How I leveraged a casino partnership to extend expiring hotel points

Editor's note: This is a recurring post, regularly updated with new information.

Points and miles have value, so I watch when and how rewards expire in the programs I use. It's easy to prevent points and miles from expiring in programs that require periodic account activity, but there's usually no way to extend rewards that lose their value a set time after they were earned.

I received an email from AwardWallet on May 1 informing me that 8,500 of my Wyndham Rewards points would expire May 31. I looked at my upcoming travel schedule to see whether there were any upcoming stays I wanted to book using Wyndham points, but I ended up using Wyndham's partnership with Caesars to reset the expiration date on my points. Here's how I did it.

When do Wyndham Rewards points expire?

According to the Wyndham Rewards' terms and conditions, Wyndham Rewards points expire four years from the checkout date of the stay during which the points were earned.

However, you'll also lose your points if you don't have any account activity for 18 consecutive months. Account activity is defined as "any (i) point earning, (ii) stay posted to a Member's Wyndham Rewards account, regardless of whether or not such stay earns Wyndham Rewards points, and (iii) redemption or transfer activity involving a change in the Member's Wyndham Rewards point balance."

Finally, Wyndham may close your account if you have not had any account activity for at least 60 consecutive months.

Related: The 12 best Wyndham hotels in the world

How to see when your Wyndham points expire

You can only see the last 18 months of your account activity when logged into your account on the Wyndham website. However, you may see when your Wyndham points expire by navigating to the My Account page and scrolling down.

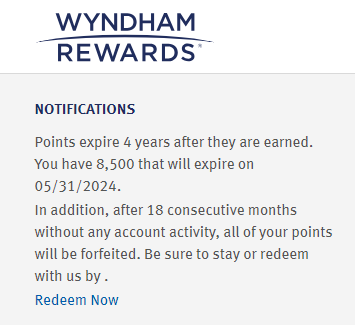

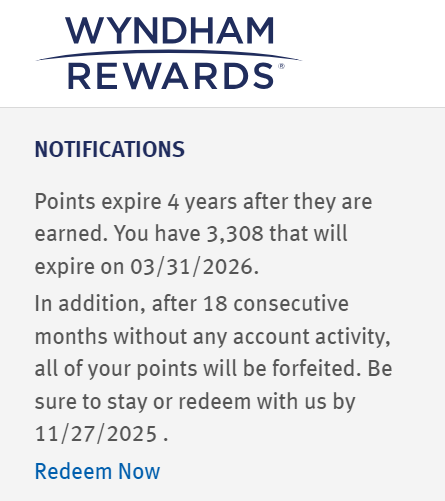

On the left-hand side of the page, you might see a notification about when your points will expire. Here are examples of what this notification looked like May 11 before I took any action and May 30 after I'd used the soon-to-expire points.

The blank in the first screenshot from May 11 isn't helpful. I've also periodically logged into my Wyndham account and found this notification missing. So, although the notice is useful when it's present and complete, I recommend setting a reminder in your calendar about a month ahead of the soonest of these two expiration dates. Alternatively, you could use a tool like AwardWallet that will alert you before your points expire.

Related: Wyndham adds 9 all-inclusive resorts with bargain award redemption rates

How to use expiring Wyndham Rewards points

Once I realized I had 8,500 Wyndham points that would expire May 31 and couldn't be extended with account activity, I checked my upcoming destinations for any appealing uses of Wyndham points. Award nights start at just 7,500 points, though you get a 10% discount if you have certain Wyndham credit cards. I recently added the Wyndham Rewards Earner® Business Card to my wallet, so I could book a one-night stay for as little as 6,750 points.

The information for the Wyndham Rewards Earner Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

In the past, I've gotten good value redeeming Wyndham points for stays in Hawaii, South Korea and Colorado, but redeeming Wyndham points for any of my upcoming trips wasn't ideal at this time.

Like most hotel loyalty programs, Wyndham Rewards offers a variety of other redemption options, including:

- Snagging Minor League Baseball tickets and experiences

- Buying merchandise from the online points catalog

- Purchasing gift cards

- Booking flights, car rentals and other transportation

- Donating to charity

- Obtaining rewards in a partner loyalty program

Minor League Baseball tickets start at just 2,500 points, but none of the upcoming games were in cities I had plans to visit. Most other redemption options offer lower redemption value than I know I can get when redeeming Wyndham points for stays.

