frequent flyer perks to correspond with its two elite status tiers: Silver and Gold.

Normally doing away with award charts in favor of dynamic pricing is terrible news to frequent flyers, but in this case, it was actually OK. Tying award prices to Spirit's usually low cash fares actually increased the value of its miles from 0.4 cents per mile to about 1.1 cents per point in our tests.

At the Gold level, having access to complimentary seat assignments (but not the Big Front Seats), a free carry-on bag and a snack and beverage on board makes the experience feel like basically all the major U.S. airlines.

The biggest problem with this otherwise pretty solid offering, given the airline's fee structure, is that the perks don't extend to anyone else on your reservation. This makes them more beneficial to small business travelers than leisure travelers, which is interesting given Spirit's overall approach to travel.

There also is no pathway to the Big Front Seat with status, though all other seats on the aircraft are available at no extra fee with Gold status. This missed opportunity to offer a very valuable benefit could be solved with another tier of benefits over the current two-tiered structure.

And as it happens, Frontier already has a three-tiered elite status system.

Related: I flew Spirit home with $3 WiFi and it was great

Frontier frequent flyer basics

While you can spend your way to even top-tier status with Frontier just like you can with Spirit, Frontier's program is actually most similar to a traditional frequent flyer program. Frontier still has an award chart and awards miles based on distance flown — not dollars spent. That places it as one of the few left in the country that does it that way.

Frontier has three elite status tiers: 20k, 50k and 100k. Solid benefits like free carry-on bag and seat assignment kick in at the 20k level — and extend to others on the reservation at the 50k level.

While Spirit has the wing up when it comes to some elements of the frequent flyer program and in-flight experience, Frontier stands above when it comes to the elite status perks being most applicable on a typical leisure trip.

What a combined Spirit and Frontier program could look like

While a combined program could differentiate itself from the pack by keeping the miles earned based on the miles flown approach that Frontier uses, I'd put those odds at slim.

I see it far more likely that they would take Spirit's approach and award miles based on how much you spend on everything from the base fare to seat assignments, with amounts that increase as you increase in status levels.

Speaking of status levels, Frontier's three tiers of status may be the way to go, with perks extending to others on the reservation starting at the mid-tier level.

The top tier could be made even more enticing with some sort of Big Front Seat inclusion. If the economics didn't work to offer it outright at the time of booking, since it is a real stand-alone revenue driver, it could be considered as a space-available check-in option, be given as an annual upgrade certificate or even offered at a 50% discount for top-tier members.

Either way, Frontier currently has extra legroom rows (named Stretch Seating) and Spirit has the Big Front Seats, so those should be used in some way as a carrot at the top-tier levels.

And since both airlines already allow you to earn elite qualifying miles at a rate of 1 dollar per 1 dollar charged to their respective co-branded credit cards, it is a reasonable assumption that that would remain unchanged in a combined program.

Both also already have a membership club that provides access to discounted fares, among other things.

Frontier offers this Discount Den membership to its top-tier members while Spirit does not with its Spirit Saver$ Club. However, if there is a third tier in the future for a combined program that Spirit participates in, then there could be room for that perk at the top.

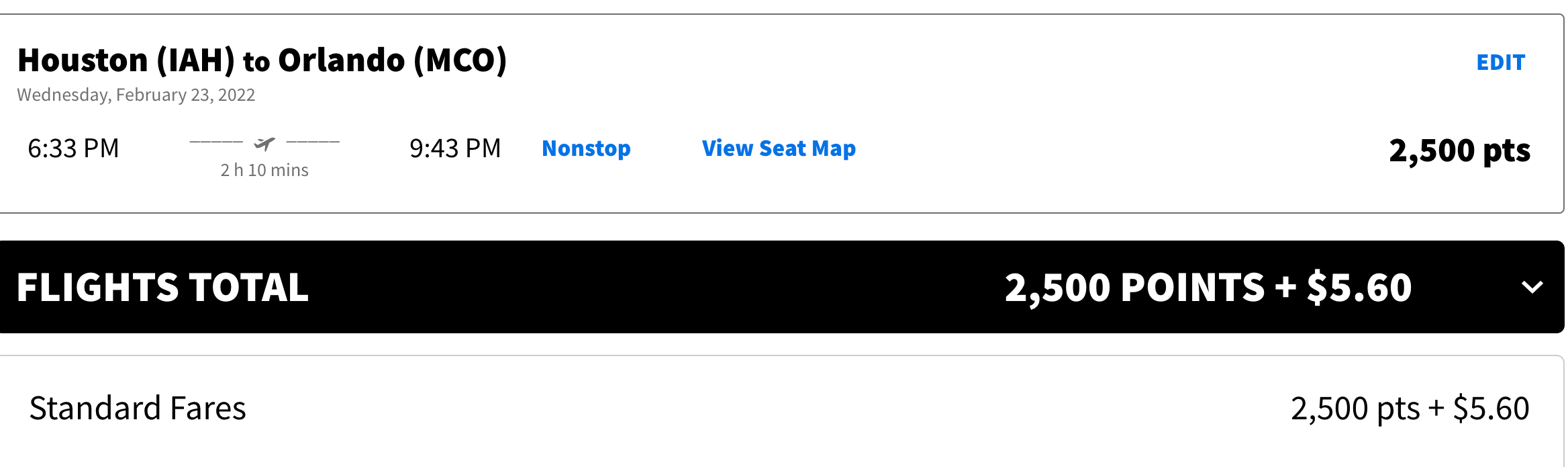

When it comes to award prices, Spirit may have the better approach for an ultra low-cost carrier with awards starting at just 2,500 points for each direction of travel. However, on the flip side, that same route could cost 40,000 points per direction of travel, so there's a downside to dynamic pricing.

With Frontier, that same route to Orlando is never going to cost less than 10,000 miles but it's also never going to cost more than 20,000 - 22,500 given the award chart. There are pros and cons to each approach, but cheap award flights that start cheaper and are dynamically priced tied to the fare are probably more on-brand for a combined Spirit and Frontier frequent flyer program than a traditional award chart.

Bottom line

A combined frequent flyer program from a Spirit and Frontier merger could become much more interesting than the individual programs of either airline as they stand. Less than 20% of the airlines' routes are duplicative, meaning that this would really open up a lot of additional flight options for those in a larger frequent flyer program.

Low-cost airlines are never going to be for everyone, but $25 fares are certainly enticing in the right situation. And if Spirit and Frontier combine the elite status tiers and benefit model of Frontier with the low-cost award flights from Spirit, with some new perks sprinkled in, this could be the start of a very interesting opportunity for several time per year low-cost travelers.

Even if you'd never have enough trips on just Spirit or just Frontier, that scale could tip with a suddenly much larger combined network. All of the sudden, elite status could be within reach. That's especially true if they lean into the spend-your-way-to-status opportunities with their co-brand credit cards and partners.

It will be a while before we learn any official details of a combined Free Spirit/Frontier Miles program, assuming the merger comes to pass, but that won't stop us from thinking through the possibilities with a larger route network, more elite status tiers and the opportunity to pull from the best of two airlines that truly have opened up the sky to travelers who otherwise wouldn't be able to fly nearly as often.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app