Related: Which credit card should you use for Wyndham stays?

How I leveraged Wyndham's partnership with Caesars Rewards

You can transfer Wyndham points to a variety of travel rewards programs. However, as is typical when you transfer hotel points to other programs, you'll usually lose some value. For example, you can transfer 6,000 Wyndham Rewards points to United MileagePlus and get 1,200 miles. Based on TPG's valuations, this transfer would see you giving up Wyndham points worth $66 for United miles worth roughly $16.

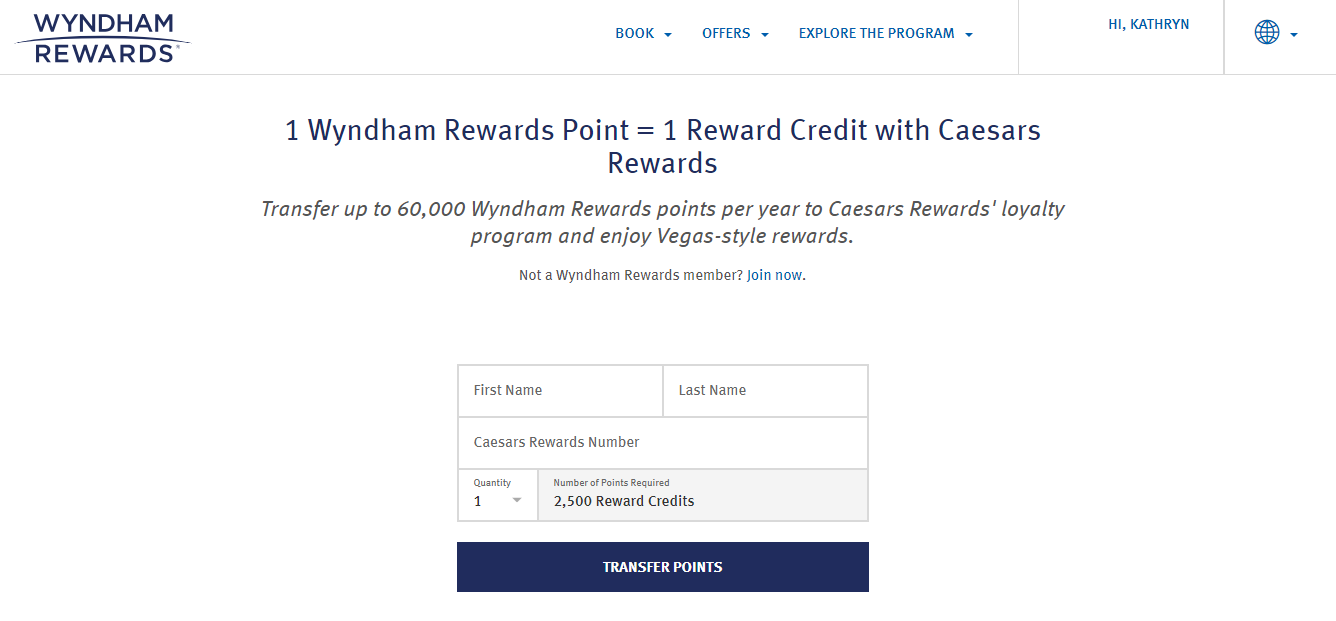

In most cases, you won't be able to move your points back to the Wyndham Rewards program once you transfer them to a partner, but Wyndham Rewards and Caesars Entertainment launched a partnership in 2017 that is still active. Through this partnership, you can transfer rewards between Wyndham Rewards and Caesars Rewards at a 1:1 ratio. This means you can transfer points back and forth between the programs without losing any value.

You can transfer up to 60,000 Wyndham Rewards points to Caesars Rewards reward credits each year in increments of 2,500 points. So, on May 11, I transferred 10,000 Wyndham points from my account to Caesars Rewards.

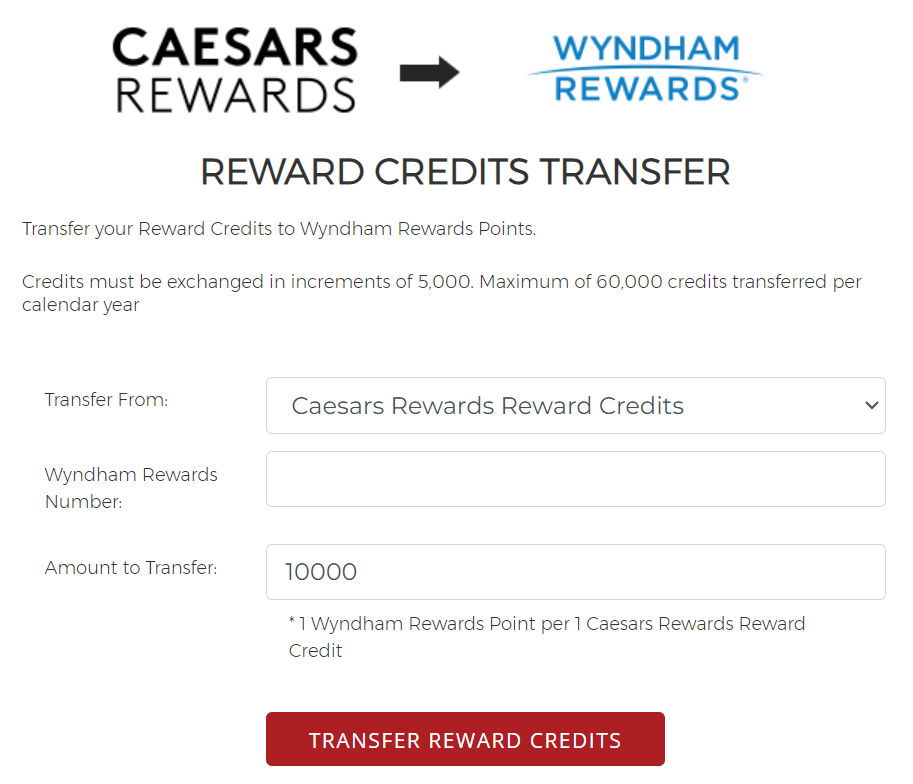

Three days later, I noticed the reward credits had arrived in my Caesars Rewards account. You can transfer up to 60,000 Caesars Rewards reward credits to Wyndham Rewards each year. The transfer ratio is 1:1 in increments of 5,000 reward credits.

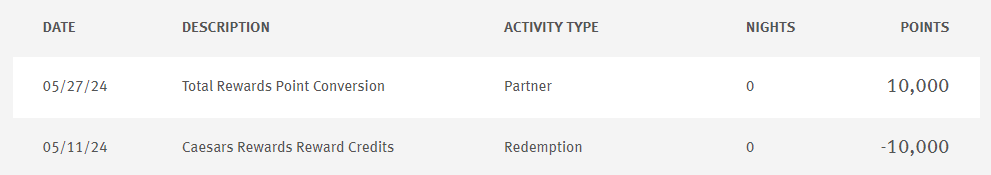

On May 14, I transferred 10,000 reward credits from my Caesars Rewards account to Wyndham Rewards. The confirmation message noted that the transfer could take six to eight weeks to process, but the points appeared in my Wyndham Rewards account 13 days later. As you can see below, the May 11 transfer was coded as a redemption while the May 27 activity was coded as a partner activity.

I won't need any Wyndham account activity for the next 18 months, but I expect I'll earn Wyndham points more frequently now that I have the Wyndham Rewards® Earner Business Card. And while I have 3,308 points set to expire in March 2026, I expect to redeem points for a stay well before then.

Related: Wyndham launches its 25th brand — one that blurs the line of hotel and apartment

Bottom line

The partnership between Caesars Rewards and Wyndham Rewards is a great way to maintain earned status in both programs. In looking for a way to use expiring Wyndham points, I also discovered the partnership is a great way to keep Wyndham points from expiring.

Even if you don't have Wyndham points expiring soon, this post is an excellent reminder to think outside the box. After all, there are often ways to earn rewards, redeem rewards and benefit from loyalty programs that aren't immediately obvious.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app